Sound investments

don't happen alone

Find your crew, build teams, compete in VS MODE, and identify investment trends in our evergrowing investment ecosystem. You aren't on an island anymore, and our community is here to help you make informed decisions in a complex world.

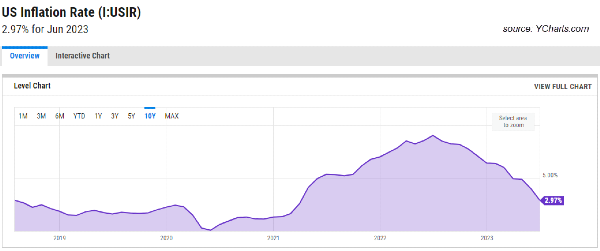

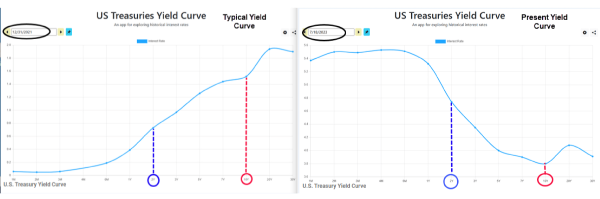

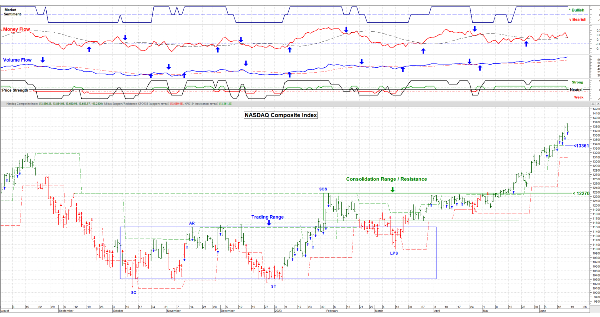

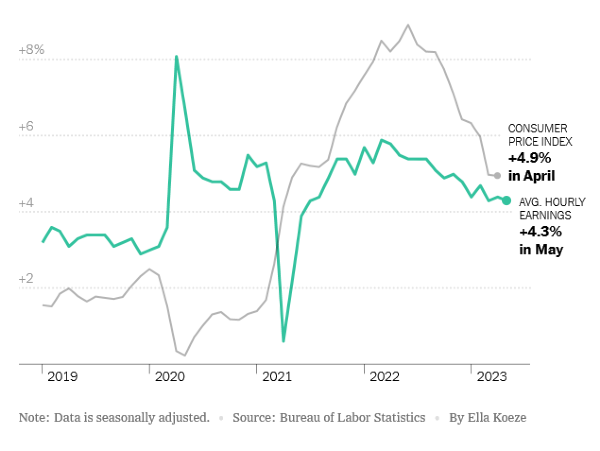

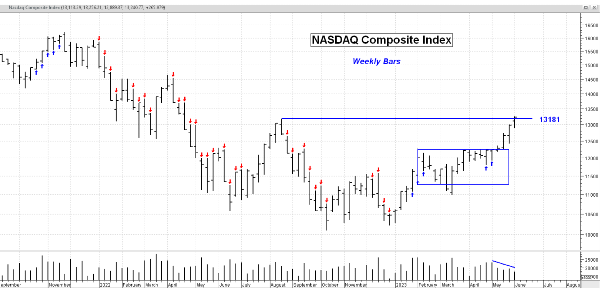

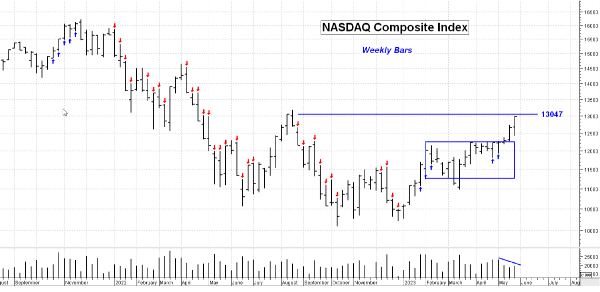

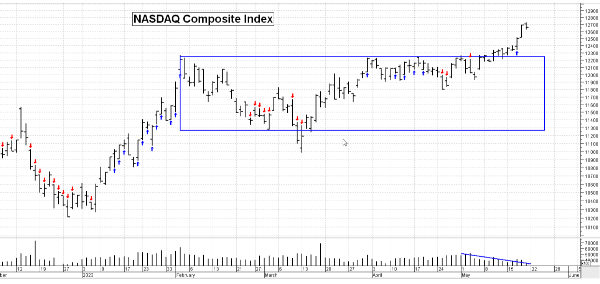

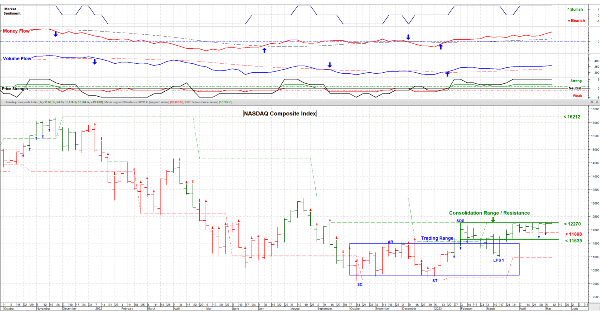

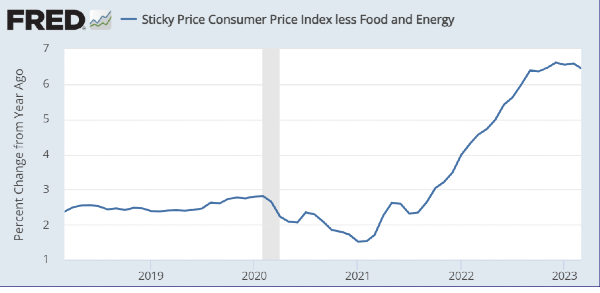

July 28, 2023 - Continued good news about the month to month inflation rate: at 2.97% for June. This encouraged the markets to ‘expect’ maybe one more rate increase then a pause, then a drop in the Fed interest rates in 2024. I point out that “inflation” measures the change in prices and it’s not an absolute measure of prices; i.e. 0% inflation would indicate stable price levels, not lower prices. And so the US markets liked this, because it was expected, and markets don’t like surprises at all.

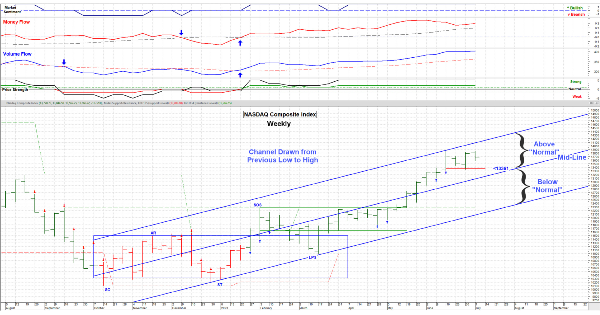

