Berkshire Hathaway Forecast ahead of Quarter 2 2022 Earnings Report

Berkshire Hathaway announced its Quarter 1 2022 earnings on 30th April. During the first quarter, earnings declined due to slowing economic growth and stock market pullback.

Berkshire Hathaway quarter 2 2022 earnings are expected to be published on 5th August. Let's look at the current market trends and Berkshire Hathaway's performance to determine a possible outcome of the quarter 2 2022 earnings.

In the last quarter, the company reported earnings of $70.81 billion, with $3.18 earnings per share and a price-to-earnings ratio of 7.7. Its public market equity portfolio was valued at over $363 billion.

Quarter 2 2022 Forecast

• Earnings per share – range of $2.68 to $3.49 consensus estimate of $3.16

• Sales – range of $72.5B to 74.6B consensus estimate of 73.5B

• Beta – 0.91

Source; Yahoo Finance

Berkshire Hathaway Profile Summary

Berkshire Hathaway has a market capitalization of $629.73 billion and is one of the largest publicly traded companies in the world. The conglomerate has been successful over the years due to wise investments mostly pioneered by its CEO, Warren Buffett.

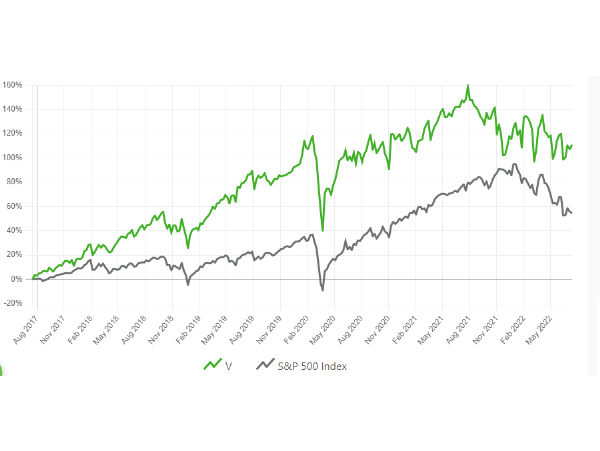

In the last 56 years, the company's portfolio has posted a 20.1% compound annual gain. The figure includes dividends and nearly doubles the S&P 500 index estimate.

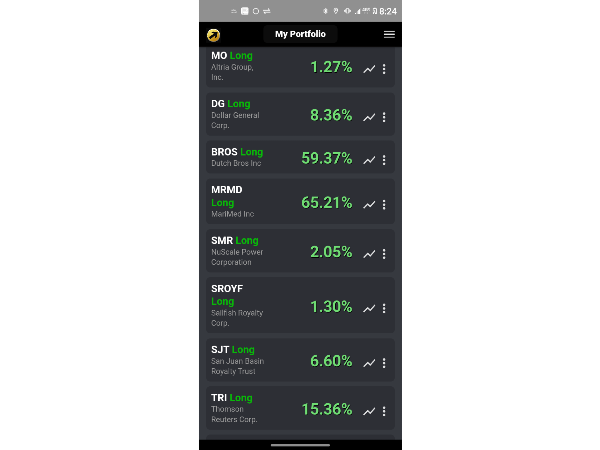

Berkshire Hathaway stock trades on the New York Stock Exchange under A and B shares. Its extensive investment portfolio of stocks comprises giant public companies such as Apple, Coca-Cola, American Express, Bank of America and UPS.

In the last two years, 70% of its annual profits of Berkshire are from investments in other companies. The profits are through direct share sales or earned dividends.

Berkshire Hathaway has been making high-value stock purchases, a trend likely to continue in quarter 2. The most notable is the large stake buy of OXY shares worth $8.5 billion, where Berkshire owns over 19.4% of the company.

The huge investment in OXY portrays Berkshire's stand on the current economy, inflation and energy. It will be interesting to analyze the potential of the company's purchases and sales during the second quarter.

Read also: Why its time to start buying Tesla long

Berkshire Hathaway Valuation

Valuing Berkshire Hathaway is a bit complex, given the volatile nature of earnings determined by fluctuations of the stock portfolio. The company continually injects high amounts of capital into valuable assets, which attracts new investors.

