Sound investments

don't happen alone

Find your crew, build teams, compete in VS MODE, and identify investment trends in our evergrowing investment ecosystem. You aren't on an island anymore, and our community is here to help you make informed decisions in a complex world.

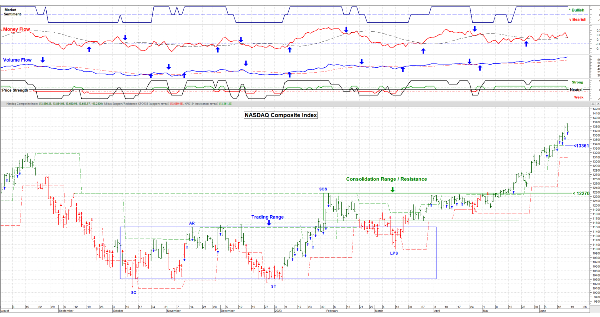

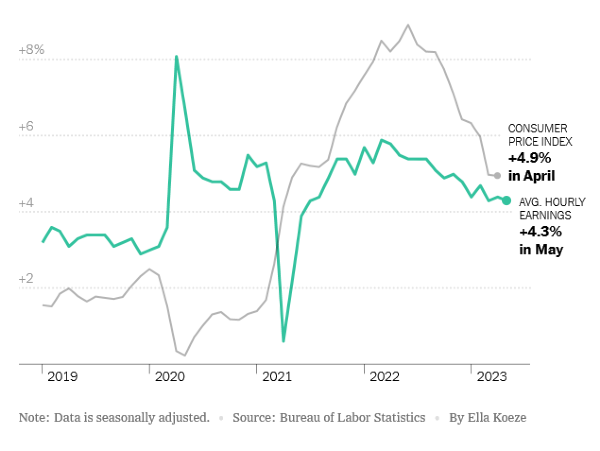

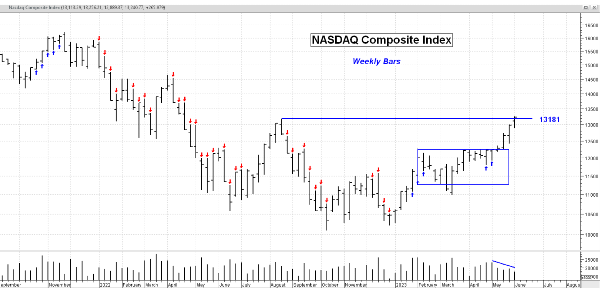

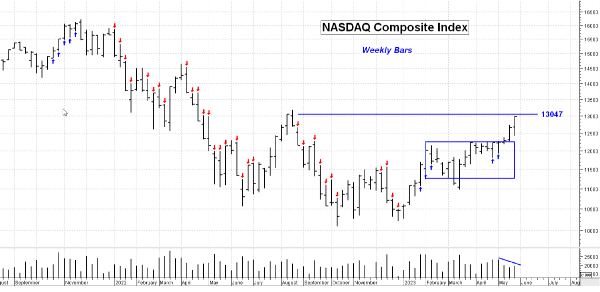

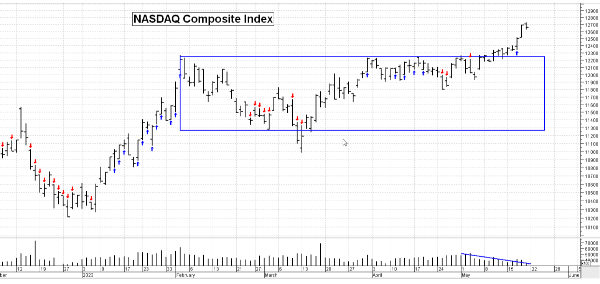

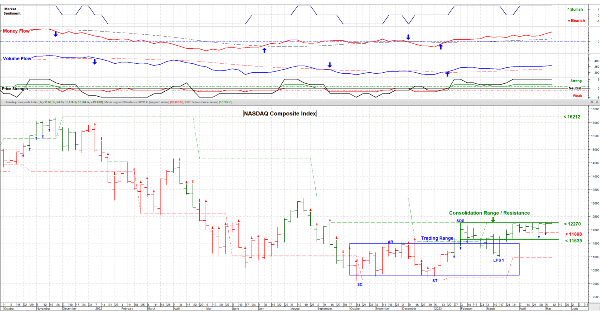

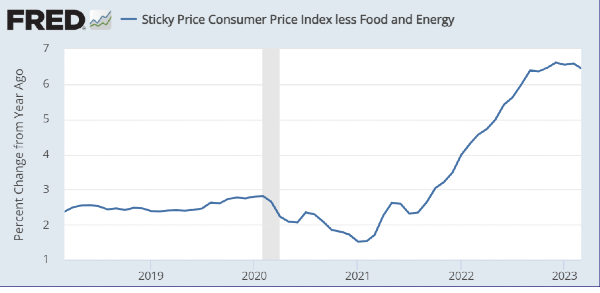

June 30, 2023 – This market continues to “Climb The Wall of Worry” since the confirmed breakout in early May. We’ve made it through the Bank Failure scare that happened a mire 2 months ago and many folks remain concerned about banks, inflation, the economy geo-political risks (i.e. Russia & China) and our domestic politics. There’s plenty to worry about but . . . employment is high, inflation is easing and (so far) the rest appears to be contained. This market IS pricing in a “soft landing” for the economy.

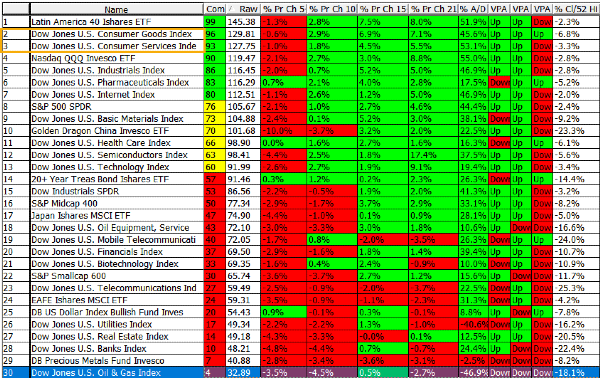

History does confirm that stocks actually can go higher with interest rates increasing and our recent ultra-low rates were just not “normal” nor sustainable. Overall the market breath continues to improve; that is more stocks are participating in the general climb higher. New Highs are overtaking New Lows; the Advance / Decline ratios are improving too. Clearly a wild card event could throw a loop and this market is susceptible to news in a significant way; all is not “sweetness & light”, that’s true. But if we wait for a sure thing, we’ll be closer to the next market top that a bottom. With reward comes risk, such is life. I am expecting a minor pullback early next week. It should be on light volume.

As a reminder: The US stock markets are open on Monday, July 3, but will close early at 1pm EDT. Those in the US, have a Happy & Safe 4th of July. Take Care and have a good week. …. Tom ….

Chart by www.StockCharts.com