Introduction

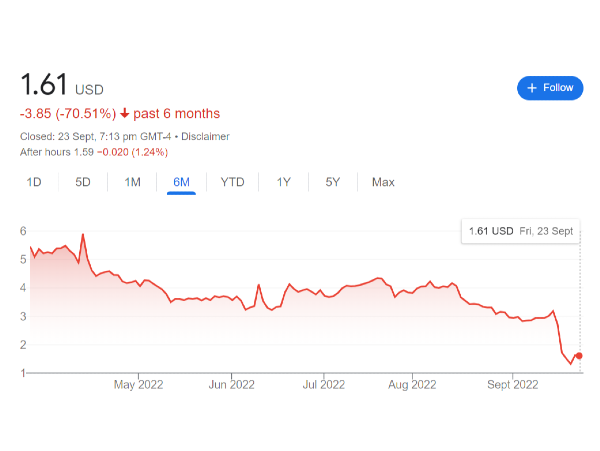

A company called Sonnet Biotherapeutics has been developing a drug that treats inflammatory bowel disease known as Crohn's. The stock price seems to be rising steadily since its IPO last year. But now that its shares have started trading on the NASDAQ (NASDAQ: SONN), I want to see if they've got the potential to become a big winner.

Last year, Sonnet Biotherapeutic's SONA Medical Corporation received FDA approval for its investigational drug, SB2, to treat patients with moderate to severe ulcerative colitis. Since then, the Company has focused on expanding the availability of its treatment, including creating a global manufacturing facility to supply SB2.

This drug is expected to increase sales of anti-inflammatory medications in the United States. After receiving regulatory approval, Sonnet Biotherapeutics began selling SB2 directly to pharmaceutical wholesalers, distributors, and physicians. In addition, the Company signed distribution agreements with several major pharmacy chains to expand access to SB2.

Sonnet Biotherapeutic Holdings Inc. focused on developing therapeutic agents to treat rare diseases affecting children and adults. The Company uses its proprietary platform technology to develop and commercialize therapies for rare disease patients. Its current pipeline consists of five preclinical programs in various stages of development and two clinical programs in the Phase 2/3 study.

With over 50% of its revenue from research and development, Sonnet has developed several unique technologies that provide a competitive advantage. Their drug development program focuses on orphan diseases, which account for over 70% of healthcare spending globally.

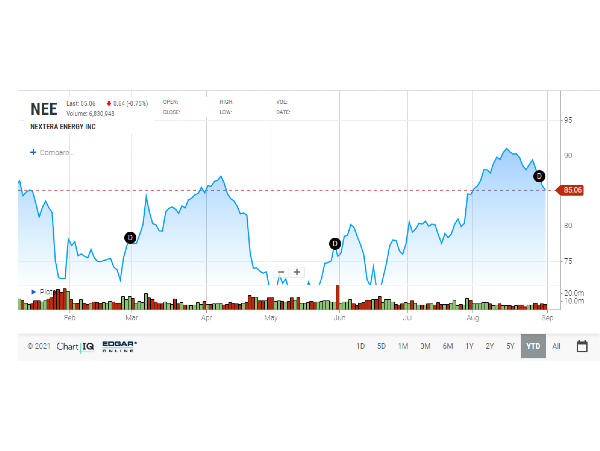

Also read about NIO Stock.

Forecast and Analysis

Since September 06, 2022, a buy signal has been issued from the pivot, and a 3.76 percent increase has been recorded. When a new pivot finds further indication of a rise will update. Sonnet Biotherapeutics Holdings Inc. follows the price formation and has increased the volume. This positive sign is that the book follows the price formation from a technical perspective. The meager volume increases the risk, which also weakens the other technical indications sent.

Additionally, specific unfavorable signals were sent, which could impact the development. The short-term moving average has issued a buy signal for Sonnet Biotherapeutics Holdings Inc. stock, while the long-term average has issued a general sell signal. Since the long-term standard is higher than the short-term average, the store has a broad sell signal and a more pessimistic outlook. The long-term moving average at $0.26 will act as a barrier for the share if it continues to rise.

The short-term average of $0.21 will provide some support if the price falls. Another purchase signal will be given if the long-term average is broken, while another sell signal will be added if the short-term average is broken, strengthening the overall movement. Additionally, the 3-month Moving Average Convergence Divergence (MACD) has issued a sell signal.