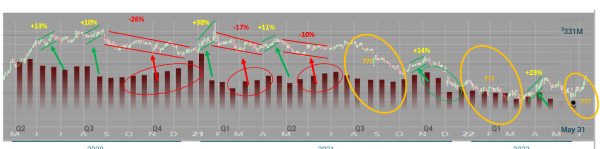

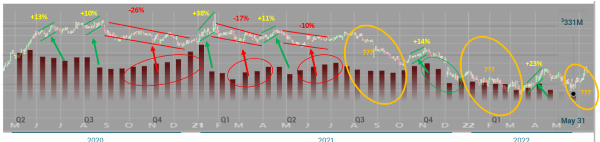

The stock price has remained stable this month, trading at an average of $270. However, the trade volumes have been declining since June. The price may likely lower as trade volumes decrease, leaving a very wide margin of safety for new investors.

With less than two weeks to the anticipated quarter 2 earnings report, current Berkshire Hathaway stockholders, especially short traders, may sell at high volumes to play safely in the uncertainty of the earnings report results.

In such a case, the stock price will fall due to market oversaturation and will be a perfect opportunity for a new investor to buy long. With Berkshire's steady growth in revenue and earnings, the company could soon hit the $1 trillion mark in net worth.

Effects of Inflation on Berkshire Hathaway Stock

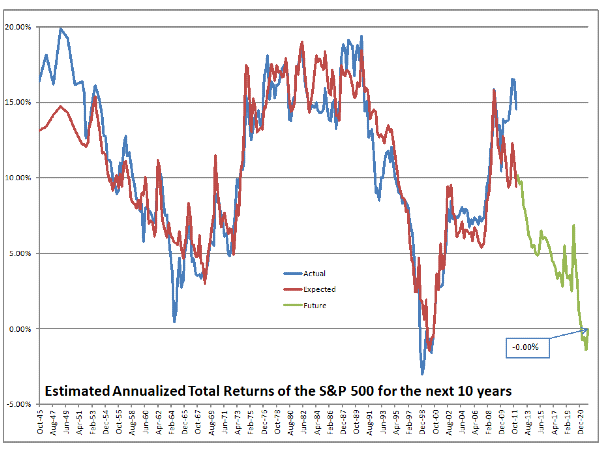

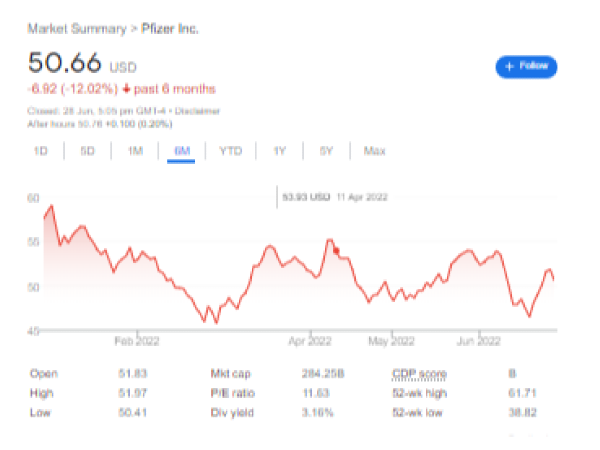

We are currently experiencing historical inflation rates in energy and food prices. As expected, the high inflation rates have directly contributed to the deflation in equities prices. Inflation will likely remain high, mainly due to a lack of clear policies that address the relationship between energy and inflation.

There is a fear of economic recession that will plummet earnings and lead to a bearish market. It is unlikely that the FED would raise interest rates higher than they currently stand. Therefore, value stocks would be the best choice for investors.

Although Berkshire doesn’t pay dividends, its stability puts it in place as a value stock. The company has adequate resources to handle any economic crisis that may occur. Berkshire has diversified subsidiaries, investments and a load of dispensable cash.

Berkshire Hathaway Buy Back Bargain

Berkshire had run a buyback program of their shares even when the prices increased. The move indicates the promise of attractive returns in the future for shareholders. The company will likely continue buying selective high-value stocks and accelerate buybacks in the anticipated price drop before the Q2 earnings report. Long-term bull investors stand to benefit the most from increased buybacks.

Final take

Berkshire Hathaway is well diversified and has a significant cash balance. Bankruptcy risk is minimal, and current stock prices favour holding and new investors. The company can handle any economic event without substantially damaging shareholder investments.

