Five Below Inc., often known as fiVe BEL°W in abbreviated form. It is a chain of specialist discount stores in the United States that sells goods for under $5 and a limited number of things for between $6 and $25. David Schlessinger and Tom Vellios founded the company, its headquarters is in Philadelphia, Pennsylvania, and targets tweens and teens. There are more than 1,100 stores nationwide.

David Schlessinger, the creator of Encore Books and Zany Brainy, and Tom Vellios, a former CEO of Zany Brainy, founded Five Below on October 4, 2002. Five Below confirmed the temporary closure of all its locations on March 18, 2020, owing to the COVID-19 pandemic. But, 75% of Five Below locations nationwide reopened as of May 29, 2020, and new stores will also follow.

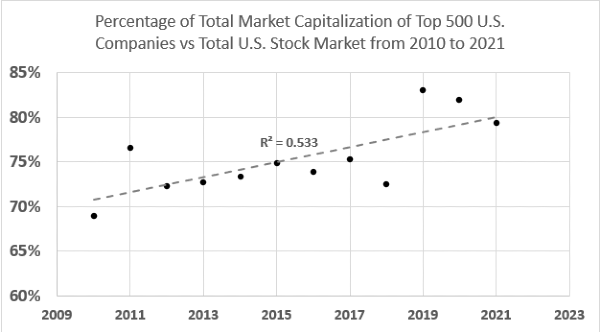

With a market valuation of $7.6 billion as of October 14, 2022, Five Below Inc. ranked 87th out of all the businesses in the Retailers - Department Stores sector.

Five Below Inc.'s price-earnings ratio is at 31.0. The trailing 12-month revenue for Five Below Inc. is $2.9 billion, with a profit margin of 8.2%. The most recent quarterly sales gain over the prior year was 3.4%. For the current fiscal year, analysts forecast adjusted earnings to come in at $4.409 per share. Currently, Five Below Inc does not distribute dividends.

Although it predicted that the global retail market to grow, the coronavirus pandemic in 2020 had a significant impact on the sector. Although it was a successful moment for e-commerce giants like Amazon, many online companies. By 2020, e-commerce channels will account for a higher percentage of retail sales than actual storefronts due to their growing market share in the retail industry.

Additionally, social commerce and influencer marketing are two of the most well-liked developments in the global retail business right now. Social media, utilized by more than 3.6 billion people globally, offers an appealing medium for shops to market their goods and services. Additionally, the market for influencer marketing would reach $13.8 billion by 2021.

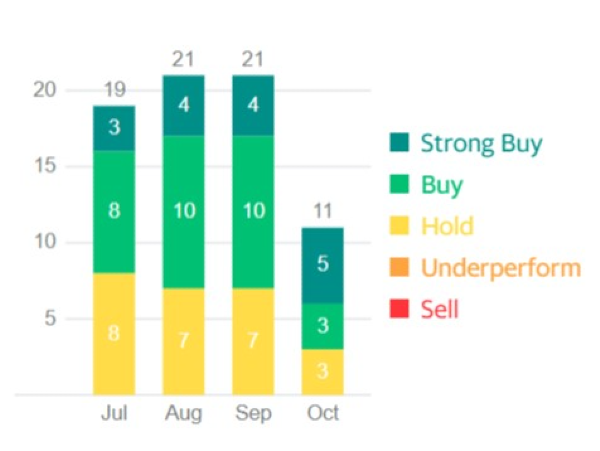

The consensus price target among the 20 analysts providing 12-month price projections for Five Below Inc. is 159.50, with an upper figure of 205.00 and a lower figure of 125.00. From the most recent price of 131.76, the median projection reflects an increase of +21.05%.

Twenty-two investment analysts survey, and the consensus is to buy Five Below Inc. shares. Since September, when it remained unchanged from a buy rating, this rating has been stable.

Is Five Below Stock (FIVE) a good investment?

Investors should be happy to learn that Five Below is still trading for a reasonable price. My valuation model indicates that the stock has an intrinsic value of $180.03, but because it is selling at US$143 on the stock market, there is still time to make a purchase. The share price of Five Below is volatile. This volatility, compounded by a correcting market, gives us more time to acquire shares at a potentially lower price because it gives us more opportunities to acquire. After all, the price may fall (or climb) in the future. Its high beta, a reliable indicator of how much the stock moves about the rest of the market, is the basis for this.

