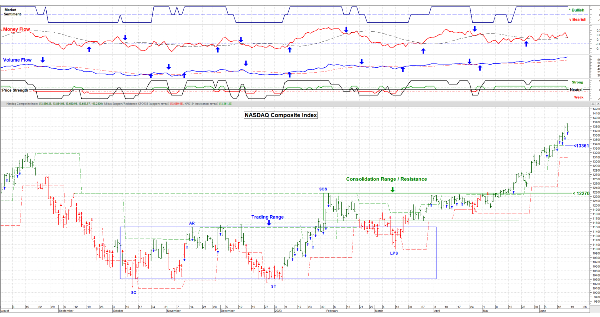

August 11, 2023 – I rarely make “projections” (sounds better that “predictions”) so I’m going out on a limb with what might be instore of the markets over the next couple of months. Note that I’m not firmly attached to any of this, that’s a “fool’s errand”, just two scenarios to ponder.

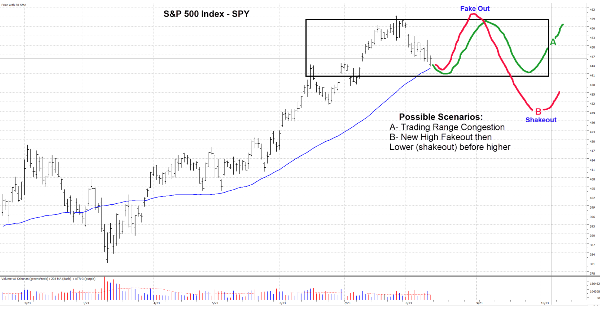

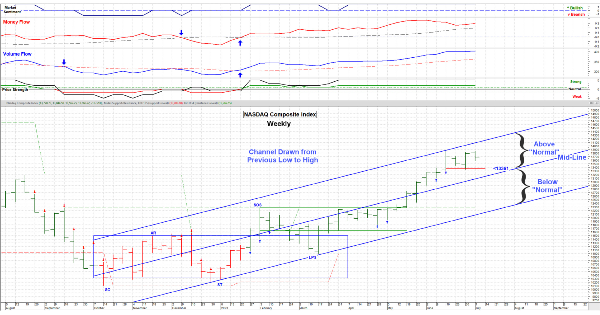

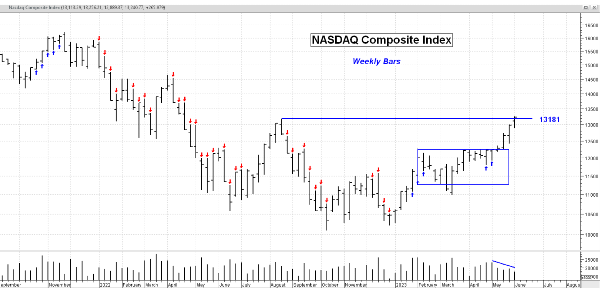

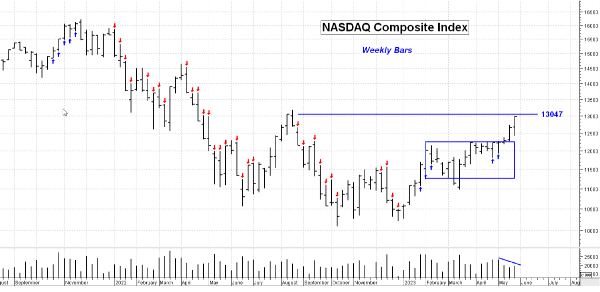

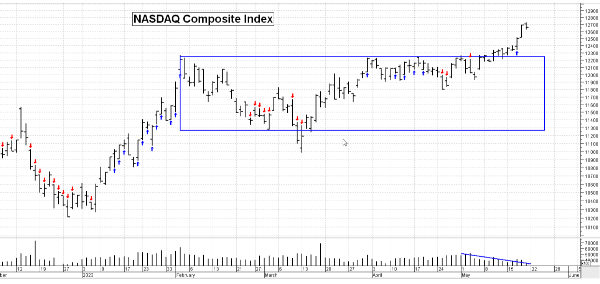

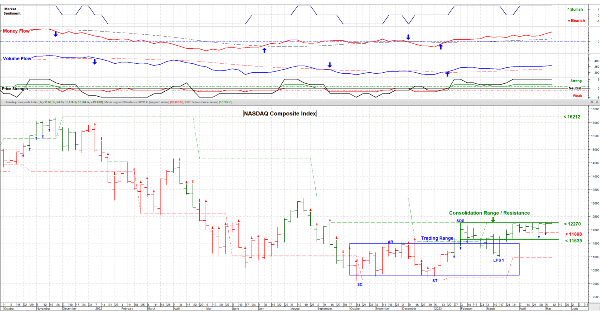

Scenario A: For the next two months we’re in a broad trading range attempting to consolidate past price increases. After roughly mid-October as economic news stabilizes, we re-enter a climb higher. This market is not cheap.

