Consumer sentiment plays a major role in how people spend money. This is especially true for consumer discretionary companies. These are brands that sell non‑essential goods like clothing, travel, entertainment, and luxury items. When people feel confident, they spend more. When they feel unsure, they pull back. This simple shift can move entire stock categories.

This article explains how consumer sentiment shapes demand, revenue, and stock performance in the discretionary sector. It also shows how investors can use sentiment data to make better decisions.

Understanding Consumer Sentiment

Consumer sentiment measures how people feel about their finances and the economy. Surveys like the Consumer Confidence Index and the Michigan Sentiment Index track this mood. They ask people how they feel about jobs, income, and future expectations.

These surveys matter because they reveal how willing people are to spend. When confidence rises, people buy more non‑essential items. When confidence falls, they delay or cancel purchases.

Discretionary spending depends heavily on emotion. People buy new shoes, book vacations, or upgrade electronics when they feel secure. They avoid these purchases when they worry about bills or job stability.

How Sentiment Impacts Discretionary Stocks

Consumer sentiment affects discretionary stocks through a simple chain. When people feel good, they spend more. That spending boosts company revenue. Higher revenue often leads to stronger stock performance. When sentiment drops, the chain reverses.

Investors also react to monthly sentiment reports. A strong report can lift retail, travel, and entertainment stocks. A weak report can push them down. These moves can happen even before earnings come out.

Social media adds another layer. Online reviews and viral trends can shift sentiment fast. A positive trend can lift a brand. A negative trend can hurt it. This can move stock prices long before traditional data updates.

How Sentiment Affects Key Discretionary Categories

| Category |

Impact When Sentiment Rises |

Impact When Sentiment Falls |

| Apparel |

More frequent purchases |

Delayed or reduced buying |

| Travel |

Higher bookings |

Cancellations and slowdowns |

| Restaurants |

More dining out |

Shift to cheaper options |

| Luxury Goods |

Strong demand |

Sharp pullbacks |

ESG, Brand Reputation, and Social Sentiment

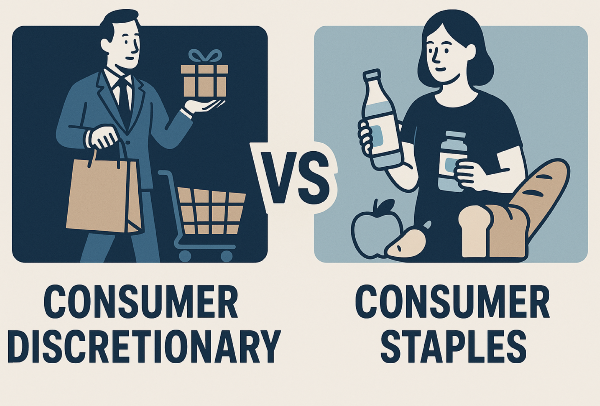

Reputation matters more in discretionary sectors than in staples. People can switch brands easily. A scandal or negative trend can push customers away fast. This can hurt revenue and stock performance.

ESG also plays a growing role. Younger consumers reward brands that focus on sustainability and ethics. Companies that fail in these areas can lose trust. That loss shows up in sales and stock prices.

Analysts now track social sentiment to understand brand momentum. Tools scan reviews, posts, and comments. This helps investors see early signs of rising or falling demand.

Economic Cycles and Consumer Sentiment

Consumer sentiment changes with the economic cycle. During expansions, people feel secure. They spend more on travel, entertainment, and upgrades. Discretionary stocks often rise early in these periods.

During recessions, sentiment drops. People cut back on non‑essential spending. Discretionary stocks usually fall faster than staples.

Inflation also affects sentiment. When prices rise, people feel pressure. They reduce discretionary purchases. Interest rate hikes have a similar effect. Higher borrowing costs make people cautious.

Employment trends matter too. When jobs are strong, people feel safe spending. When layoffs rise, they hold back. Wealth also plays a role. Rising home values or stock gains boost confidence.

Economic Factors That Influence Sentiment

| Factor |

Effect on Sentiment |

Impact on Discretionary Stocks |

| Job Growth |

Boosts confidence |

Higher spending |

| Inflation |

Reduces confidence |

Lower spending |

| Interest Rates |

Slows borrowing |

Weakens demand |

| Wealth Levels |

Increases optimism |

Stronger performance |

Company-Level Drivers of Sentiment

Brand strength helps companies weather sentiment swings. Strong brands keep customers even when confidence dips. Product innovation also helps. New releases can spark demand even in slow periods.

