Unless you've been living under a rock, you know about Americans facing unprecedented pain at the pump from record high gas prices. With oil selling at over $100 per barrel, many investors are wondering if it's time to buy "Big Oil" stocks. And the biggest oil stock of them all is ExxonMobil (XOM), the largest American oil company and leader of the supermajor oil producers. Let's take a look at whether or not XOM is a buy:

Is Exxon Growing?

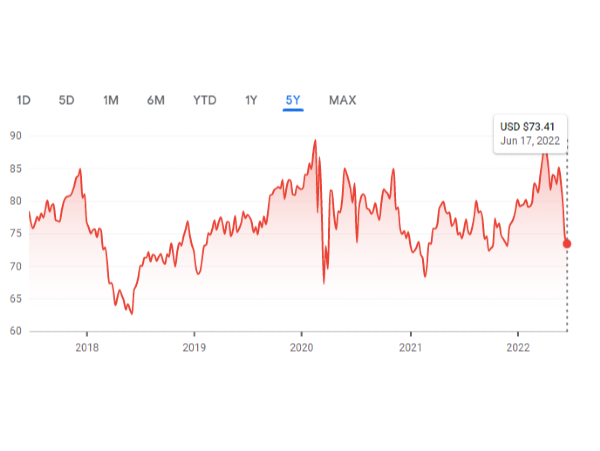

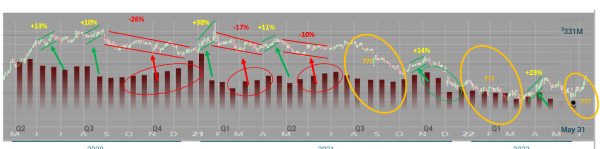

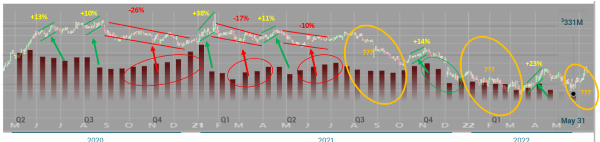

It's no surprise that, with oil prices soaring, Exxon racked up impressive financials in 2021 and Q1 2022. After a punishing 2020, which saw oil prices go below zero for the first time in history, Exxon has rebounded with the highest net income (income minus expenditures) since the previous "oil boom" that ended in autumn 2014. The company is also sitting on a tremendous stockpile of cash, which gives it stability as the economy teeters on the brink of recession. But, while Exxon is in a good financial spot today, will it last?

Will Oil Prices Remain High?

Those who follow the oil industry are used to the "boom and bust" roller coaster, which is similar to the business cycle...but on steroids. The good news for Big Oil is that prices may remain higher for longer. Due to Russia's war in Ukraine, many oil importers are looking for find replacements for Russian petroleum. Supply of oil, heavily influenced by OPEC, has not increased as much as buyers would hope.

It is possible that, having gone through steep oil busts in the 1980s, 2008, and 2014, oil producers are hesitant to ramp up production. Increasing production will, thanks to the laws of supply and demand, drive prices down. With 2021 bringing record profits, however, do oil producers want to risk overproducing and crashing the price? Famously, U.S. president Joe Biden has accused oil producers of intentionally holding back on increasing supply. In response, U.S. oil majors have responded that they are almost at capacity, signaling there likely won't be a substantial increase in oil supply - and a reduction in oil prices - soon.

Does Exxon Have a Sustainable Future?

Oil prices may remain high, but what about the long-term future? Are Big Oil's days numbered? Many point to the boom in electric vehicles (EVs) as a harbinger of doom to Big Oil, as demand for petroleum will fall significantly once many drivers switch to plug-in cars. While this may indeed occur, especially with major automakers like Ford and GM firmly investing in EVs, it doesn't look like the "EV Revolution" may be just around the corner. Some analysts are reporting that EVs are facing their own supply chain crunches, with shortages in the lithium needed to make the large batteries EVs need.

While Tesla and a growing lineup of Ford and GM EVs are certainly making plug-in rides mainstream, it doesn't look like gas- and diesel-powered vehicles are going to fade anytime soon. Shortages of lithium and other components for EVs may drive up their price, bringing consumers back to conventionally-powered automobiles. So, don't expect Exxon to fade just yet.

