Adobe Inc. is a top tech company developing software to produce different content such as graphics, motion pictures and multimedia. The company has grown steadily, making some of the best-rated innovative products in the market.

Additionally, it has acquired several viable businesses that have improved Adobe's operations and stayed ahead of competitors. It has collaborated with NVIDIA in its operations for over ten years.

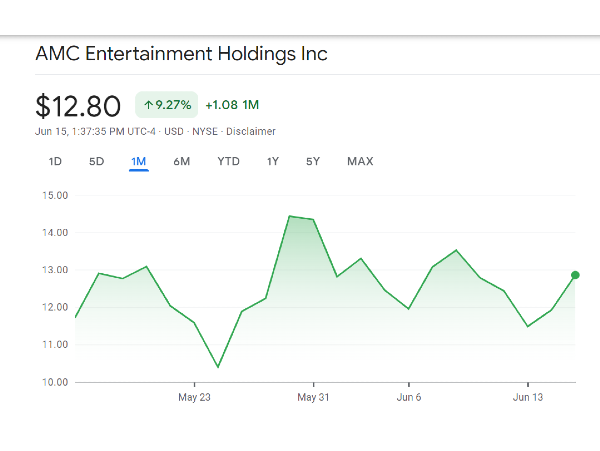

During this highly dynamic turbulence in the stock market, it isn't easy to figure out what works for you. Most stocks appear cheap compared to their value, but you need a deeper analysis to understand.

The bearish waves in the stock market make most stocks seem reasonable, inciting investors to buy the dip. This is primarily attributed to fears of recession and high inflation rates.

The price of Adobe stock was volatile during the last quarter, and the stock price went down. The management attributed the dip to the war in Ukraine, which led to the company's decision to stop all new sales in Russia and Belarus and summer seasonality.

The Federal Reserve has increased interest rates to reduce inflation, strengthening the U.S dollar. The management referred to the last quarter's economic development as 'uncertain'. However, they were optimistic about the new team on board, sourced from talent acquisition.

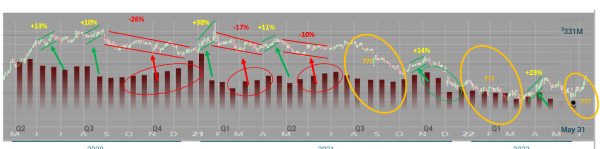

Analysis of Adobe Quarter 2 Fiscal 2022

Adobe's Q2 Fiscal 2022 ended on 3 June. The most notable figures were the 14% revenue growth YoY and a net income of increase of 6%. The company’s digital media segment had an impressive 15% increase in revenue.

In the last quarter, Adobe announced increased prices for specific creative cloud subscriptions. The increase is due to the launch of new subscriptions. The company's primary goal is to add new users; therefore, they did not go all out on the price hikes.

According to CEO Shantanu Narayen, Adobe is now targeting to acquire new targets since the prices are now more favourable.

Adobe Quarter 2 Fiscal Year 2022 Financial Highlights

• Revenue of $4.39 billion.

• Diluted GAAP EPS of $2.49 and non-GAAP of $3.35

• GAAP operating income of $1.53 billion and non-GAAP of $1.97 billion

• GAAP net income of $1.18 billion and non-GAAP of $1.59 billion

• $2.04 billion operations cash flow

• RPO of $13.82 billion

• The remaining Performance Obligations ("RPO") exiting the quarter were $13.82 billion.

• A share repurchase of 1.9 million shares

• Deferred revenue of $4.88 billion

Source:Adobe News

Why Adobe is a long buy

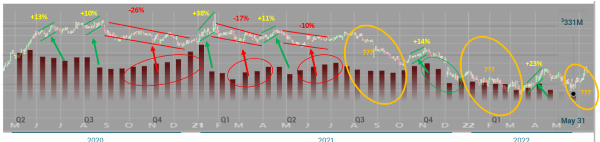

When considering to purchase, it is wise for an investor to analyze a stock's past performance. Adobe stock has been growing steadily and consistently in the past. As expected with any stock, it has fluctuated from time to time, depending on the market factors, but the performance has been good overall.

