American Water Works Stock Forecast is excellent, and its stock price has gained upward momentum after hovering near a 52-week low. Due to many Mergers & Acquisitions (M&As), this largest water company in the United States is expanding and scaling up continuously.

In this stock analysis, we will cover the latest earnings report of AWK stock and what this utility company does. Moreover, we will cover the newest AWK news to help you understand the stock's present and future earnings estimates.

Is American Water Works a Good Stock to Buy?

American Water Works (AWK) is an excellent stock to buy. Investors can take advantage of the lower price of this utility stock and get a stable dividend every quarter. Moreover, it's a safe investment against the rising tide of inflation and interest rates.

The one-year stock price forecast is expected to reach at $158 and five-year price at $217. So, it is the best time to invest in this water utility stock.

About American Water Works (NYSE: AWK) Stocks

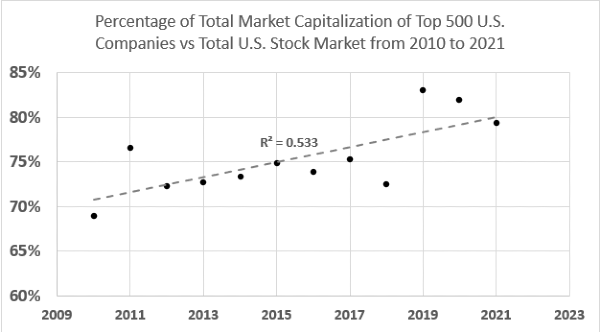

American Water Works (NYSE: AWK) stock is publicly traded at the New York Stock Exchange under the ticker symbol AWK. This expansive water utility is also a part of DJUA and the S&P 500.

This public utility company was established 136 years ago, in 1886. The founder of this water utility company was James S. Kuhn. It provides water and wastewater services in 24 states of the United States, with 14 million customers.

Its subsidiaries supply water to the residents and commercial and government agencies. In addition to this, it provides wastewater services in the United States. As a result, it is subject to many federal, state, and local regulations and safety and water quality standards.

American Water Works - AWK Stock Forecast, Price & News

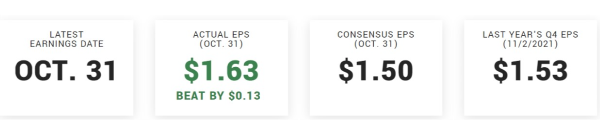

American Water Works reported year-to-date and quarterly earnings ending September 30 yesterday. The earnings-per-share were reported at $1.63, a 6% increase from the previous EPS of $1.53 in 2021. New-jersey-based water utility company's total earnings were estimated at $297 million, and a revenue of $1.08 billion.

AWK Stock Price Forecast

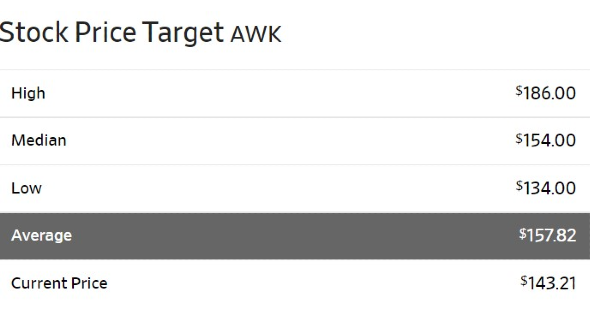

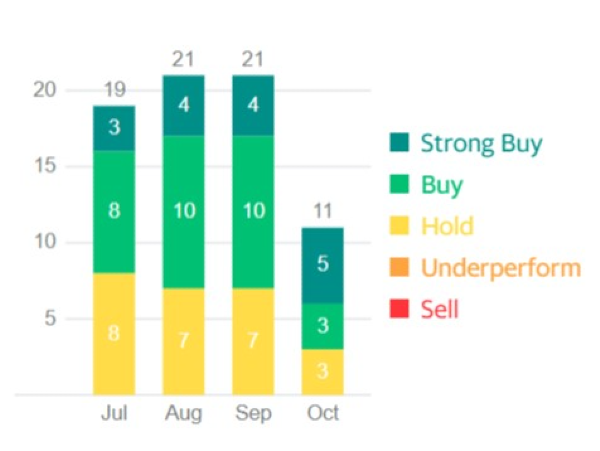

AWK stock price forecast by Wall Street Journal (WSJ) has been estimated at the median price of $154.00. AWK's highest stock price target is $186.00, and the lowest price target is $134.00.

