Sound investments

don't happen alone

Find your crew, build teams, compete in VS MODE, and identify investment trends in our evergrowing investment ecosystem. You aren't on an island anymore, and our community is here to help you make informed decisions in a complex world.

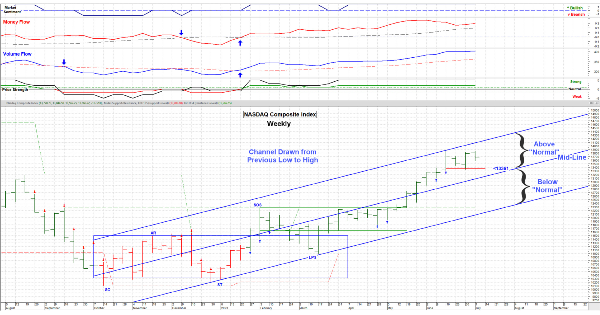

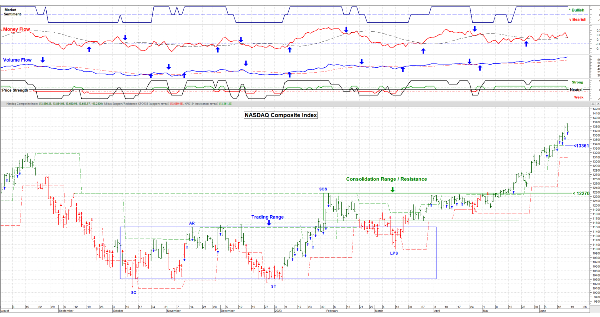

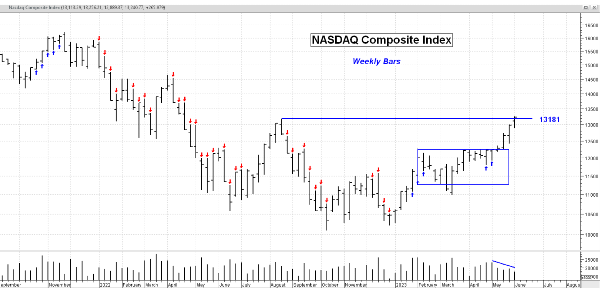

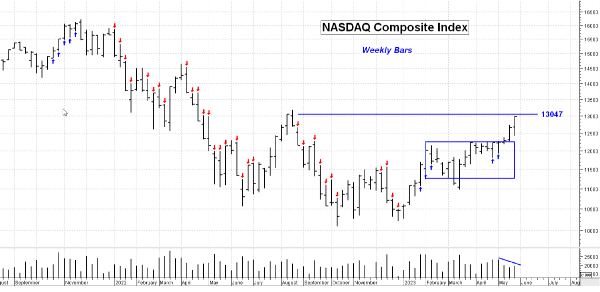

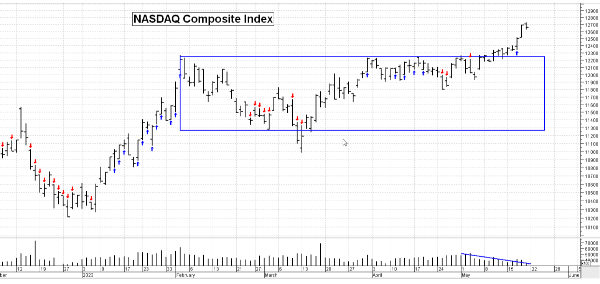

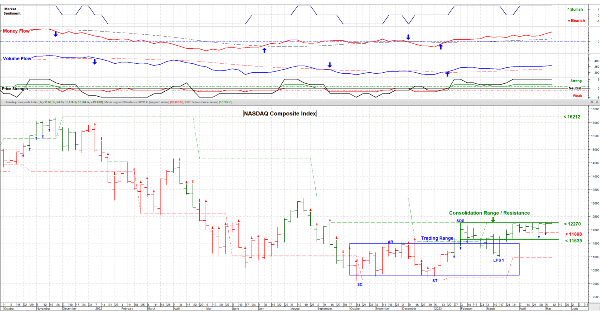

July 7, 2023 - I’ll explain why I’m anticipating a modest pullback. The chart shows the broad NASDAQ Composite Index in a weekly bar format. *(It has 5,203 stocks in it with many sectors represented but is capital weighted, that is, weighted toward bigger companies.) * I’ve drawn in a regression channel, a ‘Mid-Line’ showing that half the prices are above and half below the line. The upper & lower channel lines are +/- 2 standard deviations from the ‘Mid-Line’, showing “typical variances” from the ‘Mid-Line’.

