Sound investments

don't happen alone

Find your crew, build teams, compete in VS MODE, and identify investment trends in our evergrowing investment ecosystem. You aren't on an island anymore, and our community is here to help you make informed decisions in a complex world.

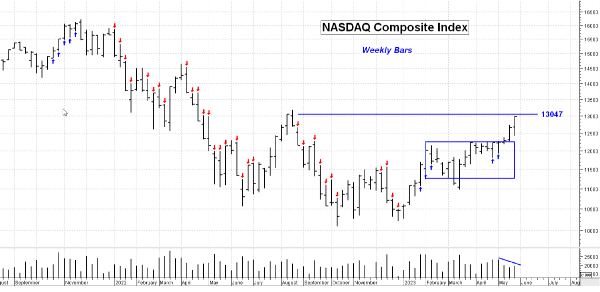

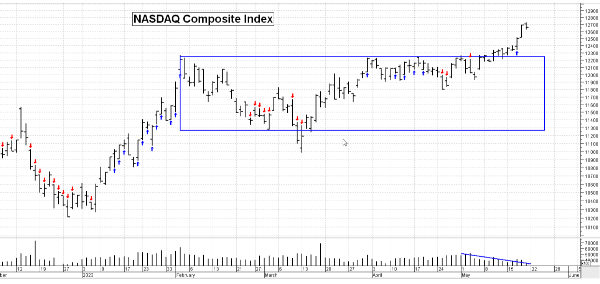

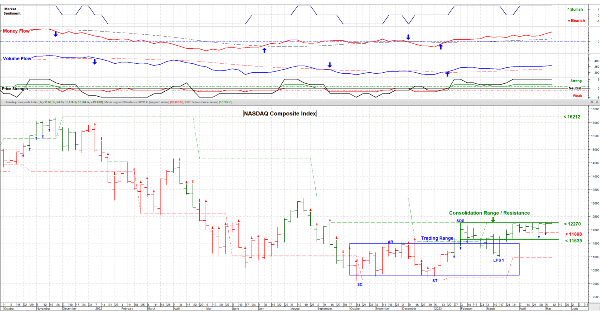

May 26, 2023 – Again, this will be short and to the point. The market indexes are at a resistance level (previous swing high) after a very good week. This is a logical & typical level to pause and consolidate before resuming a move higher. Thus I’m expecting a slight pullback with some “back and forth” movement next week. Watch the volume coming into / out of the market.

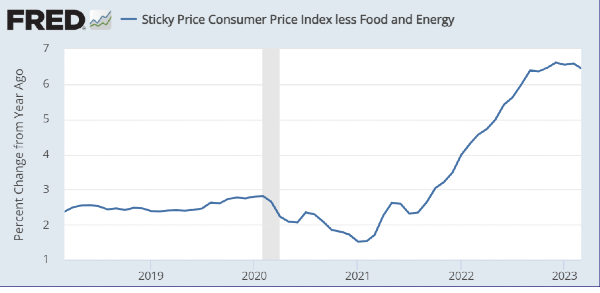

Overall I remain Bullish, but this market is very much news driven. It is expecting a “Goldie Locks” economy going forward, that is, no or minimal interest rate increases and a soft landing for the economy. But . . . Inflation remains “sticky: at an annual rate of 4.4%* (above FED goals*). And . . . the economy remains stubbornly strong (consumers keep buying). This leaves the FED in an uncomfortable position. Do they risk more rate increases, a possible recession, then corporate earnings headed lower and the resulting stock prices falling as well? “Wild Cards” are out there: a US default and the Ukrainian war with an unknown Russian response.

I note the market indexes are higher but on lower volume; not a strong positive vote for the immediate future. Technology continues to be the major (sole?) force that is driving these markets. We need more participation. I’m selective with investments and cautious. The “All Clear” has not been sounded.

Have a good week. …………. Tom ……………. Chart by MetaStock & table by HighGrowthStockInvestor.com; used with permission.