This Dividend King has had a rough 52 weeks. Over the last 52 weeks, Leggett & Platt (LEG) is down 15% of the last 52 weeks and down 23% over the last 5 years. They may be down, but are they out?! The company is a King for a reason after all. In this article, we will review Leggett & Platt to determine if this Dividend King is a stock to buy! After all, I already own 176 shares. I need to see if it is time to add to my position!

Watch more:

https://youtu.be/b2cIuJ6V9l4

About Leggett & Platt

Leggett & Platt is a unique Dividend King with a market cap of $4B. The company operates in the Consumer Cyclical sector in the Furniture, Fixtures & Appliances industry, per Morningstar. Their main products are split into three segments: begging, specialized products & Furniture, Flooring & Textile products (Home furniture, work furniture and flooring). The company impacts our daily lives. The company’s products just are not as visible to consumers as the consumer staple Dividend Kings like Johnson & Johnson (JNJ), Procter & Gamble (PG), Pepsi (PEP), and Coca-Cola (KO).

Looking further at the segments, it is easy to understand why the company is a Dividend King but also why the company face headwinds in a period of economic uncertainty. In the top right corner of the image above, it shows that the company’s sales are split well among the 3 main segments. No one segment accounts for more than 42% or less than 26% of sales. The segments are so different as well that it insulates the company from specific consumer behaviors. A slowdown in mattress sales will not impact Hydraulic Cylinders nor will a slowdown in office chairs impact Aerospace tubing, as a simplified examples.

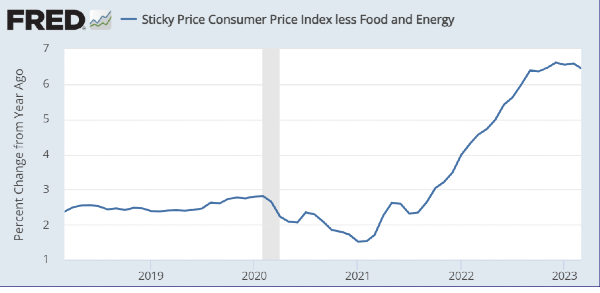

Despite the fact that the majority of the products are key pieces to products found throughout your house, some of the products listed in the image above are luxury products. “Wants” but not “needs.” A new mattress, especially one that is an adjustable beds or specialty foams, or upgrading your home office furniture or flooring, are not always needs. Unfortunately, when family budgets are stretched thin due to inflation and higher interest rates, the “want” purchases are put on hold to make room for the “needs.”

Leggett & Platt has created the amazing situation where the company’s sales have a “high floor” due to their position as market leaders in these niche segments but “a lower ceiling” in tough economic environment due to consumers tightening their budget. People still need mattresses (which they sell). They just don’t need the adjustable beds. However, when times are great, watch out. Leggett & Platt’s sales have the chance to explode (sales grew from $4.2B to $5.1B in 2021.

Financial Review

The company is set to release Q1 2023 earnings in the near future. We won’t spend a significant time reviewing the financial results. However, it is worth noting a few items from the company’s last Earnings Release Presentation.

In 2022, the company did set an all time record in sales. The company recorded over $5.1B in sales, a 1% increase compared to 2021. However, by the end of the 4th quarter, the company’s record setting sales run was losing steam. The company recorded $1.2B in sales in Q4 2022; however, it was a 10% decrease compared to Q4 2021. From an earnings standpoint, the company recorded EPS of $2.27. This more than covered the dividend, but was down 18% compared to the previous year.

Let’s turn to the balance sheet. Two things jump out when looking at the Balance Sheet (Below). First, the company has a lot of debt. In fact, the company’s debt actually increased 17% in 2022 to $2.074B. Interestingly though, if you look up a few lines, the company doesn’t really have any of this debt maturing in 2023. This is an interesting, and potentially genius, cash management strategy for management. Why? If the company is forecasting a tough 2023 with lower sales and tightening margins, why compound this by having to pay back hundreds of millions of dollars of debt?

Second, the company has a strong current ratio. the current ratio is almost 2X as of 12/31/22. Again, it shows that the company’s short term financial position is solid to weather a tough 2023.

2023 Guidance

Management produced its 2023 guidance on its investor relations page. The guidance is included in the image below. Let’s just say the results are not going to knock your socks off. In fact, I read the earnings as management setting very low expectations for the year and being up front and open with investors and analysts.

Sales are projected to be down 7% on the low range of estimates or flat in the best case scenario. Particularly, the two consumer facing segments, Bedding and Furniture, Flooring & Textile, have very low sales forecasts. See our conversation earlier and management’s guidance matches that sentiment.