Risk & Stop-loss, Support

When the support is tested, an upward reaction is anticipated; therefore, Sonnet Biotherapeutics Holdings Inc. may offer a buying opportunity at $0.22, where accumulated volume provides support.

This stock is regarded as "high risk" because it has a significant Bollinger Band prediction interval and may change significantly during the trading day (volatility). The stock moved $0.0582, or 26.91%, between high and low over the previous day. The stock's daily average volatility during the last week was 18.14%.

Stop-loss amount advised: $0.22 (-3.62%). (This stock's strong daily fluctuations come with a high risk. An earlier-than-7-day pivot bottom has generated a buy signal.

Insiders are very optimistic about buying more shares than selling in Sonnet Biotherapeutics Holdings Inc.

4.76 million shares were purchased, and 449.39 thousand shares were sold over the last 100 deals. Griffith Donald J. sold 4.51 thousand shares in the most recent transaction, which took place 161 days ago. The big difference between the number of shares acquired and sold suggests that insiders are confident in the prospect of a good upside. Sometimes, more great acquisitions can be justified by stock option expiration dates.

Is Sonnet Biotherapeutics Holdings Inc. stock A Buy?

Although Sonnet Biotherapeutics Holdings Inc. exhibits several encouraging signs, we don't believe they are sufficient to qualify the share as a buy. It should be regarded as a hold candidate (hold or accumulate) in this position while awaiting further development at the current level. Since the last evaluation, we have changed this stock's analysis conclusion from a Sell to a Hold/Accumulate contender.

Conclusion

This business, which creates novel targeted biologic therapies, declared today that it would split its outstanding common stock by 14 to 1. This will take effect for trading purposes on Monday, September 19, 2022, when trading starts.

The goal of the reverse share split is to raise Sonnet's common stock's per-share trading price to meet the $1 minimum bid price criteria for continuing listing on The Nasdaq Capital Market.

The Nasdaq Capital Market will continue to list Sonnet's common stock under the ticker "SONN" and a new CUSIP number, 83548R204. Every fourteen pre-split shares of outstanding common stock will be converted into one share of common stock due to the reverse stock split. After the reverse stock split, the par value of the Company's common stock will stay the same at $0.0001 per share.

The authorized number of shares of the Company's common stock will not change due to the reverse stock split. Except to the extent that the reverse share split results in certain stockholders owning a fractional share, the reverse stock split will have an equal impact on all stockholders and will not change any stockholder's percentage participation in the Company's ownership. In line with the reverse split, no fractional shares will be issued.

Instead of receiving a fractional share, stockholders who would otherwise be eligible would receive a cash payout based on the average closing price of the Company's ordinary share over the five (5) days preceding the reverse split. Additionally, with a commensurate adjustment to the exercise prices of Sonnet's outstanding warrants and stock options and under the Company's equity incentive schemes, common share issuable upon the exercise of those instruments will be subject to the reverse split.

For more Stock analysis: https://www.stockbossup.com/main/myProfile

Introduction

A company called Sonnet Biotherapeutics has been developing a drug that treats inflammatory bowel disease known as Crohn's. The stock price seems to be rising steadily since its IPO last year. But now that its shares have started trading on the NASDAQ (NASDAQ: SONN), I want to see if they've got the potential to become a big winner.

Last year, Sonnet Biotherapeutic's SONA Medical Corporation received FDA approval for its investigational drug, SB2, to treat patients with moderate to severe ulcerative colitis. Since then, the Company has focused on expanding the availability of its treatment, including creating a global manufacturing facility to supply SB2.

This drug is expected to increase sales of anti-inflammatory medications in the United States. After receiving regulatory approval, Sonnet Biotherapeutics began selling SB2 directly to pharmaceutical wholesalers, distributors, and physicians. In addition, the Company signed distribution agreements with several major pharmacy chains to expand access to SB2.

Sonnet Biotherapeutic Holdings Inc. focused on developing therapeutic agents to treat rare diseases affecting children and adults. The Company uses its proprietary platform technology to develop and commercialize therapies for rare disease patients. Its current pipeline consists of five preclinical programs in various stages of development and two clinical programs in the Phase 2/3 study.

