Are you struggling to find a stock that will make your portfolio more secure with less risky stocks at the top? In that case, you can check the Sempra Energy stocks (SRE) during this recession when inflation is rising unceasingly.

Investors with a long-term outlook would find this stock more attractive as the stock dividend yield is increasing steadily since its establishment in 1980.

Check Also: Bank of America Stock Price Today - BAC Making Huge Revenues in a Bear Market and Goog Earnings in Second Quarter 2022

We are going to discuss how this stock would help you get rid of the worry of paying utility bills by earning a balanced income. A utility stock such as Sempra Energy Stock, is the best stock for those who are just a beginner in investment or want to build a diversified portfolio of secured and risky stocks to achieve a balanced growth over many years.

Discussing what a Sempra Energy Stock is and how it can help you achieve your financial goals in the present economic slowdown, let’s delve deep and analyze this stock!

Read Also: IS VISA Stock A BUY? WHY & WHY NOT?, Will Meta Stock Go Up? and Is BBY A Buy or Sell? Is Best Buy still the Best Buy For Investors?

Sempra Energy Company Profile

Based on energy infrastructure, Sempra has made its innovative and strategic prowess not only in San Diego in California, this energy giant has expanded its business to Mexico and Texas as well.

Sempra was born out of the merger of the two corporations in 1998. The Pacific Enterprises, natural gas supplier, and Enova Corporations, an electricity supplier in California, were merged to form Sempra Corporation, eventually providing a large customer base in North America.

The company is still aspired to provide innovative energy solutions and works in different dimensions. Wind and solar energy solutions with the ultimate goal of providing clean and sustainable energy solutions make this stock evergreen.

As a result, long-term investors can invest in this stock, as this investment is tantamount to make an investment in the future with guaranteed returns. Let’s now discuss the returns and past performance of this stock!

Read Also: What Happened to Netflix Stock? Stranger Things About the Netflix Stock Drop in 2022

Sempra Energy Stocks Analysis

Sempra stock is a utility stock listed as SRE on NASDAQ at NYSE. The price of the stock has increased tremendously and outperformed the stock market in the bearish trend in the USA. Moreover, the stock is leading the energy industry. It is one of the most favorite stocks among investors looking to grow their income and wealth over time.

On the end of the May this year, Sempra Energy Stock has been listed on the Mexican Stock Exchange. The premier energy infrastructure in North America, the company is offering a great opportunity to the investors of Mexico to enjoy the high returns by investing in the largest sustainable energy sector.

Read Also: Should You Buy Tesla Stock? and Why is Apple Dividend So Low?

Sempra stock can give you the best return even if the market slows down and a recession is on the horizon. In a bearish trend where every stock is underperforming, Sempra energy stock can give you good yields on average.

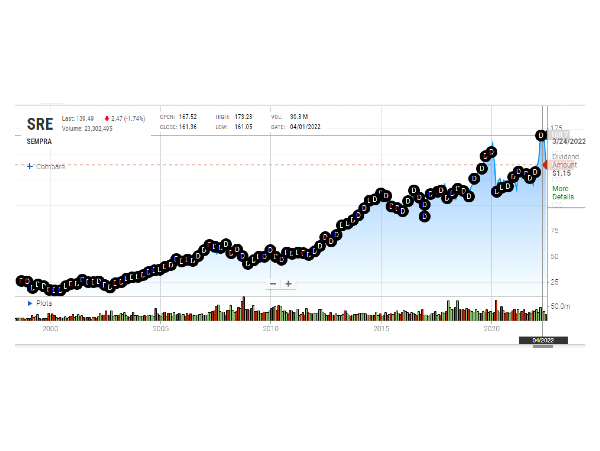

For the last ten years, the compound annual growth has been 9%, outperforming the market with 255% of shareholder returns over this period.

Currently, Sempra stock is trading at $147.16 in the market with a market capitalization of $48.62 B. With a P/E ratio of 46.54, the stock is the favorite of those investors hungry for dividends. With a steady growth of dividends and earnings, dividend investors can find this stock attractive.

If we look at the historical data, we will observe that this income-generating stock is rising continuously in value and earnings. So, we can say that Sempra is a good stock to buy, especially when the market has slowed down and you do not want to lose your money with your investment in this energy stock.

Similarly, if we look at the historical data of the last 10 years and compare this stock with its competitors, we will notice clearly this energy stock has outperformed its competitors in the dividend growth also. Read my another article on why dominion Energy Stock is dropping, NRG Energy Stock and Amazon Stock Price Prediction

Opportunity for the investors

In the current market, there’s a great opportunity for investors who look towards the lowest price or the undervalued stocks. They can buy the dip stock and enjoy returns for a long time. The 52-week high price was $173.28 and the lowest of 52 weeks price was $119.56. Currently, it is trading at $144.03.

Read Also: Edison International Stock Price - A stock To Hold In Recession

and NextEra Energy Stock (NEE)

So, if the investors can wait for a more price decrease, they can buy the stock at a much lower price. Otherwise, they can buy it now to enjoy the dividend that has crossed the 3% yield mark in the month of June. As the market is expected to continue its bearish trend, the price is expected to fall further.

Therefore, investors are recommended to hold on and wait for the right opportunity, keeping the Sempra energy stocks on their watch list. It will be a lifetime opportunity to buy the Sempra stock at its lowest price for enjoying the highest returns.

Final Thoughts

Sempra Energy Stock (SRE) is ideal for investors who want to enjoy a steady flow of income during the high inflation and recession. Although the stock earnings have been lowered under the current bearish market trend, it goes without saying this strong stock will bounce back, accelerating its earnings and the dividend growth eventually.