Earnings are also expected to be lower due to lower sales and lower margins as a result of higher costs and transportation costs. We will come back to EPS and the dividend later in the article. Lastly, the other guidance figures I’d like to call out is operating cash of $450m – $500m and dividends of ~$240m. The operating cash is forecasted to continue covering the dividend. At least there is that, right?!

.

Dividend Diplomat Stock Screener

To find and analyze undervalued dividend stocks, we use 3 SIMPLE metrics to evaluate every dividend stock. The goal of our stock screener is to identify if a stock is an undervalued dividend growth stock to buy.

Watch: Our Simple, 3 Step Stock Screener

Here is a rundown of the 3 metrics of our stock screener:

1.) Price to Earnings Ratio Less than the S&P 500. Currently, the S&P 500 is trading at a P/E Ratio of 22.3X.

2.) Dividend Payout Ratio Less than 60%. The payout ratio measures the safety of the dividend. This ensures the company can continue growing its dividend during good times and bad. That’s why it is a critical metric in our stock screener that we must evaluate! We think the perfect payout ratio range is between 40% and 60%!

Read: Dividend Aristocrats with a PERFECT Dividend Payout Ratio

3.) History of Increasing Dividends. We review this metric by reviewing the company’s five-year average dividend growth rate and consecutive annual dividend increases. Since we are long term investors, it is important that a company increases its dividend consistently!

Bonus: Dividend Yield. We like to also throw in a bonus metric to our dividend stock analysis. Yield does not drive our decision; however, we would be lying if we said we completely ignore dividend yield.

See the video below, for further details and explanation. If you don’t like to watch videos – see our Dividend Diplomat Stock Screener page!

Leggett & Platt’s Results

Now let’s run Leggett & Platt through our Dividend Stock Screener! LEG’s stock price is $31.56 per share at the time of this article. The company’s forward EPS is $1.83 per share and the annual dividend is $1.76 per share. Let’s see how the metrics shake out.

1.) Price to Earnings Ratio: 17.24x.

2.) Dividend Payout Ratio: 96%.

3.) History of Increasing Dividends: LEG’s 5 Year DGR is 4.10% and the company has increased its dividend for 51+ consecutive years. The chart below from Leggett & Platt’s investor relations page shows the company’s strong dividend growth over the years!

4.) Dividend Yield: 5.57%

Summary

The results are very interesting when run through the stock screener. The company’s dividend history is second to none. They are a Dividend King. Enough said. We can get that metric out of the way. Now let’s talk about the valuation. Leggett & Platt is not the cheapest dividend stock despite the fact the stock is down 13% year to date. The P/E Ratio is below the current market…just not by a lot. The low earnings forecasts do not help. Still though, it passes the first metric of our screener.

Now. let’s talk about that payout ratio. The company’s dividend payout ratio of 90% is well above the 60% threshold we use in our dividend stock screener. Is this a short-term blip due to low earnings forecasts or a longer-term trend to be concerned about? To determine this, I did a little more digging.

In management’s 2023 forecast and updates on the Investor Relations Page, management addresses the dividend safety and the company’s cash position. First, the company shares its focus on maintaining a strong cash position and keeping strong cash flow (see image below). Further, the company basically states that “we’ve been here before.” We have a cash flow stream that is there in great and bad economic cycles. That’s why the company has been able to earn the Dividend King title. Surely 2023 isn’t the first recession the company has increased its dividend in, right?!

Further, in the image above, there was a point I alluded to earlier in the article when reviewing the balance sheet. The company does not have any major debt coming due in 2023. In fact, the situation was better than expected. Management stated they don’t have any major debt maturities until November 2024! On top of it, if needed, the company have $1.2B available via credit facility if needed. You don’t want to see a company taking out high interest rate debt to fund its dividend. However, it is good to know that the company has multiple avenues to access cash in a tough economic environment if needed.

Reading through the presentation gives me confidence that management is committed to increasing its dividend once again in 2023 when the time arises. Will the increase be large? Doubt it. In fact, I’m expecting a tiny dividend increase. The earnings forecasts are dismal and thus, the 90% payout ratio factors in some pretty bad scenarios. There clearly is a strong commitment to maintaining Dividend King status that should be considered here. Plus, I think management is doing a great job managing cash and positioning itself well to weather a tough 2023 and come out stronger on the other side of the potential recession.

Will I be buying shares of Leggett & Platt? Yes. In a recent YouTube video, I would love to grow my LEG position to 200 shares. We are currently at 176 shares. I could easily build this position to 200 by the end of the quarter and lower my cost basis and take advantage of these low prices. In fact, that may become my portfolio’s new short term goal!

