Understanding the difference between consumer discretionary and consumer staples can help investors make better choices. These two sectors react to the economy in very different ways. Knowing how they behave can guide you toward a stronger and more balanced portfolio.

Consumer spending drives both sectors, but the reasons people buy these products are not the same. Some items are essential. Others are optional. This simple idea shapes how each sector performs in good times and bad.

What Are Consumer Discretionary Stocks?

Consumer discretionary stocks include companies that sell non‑essential goods and services. These are items people want but do not need for daily life. When the economy is strong, people spend more on these products. When times are tough, spending slows down.

This sector includes many well‑known industries. Clothing, luxury goods, travel, entertainment, and cars all fall under this category. These companies often see big swings in revenue because their sales depend on consumer confidence.

Discretionary companies also tend to focus on growth. They invest heavily in marketing, new products, and expansion. This can lead to higher returns during strong economic periods.

What Are Consumer Staples Stocks?

Consumer staples include companies that sell essential goods. These are products people buy no matter what the economy is doing. Food, drinks, household items, and personal care products all fall into this group.

Because demand stays steady, these companies tend to have predictable revenue. They also hold up well during recessions. This makes them popular with conservative investors.

Staples companies often pay steady dividends. Their cash flow is strong, and their products are always in demand. This gives them a defensive role in many portfolios.

Examples of Consumer Discretionary Industries vs Consumer Staple Industries

| Category |

Consumer Discretionary |

Consumer Staples |

| Industries |

Apparel and footwear, Hotels and travel, Restaurants, Automobiles, Entertainment and leisure |

Food and beverage, Household cleaning products, Personal care, Tobacco, Discount retail |

| Sample Companies |

Nike (NKE), Tesla (TSLA), Marriott (MAR), Starbucks (SBUX) |

Procter & Gamble (PG), Coca‑Cola (KO), Walmart (WMT), Colgate‑Palmolive (CL) |

| Demand |

Rises in strong economies, falls in weak ones |

Steady regardless of economic conditions |

| Volatility |

Higher than average |

Lower and more predictable |

| Dividend Levels |

Often lower |

Typically strong and consistent |

| Growth Potential |

High during expansions |

Stable with defensive characteristics |

Consumer Sector Comparison

Core Differences Between the Two Sectors

The biggest difference between these sectors is how they react to the economy. Discretionary stocks rise when people feel confident. Staples stay steady even when confidence drops.

Discretionary companies face more risk. Their earnings can swing from year to year. Staples companies face less risk because their products are always needed.

Consumer behavior also plays a major role. Discretionary purchases are emotional or lifestyle‑driven. Staples purchases are based on need. This leads to different pricing power and different profit patterns.

Inflation affects each sector in unique ways. Staples companies often pass higher costs to customers. Discretionary companies may struggle because shoppers cut back on optional items.

Dividend trends also differ. Staples companies usually pay higher dividends. Discretionary companies reinvest more money into growth.

| Category |

Discretionary |

Staples |

| Economic Sensitivity |

High |

Low |

| Revenue Stability |

Unstable |

Stable |

| Risk Level |

Higher |

Lower |

| Dividend Strength |

Moderate |

Strong |

| Consumer Behavior |

Want‑based |

Need‑based |

Key Differences at a Glance

Performance in Different Market Conditions

During bull markets, discretionary stocks often shine. People spend more on travel, entertainment, and luxury goods. This boosts earnings and stock prices.

During bear markets, staples tend to outperform. People still buy food, soap, and cleaning supplies. These companies stay steady even when the market drops.

Inflation can help staples companies because they can raise prices. Discretionary companies may struggle because shoppers cut back.

In recessions, discretionary spending falls fast. Staples become a safe haven for investors who want stability.

