Sempra Energy Stock has experienced many ups and downs this year due to market uncertainty, FED's policy rates and the consumer's lower confidence. However, this utility stock has seen many highs and lows without losing the spirit of the investors holding this stock and enjoying the regular dividend during this bearish market.

Let's explore this stock to analyze the current Sempra Energy dividend history and the opportunities for new investors by providing an SRE stock forecast.

Read Also: Next Era Energy (NEE) Stock, Sempra Energy Stock (SRE), Edison International Stock (EIX), Dominion Energy Stock (D) and NRG Energy Stock

Sempra Energy Stock

Based in San Diego, North America, Sempra is committed to delivering clean energy solutions to its 40 million global consumers. As a result, Sempra Energy is the only company in the United States to be listed on the Dow Jones Sustainability World Index.

Along with many Mergers & Acquisitions (M&As), it has also participated and invested in many philanthropic works, including establishing the Sempra Foundation.

As a result of the Russian-Ukraine War, Sempra began to collaborate with European Energy Companies to help Europe replace the Russian LNG and signed many agreements with them. [1] This initiative will help the Europeans to continue their economic activities without any disruption in the delivery of their services. [2]

Read also about Tesla (TSLA) Alphabet (GOOG), and Netflix (NFLX) stocks

SRE Latest Earnings

SRE announced their second quarter report on August 4, 2022. With an increase of 29.41% in revenues, SRE earned a revenue of $3.55 billion. The net income also increased by 28.38%, with a diluted EPS of $1.17. However, the net profit margin fell by 0.8%, and operating income increased by 50.34%.

The positive outlook in 2022 led the company to provide an EPS between $6.90 to $7.50 in their earning guidance. On the other hand, the company expects an adjusted Earnings-Per-Share (EPS) of $8.10 to $8.70.

You can also read the historical earnings report of Sempra Company here.

SRE Price Forecast

Sempra Energy Stock will announce the latest earnings of the fourth quarter on November 4, 2022. Currently, the SRE stock price is $152.39, and this price has increased by 17,147.15% since the inception of this utility stock company in the United States.

This utility stock has increased by 28.08% over the last five years. As a result, the SRE price forecast is expected to grow. Simply Wall St provided a high-price estimation of $204.00 and a low-price estimation of $146.00 for the next year with a median price of $175.00.

Read Also: Visa (V) and Bank of America (BAC)

SRE Analysts Recommendations

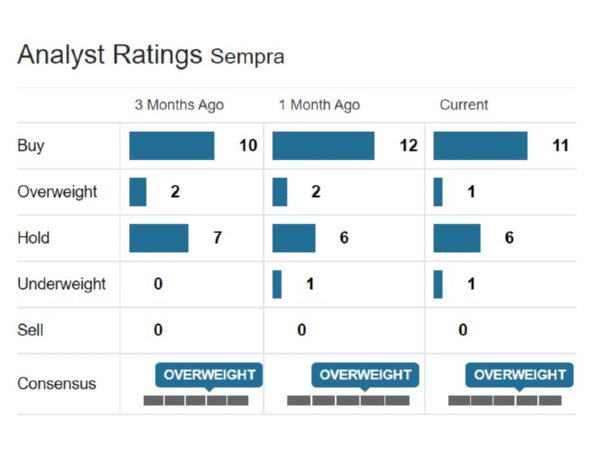

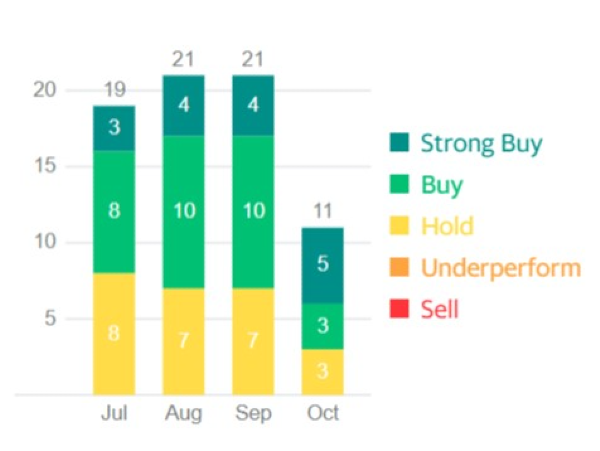

Analysts expect the SRE share price to be 20% less than the current share price. Analysts at the Wall Street Journal (WSJ) rate this stock as a buy due to the low price and average dividend yield when the market sentiments are unfavorable both for the businesses and the investors. WSJ analysts have not recommended selling this stock as it is a recession-proof stock.