Adobe has experienced high growth in the past, which has seen investors willing to invest more resources. We will examine why Adobe is a potential buy-and-hold stock by considering fundamental and macro events that influence price movements.

Considering the increased value in Adobe stock in the past years, it is likely that the upward momentum will continue. Below are the three main reasons why Adobe is a long buy.

Healthy financial performance

In the last year, revenue increased by 23% and operating income by 37%. The company’s growth is mainly from Digital Media and Digital Experiences. The company also makes significant revenue from subscriptions.

In 2021, subscriptions contributed to 92% of the total revenue. The income from recurring subscriptions has fewer revenue expenses and therefore increases profits. The increased overall revenue has improved the company's gross margin,

Potential for growth

Tech is the future, and most tech companies may be around for a while since there is room to explore the industry. Adobe has been successful in the past, which gives confidence in its future.

The management has very optimistic projections. For example, it believes the TAM for its creative cloud products estimate is $63 billion.

The figure may seem exceedingly ambitious compared to the $9.6 billion in innovative revenue. However, it is possible if the company increases its market share significantly.

Adobe aims to improve its products, directly translating to new consumers and increasing revenue.

Efficiency in operations and share repurchases

The business efficiency of the company is improving, therefore improving financial performance.

Over the past two years, operating expenses have decreased compared to the revenue. This shows the company can keep costs in check and maximize increasing its revenue.

The company's share repurchase program strengthens its stock and helps it maintain authority over its shares. Over the last four years, the company has repurchased an estimated $12 billion of its shares.

Takeway

The company's growth is foreseeable based on the increasing success of its cloud products. Subscription revenue increases every quarter. There is great promise in its adaption across most mobile apps.

The world is constantly changing toward a digital economy. Companies like Adobe which are at the forefront of the revolution will be the biggest winners.

There is an increased demand for online video content, which has increased the market. Adobe's products are likely to get overwhelming demand in the near future.

The demand will likely come from their creative innovations, strategic acquisition and development of high-tech applications. Investing is always a risk, but Adobe projects itself as a reasonable risk overall.

Adobe Inc. is a top tech company developing software to produce different content such as graphics, motion pictures and multimedia. The company has grown steadily, making some of the best-rated innovative products in the market.

Additionally, it has acquired several viable businesses that have improved Adobe's operations and stayed ahead of competitors. It has collaborated with NVIDIA in its operations for over ten years.

During this highly dynamic turbulence in the stock market, it isn't easy to figure out what works for you. Most stocks appear cheap compared to their value, but you need a deeper analysis to understand.

The bearish waves in the stock market make most stocks seem reasonable, inciting investors to buy the dip. This is primarily attributed to fears of recession and high inflation rates.

The price of Adobe stock was volatile during the last quarter, and the stock price went down. The management attributed the dip to the war in Ukraine, which led to the company's decision to stop all new sales in Russia and Belarus and summer seasonality.

The Federal Reserve has increased interest rates to reduce inflation, strengthening the U.S dollar. The management referred to the last quarter's economic development as 'uncertain'. However, they were optimistic about the new team on board, sourced from talent acquisition.

Analysis of Adobe Quarter 2 Fiscal 2022

Adobe's Q2 Fiscal 2022 ended on 3 June. The most notable figures were the 14% revenue growth YoY and a net income of increase of 6%. The company’s digital media segment had an impressive 15% increase in revenue.

In the last quarter, Adobe announced increased prices for specific creative cloud subscriptions. The increase is due to the launch of new subscriptions. The company's primary goal is to add new users; therefore, they did not go all out on the price hikes.

According to CEO Shantanu Narayen, Adobe is now targeting to acquire new targets since the prices are now more favourable.