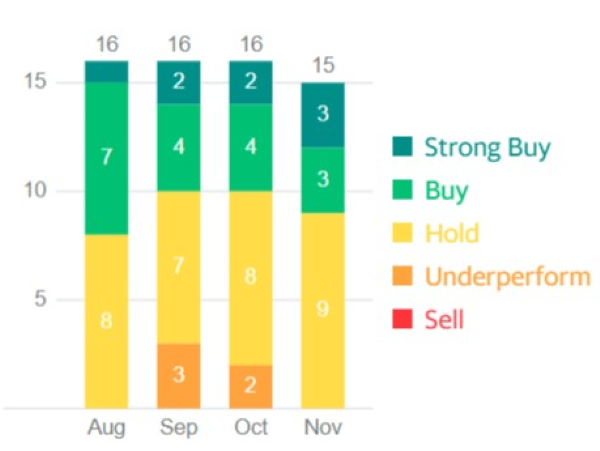

The overall analyst ratings for this largest waterworks company are overweight. So, it's an excellent opportunity for investors to invest in this growth utility stock.

Conversely, company management's earning guidance will play a crucial role. The full-year EPS in the earning guidance was announced during the third quarter's earnings call. It ranges between $4.72 to $4.82 per share. The third quarter EPS is $1.53.

AWK stock news

Four Management Team Members Promoted at AWK

AWK promoted four highly experienced team members on November 1, 2022. Mike Chief was promoted as Deputy Chief Operating Officer. At the same time, the position of David Bowler was upgraded to Deputy Chief Financial Officer & Treasurer.

Justin Ladner's and Rebecca Losli's roles have also been upgraded as President of Pennsylvania American Water and President of Illinois American Water, respectively. All four management members are crucial members of American Water Works.

Agreement with the Butler Area Sewer Authority (BASA)

Pennsylvania AWK initiated a contract with Butler Area Sewer Authority (BASA) and invested $231.5 million. It will help the organization acquire the wastewater system and serve approximately 15,000 more customers using the wastewater system of Butler.

An additional investment of $75 million is required to upgrade the system,aiming to improve the water treatment and replace the water systems with the safer ones.

Acquisition of Foster Township West End Wastewater System

For $3.75 million, Pennsylvania AWK successfully acquired Foster Township West End Wastewater System in October to upgrade the system and ensure higher standards to water-quality checks.

Pennsylvania AWK aims to achieve excellence by making upgrades to the water inflows and infiltrations and replacing the pump stations with the new ones. On the other hand, AWK announced that it will maintain the same rates as set by the Foster Township West End. Any changes in the rates have to be approved from Pennsylvania Public Utility Commission (PUC).

AWK Latest Earnings Reports

AWK announced the third quarter reports with an earnings surprise of 9.40%, beating the Zacks earnings consensus of $1.49. The third-quarter EPS stood at $1.63, eight percent higher than in 2021.

Moreover, the revenue of $1.08 billion for the quarter ended in September is higher than the $937 million revenue of 2021.

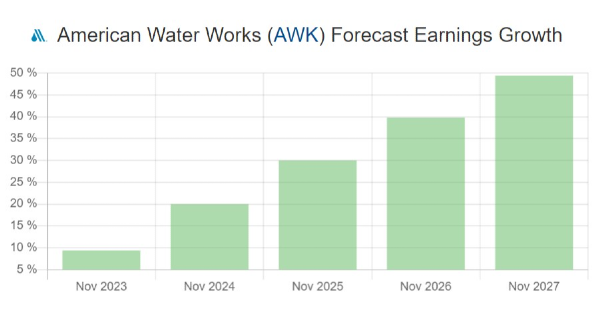

The subsequent quarter's earnings guidance ranges from $4.72 to $4.82 per share, with third-quarter earnings-per-share at $$1.63. The AWK earnings guidance provided an estimate of the Compound Annual Estimate of Growth (CAGR) as 7-9% with equal dividend growth.