Moreover, the financial experts of this leading company have given a consensus of overweight to Sempra. This consensus is due to the expected earnings to outperform the industry and the market in the upcoming months.

Wells Fargo Boost Price Target

Wells Fargo Boost Price target has been lowered, and they have given a consensus of overweight for the SRE company stock. They set a higher price target of $189.00 and the lower price target of $168.

SRE News Coverage

Sempra Energy stock has been in the news due to the positive earnings growth and the ban on natural gas to make California carbon-free and sustainable.

California is taking a step away from natural gas to heat buildings

To make California carbon-free and sustainable, the San Diego City Council voted in favour of eliminating Natural Gas from the newly-constructed building and retrofitting the old ones. As we all know that Sempra is the largest distributor and supplier of Liquified Natural Gas (LNG) in California, many suspects that this leading utility company will have many challenges due to this decision.

However, the CEO of Sempra, Jeff Martin, looks quite comfortable with this decision due to the passing on of costs nature of these utility companies. He explained that the company honours the conclusion of the climate authorities and is obliged to follow them and align its business goals with them.[3]

SRE Energy Stock - FAQ's

Is SRE Stock a Good Buy?

SRE is a HOLD stock with a price target of $144.00, as suggested by Stephen Brad. On the other hand, SRE is overvalued as compared to other stocks. It is trading at a relatively expensive P/E ratio of 41.1 in contrast to the fair value of 23.9, analyzed by Simply Wall St.

What Companies Does Sempra Own?

Sempra owns San Diego Gas & Electric (SDG&E), Southern California Gas Company (SoCalGas) and Oncor Electric Delivery Company. DSG&E provides electricity and natural gas to the 20 million people of Southern California.

Does SRE pay a Dividend?

SRE pays dividends to its shareholders every quarter of a financial year. The payout ratio has been 128.29% . The dividend payments have been stable for the past seventeen years. The dividend details can be viewed here.

The dividend yield is expected to grow by 12% by the end of this year from $4.54 to $5.01. The annual dividend yield of 3.01% is estimated to be lower than the US market average dividends of 4.01% and the industry average of 4.66%.

How often Are SRE Dividends Paid?

SRE dividends are paid every quarter. It means Sempra Energy Company pays dividends four times a year. SRE has regularly paid its investors dividends for the past ten years. The dividend growth is positive and increases every year.

The Bottom Line - Is SRE A Good Stock to Buy?

We wrap up the discussion and conclude that the SRE stock price forecast is low and will vary slightly. However, the SRE company will be affected by the ban of California authorities on the prohibition of natural gas. As a result, this LNG-dependent company has to switch to other sustainable energy solutions and invest heavily in renewable energy sources.

Conversely, this stock is performing exceptionally well amid the recessionary fears and heightening inflation expectations. So, this recession-proof stock can provide you average dividend yield. And, you can get a stream of income when the market is highly volatile and investors' sentiments have been deteriorating.

Read also: Utility Stocks in a Recession- Are Utility Stocks a Good Buy Now?

References

[1] Sempra Infra deep into Mexican gas projects, as European demand

[2] Sempra: Supplying LNG To Europe Is A Major Catalyst

[3]

Sempra boss says company is OK with San Diego City Council plan to eliminate natural gas

Sempra Energy Stock has experienced many ups and downs this year due to market uncertainty, FED's policy rates and the consumer's lower confidence. However, this utility stock has seen many highs and lows without losing the spirit of the investors holding this stock and enjoying the regular dividend during this bearish market.

Let's explore this stock to analyze the current Sempra Energy dividend history and the opportunities for new investors by providing an SRE stock forecast.

Read Also: Next Era Energy (NEE) Stock, Sempra Energy Stock (SRE), Edison International Stock (EIX), Dominion Energy Stock (D) and NRG Energy Stock

Sempra Energy Stock

Based in San Diego, North America, Sempra is committed to delivering clean energy solutions to its 40 million global consumers. As a result, Sempra Energy is the only company in the United States to be listed on the Dow Jones Sustainability World Index.

Along with many Mergers & Acquisitions (M&As), it has also participated and invested in many philanthropic works, including establishing the Sempra Foundation.

As a result of the Russian-Ukraine War, Sempra began to collaborate with European Energy Companies to help Europe replace the Russian LNG and signed many agreements with them. [1] This initiative will help the Europeans to continue their economic activities without any disruption in the delivery of their services. [2]

Read also about Tesla (TSLA) Alphabet (GOOG), and Netflix (NFLX) stocks

SRE Latest Earnings

SRE announced their second quarter report on August 4, 2022. With an increase of 29.41% in revenues, SRE earned a revenue of $3.55 billion. The net income also increased by 28.38%, with a diluted EPS of $1.17. However, the net profit margin fell by 0.8%, and operating income increased by 50.34%.