What do you think of Leggett & Platt? Do you think I’m being too optimistic about the company despite the high payout ratio? Would you build my position to 200 shares if you were me?

Bert

This Dividend King has had a rough 52 weeks. Over the last 52 weeks, Leggett & Platt (LEG) is down 15% of the last 52 weeks and down 23% over the last 5 years. They may be down, but are they out?! The company is a King for a reason after all. In this article, we will review Leggett & Platt to determine if this Dividend King is a stock to buy! After all, I already own 176 shares. I need to see if it is time to add to my position!

Watch more:

https://youtu.be/b2cIuJ6V9l4

About Leggett & Platt

Leggett & Platt is a unique Dividend King with a market cap of $4B. The company operates in the Consumer Cyclical sector in the Furniture, Fixtures & Appliances industry, per Morningstar. Their main products are split into three segments: begging, specialized products & Furniture, Flooring & Textile products (Home furniture, work furniture and flooring). The company impacts our daily lives. The company’s products just are not as visible to consumers as the consumer staple Dividend Kings like Johnson & Johnson (JNJ), Procter & Gamble (PG), Pepsi (PEP), and Coca-Cola (KO).

Looking further at the segments, it is easy to understand why the company is a Dividend King but also why the company face headwinds in a period of economic uncertainty. In the top right corner of the image above, it shows that the company’s sales are split well among the 3 main segments. No one segment accounts for more than 42% or less than 26% of sales. The segments are so different as well that it insulates the company from specific consumer behaviors. A slowdown in mattress sales will not impact Hydraulic Cylinders nor will a slowdown in office chairs impact Aerospace tubing, as a simplified examples.

Despite the fact that the majority of the products are key pieces to products found throughout your house, some of the products listed in the image above are luxury products. “Wants” but not “needs.” A new mattress, especially one that is an adjustable beds or specialty foams, or upgrading your home office furniture or flooring, are not always needs. Unfortunately, when family budgets are stretched thin due to inflation and higher interest rates, the “want” purchases are put on hold to make room for the “needs.”

Leggett & Platt has created the amazing situation where the company’s sales have a “high floor” due to their position as market leaders in these niche segments but “a lower ceiling” in tough economic environment due to consumers tightening their budget. People still need mattresses (which they sell). They just don’t need the adjustable beds. However, when times are great, watch out. Leggett & Platt’s sales have the chance to explode (sales grew from $4.2B to $5.1B in 2021.

Financial Review

The company is set to release Q1 2023 earnings in the near future. We won’t spend a significant time reviewing the financial results. However, it is worth noting a few items from the company’s last Earnings Release Presentation.

In 2022, the company did set an all time record in sales. The company recorded over $5.1B in sales, a 1% increase compared to 2021. However, by the end of the 4th quarter, the company’s record setting sales run was losing steam. The company recorded $1.2B in sales in Q4 2022; however, it was a 10% decrease compared to Q4 2021. From an earnings standpoint, the company recorded EPS of $2.27. This more than covered the dividend, but was down 18% compared to the previous year.

Let’s turn to the balance sheet. Two things jump out when looking at the Balance Sheet (Below). First, the company has a lot of debt. In fact, the company’s debt actually increased 17% in 2022 to $2.074B. Interestingly though, if you look up a few lines, the company doesn’t really have any of this debt maturing in 2023. This is an interesting, and potentially genius, cash management strategy for management. Why? If the company is forecasting a tough 2023 with lower sales and tightening margins, why compound this by having to pay back hundreds of millions of dollars of debt?

Second, the company has a strong current ratio. the current ratio is almost 2X as of 12/31/22. Again, it shows that the company’s short term financial position is solid to weather a tough 2023.

2023 Guidance

Management produced its 2023 guidance on its investor relations page. The guidance is included in the image below. Let’s just say the results are not going to knock your socks off. In fact, I read the earnings as management setting very low expectations for the year and being up front and open with investors and analysts.

Sales are projected to be down 7% on the low range of estimates or flat in the best case scenario. Particularly, the two consumer facing segments, Bedding and Furniture, Flooring & Textile, have very low sales forecasts. See our conversation earlier and management’s guidance matches that sentiment.

Earnings are also expected to be lower due to lower sales and lower margins as a result of higher costs and transportation costs. We will come back to EPS and the dividend later in the article. Lastly, the other guidance figures I’d like to call out is operating cash of $450m – $500m and dividends of ~$240m. The operating cash is forecasted to continue covering the dividend. At least there is that, right?!