Bullish: Yep, the channel is pointed up and the prices are above the lower channel line. But where is the price now? Well it’s right near the top of the upper channel. Well, that’s just a little unusual. Looks like this market got “a little ahead of itself” in the current trend. Now . . . that doesn’t mean that the market “has to” correct and come back down. The market doesn’t “have to “do anything. It can come down a little or pause and let time catch up to price.

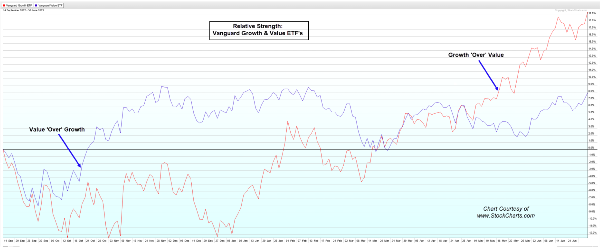

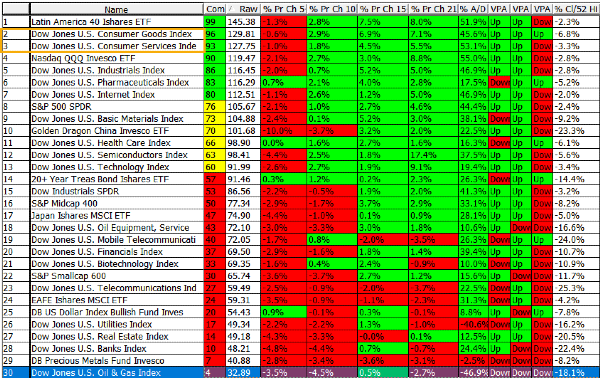

My point is a continuation of prices going up at this rate would be unusual, so I would not be surprised if we take a breather in here, for the market, in general. Certain sectors and stocks will indeed go much higher or much lower but I’m looking at the big weekly picture. After all . . . it is the summer and that’s a seasonal time for markets to ‘take it easy’. What is moving more than the market as a whole? The Short Term Sector Strength table gives us a clue (available at: www.Special-Risk.net )

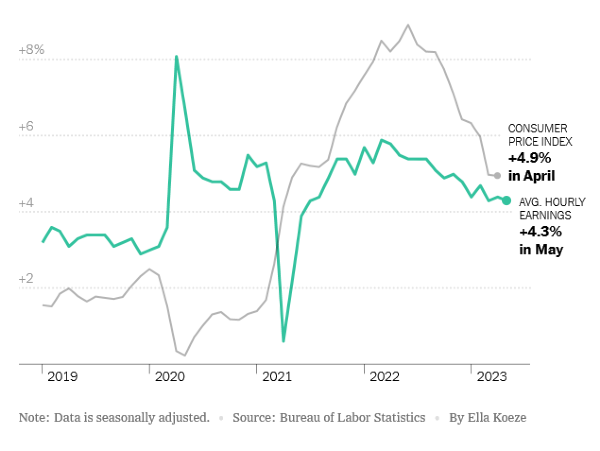

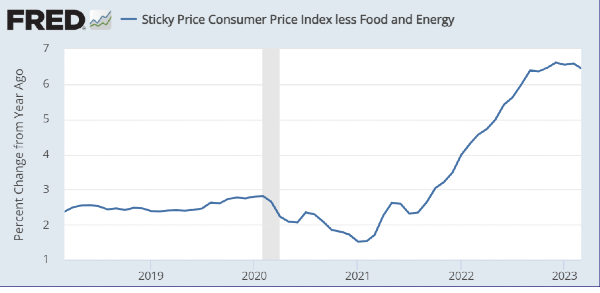

The market remains nervous about inflation and a recession and that’s likely to continue with the next FED meeting coming July 25 – 26. Another ¼% increase is expected. That’s it for now. Have a good week. …………. Tom ……………..