Casual dining sits between fast food and fine dining. It offers sit‑down meals, friendly service, and prices most families can afford. This mix makes the category steady, even when the economy slows. Many investors look at casual dining stocks because they can grow over long periods without extreme swings.

Some casual dining chains make more money from takeout and catering than dine‑in customers. This shift started years before the pandemic.

Casual dining companies also benefit from strong brand loyalty. When people find a place they like, they often return for years. That loyalty helps these companies keep revenue stable.

Below are some of the top casual dining stocks that long‑term investors often watch.

Darden Restaurants (DRI)

Darden Restaurants runs Olive Garden, LongHorn Steakhouse, and other well‑known brands. Its ticker is DRI. Olive Garden alone brings in billions each year. The company focuses on simple menus and efficient kitchens. This helps keep costs down.

Olive Garden sells more than 600 million breadsticks a year. That consistency shows how strong the brand is.

Darden also has a long history of paying dividends. Many investors like this because it adds steady income on top of stock growth.

Texas Roadhouse (TXRH)

Texas Roadhouse is known for hand‑cut steaks and lively dining rooms. Its ticker is TXRH. The company has grown for years by opening new locations at a steady pace. It also keeps customer satisfaction high.

Texas Roadhouse makes its rolls fresh every five minutes during peak hours. This focus on quality helps keep guests coming back.

The company also has strong same‑store sales growth. That means older locations continue to perform well, not just the new ones.

The Cheesecake Factory (CAKE)

The Cheesecake Factory is famous for its huge menu and large portions. Its ticker is CAKE. The brand has a loyal following and strong name recognition. It also owns smaller concepts like North Italia.

The company has been expanding slowly but steadily. It focuses on high‑traffic areas and strong customer experiences.

Why Casual Dining Stocks Appeal to Long‑Term Investors

Casual dining stocks often grow at a steady pace. They are not as fast‑moving as tech stocks, but they can deliver strong returns over time. Many also pay dividends, which adds income for investors.

Some casual dining chains make more money on weekends than the entire rest of the week combined. This shows how important family dining patterns are to the industry.

These companies also benefit from menu innovation. Small changes, like adding seasonal dishes, can boost sales without raising costs too much.

Table: Key Casual Dining Stocks at a Glance

| Company |

Ticker |

Main Brand |

Notable Strength |

| Darden Restaurants |

DRI |

Olive Garden |

Strong dividends |

| Texas Roadhouse |

TXRH |

Texas Roadhouse |

High customer loyalty |

| Cheesecake Factory |

CAKE |

Cheesecake Factory |

Strong brand recognition |

Industry Trends to Watch

Casual dining is changing. More customers want online ordering and curbside pickup. Many chains now earn a large share of revenue from off‑premise sales. This trend is likely to continue.

Companies that manage staffing well tend to perform better. Technology, such as kitchen automation, is helping reduce pressure.

How Investors Can Evaluate These Stocks

When looking at casual dining stocks, investors often check same‑store sales growth. This shows how well existing locations are performing. They also look at operating margins, debt levels, and expansion plans.

Another surprising fact: some chains open fewer locations during strong economic years because construction costs rise too fast. They wait for prices to cool before expanding.

Long‑term investors may also consider dividend history. Companies with steady payouts often show financial discipline.

Table: Common Metrics Investors Track

| Metric |

What It Shows |

Why It Matters |

| Same‑Store Sales |

Growth at existing locations |

Signals brand strength |

| Operating Margin |

Profit after costs |

Shows efficiency |

| Debt Levels |

Borrowing load |

Impacts long‑term stability |

| Dividend History |

Payout consistency |

Helps income investors |

Many casual dining chains own very little real estate. They lease most locations, which keeps upfront costs low and allows faster expansion.

Final Thoughts

Casual dining stocks offer a mix of stability and growth. Brands like Olive Garden, Texas Roadhouse, and The Cheesecake Factory have strong customer loyalty and long histories of performance. These companies adapt well to changing trends, such as online ordering and menu updates.