The positive outlook in 2022 led the company to provide an EPS between $6.90 to $7.50 in their earning guidance. On the other hand, the company expects an adjusted Earnings-Per-Share (EPS) of $8.10 to $8.70. You can also read the historical earnings report of Sempra Company here.

SRE Price Forecast

Sempra Energy Stock will announce the latest earnings of the fourth quarter on November 4, 2022. Currently, the SRE stock price is $152.39, and this price has increased by 17,147.15% since the inception of this utility stock company in the United States.

This utility stock has increased by 28.08% over the last five years. As a result, the SRE price forecast is expected to grow. Simply Wall St provided a high-price estimation of $204.00 and a low-price estimation of $146.00 for the next year with a median price of $175.00.

Read Also: Visa (V) and Bank of America (BAC)

SRE Analysts Recommendations

Analysts expect the SRE share price to be 20% less than the current share price. Analysts at the Wall Street Journal (WSJ) rate this stock as a buy due to the low price and average dividend yield when the market sentiments are unfavorable both for the businesses and the investors. WSJ analysts have not recommended selling this stock as it is a recession-proof stock.

Moreover, the financial experts of this leading company have given a consensus of overweight to Sempra. This consensus is due to the expected earnings to outperform the industry and the market in the upcoming months.

Wells Fargo Boost Price Target

Wells Fargo Boost Price target has been lowered, and they have given a consensus of overweight for the SRE company stock. They set a higher price target of $189.00 and the lower price target of $168.

SRE News Coverage

Sempra Energy stock has been in the news due to the positive earnings growth and the ban on natural gas to make California carbon-free and sustainable.

California is taking a step away from natural gas to heat buildings

To make California carbon-free and sustainable, the San Diego City Council voted in favour of eliminating Natural Gas from the newly-constructed building and retrofitting the old ones. As we all know that Sempra is the largest distributor and supplier of Liquified Natural Gas (LNG) in California, many suspects that this leading utility company will have many challenges due to this decision.

However, the CEO of Sempra, Jeff Martin, looks quite comfortable with this decision due to the passing on of costs nature of these utility companies. He explained that the company honours the conclusion of the climate authorities and is obliged to follow them and align its business goals with them.[3]

SRE Energy Stock - FAQ's

Is SRE Stock a Good Buy?

SRE is a HOLD stock with a price target of $144.00, as suggested by Stephen Brad. On the other hand, SRE is overvalued as compared to other stocks. It is trading at a relatively expensive P/E ratio of 41.1 in contrast to the fair value of 23.9, analyzed by Simply Wall St.

What Companies Does Sempra Own?

Sempra owns San Diego Gas & Electric (SDG&E), Southern California Gas Company (SoCalGas) and Oncor Electric Delivery Company. DSG&E provides electricity and natural gas to the 20 million people of Southern California.

Does SRE pay a Dividend?

SRE pays dividends to its shareholders every quarter of a financial year. The payout ratio has been 128.29% . The dividend payments have been stable for the past seventeen years. The dividend details can be viewed here.

The dividend yield is expected to grow by 12% by the end of this year from $4.54 to $5.01. The annual dividend yield of 3.01% is estimated to be lower than the US market average dividends of 4.01% and the industry average of 4.66%.

How often Are SRE Dividends Paid?

SRE dividends are paid every quarter. It means Sempra Energy Company pays dividends four times a year. SRE has regularly paid its investors dividends for the past ten years. The dividend growth is positive and increases every year.

The Bottom Line - Is SRE A Good Stock to Buy?

We wrap up the discussion and conclude that the SRE stock price forecast is low and will vary slightly. However, the SRE company will be affected by the ban of California authorities on the prohibition of natural gas. As a result, this LNG-dependent company has to switch to other sustainable energy solutions and invest heavily in renewable energy sources.

Conversely, this stock is performing exceptionally well amid the recessionary fears and heightening inflation expectations. So, this recession-proof stock can provide you average dividend yield. And, you can get a stream of income when the market is highly volatile and investors' sentiments have been deteriorating.

Read also: Utility Stocks in a Recession- Are Utility Stocks a Good Buy Now?

References

[1] Sempra Infra deep into Mexican gas projects, as European demand

[2] Sempra: Supplying LNG To Europe Is A Major Catalyst

[3] Sempra boss says company is OK with San Diego City Council plan to eliminate natural gas