With over 50% of its revenue from research and development, Sonnet has developed several unique technologies that provide a competitive advantage. Their drug development program focuses on orphan diseases, which account for over 70% of healthcare spending globally.

Also read about NIO Stock.

Forecast and Analysis

Since September 06, 2022, a buy signal has been issued from the pivot, and a 3.76 percent increase has been recorded. When a new pivot finds further indication of a rise will update. Sonnet Biotherapeutics Holdings Inc. follows the price formation and has increased the volume. This positive sign is that the book follows the price formation from a technical perspective. The meager volume increases the risk, which also weakens the other technical indications sent. Additionally, specific unfavorable signals were sent, which could impact the development. The short-term moving average has issued a buy signal for Sonnet Biotherapeutics Holdings Inc. stock, while the long-term average has issued a general sell signal. Since the long-term standard is higher than the short-term average, the store has a broad sell signal and a more pessimistic outlook. The long-term moving average at $0.26 will act as a barrier for the share if it continues to rise. The short-term average of $0.21 will provide some support if the price falls. Another purchase signal will be given if the long-term average is broken, while another sell signal will be added if the short-term average is broken, strengthening the overall movement. Additionally, the 3-month Moving Average Convergence Divergence (MACD) has issued a sell signal.

Risk & Stop-loss, Support

When the support is tested, an upward reaction is anticipated; therefore, Sonnet Biotherapeutics Holdings Inc. may offer a buying opportunity at $0.22, where accumulated volume provides support. This stock is regarded as "high risk" because it has a significant Bollinger Band prediction interval and may change significantly during the trading day (volatility). The stock moved $0.0582, or 26.91%, between high and low over the previous day. The stock's daily average volatility during the last week was 18.14%.

Stop-loss amount advised: $0.22 (-3.62%). (This stock's strong daily fluctuations come with a high risk. An earlier-than-7-day pivot bottom has generated a buy signal.

Insiders are very optimistic about buying more shares than selling in Sonnet Biotherapeutics Holdings Inc.

4.76 million shares were purchased, and 449.39 thousand shares were sold over the last 100 deals. Griffith Donald J. sold 4.51 thousand shares in the most recent transaction, which took place 161 days ago. The big difference between the number of shares acquired and sold suggests that insiders are confident in the prospect of a good upside. Sometimes, more great acquisitions can be justified by stock option expiration dates.

Is Sonnet Biotherapeutics Holdings Inc. stock A Buy?

Although Sonnet Biotherapeutics Holdings Inc. exhibits several encouraging signs, we don't believe they are sufficient to qualify the share as a buy. It should be regarded as a hold candidate (hold or accumulate) in this position while awaiting further development at the current level. Since the last evaluation, we have changed this stock's analysis conclusion from a Sell to a Hold/Accumulate contender.

Conclusion

This business, which creates novel targeted biologic therapies, declared today that it would split its outstanding common stock by 14 to 1. This will take effect for trading purposes on Monday, September 19, 2022, when trading starts. The goal of the reverse share split is to raise Sonnet's common stock's per-share trading price to meet the $1 minimum bid price criteria for continuing listing on The Nasdaq Capital Market.

The Nasdaq Capital Market will continue to list Sonnet's common stock under the ticker "SONN" and a new CUSIP number, 83548R204. Every fourteen pre-split shares of outstanding common stock will be converted into one share of common stock due to the reverse stock split. After the reverse stock split, the par value of the Company's common stock will stay the same at $0.0001 per share.

The authorized number of shares of the Company's common stock will not change due to the reverse stock split. Except to the extent that the reverse share split results in certain stockholders owning a fractional share, the reverse stock split will have an equal impact on all stockholders and will not change any stockholder's percentage participation in the Company's ownership. In line with the reverse split, no fractional shares will be issued.

Instead of receiving a fractional share, stockholders who would otherwise be eligible would receive a cash payout based on the average closing price of the Company's ordinary share over the five (5) days preceding the reverse split. Additionally, with a commensurate adjustment to the exercise prices of Sonnet's outstanding warrants and stock options and under the Company's equity incentive schemes, common share issuable upon the exercise of those instruments will be subject to the reverse split.

For more Stock analysis: https://www.stockbossup.com/main/myProfile