And, as one of the companies to emerge from Standard Oil, Exxon has a track record of surviving the rigorous boom-and-bust cycle. It's hard to count XOM out, especially as it seems to understand the sustainability game. And while some may scoff at the notion that Exxon is ready for the future, it seems that they may have understood climate change ramifications before almost anyone else...

Is Exxon Stock Worth Buying?

XOM is in a good place today and will definitely still be here tomorrow. If you're investing for income, Exxon's impressive 4.09 percent dividend yield is a major attraction. If you're looking for long-term value and growth, the stock may not be as solid. However, if you don't own any energy stocks yet, XOM might be a good security to add to your portfolio for some diversification. I recommend a buy, but not a big buy.

I/we have no positions in any asset mentioned, and no plans to initiate any positions for the next 7 days

Unless you've been living under a rock, you know about Americans facing unprecedented pain at the pump from record high gas prices. With oil selling at over $100 per barrel, many investors are wondering if it's time to buy "Big Oil" stocks. And the biggest oil stock of them all is ExxonMobil (XOM), the largest American oil company and leader of the supermajor oil producers. Let's take a look at whether or not XOM is a buy:

Is Exxon Growing?

It's no surprise that, with oil prices soaring, Exxon racked up impressive financials in 2021 and Q1 2022. After a punishing 2020, which saw oil prices go below zero for the first time in history, Exxon has rebounded with the highest net income (income minus expenditures) since the previous "oil boom" that ended in autumn 2014. The company is also sitting on a tremendous stockpile of cash, which gives it stability as the economy teeters on the brink of recession. But, while Exxon is in a good financial spot today, will it last?

Will Oil Prices Remain High?

Those who follow the oil industry are used to the "boom and bust" roller coaster, which is similar to the business cycle...but on steroids. The good news for Big Oil is that prices may remain higher for longer. Due to Russia's war in Ukraine, many oil importers are looking for find replacements for Russian petroleum. Supply of oil, heavily influenced by OPEC, has not increased as much as buyers would hope.

It is possible that, having gone through steep oil busts in the 1980s, 2008, and 2014, oil producers are hesitant to ramp up production. Increasing production will, thanks to the laws of supply and demand, drive prices down. With 2021 bringing record profits, however, do oil producers want to risk overproducing and crashing the price? Famously, U.S. president Joe Biden has accused oil producers of intentionally holding back on increasing supply. In response, U.S. oil majors have responded that they are almost at capacity, signaling there likely won't be a substantial increase in oil supply - and a reduction in oil prices - soon.

Does Exxon Have a Sustainable Future?

Oil prices may remain high, but what about the long-term future? Are Big Oil's days numbered? Many point to the boom in electric vehicles (EVs) as a harbinger of doom to Big Oil, as demand for petroleum will fall significantly once many drivers switch to plug-in cars. While this may indeed occur, especially with major automakers like Ford and GM firmly investing in EVs, it doesn't look like the "EV Revolution" may be just around the corner. Some analysts are reporting that EVs are facing their own supply chain crunches, with shortages in the lithium needed to make the large batteries EVs need.

While Tesla and a growing lineup of Ford and GM EVs are certainly making plug-in rides mainstream, it doesn't look like gas- and diesel-powered vehicles are going to fade anytime soon. Shortages of lithium and other components for EVs may drive up their price, bringing consumers back to conventionally-powered automobiles. So, don't expect Exxon to fade just yet.

And, as one of the companies to emerge from Standard Oil, Exxon has a track record of surviving the rigorous boom-and-bust cycle. It's hard to count XOM out, especially as it seems to understand the sustainability game. And while some may scoff at the notion that Exxon is ready for the future, it seems that they may have understood climate change ramifications before almost anyone else...

Is Exxon Stock Worth Buying?

XOM is in a good place today and will definitely still be here tomorrow. If you're investing for income, Exxon's impressive 4.09 percent dividend yield is a major attraction. If you're looking for long-term value and growth, the stock may not be as solid. However, if you don't own any energy stocks yet, XOM might be a good security to add to your portfolio for some diversification. I recommend a buy, but not a big buy.

I/we have no positions in any asset mentioned, and no plans to initiate any positions for the next 7 days