Adobe Quarter 2 Fiscal Year 2022 Financial Highlights

• Revenue of $4.39 billion. • Diluted GAAP EPS of $2.49 and non-GAAP of $3.35 • GAAP operating income of $1.53 billion and non-GAAP of $1.97 billion • GAAP net income of $1.18 billion and non-GAAP of $1.59 billion • $2.04 billion operations cash flow • RPO of $13.82 billion • The remaining Performance Obligations ("RPO") exiting the quarter were $13.82 billion. • A share repurchase of 1.9 million shares

• Deferred revenue of $4.88 billion

Source:Adobe News

Why Adobe is a long buy

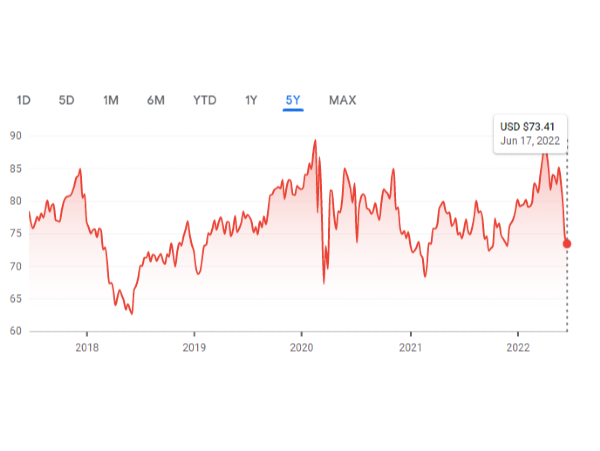

When considering to purchase, it is wise for an investor to analyze a stock's past performance. Adobe stock has been growing steadily and consistently in the past. As expected with any stock, it has fluctuated from time to time, depending on the market factors, but the performance has been good overall.

Adobe has experienced high growth in the past, which has seen investors willing to invest more resources. We will examine why Adobe is a potential buy-and-hold stock by considering fundamental and macro events that influence price movements.

Considering the increased value in Adobe stock in the past years, it is likely that the upward momentum will continue. Below are the three main reasons why Adobe is a long buy.

Healthy financial performance

In the last year, revenue increased by 23% and operating income by 37%. The company’s growth is mainly from Digital Media and Digital Experiences. The company also makes significant revenue from subscriptions.

In 2021, subscriptions contributed to 92% of the total revenue. The income from recurring subscriptions has fewer revenue expenses and therefore increases profits. The increased overall revenue has improved the company's gross margin,

Potential for growth

Tech is the future, and most tech companies may be around for a while since there is room to explore the industry. Adobe has been successful in the past, which gives confidence in its future.

The management has very optimistic projections. For example, it believes the TAM for its creative cloud products estimate is $63 billion.

The figure may seem exceedingly ambitious compared to the $9.6 billion in innovative revenue. However, it is possible if the company increases its market share significantly.

Adobe aims to improve its products, directly translating to new consumers and increasing revenue.

Efficiency in operations and share repurchases

The business efficiency of the company is improving, therefore improving financial performance.

Over the past two years, operating expenses have decreased compared to the revenue. This shows the company can keep costs in check and maximize increasing its revenue.

The company's share repurchase program strengthens its stock and helps it maintain authority over its shares. Over the last four years, the company has repurchased an estimated $12 billion of its shares.

Takeway

The company's growth is foreseeable based on the increasing success of its cloud products. Subscription revenue increases every quarter. There is great promise in its adaption across most mobile apps.

The world is constantly changing toward a digital economy. Companies like Adobe which are at the forefront of the revolution will be the biggest winners.

There is an increased demand for online video content, which has increased the market. Adobe's products are likely to get overwhelming demand in the near future.

The demand will likely come from their creative innovations, strategic acquisition and development of high-tech applications. Investing is always a risk, but Adobe projects itself as a reasonable risk overall.