The Top Financial Literacy Articles

The top Financial Literacy reads for February 2026

Why is Financial Literacy Important?

Financial literacy provides the blue prints, process, and guidelines for financial success. Learning financial literacy leads to financial security, financial freedom, and financial independence. Any person can achieve these levels of financial success so long as they:

- Maintain a steady job or stream of income

- Practice Discipline

- Learn financial literacy

Financial literacy teaches individuals how to measure and control their personal finance. Financial goals will differ from person to person and may expand when they meet their goals. Examples of financial goals include:

- Building enough assets for an emergency fund

- Eliminating personal debt and interest payments

- Asset growth for use in retirement

- Complete financial freedom from passive income

How to Gain Financial Knowledge

StockBossUp’s mission is “Wealth Creation at Scale”. Our main mission is to provide investment ideas from the community that are honest, well researched, and performance based. But to start building wealth, you must have a baseline knowledge of financial literacy. Investing is only one part of financial literacy. If you are just starting your journey into financial literacy, start by reading one financial literacy article here on StockBossUp a week. We trend articles that are relevant and engaging. An article needs to not only be financial education but also be engaging and entertaining. We want to keep financial literacy fun so that you continue to learn.

The Five Areas of Financial Literacy

Financial Goals and Planning

Financial goals are the first and most important aspect of financial literacy. Understanding the goals you can achieve are critical in setting yourself on a path. Many people do not have financial goals as they are completely unaware of what they can achieve. They also may not know how to articulate a financial goal. This topical area covers:

- Retirement Planning

- Estate Planning

- FIRE Movement

- What Financial Security Means

- What Financial Independence Means

- What Financial Freedom Means

Without knowing a goal or possibility, an individual cannot plan out the steps necessary to reach these goals. Once you know your goals, be sure to set a process and change habits to meet your financial goals.

Earn and Income

Earning income from working, investing, and entrepreneurship are the cornerstone of financial literacy. It is the baseline that is needed to start discussions about budgeting, investing and debt. Some topics important to earning are:

- Income Tax

- Side Hustles

- Small Business Topics

- Passive Income

Just like a business, earning is the top line of your budget.

Read More: The Top Dividend Stocks to Grow Your Passive Income

Budgeting and Saving

Budgeting is the template for your financial plan. If financial goals are your destination, your budget is the map. Budgeting is the action plan needed to get to your financial goals. Budgeting is more than just austerity, budgeting is road map to financial success. Budgeting sets out to allocate your earnings, borrowing, and investing to direct them toward your financial goals. With proper cash flow management, you can start eliminating debt and growing your investments.

Borrowing, Debt, and Credit

Debt helps people diversify through time by giving people access to assets now that they can use to improve their ability to create income, improve their wellbeing, or accumulate assets now.

Debt can be used to improve one’s income potential. When you buy a car with credit, you are increasing your income potential by having a vehicle to commit to work. You can use debt to buy a house without all the money needed to purchase the property. Having the house improves your well-being and can help you focus on your career.

You can also use debt to buy investments. When buying stocks this is called margin. Buying stocks using margin helps you diversify in time as you can now own more stock now instead of waiting into the future.

Investing

Investing is a critical component to personal finance. If you earn your salary and this is your only income stream, then you’ve capped the maximum amount of money you can make. You’ve limited your earning potential to only the amount of time you can work. Investing in stocks allows you to buy enterprises where you can profit from the efforts and collaborations of others.

By investing, you diversify your income streams away from just income from your time. This is a necessity when you start to plan for retirement.

Read More: The Top Stock Picks From Across the Platform

How to Assess Your Financial Literacy

- Do you know what your current net assets are? Knowing what your net assets are (total investments and assets minus liabilities) is the first step in knowing your financial health. Your net assets should increase quarter over quarter.

- Do you have a budget? You can increase your assets without a budget. You need to know your regular expenses and how much you need to cut down to meet your asset growth goals.

- Do you have an emergency fund in case of an unexpected life event? You should have a minimum of 6 months of expenses covered with liquid assets likes cash, bonds, and stocks

- Do you have a retirement plan? One of the biggest retirement mistake is to not create a retirement plan. Inevitably, a day will come where you will not work and replacing that income with investments is the ideal plan.

- Do you know your credit score? Checking and monitoring your credit score can help you improve your score. Higher scores helps you to get debt with lower interest rates and better terms.

- What is your plan to pay off your debt? You can use the snow ball technique or the avalanche technique to pay off your debt; however, the first step to reducing your debt is to stop accumulating more debt with credit cards.

What is the Benefit of Financial Literacy?