Berkshire is a conservative business with excellent prospects for a long buy. If you are an investor whose priority is flexibility and affordability, Berkshire Hathaway Class B shares will work for you. Class A shares, which trade at over $400,000, are best for high net worth investors seeking high returns. Berkshire Hathaway earnings are likely to reflect increased sales and earnings but decreased share price.

Berkshire Hathaway Forecast ahead of Quarter 2 2022 Earnings Report

Berkshire Hathaway announced its Quarter 1 2022 earnings on 30th April. During the first quarter, earnings declined due to slowing economic growth and stock market pullback.

Berkshire Hathaway quarter 2 2022 earnings are expected to be published on 5th August. Let's look at the current market trends and Berkshire Hathaway's performance to determine a possible outcome of the quarter 2 2022 earnings.

In the last quarter, the company reported earnings of $70.81 billion, with $3.18 earnings per share and a price-to-earnings ratio of 7.7. Its public market equity portfolio was valued at over $363 billion.

Quarter 2 2022 Forecast • Earnings per share – range of $2.68 to $3.49 consensus estimate of $3.16 • Sales – range of $72.5B to 74.6B consensus estimate of 73.5B • Beta – 0.91

Source; Yahoo Finance

Berkshire Hathaway Profile Summary

Berkshire Hathaway has a market capitalization of $629.73 billion and is one of the largest publicly traded companies in the world. The conglomerate has been successful over the years due to wise investments mostly pioneered by its CEO, Warren Buffett.

In the last 56 years, the company's portfolio has posted a 20.1% compound annual gain. The figure includes dividends and nearly doubles the S&P 500 index estimate.

Berkshire Hathaway stock trades on the New York Stock Exchange under A and B shares. Its extensive investment portfolio of stocks comprises giant public companies such as Apple, Coca-Cola, American Express, Bank of America and UPS.

In the last two years, 70% of its annual profits of Berkshire are from investments in other companies. The profits are through direct share sales or earned dividends.

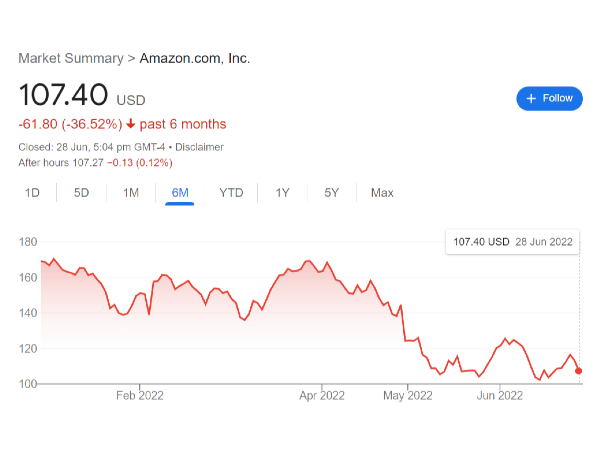

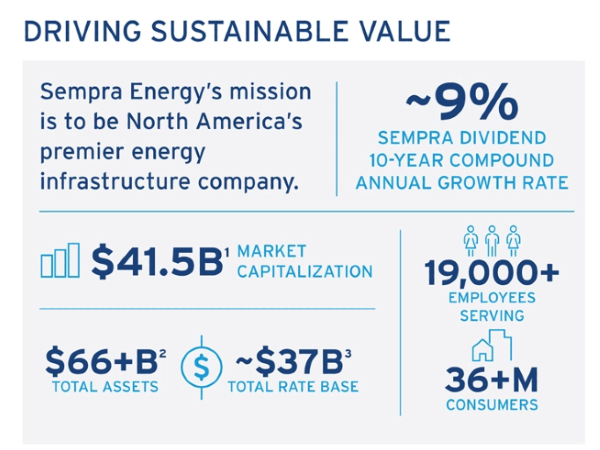

Berkshire Hathaway has been making high-value stock purchases, a trend likely to continue in quarter 2. The most notable is the large stake buy of OXY shares worth $8.5 billion, where Berkshire owns over 19.4% of the company.

The huge investment in OXY portrays Berkshire's stand on the current economy, inflation and energy. It will be interesting to analyze the potential of the company's purchases and sales during the second quarter.