Moreover, the long-term capital investment plan is expected to increase by $14 to $15 billion and $30 to #34 billion for 2023 – 2027 and 2023-2032, respectively.

Top Utility Stocks

This is the high time to buy utility stocks due to their low price and high dividend yield. Some of the best growth utility stocks are as follows:

- Sempra Energy Stock (SRE)

- Dominion Energy Stock (D)

- NextEra Energy Stock (NEE)

- NRG Stock

- SunRun Stock

See Also: Top Utility Stocks to Buy

AWK stock - Frequently Asked Questions

Is AWK a buy or sell?

AWK is a strong buy right now, as it has been recommended by several analysts at Wall Street Zen and Yahoo Finance. The stock price of American Water Works stock has plummeted recently. However, it has started to increase due to the positive market sentiment.

Does American Water Works stock pay a dividend?

American Water Works pays a dividend yield of 1.80%. This dividend is paid four times a year. The payout ratio is approximately 34.56%, with retained earnings of 65.4%. The latest dividend given to AWK shareholders is $0.655, a dividend yield of 1.8%. The subsequent payments will be announced on February 15, 2023, with an estimated dividend yield.

Read More: What are the Dividend Policies of the Top Utility Stocks

Is AWK a dividend aristocrat?

AWK is considered a dividend aristocrat because this public company has increased its dividend yields for years. In addition, it is one of the largest companies in the S&P 500.

Should we invest in water companies?

Water companies' stocks are stable as the demand for water constantly increases. In addition, the need for water is growing due to the rising climate change and pressure. So, defensive investors should invest in water companies to enjoy steady dividends.

Bottom Line

AWK's water utility company is paying a stable yet low dividend to its shareholders. The cash flow needs to be better covered by this company. Defensive investors can add AWK stock to their portfolio to diversify it as it is a comparatively less risky stock.

Many analysts have given it a rating of a strong buy due to the positive stock price target and higher dividend yield in next quarter. American Water Works stock forecast is favorable for the investors right now.

American Water Works Stock Forecast is excellent, and its stock price has gained upward momentum after hovering near a 52-week low. Due to many Mergers & Acquisitions (M&As), this largest water company in the United States is expanding and scaling up continuously.

In this stock analysis, we will cover the latest earnings report of AWK stock and what this utility company does. Moreover, we will cover the newest AWK news to help you understand the stock's present and future earnings estimates.

Is American Water Works a Good Stock to Buy?

American Water Works (AWK) is an excellent stock to buy. Investors can take advantage of the lower price of this utility stock and get a stable dividend every quarter. Moreover, it's a safe investment against the rising tide of inflation and interest rates.

The one-year stock price forecast is expected to reach at $158 and five-year price at $217. So, it is the best time to invest in this water utility stock.

About American Water Works (NYSE: AWK) Stocks

American Water Works (NYSE: AWK) stock is publicly traded at the New York Stock Exchange under the ticker symbol AWK. This expansive water utility is also a part of DJUA and the S&P 500.

This public utility company was established 136 years ago, in 1886. The founder of this water utility company was James S. Kuhn. It provides water and wastewater services in 24 states of the United States, with 14 million customers.

Its subsidiaries supply water to the residents and commercial and government agencies. In addition to this, it provides wastewater services in the United States. As a result, it is subject to many federal, state, and local regulations and safety and water quality standards.

American Water Works - AWK Stock Forecast, Price & News

American Water Works reported year-to-date and quarterly earnings ending September 30 yesterday. The earnings-per-share were reported at $1.63, a 6% increase from the previous EPS of $1.53 in 2021. New-jersey-based water utility company's total earnings were estimated at $297 million, and a revenue of $1.08 billion.

AWK Stock Price Forecast

AWK stock price forecast by Wall Street Journal (WSJ) has been estimated at the median price of $154.00. AWK's highest stock price target is $186.00, and the lowest price target is $134.00.