.

Dividend Diplomat Stock Screener

To find and analyze undervalued dividend stocks, we use 3 SIMPLE metrics to evaluate every dividend stock. The goal of our stock screener is to identify if a stock is an undervalued dividend growth stock to buy.

Watch: Our Simple, 3 Step Stock Screener

Here is a rundown of the 3 metrics of our stock screener:

1.) Price to Earnings Ratio Less than the S&P 500. Currently, the S&P 500 is trading at a P/E Ratio of 22.3X.

2.) Dividend Payout Ratio Less than 60%. The payout ratio measures the safety of the dividend. This ensures the company can continue growing its dividend during good times and bad. That’s why it is a critical metric in our stock screener that we must evaluate! We think the perfect payout ratio range is between 40% and 60%!

Read: Dividend Aristocrats with a PERFECT Dividend Payout Ratio

3.) History of Increasing Dividends. We review this metric by reviewing the company’s five-year average dividend growth rate and consecutive annual dividend increases. Since we are long term investors, it is important that a company increases its dividend consistently!

Bonus: Dividend Yield. We like to also throw in a bonus metric to our dividend stock analysis. Yield does not drive our decision; however, we would be lying if we said we completely ignore dividend yield.

See the video below, for further details and explanation. If you don’t like to watch videos – see our Dividend Diplomat Stock Screener page!

Leggett & Platt’s Results

Now let’s run Leggett & Platt through our Dividend Stock Screener! LEG’s stock price is $31.56 per share at the time of this article. The company’s forward EPS is $1.83 per share and the annual dividend is $1.76 per share. Let’s see how the metrics shake out.

1.) Price to Earnings Ratio: 17.24x.

2.) Dividend Payout Ratio: 96%.

3.) History of Increasing Dividends: LEG’s 5 Year DGR is 4.10% and the company has increased its dividend for 51+ consecutive years. The chart below from Leggett & Platt’s investor relations page shows the company’s strong dividend growth over the years!

4.) Dividend Yield: 5.57%

Summary

The results are very interesting when run through the stock screener. The company’s dividend history is second to none. They are a Dividend King. Enough said. We can get that metric out of the way. Now let’s talk about the valuation. Leggett & Platt is not the cheapest dividend stock despite the fact the stock is down 13% year to date. The P/E Ratio is below the current market…just not by a lot. The low earnings forecasts do not help. Still though, it passes the first metric of our screener.

Now. let’s talk about that payout ratio. The company’s dividend payout ratio of 90% is well above the 60% threshold we use in our dividend stock screener. Is this a short-term blip due to low earnings forecasts or a longer-term trend to be concerned about? To determine this, I did a little more digging.

In management’s 2023 forecast and updates on the Investor Relations Page, management addresses the dividend safety and the company’s cash position. First, the company shares its focus on maintaining a strong cash position and keeping strong cash flow (see image below). Further, the company basically states that “we’ve been here before.” We have a cash flow stream that is there in great and bad economic cycles. That’s why the company has been able to earn the Dividend King title. Surely 2023 isn’t the first recession the company has increased its dividend in, right?!

Further, in the image above, there was a point I alluded to earlier in the article when reviewing the balance sheet. The company does not have any major debt coming due in 2023. In fact, the situation was better than expected. Management stated they don’t have any major debt maturities until November 2024! On top of it, if needed, the company have $1.2B available via credit facility if needed. You don’t want to see a company taking out high interest rate debt to fund its dividend. However, it is good to know that the company has multiple avenues to access cash in a tough economic environment if needed.

Reading through the presentation gives me confidence that management is committed to increasing its dividend once again in 2023 when the time arises. Will the increase be large? Doubt it. In fact, I’m expecting a tiny dividend increase. The earnings forecasts are dismal and thus, the 90% payout ratio factors in some pretty bad scenarios. There clearly is a strong commitment to maintaining Dividend King status that should be considered here. Plus, I think management is doing a great job managing cash and positioning itself well to weather a tough 2023 and come out stronger on the other side of the potential recession.

Will I be buying shares of Leggett & Platt? Yes. In a recent YouTube video, I would love to grow my LEG position to 200 shares. We are currently at 176 shares. I could easily build this position to 200 by the end of the quarter and lower my cost basis and take advantage of these low prices. In fact, that may become my portfolio’s new short term goal!

What do you think of Leggett & Platt? Do you think I’m being too optimistic about the company despite the high payout ratio? Would you build my position to 200 shares if you were me?

Bert

Originally Posted on dividenddiplomats.com