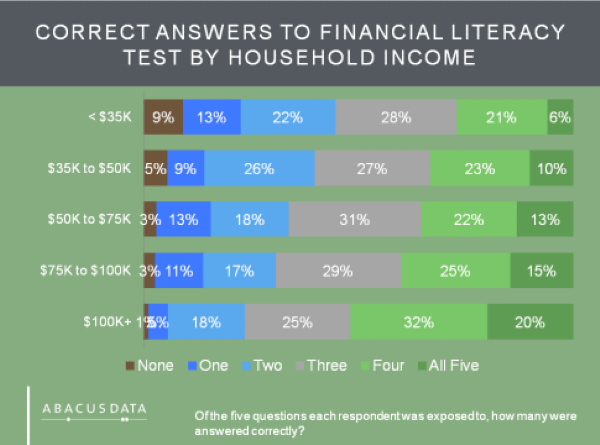

A study by FDIC found that consumers changed their financial behavior positively after conducting a financial education program called “Money Smart”[1]. Some examples of changed behavior including an increase in checking accounts and savings accounts opened, an increase in budgets built and used, and an increase in bills paid on time. Another survey showed that there was a correlation between financial literacy knowledge and household income [2]

How does financial literacy impact society?

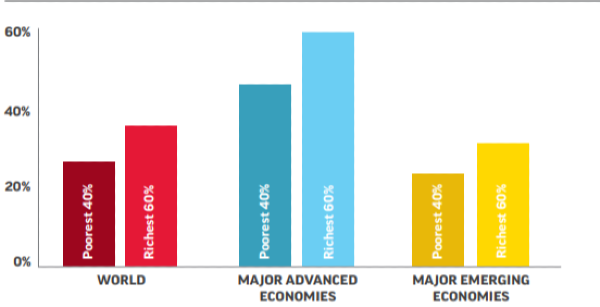

Data gathered by Standard & Poors showed that increased financial literacy correlates with higher incomes.

Financial Literacy Grows with Income[3], percent of adults who are financially literate

Surveys suggest that financial insecurity is prevalent in American households. A survey conducted by FINRA found that most people are anxious about their finances and around 44% found discussing their finances stressful[4].

Financial literacy has shown to correlate with higher incomes and better financial habits. Promoting financial literacy to larger groups may help relieve stress and anxiety. Financial literacy may be more than economically beneficial to households but may also support healthier ways of living.

Financial Literacy Articles for High School Students

Our platform has partnered with multiple foundations and organizations to create financial literacy content for High School students. If your organization is interested in publishing your content on our platform, email us at info@stockbossup.com.

ClimbUsa

climbusa.org – Promotes financial education and are focused on ‘opportunity youth’, families, and communities that have historically been underserved.

Our platform has partnered with multiple programs to

Wealth Habits

The mission of Wealthyhabits.org is to:

empower children and adults across the socioeconomic spectrum with the knowledge and skills essential for successful financial decision making.

Our platform works with Wealthy Habits to syndicate financial education content. Wealthy Habits writes content for students, children and adults in their program.

Financial Literacy Articles for College Students

TheRapSnacksFoundation.org is a non-profit arm of Rap Snacks. The program connects with HBCUs* to support financial literacy, entrepreneurship, and investing.

Top Financial Literacy Stocks: The Complete Guide for 2026

If you’re searching for the top consumer discretionary stocks, this guide gives you a clearer picture than traditional rankings based on market cap or last year’s earnings. Instead of backward‑looking metrics, our list is powered by the real‑world performance of StockBossUp’s highest‑achieving investors. These investors must consistently perform well to stay ranked, which adds accountability and depth to every stock they choose.

This means the stocks you see here aren’t just popular. They reflect conviction backed by results. If you want to compete with top investors and share your own ideas, join StockBossUp and make your mark.

The Top 5 Financial Literacy Stocks

These five companies represent the top Financial Literacy stocks chosen by our highest‑performing community members. The list updates daily, giving you a real‑time look at where experienced investors see opportunity in this stock category.

There may be less than 5 stocks when top investors are not rating Financial Literacy a buy.

Why These Stocks Stand Out

Each stock earns its place through:

Strong long‑term investor sentiment

Consistent performance from top‑ranked users

Analysis focused on durable growth, not short‑term hype

The Top 16 Financial Literacy Stocks

This expanded list gives you a broader view of the best Financial Literacy consumer discretionary stocks for long‑term investors. These stocks are ranked by sentiment from our highest‑performing long‑term investors, offering a snapshot of where experienced stock pickers see opportunity today.