Pricing power matters too. Premium brands may hold demand when sentiment is high. Value brands may gain share when sentiment drops.

Customer experience shapes long‑term sentiment. Good reviews build trust. Bad reviews spread fast and can hurt sales.

Tools for Tracking Consumer Sentiment

Investors can track sentiment using several indicators. The Consumer Confidence Index and Michigan Sentiment Index are the most common. Retail sales and personal consumption data also help.

Alternative data sources offer real‑time insight. Social media sentiment, Google Trends, and credit card spending show how people behave day‑to‑day. Foot traffic data reveals how often people visit stores.

Analysts use these tools to forecast revenue. They adjust models based on sentiment risk. This helps them spot turning points before earnings reports.

Case Studies: Sentiment in Action

A strong example is Nike (NKE). When consumer confidence rises, demand for athletic wear increases. This often boosts Nike’s revenue and stock performance.

On the other hand, Peloton (PTON) saw sentiment shift after safety concerns and product recalls. Negative sentiment reduced demand and hurt the stock.

These cases show how fast sentiment can move discretionary stocks. They also show why investors must watch both economic and social signals.

Sentiment-Driven Stock Examples**

| Company |

Ticker |

Sentiment Shift |

Result |

| Nike |

NKE |

Rising confidence |

Higher demand |

| Peloton |

PTON |

Negative news |

Lower demand |

| Starbucks |

SBUX |

Social trends |

Sales swings |

Strategies for Investors

Investors can use sentiment indicators to guide stock selection. Rising sentiment often supports travel, apparel, and luxury stocks. Falling sentiment may favor value brands.

Sentiment should not replace fundamentals. Investors should still study margins, inventory turnover, and same‑store sales. Sentiment works best as a signal, not a full strategy.

Risk management is key. Discretionary stocks can be volatile. Diversifying across sub‑sectors helps reduce risk. Tracking real‑time sentiment helps investors react early.

Conclusion

Consumer sentiment plays a major role in discretionary stock performance. It shapes spending, revenue, and investor expectations. It also moves faster today because of social media and online reviews.

Investors who track sentiment can spot trends early. They can also avoid companies facing negative momentum. As the economy changes, sentiment will remain a powerful force in this sector.

Recommended Reading on Consumer Discretionary Investing

Continue building your expertise with these related analyses and sector guides. Each resource expands on key themes discussed in this article and supports a deeper understanding of consumer discretionary dynamics.

Consumer sentiment plays a major role in how people spend money. This is especially true for consumer discretionary companies. These are brands that sell non‑essential goods like clothing, travel, entertainment, and luxury items. When people feel confident, they spend more. When they feel unsure, they pull back. This simple shift can move entire stock categories.

This article explains how consumer sentiment shapes demand, revenue, and stock performance in the discretionary sector. It also shows how investors can use sentiment data to make better decisions.

Understanding Consumer Sentiment

Consumer sentiment measures how people feel about their finances and the economy. Surveys like the Consumer Confidence Index and the Michigan Sentiment Index track this mood. They ask people how they feel about jobs, income, and future expectations.

These surveys matter because they reveal how willing people are to spend. When confidence rises, people buy more non‑essential items. When confidence falls, they delay or cancel purchases.

Discretionary spending depends heavily on emotion. People buy new shoes, book vacations, or upgrade electronics when they feel secure. They avoid these purchases when they worry about bills or job stability.

How Sentiment Impacts Discretionary Stocks

Consumer sentiment affects discretionary stocks through a simple chain. When people feel good, they spend more. That spending boosts company revenue. Higher revenue often leads to stronger stock performance. When sentiment drops, the chain reverses.

Investors also react to monthly sentiment reports. A strong report can lift retail, travel, and entertainment stocks. A weak report can push them down. These moves can happen even before earnings come out.

Social media adds another layer. Online reviews and viral trends can shift sentiment fast. A positive trend can lift a brand. A negative trend can hurt it. This can move stock prices long before traditional data updates.

How Sentiment Affects Key Discretionary Categories

ESG, Brand Reputation, and Social Sentiment

Reputation matters more in discretionary sectors than in staples. People can switch brands easily. A scandal or negative trend can push customers away fast. This can hurt revenue and stock performance.

ESG also plays a growing role. Younger consumers reward brands that focus on sustainability and ethics. Companies that fail in these areas can lose trust. That loss shows up in sales and stock prices.

