Since there was a controversy arises about the founder of Tesla (TSLA) Elon Mask, that is going by Twitter (TWRT). However, the Tesla (TSLA) stock perform quite well in July. TSLA shares acquired a 10% gain since the month started.

What will be the price of TSLA stock in the coming months and years? Will it recover its position after this recent dip?

So, in short, this article is related to the factors that affect TSLA stock price and the tesla stock prediction for the future.

Tesla stock price: Dominant Factors

Till now tesla stock losses 30% of its price since the beginning of the year because of some negative dominant factors related to it.

As the performance and operation of Tesla are not directly related to the Twitter scenario but Mask decided to sell some portion of his share from Tesla in April to get the remaining fund to buy out Twitter. This bold decision and some macroeconomics conditions led to the decline of TSLA stock price by 30% in that single month.

In July, the firm sell 254,695 vehicles as well as 258,580 vehicles manufactured. This become a positive sign for the firm and significant gain occurred this month. Furthermore, the company sells 75% of its bitcoin holdings which rises the firm cash capital by $936m, as confirmed by the company's quarterly earnings report.

Behind this decision, Musk said: "We are certainly open to increasing our Bitcoin holdings in the future. So, this should not be taken as some verdict on Bitcoin. It's just that we were concerned about overall liquidity for the company given COVID shutdowns in China. And we have not sold any of our Dogecoin."

Why did TSLA price dip

During the current year, Tesla stock suffered a loss of 30% due to some negative factors.

Macroeconomic

The central bank of the United State increases the benchmark of interest rates to cope with Inflation. Since the potential investor adjusts their risk premium above the benchmark. However, the vehicle companies are unable to provide the share with a high-interest rate. This led to a decline in investment and ultimately the demand falls and the price of shares decreases.

Higher Interest Rate

Due to higher interest rates the consumer also suffers as the cost of vehicles increases. This also leads to a decrease in the demand for vehicles.

Lockdown in China

In March, the Chinese government announced a lockdown in some big cities. Due to this Tesla's manufacturing operations in these cities were stopped. This factor also contributed to the downward of tesla stock price significantly.

Technical analysis of Tesla stock

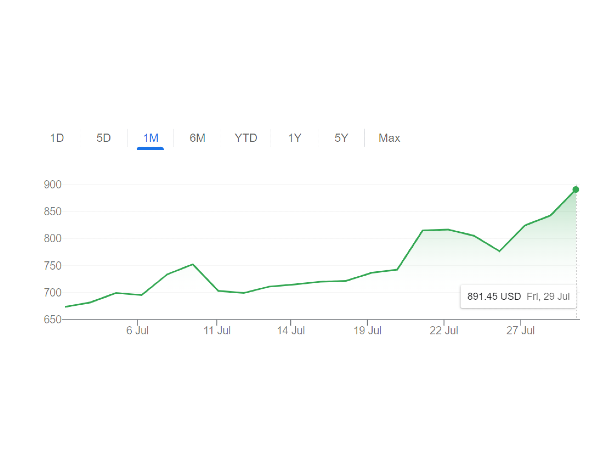

Since the price of Tesla stock is almost above $800 this year as well but during May and June, the price of the share was under $800. The lowest price observed was $628 on 24 May. Market participants are waiting for the next meeting of the Federal Reserve which will have a positive impact on the share price in the coming months. In addition, the Chinese government is lifting many restrictions on the vehicles industry, as a result, it would have a positive impact on the price of TSLA shares.

Currently telsa is in recovring stage

Fundamental analysis of Tesla stock

Tesla uploaded its financial statement for the second quarter ended on 30th June which shows total revenue of $16.93bn. This positive result is because of the small increase in the revenue of the automotive industry.

The cash reserves of the company ended at $18.91bn which includes marketable securities and the firm's cash. The company's digital asset holdings have declined and it is standing at $218m which was $1.26bn in the previous quarter. Moreover, the long-term debts of the firm are $6.83bn at the end of Q2.

The director of Amplify trading, Eddie Donmez said: "Strong quarter despite supply-chain issues and the weaker wider economy. They also sold 75% of their Bitcoin No-wonder Musk is partying in Mykonos."

Tesla stock forecast for the year 2022-2025

'Buy', 'Sell' or 'Hold' which option is better now for an investor. To get a reasonable answer a survey has been carried out by MarketBeat. A total of 36 analysts participate in it of which 19 rated TSLA a 'buy', 9 rated a 'hold' and 8 recommended a 'sell'.

$868.54 is the average TSLA price, having a 17% upside potential based. On 29 July closing price of the share is $842.70. As per the prediction from analysts, the maximum TSLA stock price would be $1,580 and the minimum would be $250.

As per the wallet investor, the price of TSLA stock at the end of this year would be $946.42.

By using algorithm-based forecasting it is predicted that by the end of this year the value of the share would be above $1000 and $1305.6 at the end of 2023 and it will hit $1675.99 at the end of 2024.