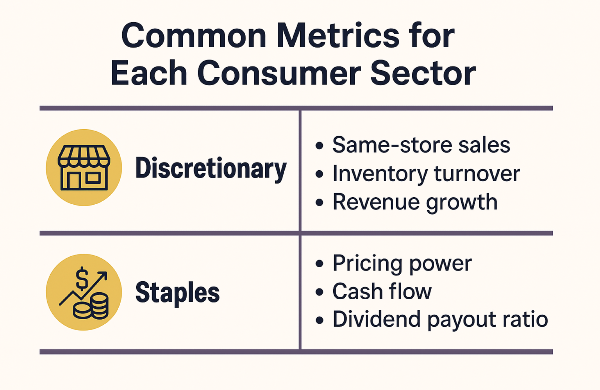

How to Analyze Each Sector

Investors use different metrics to evaluate these sectors. For discretionary stocks, same‑store sales and consumer sentiment are important. These numbers show how much people are willing to spend.

For staples stocks, pricing power and cash flow matter more. These companies need to show they can maintain steady demand and protect their margins.

ETFs make it easy to track each sector. Many investors use them to balance growth and stability.

Portfolio Strategy: When to Favor Each Sector

Your goals and risk tolerance should guide your choices. If you want growth and can handle swings, discretionary stocks may fit your plan. If you want stability and steady income, staples may be better.

Many investors hold both sectors. This creates balance. When one sector struggles, the other may hold steady.

Some investors rotate between sectors based on the economic outlook. This strategy can work well when done with care.

Real‑World Examples

During strong economic years, travel and luxury brands often see big gains. People book more trips and buy more high‑end items. This boosts discretionary stocks.

During recessions, companies like Walmart and Procter & Gamble stay strong. People still buy groceries and household goods. This helps staples stocks hold their value.

Common Misconceptions

Some people think staples are always safe. While they are more stable, they can still face challenges. Rising costs or supply issues can hurt profits.

Others believe discretionary stocks are only for aggressive investors. In reality, many large discretionary companies are well‑run and profitable.

Another myth is that both sectors move together. They often move in opposite directions based on the economy.

Conclusion

Consumer discretionary and consumer staples play different roles in the market. Discretionary stocks offer growth during strong economic periods. Staples provide stability when times are tough. Understanding these differences can help you build a balanced and resilient portfolio.

Recommended Reading on Consumer Discretionary Investing

Continue building your expertise with these related analyses and sector guides. Each resource expands on key themes discussed in this article and supports a deeper understanding of consumer discretionary dynamics.

Understanding the difference between consumer discretionary and consumer staples can help investors make better choices. These two sectors react to the economy in very different ways. Knowing how they behave can guide you toward a stronger and more balanced portfolio.

Consumer spending drives both sectors, but the reasons people buy these products are not the same. Some items are essential. Others are optional. This simple idea shapes how each sector performs in good times and bad.

What Are Consumer Discretionary Stocks?

Consumer discretionary stocks include companies that sell non‑essential goods and services. These are items people want but do not need for daily life. When the economy is strong, people spend more on these products. When times are tough, spending slows down.

This sector includes many well‑known industries. Clothing, luxury goods, travel, entertainment, and cars all fall under this category. These companies often see big swings in revenue because their sales depend on consumer confidence.

Discretionary companies also tend to focus on growth. They invest heavily in marketing, new products, and expansion. This can lead to higher returns during strong economic periods.

What Are Consumer Staples Stocks?

Consumer staples include companies that sell essential goods. These are products people buy no matter what the economy is doing. Food, drinks, household items, and personal care products all fall into this group.

Because demand stays steady, these companies tend to have predictable revenue. They also hold up well during recessions. This makes them popular with conservative investors.

Staples companies often pay steady dividends. Their cash flow is strong, and their products are always in demand. This gives them a defensive role in many portfolios.

Examples of Consumer Discretionary Industries vs Consumer Staple Industries

Consumer Sector Comparison

Core Differences Between the Two Sectors

The biggest difference between these sectors is how they react to the economy. Discretionary stocks rise when people feel confident. Staples stay steady even when confidence drops.

Discretionary companies face more risk. Their earnings can swing from year to year. Staples companies face less risk because their products are always needed.