Scenario B: We dip just a little lower next week, then begin a rise just past the previous swing high. That “new high” will draw people in and could be considered a “Fakeout”, before a significant low late September / early October. Thereafter buying comes in and a “Shakeout” of weak hands is accomplished before price resume a climb higher. This is how the “big guys” make money.

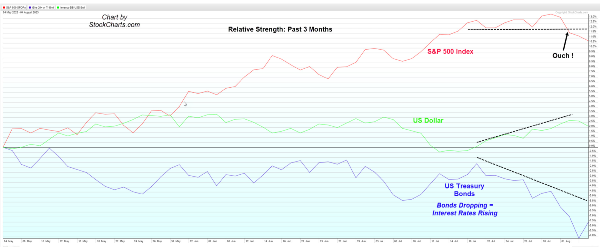

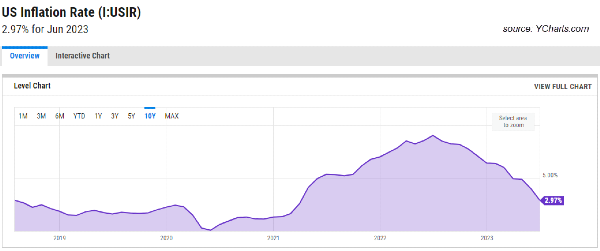

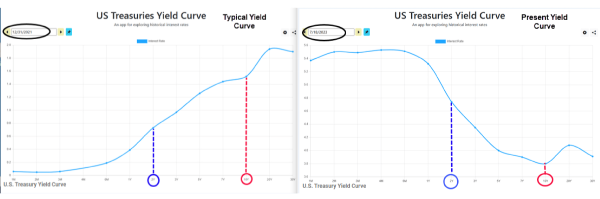

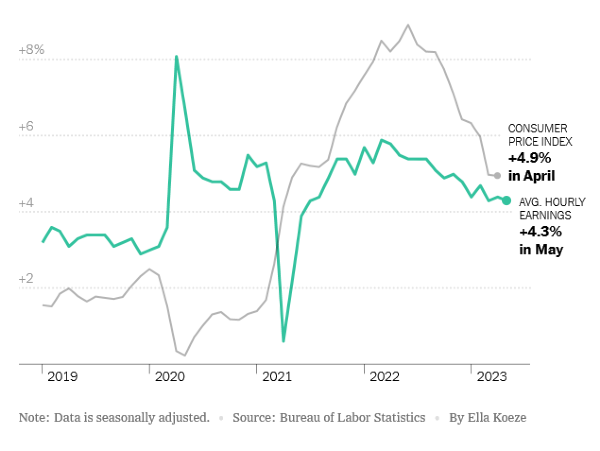

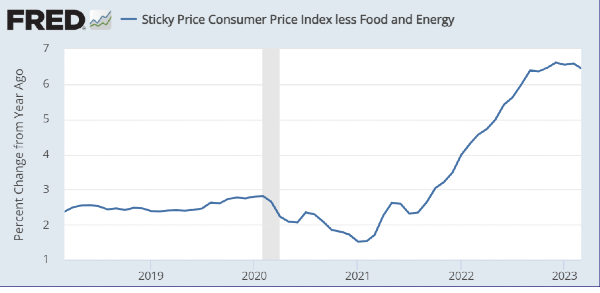

The one common thing is that the next couple of months will be more volatile and picking investments to hold won’t be easy. A trader’s paradise; rise and repeat. As always, we’re susceptible to bad news, especially economic news. The market is expecting only one more small interest rate increase with inflation under control and going lower. IF that doesn’t happen . . . well then both scenarios are out the window.