The overall analyst ratings for this largest waterworks company are overweight. So, it's an excellent opportunity for investors to invest in this growth utility stock.

Conversely, company management's earning guidance will play a crucial role. The full-year EPS in the earning guidance was announced during the third quarter's earnings call. It ranges between $4.72 to $4.82 per share. The third quarter EPS is $1.53.

AWK stock news

Four Management Team Members Promoted at AWK

AWK promoted four highly experienced team members on November 1, 2022. Mike Chief was promoted as Deputy Chief Operating Officer. At the same time, the position of David Bowler was upgraded to Deputy Chief Financial Officer & Treasurer. Justin Ladner's and Rebecca Losli's roles have also been upgraded as President of Pennsylvania American Water and President of Illinois American Water, respectively. All four management members are crucial members of American Water Works.

Agreement with the Butler Area Sewer Authority (BASA)

Pennsylvania AWK initiated a contract with Butler Area Sewer Authority (BASA) and invested $231.5 million. It will help the organization acquire the wastewater system and serve approximately 15,000 more customers using the wastewater system of Butler. An additional investment of $75 million is required to upgrade the system,aiming to improve the water treatment and replace the water systems with the safer ones.

Acquisition of Foster Township West End Wastewater System

For $3.75 million, Pennsylvania AWK successfully acquired Foster Township West End Wastewater System in October to upgrade the system and ensure higher standards to water-quality checks.

Pennsylvania AWK aims to achieve excellence by making upgrades to the water inflows and infiltrations and replacing the pump stations with the new ones. On the other hand, AWK announced that it will maintain the same rates as set by the Foster Township West End. Any changes in the rates have to be approved from Pennsylvania Public Utility Commission (PUC).

AWK Latest Earnings Reports

AWK announced the third quarter reports with an earnings surprise of 9.40%, beating the Zacks earnings consensus of $1.49. The third-quarter EPS stood at $1.63, eight percent higher than in 2021.

Moreover, the revenue of $1.08 billion for the quarter ended in September is higher than the $937 million revenue of 2021.

The subsequent quarter's earnings guidance ranges from $4.72 to $4.82 per share, with third-quarter earnings-per-share at $$1.63. The AWK earnings guidance provided an estimate of the Compound Annual Estimate of Growth (CAGR) as 7-9% with equal dividend growth.

Moreover, the long-term capital investment plan is expected to increase by $14 to $15 billion and $30 to #34 billion for 2023 – 2027 and 2023-2032, respectively.

Top Utility Stocks

This is the high time to buy utility stocks due to their low price and high dividend yield. Some of the best growth utility stocks are as follows:

See Also: Top Utility Stocks to Buy

AWK stock - Frequently Asked Questions

Is AWK a buy or sell?

AWK is a strong buy right now, as it has been recommended by several analysts at Wall Street Zen and Yahoo Finance. The stock price of American Water Works stock has plummeted recently. However, it has started to increase due to the positive market sentiment.

Does American Water Works stock pay a dividend?

American Water Works pays a dividend yield of 1.80%. This dividend is paid four times a year. The payout ratio is approximately 34.56%, with retained earnings of 65.4%. The latest dividend given to AWK shareholders is $0.655, a dividend yield of 1.8%. The subsequent payments will be announced on February 15, 2023, with an estimated dividend yield.

Read More: What are the Dividend Policies of the Top Utility Stocks

Is AWK a dividend aristocrat?

AWK is considered a dividend aristocrat because this public company has increased its dividend yields for years. In addition, it is one of the largest companies in the S&P 500.

Should we invest in water companies?

Water companies' stocks are stable as the demand for water constantly increases. In addition, the need for water is growing due to the rising climate change and pressure. So, defensive investors should invest in water companies to enjoy steady dividends.

Bottom Line

AWK's water utility company is paying a stable yet low dividend to its shareholders. The cash flow needs to be better covered by this company. Defensive investors can add AWK stock to their portfolio to diversify it as it is a comparatively less risky stock. Many analysts have given it a rating of a strong buy due to the positive stock price target and higher dividend yield in next quarter. American Water Works stock forecast is favorable for the investors right now.