⚡ Explore More

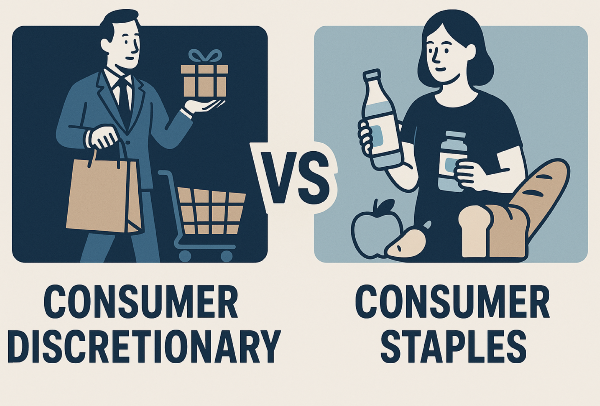

🏷️ Consumer Discretionary Sector

🍽️ Restaurant Industry — Core Overviews

📈 Performance & Financial Strength

🌍 Specialized & Global Categories

🚀 Ready to Deepen Your Research?

Unlock deeper insights, compare trends, and build a sharper investment strategy by exploring each topic above.

Casual dining sits between fast food and fine dining. It offers sit‑down meals, friendly service, and prices most families can afford. This mix makes the category steady, even when the economy slows. Many investors look at casual dining stocks because they can grow over long periods without extreme swings.

Casual dining companies also benefit from strong brand loyalty. When people find a place they like, they often return for years. That loyalty helps these companies keep revenue stable.

Below are some of the top casual dining stocks that long‑term investors often watch.

Darden Restaurants (DRI)

Darden Restaurants runs Olive Garden, LongHorn Steakhouse, and other well‑known brands. Its ticker is DRI. Olive Garden alone brings in billions each year. The company focuses on simple menus and efficient kitchens. This helps keep costs down.

Darden also has a long history of paying dividends. Many investors like this because it adds steady income on top of stock growth.

Texas Roadhouse (TXRH)

Texas Roadhouse is known for hand‑cut steaks and lively dining rooms. Its ticker is TXRH. The company has grown for years by opening new locations at a steady pace. It also keeps customer satisfaction high.

The company also has strong same‑store sales growth. That means older locations continue to perform well, not just the new ones.

The Cheesecake Factory (CAKE)

The Cheesecake Factory is famous for its huge menu and large portions. Its ticker is CAKE. The brand has a loyal following and strong name recognition. It also owns smaller concepts like North Italia.

The company has been expanding slowly but steadily. It focuses on high‑traffic areas and strong customer experiences.

Why Casual Dining Stocks Appeal to Long‑Term Investors

Casual dining stocks often grow at a steady pace. They are not as fast‑moving as tech stocks, but they can deliver strong returns over time. Many also pay dividends, which adds income for investors.

These companies also benefit from menu innovation. Small changes, like adding seasonal dishes, can boost sales without raising costs too much.

Table: Key Casual Dining Stocks at a Glance

Industry Trends to Watch

Casual dining is changing. More customers want online ordering and curbside pickup. Many chains now earn a large share of revenue from off‑premise sales. This trend is likely to continue.

Companies that manage staffing well tend to perform better. Technology, such as kitchen automation, is helping reduce pressure.

How Investors Can Evaluate These Stocks

When looking at casual dining stocks, investors often check same‑store sales growth. This shows how well existing locations are performing. They also look at operating margins, debt levels, and expansion plans.

Another surprising fact: some chains open fewer locations during strong economic years because construction costs rise too fast. They wait for prices to cool before expanding.

Long‑term investors may also consider dividend history. Companies with steady payouts often show financial discipline.

Table: Common Metrics Investors Track

Final Thoughts

Casual dining stocks offer a mix of stability and growth. Brands like Olive Garden, Texas Roadhouse, and The Cheesecake Factory have strong customer loyalty and long histories of performance. These companies adapt well to changing trends, such as online ordering and menu updates.

⚡ Explore More

🏷️ Consumer Discretionary Sector

🍽️ Restaurant Industry — Core Overviews

📈 Performance & Financial Strength

🌍 Specialized & Global Categories

🚀 Ready to Deepen Your Research?

Unlock deeper insights, compare trends, and build a sharper investment strategy by exploring each topic above.