This is a new format driven by me switching to a new computer and not all of my programs are “behaving” well, but new graphics help spice things up. 😊

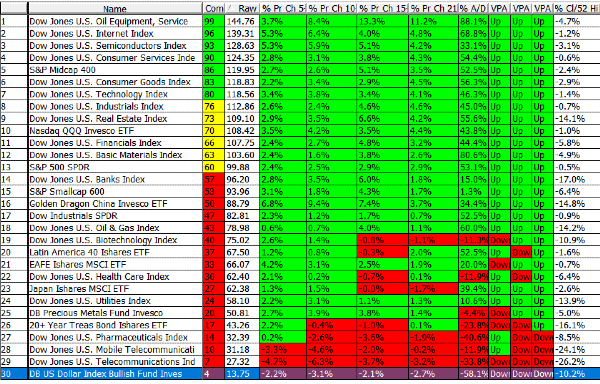

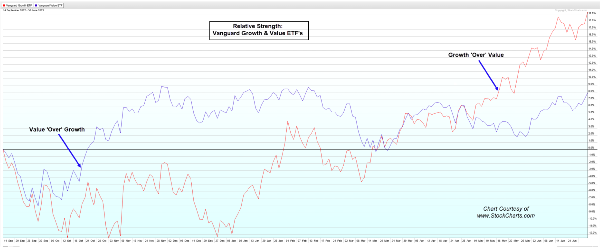

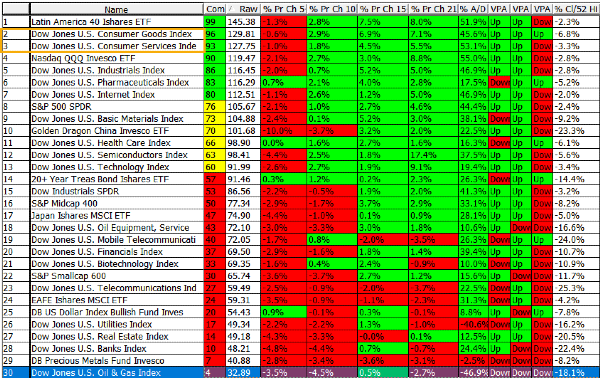

I’ve taken some money off the table over the past week as this market has shown signs of weakening. Nothing major but I’m looking for some rotation in sectors that will be better performers over the next couple of months. The traditional growth & tech stocks have had a good run and may need a rest. We’ll see. Have a good week. ………….. Tom …………

Price chart by www.HighGrowthStock.com. Used with permission.

August 11, 2023 – I rarely make “projections” (sounds better that “predictions”) so I’m going out on a limb with what might be instore of the markets over the next couple of months. Note that I’m not firmly attached to any of this, that’s a “fool’s errand”, just two scenarios to ponder.

Scenario A: For the next two months we’re in a broad trading range attempting to consolidate past price increases. After roughly mid-October as economic news stabilizes, we re-enter a climb higher. This market is not cheap.

Scenario B: We dip just a little lower next week, then begin a rise just past the previous swing high. That “new high” will draw people in and could be considered a “Fakeout”, before a significant low late September / early October. Thereafter buying comes in and a “Shakeout” of weak hands is accomplished before price resume a climb higher. This is how the “big guys” make money.

The one common thing is that the next couple of months will be more volatile and picking investments to hold won’t be easy. A trader’s paradise; rise and repeat. As always, we’re susceptible to bad news, especially economic news. The market is expecting only one more small interest rate increase with inflation under control and going lower. IF that doesn’t happen . . . well then both scenarios are out the window.

This is a new format driven by me switching to a new computer and not all of my programs are “behaving” well, but new graphics help spice things up. 😊

I’ve taken some money off the table over the past week as this market has shown signs of weakening. Nothing major but I’m looking for some rotation in sectors that will be better performers over the next couple of months. The traditional growth & tech stocks have had a good run and may need a rest. We’ll see. Have a good week. ………….. Tom …………

Price chart by www.HighGrowthStock.com. Used with permission.