Sound investments

don't happen alone

Find your crew, build teams, compete in VS MODE, and identify investment trends in our evergrowing investment ecosystem. You aren't on an island anymore, and our community is here to help you make informed decisions in a complex world.

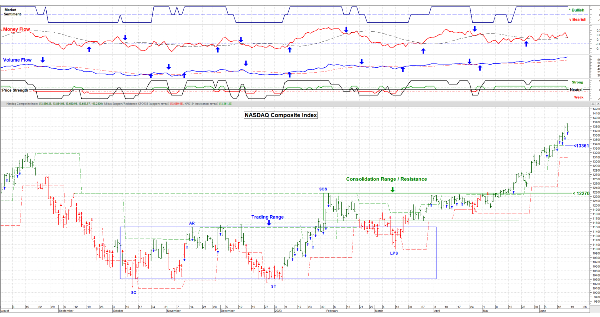

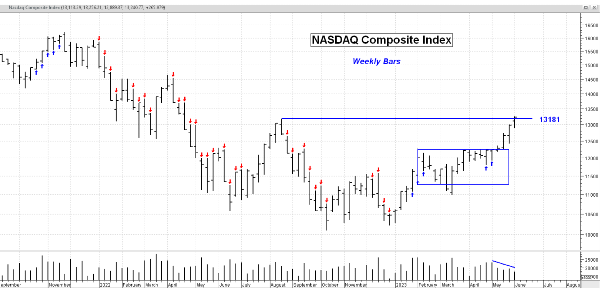

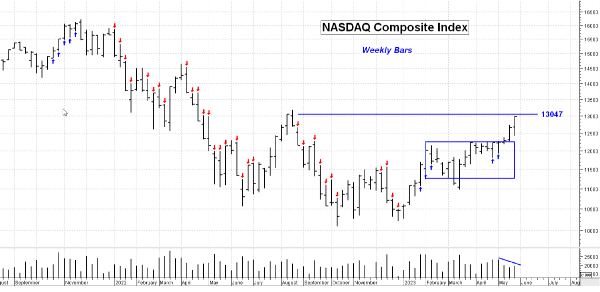

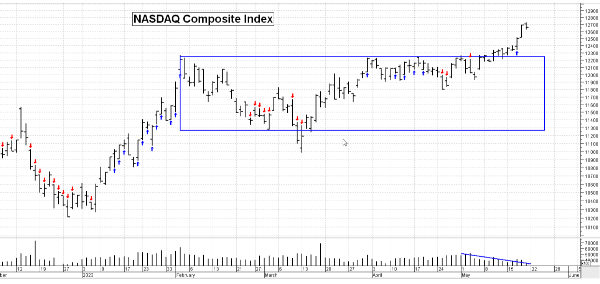

June 16, 2023 - A quick look at the chart shows just how far & fast this market has come over the past 6 weeks. Yes, definitely led by Technology stocks and FOMO (Fear Of Missing Out) plus heavy short term option activity. It’s all good; right? Well over the long run, Yes I believe so, but just looking at the rate of the increase tells me that a pause / slight pull back is in order here. And that . . . would likely be a buying opportunity.

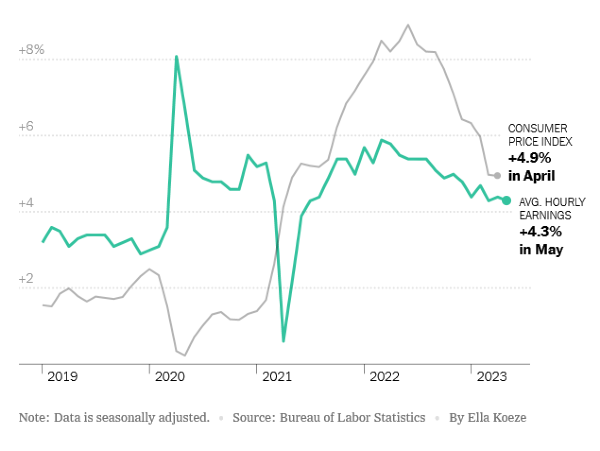

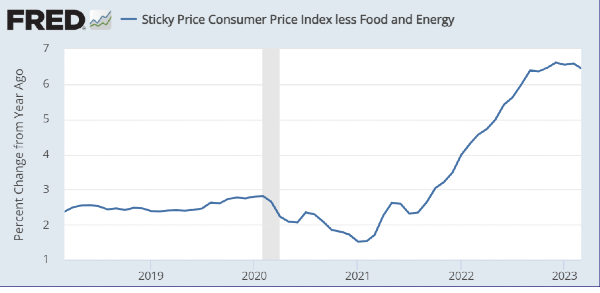

The FED took the position of pausing interest rate hikes but left the door wide open for increases in the future “based on the data”. The rate of inflation is slowly (very slowly) coming down and consumer consumption remains strong along with employment. The FEDs task is to bring down inflation and the demand for goods without having a big effect on employment. Not an easy task. We hear talk of a recession, but under the current conditions, No . . . . at least not yet.

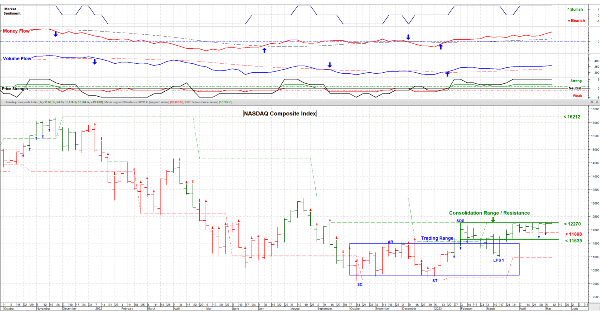

A pull back to roughly the 13361 level on the NASDAQ Composite would actually be healthy. As the market edges higher to 14646 (blue line) we could see some resistance. There remains a fair amount of money in Cash, short term CD’s and Money Markets. Logical places with these interest rates. But as the market climbs that money will flow back into equities. (A market top will come when there is no one left to buy.) The Short Term Sector Table is shown on my website: www.Special-Risk.net

It’s heartening to see sectors other than Tech start to move up the table in strength; notably Basic Materials, Industrials and even Financials. This broadening is a positive long term sign. I continue to scale into this market, but sure would like to see a slight pull back. That could happen this week. Well, I’m back from a 4 week trip to Eastern Europe. I find it very interesting to see just what other cultures are doing and get a sense of the “vibe” in the society. Make no mistake . . . other countries are moving forward and in some cases at a faster rate than the USA. Something to ponder. Have a good week. ………….. Tom …………..

Price chart by MetaStock; table by www.HighGrowthStock.com. Used with permission.