Investors looking to expand their portfolio may want to consider the company's prospects before acquiring shares. Despite value investors' claims that intrinsic value over price is what matters most. The more appealing investment strategy would be one that offered substantial growth potential at a low price. The projected 82% growth in Five Below's earnings over the following few years indicates a promising future. This ought to produce more consistent cash flows, raising the share price.

If you are a Shareholder

Increasing your holdings in FIVE might be a good idea because the stock is currently undervalued. With an optimistic forecast for the future, the share price has not yet accounted for this increase. There are more variables to consider, such as capital structure (A company's capital structure refers to the specific ratio of debt to equity that it uses to fund all aspects of operations and expansion), which may help explain the current devaluation.

Since the firm has more equity financing than debt. So it is better to "HOLD" your shares.

If you are a potential investor

If you've been watching FIVE for a while, this could be the ideal opportunity to buy the stock. It's still possible to buy FIVE because the current share price doesn't yet reflect its bright prospects. But, to make a well-informed investment selection, consider other criteria, such as the soundness of its balance sheet, before making any investment decisions.

Maximum earnings are from non cash transactions on its balance sheet.

Should I Buy Five Below Inc Stock?

Investors have an excellent opportunity to buy shares because of the market's immediate response to the most recent earnings results. Five Below has a history of outperforming the market with its strategy of offering trendy goods at reduced prices. By increasing fulfillment capacity and adding more outlets, management is still concentrating on making investments for long-term growth.

At the end of the quarter, Five Below had $117.3 million in short-term investment securities and $155.1 million in cash and cash equivalents. As of July 30, 2022, there was $1,162.6 million in total shareholders' equity. Five Below repurchased 247,132 shares in the third quarter for almost $40 million.

Five Below predicted gross capital expenditures in the upcoming fiscal year of around $235 million. which is excluding tenant allowances. This includes the construction of a new distribution center in Indiana.

FIVE stocks - FAQs

Does Five Below have any debt?

For the fiscal years ending in February 2018 to 2022, Five Below's total debt to total assets ratio averaged 28.3%. From the fiscal years ending in February 2018 through 2022, Five Below's had a median total debt-to-total asset ratio of 45.1%.

Does Five Below pay a dividend?

Five Below (NASDAQ: FIVE) pay no dividend. Because Five below is building out its distribution center in Indiana. So, funds are allocated to growth instead of dividends. Due to the cyclical nature of its business, FIVE would have difficulty paying out a consistent dividend.

Who are Five Below's competitors?

In August 2022, dollartree.com, target.com, walmart.com, biglots.com, and more will be fivebelow.com's top 5 competitors. According to our research, dollartree.com, with 10.5M visits, will be fivebelow.com's main rival in September 2022.

Read more: AMC Stock Forecast

Five Below Inc., often known as fiVe BEL°W in abbreviated form. It is a chain of specialist discount stores in the United States that sells goods for under $5 and a limited number of things for between $6 and $25. David Schlessinger and Tom Vellios founded the company, its headquarters is in Philadelphia, Pennsylvania, and targets tweens and teens. There are more than 1,100 stores nationwide.

David Schlessinger, the creator of Encore Books and Zany Brainy, and Tom Vellios, a former CEO of Zany Brainy, founded Five Below on October 4, 2002. Five Below confirmed the temporary closure of all its locations on March 18, 2020, owing to the COVID-19 pandemic. But, 75% of Five Below locations nationwide reopened as of May 29, 2020, and new stores will also follow.

Five Below - FIVE Stock Forecast, Price & News

With a market valuation of $7.6 billion as of October 14, 2022, Five Below Inc. ranked 87th out of all the businesses in the Retailers - Department Stores sector.

Five Below Inc.'s price-earnings ratio is at 31.0. The trailing 12-month revenue for Five Below Inc. is $2.9 billion, with a profit margin of 8.2%. The most recent quarterly sales gain over the prior year was 3.4%. For the current fiscal year, analysts forecast adjusted earnings to come in at $4.409 per share. Currently, Five Below Inc does not distribute dividends.