Read also: Why its time to start buying Tesla long

Berkshire Hathaway Valuation

Valuing Berkshire Hathaway is a bit complex, given the volatile nature of earnings determined by fluctuations of the stock portfolio. The company continually injects high amounts of capital into valuable assets, which attracts new investors.

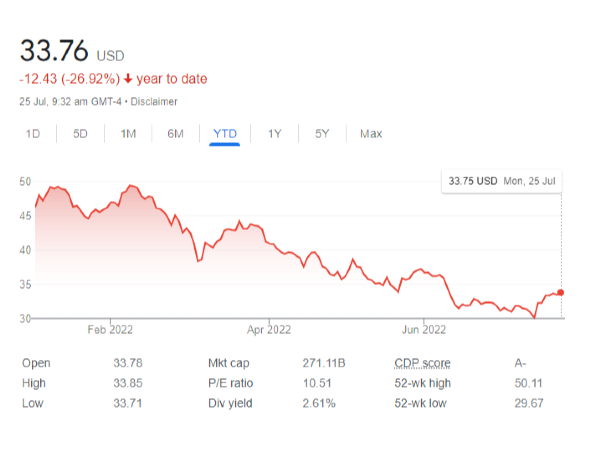

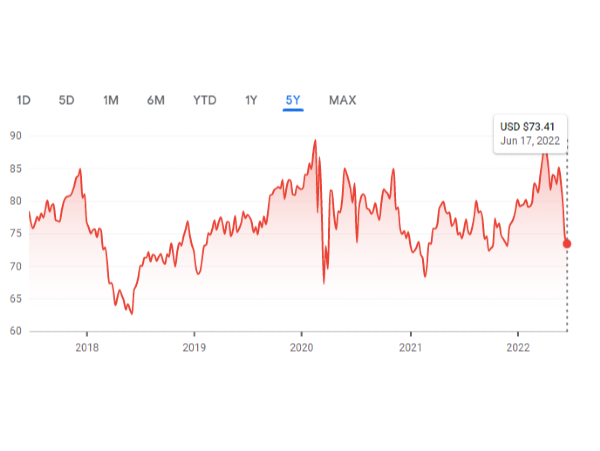

The stock price has remained stable this month, trading at an average of $270. However, the trade volumes have been declining since June. The price may likely lower as trade volumes decrease, leaving a very wide margin of safety for new investors.

With less than two weeks to the anticipated quarter 2 earnings report, current Berkshire Hathaway stockholders, especially short traders, may sell at high volumes to play safely in the uncertainty of the earnings report results.

In such a case, the stock price will fall due to market oversaturation and will be a perfect opportunity for a new investor to buy long. With Berkshire's steady growth in revenue and earnings, the company could soon hit the $1 trillion mark in net worth.

Effects of Inflation on Berkshire Hathaway Stock

We are currently experiencing historical inflation rates in energy and food prices. As expected, the high inflation rates have directly contributed to the deflation in equities prices. Inflation will likely remain high, mainly due to a lack of clear policies that address the relationship between energy and inflation.

There is a fear of economic recession that will plummet earnings and lead to a bearish market. It is unlikely that the FED would raise interest rates higher than they currently stand. Therefore, value stocks would be the best choice for investors.

Although Berkshire doesn’t pay dividends, its stability puts it in place as a value stock. The company has adequate resources to handle any economic crisis that may occur. Berkshire has diversified subsidiaries, investments and a load of dispensable cash.

Berkshire Hathaway Buy Back Bargain

Berkshire had run a buyback program of their shares even when the prices increased. The move indicates the promise of attractive returns in the future for shareholders. The company will likely continue buying selective high-value stocks and accelerate buybacks in the anticipated price drop before the Q2 earnings report. Long-term bull investors stand to benefit the most from increased buybacks.

Final take

Berkshire Hathaway is well diversified and has a significant cash balance. Bankruptcy risk is minimal, and current stock prices favour holding and new investors. The company can handle any economic event without substantially damaging shareholder investments.

Berkshire is a conservative business with excellent prospects for a long buy. If you are an investor whose priority is flexibility and affordability, Berkshire Hathaway Class B shares will work for you. Class A shares, which trade at over $400,000, are best for high net worth investors seeking high returns. Berkshire Hathaway earnings are likely to reflect increased sales and earnings but decreased share price.