Furthermore, TSLA's stock price would be $2,037.64 at the end of the year 2025. If the share follows this trend then in 2027 according to Wallet Investor the share will trade for $2,541.15.

Since will analyze and predict the TSLA stock price using analysts' feedback and algorithm-based forecasting. Which does not provide you 100% guarantee that this prediction would be right. You should also use your knowledge and expertise to analyze the growth of Tesla stock and make a decision.

Since there was a controversy arises about the founder of Tesla (TSLA) Elon Mask, that is going by Twitter (TWRT). However, the Tesla (TSLA) stock perform quite well in July. TSLA shares acquired a 10% gain since the month started. What will be the price of TSLA stock in the coming months and years? Will it recover its position after this recent dip? So, in short, this article is related to the factors that affect TSLA stock price and the tesla stock prediction for the future.

Tesla stock price: Dominant Factors

Till now tesla stock losses 30% of its price since the beginning of the year because of some negative dominant factors related to it. As the performance and operation of Tesla are not directly related to the Twitter scenario but Mask decided to sell some portion of his share from Tesla in April to get the remaining fund to buy out Twitter. This bold decision and some macroeconomics conditions led to the decline of TSLA stock price by 30% in that single month. In July, the firm sell 254,695 vehicles as well as 258,580 vehicles manufactured. This become a positive sign for the firm and significant gain occurred this month. Furthermore, the company sells 75% of its bitcoin holdings which rises the firm cash capital by $936m, as confirmed by the company's quarterly earnings report. Behind this decision, Musk said: "We are certainly open to increasing our Bitcoin holdings in the future. So, this should not be taken as some verdict on Bitcoin. It's just that we were concerned about overall liquidity for the company given COVID shutdowns in China. And we have not sold any of our Dogecoin."

Why did TSLA price dip

During the current year, Tesla stock suffered a loss of 30% due to some negative factors.

Macroeconomic

The central bank of the United State increases the benchmark of interest rates to cope with Inflation. Since the potential investor adjusts their risk premium above the benchmark. However, the vehicle companies are unable to provide the share with a high-interest rate. This led to a decline in investment and ultimately the demand falls and the price of shares decreases.

Higher Interest Rate

Due to higher interest rates the consumer also suffers as the cost of vehicles increases. This also leads to a decrease in the demand for vehicles.

Lockdown in China

In March, the Chinese government announced a lockdown in some big cities. Due to this Tesla's manufacturing operations in these cities were stopped. This factor also contributed to the downward of tesla stock price significantly.

Technical analysis of Tesla stock

Since the price of Tesla stock is almost above $800 this year as well but during May and June, the price of the share was under $800. The lowest price observed was $628 on 24 May. Market participants are waiting for the next meeting of the Federal Reserve which will have a positive impact on the share price in the coming months. In addition, the Chinese government is lifting many restrictions on the vehicles industry, as a result, it would have a positive impact on the price of TSLA shares.

Currently telsa is in recovring stage

Fundamental analysis of Tesla stock

Tesla uploaded its financial statement for the second quarter ended on 30th June which shows total revenue of $16.93bn. This positive result is because of the small increase in the revenue of the automotive industry. The cash reserves of the company ended at $18.91bn which includes marketable securities and the firm's cash. The company's digital asset holdings have declined and it is standing at $218m which was $1.26bn in the previous quarter. Moreover, the long-term debts of the firm are $6.83bn at the end of Q2. The director of Amplify trading, Eddie Donmez said: "Strong quarter despite supply-chain issues and the weaker wider economy. They also sold 75% of their Bitcoin No-wonder Musk is partying in Mykonos."

Tesla stock forecast for the year 2022-2025

'Buy', 'Sell' or 'Hold' which option is better now for an investor. To get a reasonable answer a survey has been carried out by MarketBeat. A total of 36 analysts participate in it of which 19 rated TSLA a 'buy', 9 rated a 'hold' and 8 recommended a 'sell'. $868.54 is the average TSLA price, having a 17% upside potential based. On 29 July closing price of the share is $842.70. As per the prediction from analysts, the maximum TSLA stock price would be $1,580 and the minimum would be $250. As per the wallet investor, the price of TSLA stock at the end of this year would be $946.42. By using algorithm-based forecasting it is predicted that by the end of this year the value of the share would be above $1000 and $1305.6 at the end of 2023 and it will hit $1675.99 at the end of 2024. Furthermore, TSLA's stock price would be $2,037.64 at the end of the year 2025. If the share follows this trend then in 2027 according to Wallet Investor the share will trade for $2,541.15. Since will analyze and predict the TSLA stock price using analysts' feedback and algorithm-based forecasting. Which does not provide you 100% guarantee that this prediction would be right. You should also use your knowledge and expertise to analyze the growth of Tesla stock and make a decision.