Second quarter earnings are coming in generally pretty strong. There is some forward guidance that indicates a slowing growth rate but consider that this good news is already priced into many stocks. For prices to continue to rise dramatically ‘something good’ needs to happen to justify it.

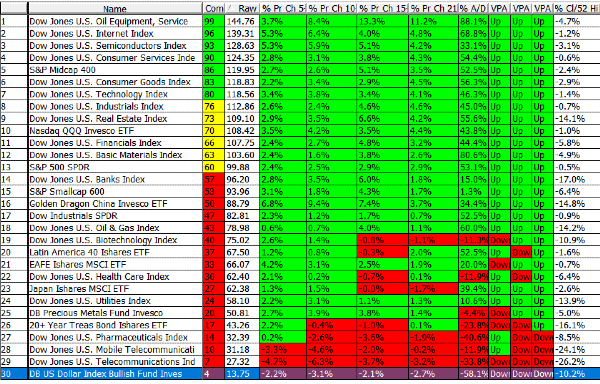

As we enter August and the “Dog Days of Summer”, I am considering a market pause to consolidate past gains. This would be ‘normal’ both seasonally and in lieu of recent price activity. The rest of 2023 will likely be a stock pickers market, in that we’ve likely witnessed the ‘rising tide that lifts all boats’ part of this market phase. In all likelihood, more is to more, just not all at once and at this rate.

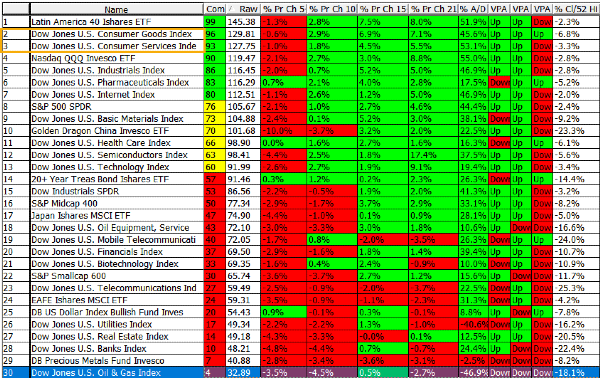

The Short Term Sector Strength table is show at www.Special-Risk.net

I note that select Chinese sectors recently appeared toward the top of the table. Interesting since the Chinese economy is nowhere near its previous growth rate. That’s it for now. Take Care and Stay Cool (or try to). …………. Tom …………. Price chart by MetaStock; & table by www.HighGrowthStock.com. Used with permission.