Therefore, you can buy this stock right now as this Sempra Energy Stocks price is quite low and value investors can take advantage of this bearish market, buying the stock at the lowest price. On the other hand, the balanced growth investors can also benefit from this opportunity, including Sempra stock in their portfolio to increase their total revenues ultimately.

Similarly, the prices of electricity are expected to rise amid inflationary pressure, you can play smartly and invest in this energy stock to pay your utility bills with Sempra Energy Stock dividend. Indeed, SRE Stock Forecast recommends that it is a smart choice for the smart investors.

Are you struggling to find a stock that will make your portfolio more secure with less risky stocks at the top? In that case, you can check the Sempra Energy stocks (SRE) during this recession when inflation is rising unceasingly.

Investors with a long-term outlook would find this stock more attractive as the stock dividend yield is increasing steadily since its establishment in 1980.

Check Also: Bank of America Stock Price Today - BAC Making Huge Revenues in a Bear Market and Goog Earnings in Second Quarter 2022

We are going to discuss how this stock would help you get rid of the worry of paying utility bills by earning a balanced income. A utility stock such as Sempra Energy Stock, is the best stock for those who are just a beginner in investment or want to build a diversified portfolio of secured and risky stocks to achieve a balanced growth over many years.

Discussing what a Sempra Energy Stock is and how it can help you achieve your financial goals in the present economic slowdown, let’s delve deep and analyze this stock!

Read Also: IS VISA Stock A BUY? WHY & WHY NOT?, Will Meta Stock Go Up? and Is BBY A Buy or Sell? Is Best Buy still the Best Buy For Investors?

Sempra Energy Company Profile

Based on energy infrastructure, Sempra has made its innovative and strategic prowess not only in San Diego in California, this energy giant has expanded its business to Mexico and Texas as well.

Sempra was born out of the merger of the two corporations in 1998. The Pacific Enterprises, natural gas supplier, and Enova Corporations, an electricity supplier in California, were merged to form Sempra Corporation, eventually providing a large customer base in North America.

The company is still aspired to provide innovative energy solutions and works in different dimensions. Wind and solar energy solutions with the ultimate goal of providing clean and sustainable energy solutions make this stock evergreen.

As a result, long-term investors can invest in this stock, as this investment is tantamount to make an investment in the future with guaranteed returns. Let’s now discuss the returns and past performance of this stock!

Read Also: What Happened to Netflix Stock? Stranger Things About the Netflix Stock Drop in 2022

Sempra Energy Stocks Analysis

Sempra stock is a utility stock listed as SRE on NASDAQ at NYSE. The price of the stock has increased tremendously and outperformed the stock market in the bearish trend in the USA. Moreover, the stock is leading the energy industry. It is one of the most favorite stocks among investors looking to grow their income and wealth over time.

On the end of the May this year, Sempra Energy Stock has been listed on the Mexican Stock Exchange. The premier energy infrastructure in North America, the company is offering a great opportunity to the investors of Mexico to enjoy the high returns by investing in the largest sustainable energy sector.

Read Also: Should You Buy Tesla Stock? and Why is Apple Dividend So Low?

Sempra stock can give you the best return even if the market slows down and a recession is on the horizon. In a bearish trend where every stock is underperforming, Sempra energy stock can give you good yields on average.

For the last ten years, the compound annual growth has been 9%, outperforming the market with 255% of shareholder returns over this period. Currently, Sempra stock is trading at $147.16 in the market with a market capitalization of $48.62 B. With a P/E ratio of 46.54, the stock is the favorite of those investors hungry for dividends. With a steady growth of dividends and earnings, dividend investors can find this stock attractive.

If we look at the historical data, we will observe that this income-generating stock is rising continuously in value and earnings. So, we can say that Sempra is a good stock to buy, especially when the market has slowed down and you do not want to lose your money with your investment in this energy stock.

Similarly, if we look at the historical data of the last 10 years and compare this stock with its competitors, we will notice clearly this energy stock has outperformed its competitors in the dividend growth also. Read my another article on why dominion Energy Stock is dropping, NRG Energy Stock and Amazon Stock Price Prediction

Opportunity for the investors

In the current market, there’s a great opportunity for investors who look towards the lowest price or the undervalued stocks. They can buy the dip stock and enjoy returns for a long time. The 52-week high price was $173.28 and the lowest of 52 weeks price was $119.56. Currently, it is trading at $144.03.

Read Also: Edison International Stock Price - A stock To Hold In Recession and NextEra Energy Stock (NEE)

So, if the investors can wait for a more price decrease, they can buy the stock at a much lower price. Otherwise, they can buy it now to enjoy the dividend that has crossed the 3% yield mark in the month of June. As the market is expected to continue its bearish trend, the price is expected to fall further.

Therefore, investors are recommended to hold on and wait for the right opportunity, keeping the Sempra energy stocks on their watch list. It will be a lifetime opportunity to buy the Sempra stock at its lowest price for enjoying the highest returns.

Final Thoughts

Sempra Energy Stock (SRE) is ideal for investors who want to enjoy a steady flow of income during the high inflation and recession. Although the stock earnings have been lowered under the current bearish market trend, it goes without saying this strong stock will bounce back, accelerating its earnings and the dividend growth eventually.

Therefore, you can buy this stock right now as this Sempra Energy Stocks price is quite low and value investors can take advantage of this bearish market, buying the stock at the lowest price. On the other hand, the balanced growth investors can also benefit from this opportunity, including Sempra stock in their portfolio to increase their total revenues ultimately.

Similarly, the prices of electricity are expected to rise amid inflationary pressure, you can play smartly and invest in this energy stock to pay your utility bills with Sempra Energy Stock dividend. Indeed, SRE Stock Forecast recommends that it is a smart choice for the smart investors.