Consumer behavior also plays a major role. Discretionary purchases are emotional or lifestyle‑driven. Staples purchases are based on need. This leads to different pricing power and different profit patterns.

Inflation affects each sector in unique ways. Staples companies often pass higher costs to customers. Discretionary companies may struggle because shoppers cut back on optional items.

Dividend trends also differ. Staples companies usually pay higher dividends. Discretionary companies reinvest more money into growth.

Key Differences at a Glance

Performance in Different Market Conditions

During bull markets, discretionary stocks often shine. People spend more on travel, entertainment, and luxury goods. This boosts earnings and stock prices.

During bear markets, staples tend to outperform. People still buy food, soap, and cleaning supplies. These companies stay steady even when the market drops.

Inflation can help staples companies because they can raise prices. Discretionary companies may struggle because shoppers cut back.

In recessions, discretionary spending falls fast. Staples become a safe haven for investors who want stability.

How to Analyze Each Sector

Investors use different metrics to evaluate these sectors. For discretionary stocks, same‑store sales and consumer sentiment are important. These numbers show how much people are willing to spend.

For staples stocks, pricing power and cash flow matter more. These companies need to show they can maintain steady demand and protect their margins.

ETFs make it easy to track each sector. Many investors use them to balance growth and stability.

Portfolio Strategy: When to Favor Each Sector

Your goals and risk tolerance should guide your choices. If you want growth and can handle swings, discretionary stocks may fit your plan. If you want stability and steady income, staples may be better.

Many investors hold both sectors. This creates balance. When one sector struggles, the other may hold steady.

Some investors rotate between sectors based on the economic outlook. This strategy can work well when done with care.

Real‑World Examples

During strong economic years, travel and luxury brands often see big gains. People book more trips and buy more high‑end items. This boosts discretionary stocks.

During recessions, companies like Walmart and Procter & Gamble stay strong. People still buy groceries and household goods. This helps staples stocks hold their value.

Common Misconceptions

Some people think staples are always safe. While they are more stable, they can still face challenges. Rising costs or supply issues can hurt profits.

Others believe discretionary stocks are only for aggressive investors. In reality, many large discretionary companies are well‑run and profitable.

Another myth is that both sectors move together. They often move in opposite directions based on the economy.

Conclusion

Consumer discretionary and consumer staples play different roles in the market. Discretionary stocks offer growth during strong economic periods. Staples provide stability when times are tough. Understanding these differences can help you build a balanced and resilient portfolio.

Recommended Reading on Consumer Discretionary Investing

Continue building your expertise with these related analyses and sector guides. Each resource expands on key themes discussed in this article and supports a deeper understanding of consumer discretionary dynamics.

The Top Consumer Discretionary Stocks

A dynamic list of leading companies within the sector, highlighting notable performers and long‑term growth drivers. A majority of top investors on StockBossUp rated each company on this list a buy.

What Are Consumer Discretionary Stocks?

An introduction to the sector’s core characteristics and market role.

How Consumer Discretionary Stocks Perform in Different Market Cycles

A review of how economic conditions influence sector performance.

Consumer Discretionary vs Consumer Staples: Key Differences

A comparison of spending patterns, risk profiles, and investment considerations.

How to Analyze Consumer Discretionary Companies

A structured approach to evaluating business models and financial strength.

The Role of Consumer Sentiment in Discretionary Stock Performance

Insight into how consumer confidence and behavioral trends shape demand.

How Interest Rates Impact Consumer Discretionary Stocks

An examination of rate sensitivity and macroeconomic pressures.

Are Consumer Discretionary Stocks Good for Long Term Investors?

A long term perspective on growth potential and sector volatility.

How to Build a Portfolio of Consumer Discretionary Stocks

Practical guidance for constructing and managing sector exposure.

Best ETFs for Consumer Discretionary Exposure

A review of leading ETFs offering diversified access to the sector.

How to Classify a Stock as Consumer Discretionary

A clear explanation of classification standards and sector placement.