Although it predicted that the global retail market to grow, the coronavirus pandemic in 2020 had a significant impact on the sector. Although it was a successful moment for e-commerce giants like Amazon, many online companies. By 2020, e-commerce channels will account for a higher percentage of retail sales than actual storefronts due to their growing market share in the retail industry.

Additionally, social commerce and influencer marketing are two of the most well-liked developments in the global retail business right now. Social media, utilized by more than 3.6 billion people globally, offers an appealing medium for shops to market their goods and services. Additionally, the market for influencer marketing would reach $13.8 billion by 2021.

Five Below Analyst Forecast

The consensus price target among the 20 analysts providing 12-month price projections for Five Below Inc. is 159.50, with an upper figure of 205.00 and a lower figure of 125.00. From the most recent price of 131.76, the median projection reflects an increase of +21.05%.

Analyst Recommendation

Twenty-two investment analysts survey, and the consensus is to buy Five Below Inc. shares. Since September, when it remained unchanged from a buy rating, this rating has been stable.

Is Five Below Stock (FIVE) a good investment?

Investors should be happy to learn that Five Below is still trading for a reasonable price. My valuation model indicates that the stock has an intrinsic value of $180.03, but because it is selling at US$143 on the stock market, there is still time to make a purchase. The share price of Five Below is volatile. This volatility, compounded by a correcting market, gives us more time to acquire shares at a potentially lower price because it gives us more opportunities to acquire. After all, the price may fall (or climb) in the future. Its high beta, a reliable indicator of how much the stock moves about the rest of the market, is the basis for this.

Investors looking to expand their portfolio may want to consider the company's prospects before acquiring shares. Despite value investors' claims that intrinsic value over price is what matters most. The more appealing investment strategy would be one that offered substantial growth potential at a low price. The projected 82% growth in Five Below's earnings over the following few years indicates a promising future. This ought to produce more consistent cash flows, raising the share price.

If you are a Shareholder

Increasing your holdings in FIVE might be a good idea because the stock is currently undervalued. With an optimistic forecast for the future, the share price has not yet accounted for this increase. There are more variables to consider, such as capital structure (A company's capital structure refers to the specific ratio of debt to equity that it uses to fund all aspects of operations and expansion), which may help explain the current devaluation. Since the firm has more equity financing than debt. So it is better to "HOLD" your shares.

If you are a potential investor

If you've been watching FIVE for a while, this could be the ideal opportunity to buy the stock. It's still possible to buy FIVE because the current share price doesn't yet reflect its bright prospects. But, to make a well-informed investment selection, consider other criteria, such as the soundness of its balance sheet, before making any investment decisions.

Maximum earnings are from non cash transactions on its balance sheet.

Should I Buy Five Below Inc Stock?

Investors have an excellent opportunity to buy shares because of the market's immediate response to the most recent earnings results. Five Below has a history of outperforming the market with its strategy of offering trendy goods at reduced prices. By increasing fulfillment capacity and adding more outlets, management is still concentrating on making investments for long-term growth.

At the end of the quarter, Five Below had $117.3 million in short-term investment securities and $155.1 million in cash and cash equivalents. As of July 30, 2022, there was $1,162.6 million in total shareholders' equity. Five Below repurchased 247,132 shares in the third quarter for almost $40 million.

Five Below predicted gross capital expenditures in the upcoming fiscal year of around $235 million. which is excluding tenant allowances. This includes the construction of a new distribution center in Indiana.

FIVE stocks - FAQs

Does Five Below have any debt?

For the fiscal years ending in February 2018 to 2022, Five Below's total debt to total assets ratio averaged 28.3%. From the fiscal years ending in February 2018 through 2022, Five Below's had a median total debt-to-total asset ratio of 45.1%.

Does Five Below pay a dividend?

Five Below (NASDAQ: FIVE) pay no dividend. Because Five below is building out its distribution center in Indiana. So, funds are allocated to growth instead of dividends. Due to the cyclical nature of its business, FIVE would have difficulty paying out a consistent dividend.

Who are Five Below's competitors?

In August 2022, dollartree.com, target.com, walmart.com, biglots.com, and more will be fivebelow.com's top 5 competitors. According to our research, dollartree.com, with 10.5M visits, will be fivebelow.com's main rival in September 2022.

Read more: AMC Stock Forecast