Sound investments

don't happen alone

Find your crew, build teams, compete in VS MODE, and identify investment trends in our evergrowing investment ecosystem. You aren't on an island anymore, and our community is here to help you make informed decisions in a complex world.

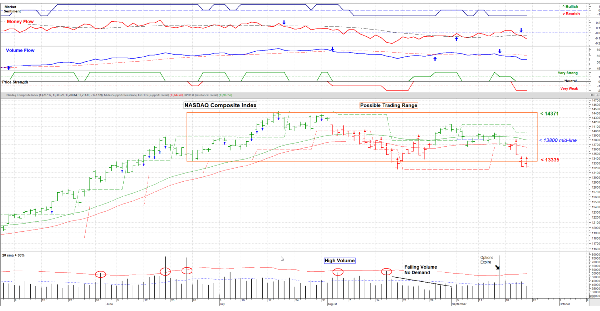

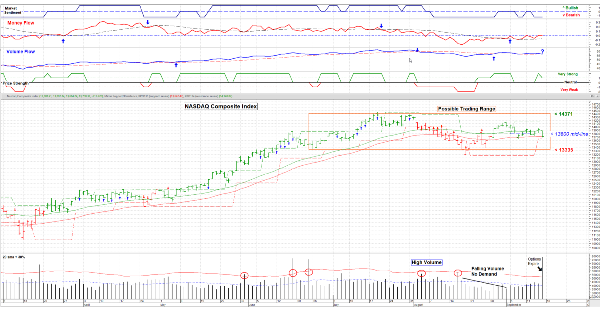

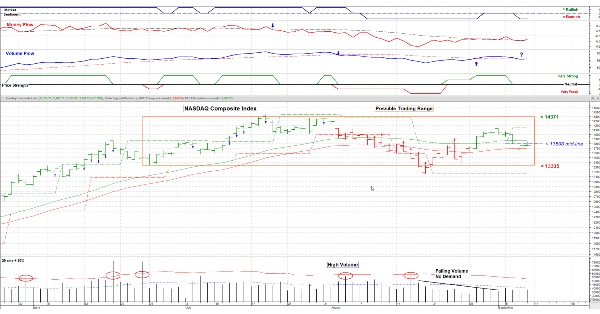

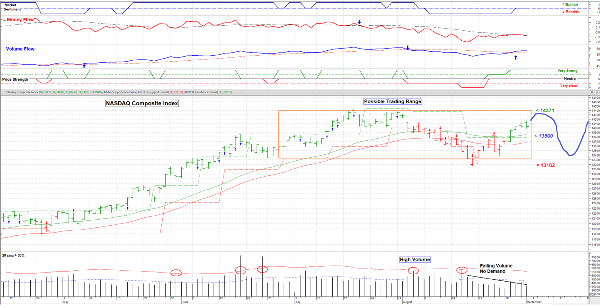

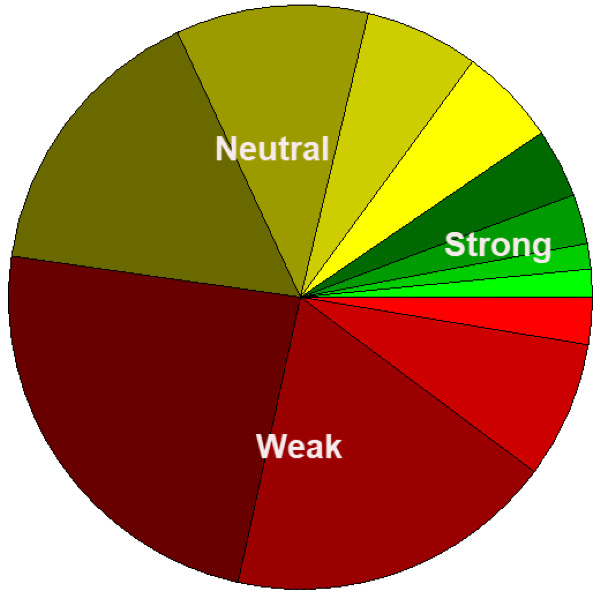

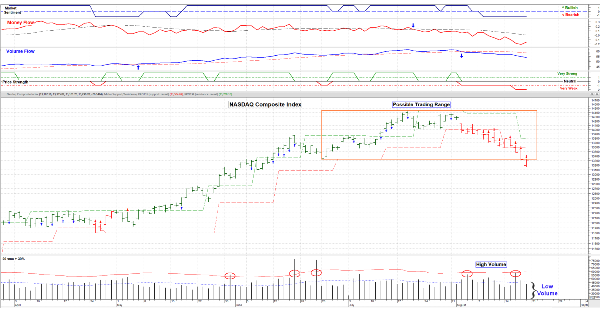

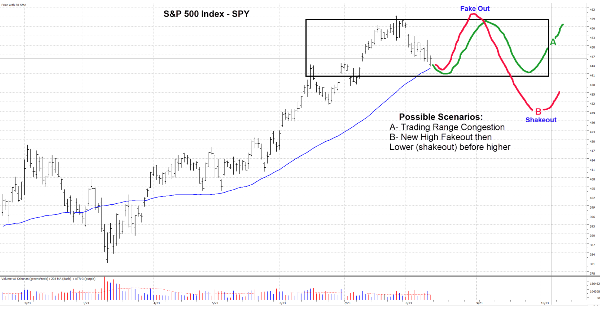

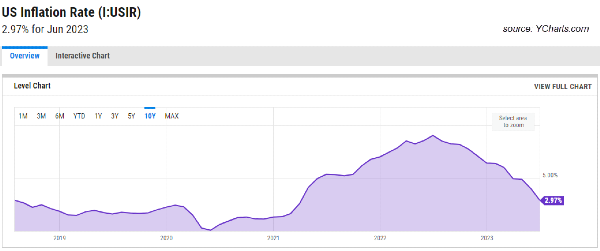

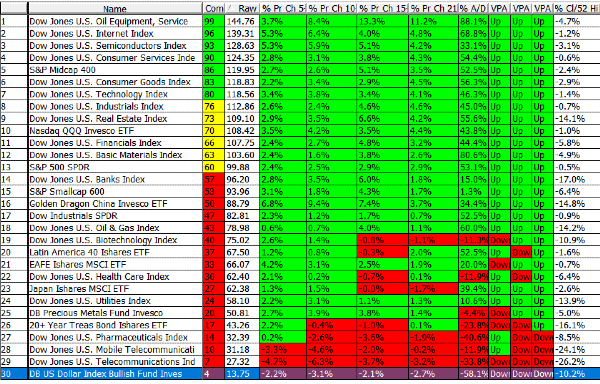

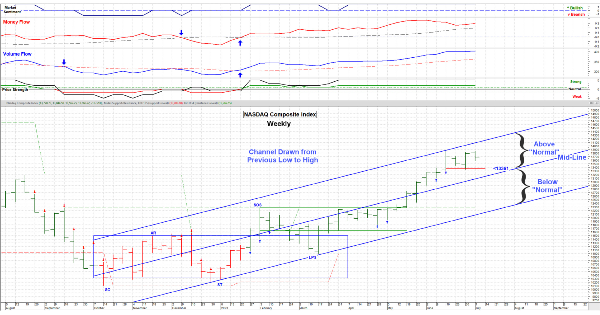

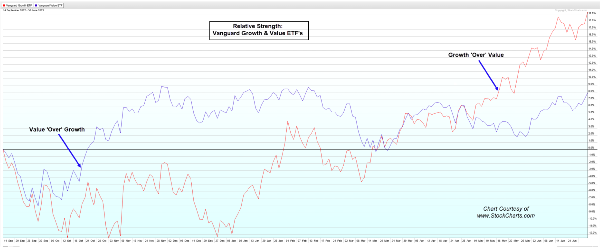

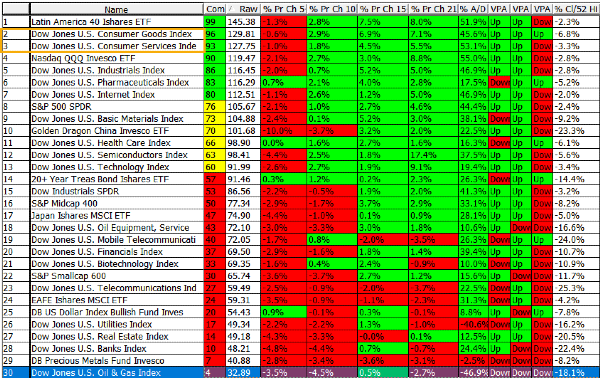

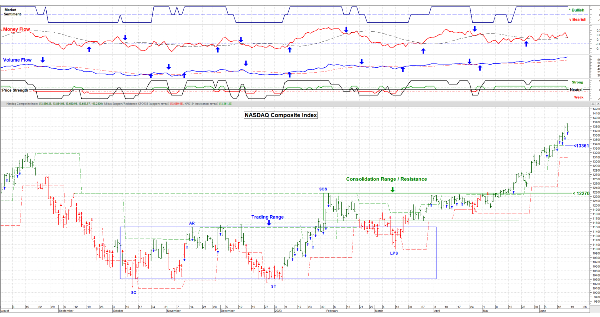