Analysts now track social sentiment to understand brand momentum. Tools scan reviews, posts, and comments. This helps investors see early signs of rising or falling demand.

Economic Cycles and Consumer Sentiment

Consumer sentiment changes with the economic cycle. During expansions, people feel secure. They spend more on travel, entertainment, and upgrades. Discretionary stocks often rise early in these periods.

During recessions, sentiment drops. People cut back on non‑essential spending. Discretionary stocks usually fall faster than staples.

Inflation also affects sentiment. When prices rise, people feel pressure. They reduce discretionary purchases. Interest rate hikes have a similar effect. Higher borrowing costs make people cautious.

Employment trends matter too. When jobs are strong, people feel safe spending. When layoffs rise, they hold back. Wealth also plays a role. Rising home values or stock gains boost confidence.

Economic Factors That Influence Sentiment

Company-Level Drivers of Sentiment

Brand strength helps companies weather sentiment swings. Strong brands keep customers even when confidence dips. Product innovation also helps. New releases can spark demand even in slow periods.

Pricing power matters too. Premium brands may hold demand when sentiment is high. Value brands may gain share when sentiment drops.

Customer experience shapes long‑term sentiment. Good reviews build trust. Bad reviews spread fast and can hurt sales.

Tools for Tracking Consumer Sentiment

Investors can track sentiment using several indicators. The Consumer Confidence Index and Michigan Sentiment Index are the most common. Retail sales and personal consumption data also help.

Alternative data sources offer real‑time insight. Social media sentiment, Google Trends, and credit card spending show how people behave day‑to‑day. Foot traffic data reveals how often people visit stores.

Analysts use these tools to forecast revenue. They adjust models based on sentiment risk. This helps them spot turning points before earnings reports.

Case Studies: Sentiment in Action

A strong example is Nike (NKE). When consumer confidence rises, demand for athletic wear increases. This often boosts Nike’s revenue and stock performance.

On the other hand, Peloton (PTON) saw sentiment shift after safety concerns and product recalls. Negative sentiment reduced demand and hurt the stock.

These cases show how fast sentiment can move discretionary stocks. They also show why investors must watch both economic and social signals.

Sentiment-Driven Stock Examples**

Strategies for Investors

Investors can use sentiment indicators to guide stock selection. Rising sentiment often supports travel, apparel, and luxury stocks. Falling sentiment may favor value brands.

Sentiment should not replace fundamentals. Investors should still study margins, inventory turnover, and same‑store sales. Sentiment works best as a signal, not a full strategy.

Risk management is key. Discretionary stocks can be volatile. Diversifying across sub‑sectors helps reduce risk. Tracking real‑time sentiment helps investors react early.

Conclusion

Consumer sentiment plays a major role in discretionary stock performance. It shapes spending, revenue, and investor expectations. It also moves faster today because of social media and online reviews.

Investors who track sentiment can spot trends early. They can also avoid companies facing negative momentum. As the economy changes, sentiment will remain a powerful force in this sector.

Recommended Reading on Consumer Discretionary Investing

Continue building your expertise with these related analyses and sector guides. Each resource expands on key themes discussed in this article and supports a deeper understanding of consumer discretionary dynamics.

The Top Consumer Discretionary Stocks

A dynamic list of leading companies within the sector, highlighting notable performers and long‑term growth drivers. A majority of top investors on StockBossUp rated each company on this list a buy.

What Are Consumer Discretionary Stocks?

An introduction to the sector’s core characteristics and market role.

How Consumer Discretionary Stocks Perform in Different Market Cycles

A review of how economic conditions influence sector performance.

Consumer Discretionary vs Consumer Staples: Key Differences

A comparison of spending patterns, risk profiles, and investment considerations.

How to Analyze Consumer Discretionary Companies

A structured approach to evaluating business models and financial strength.

The Role of Consumer Sentiment in Discretionary Stock Performance

Insight into how consumer confidence and behavioral trends shape demand.

How Interest Rates Impact Consumer Discretionary Stocks

An examination of rate sensitivity and macroeconomic pressures.

Are Consumer Discretionary Stocks Good for Long Term Investors?

A long term perspective on growth potential and sector volatility.

How to Build a Portfolio of Consumer Discretionary Stocks

Practical guidance for constructing and managing sector exposure.

Best ETFs for Consumer Discretionary Exposure

A review of leading ETFs offering diversified access to the sector.

How to Classify a Stock as Consumer Discretionary

A clear explanation of classification standards and sector placement.