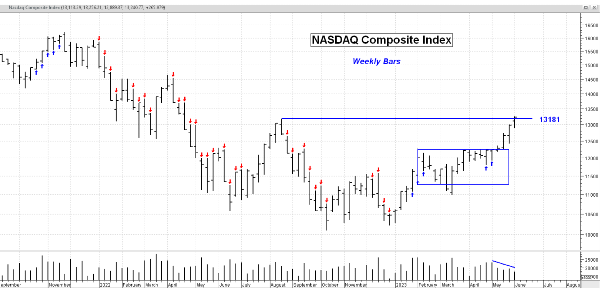

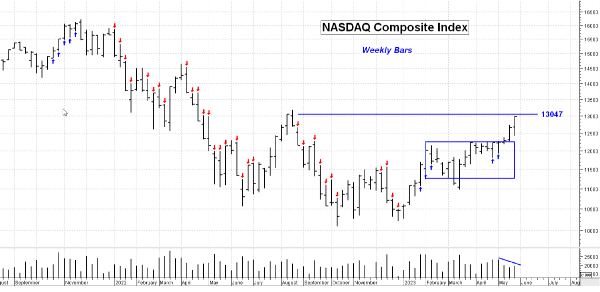

Sept. 22, 2023 - In the short term we were “Over Bought”, that is, stocks had a long run up and prices were such that they weren’t cheap any more. Also, leadership was focused on a smaller and smaller number of Tech stocks; not exactly “healthy” overall. Now, in the very short term, we are over sold. Prices for many of those high-flying Tech stocks have come back to a more reasonable price.

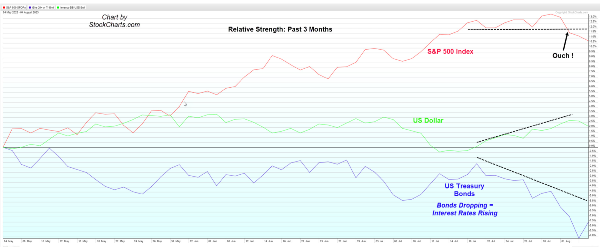

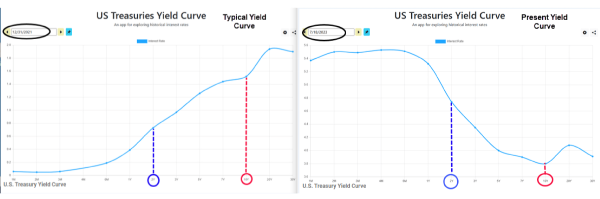

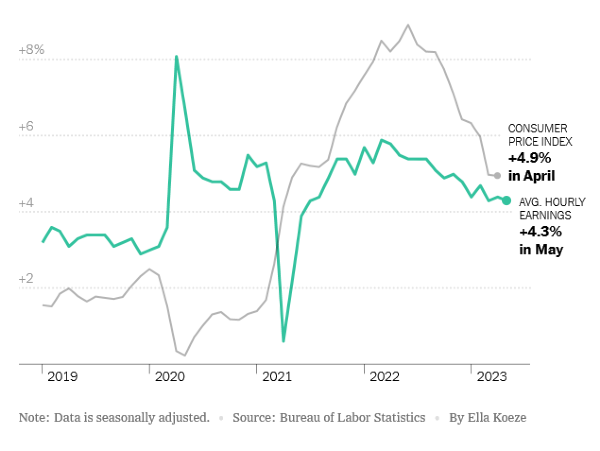

What’s next? Likely a bounce up then a re-test of the lows. At that point the market will decide whether to go lower or form a base and rebound. I doubt that any rebound will happen until the first week in October. Why? The United States Congress. The political shenanigans of MAGA Republicans may force the US into a default. Interest rates will rise and the government goes into a partial shutdown. Is that the only thing? No . . . it’s the strong US dollar. The European Union reported weak manufacturing (recession fears) and the Japanese Yen weakened. That strengthen the US dollar (more demand for USA $) and made US companies products more expensive worldwide (lower profits & more competition).

I am now about 50% in Cash and waiting for a confirmed market move lower or higher. We’ve got time to figure it out . . . maybe more time than the Congress has. (Editorial: “Bone Heads!”)

The** Short-Term Sector Strength*** table is shown at www.Special-Risk.net (not much green there)

Have a good & Cautious week. Keep smiling ! ………… Tom ………….