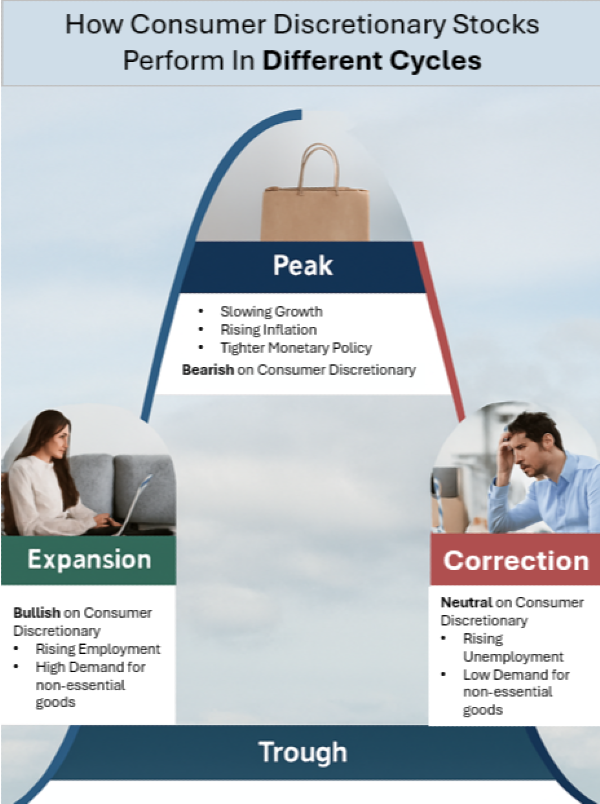

Consumer discretionary stocks rise and fall with the economy. These companies sell goods and services that people buy when they feel confident. Examples include clothing, travel, cars, and entertainment. When times are good, people spend more. When times are tough, they cut back.

Understanding how these stocks behave in each market cycle helps investors make better choices. It also helps you avoid buying at the wrong time or selling too early.

Market cycles move through four main phases: expansion, peak, contraction, and recovery. Each phase affects consumer spending in different ways. This article explains how these stocks react and what investors should watch.

What Are Market Cycles?

A market cycle is the rise and fall of economic activity over time. These cycles repeat, but the length and speed can change. They are shaped by interest rates, inflation, jobs, and consumer confidence.

During an expansion, the economy grows. At a peak, growth slows. In a contraction, spending drops. At the bottom, conditions stabilize and prepare for recovery.

Consumer discretionary stocks are sensitive because they depend on extra income. When people feel secure, they spend more on non‑essential items. When they worry, they save instead.

Key Economic Indicators

Several indicators help investors track where the economy is heading:

| Economic Indicator |

Impact on Consumer Discretionary Stocks |

| GDP Growth |

Higher GDP signals a growing economy, boosting consumer spending and demand for non-essential goods. |

| Interest Rates |

Rising rates make borrowing more expensive, reducing big-ticket purchases like cars and travel. |

| Inflation |

High inflation raises costs and squeezes margins, especially for retailers with limited pricing power. |

| Retail Sales |

Strong retail sales reflect healthy consumer demand, often leading to better earnings for discretionary firms. |

| Consumer Confidence |

When confidence is high, people are more willing to spend on luxury, entertainment, and travel. |

| Unemployment Levels |

High unemployment lowers disposable income, hurting demand for discretionary products and services. |

Expansion: When Consumer Discretionary Stocks Shine

When the economy is growing, people feel more confident about their money. Jobs are easier to find, wages go up, and families have more to spend. This leads to higher demand for things like travel, clothes, electronics, and entertainment. These are all part of the consumer discretionary sector—products people buy when they have extra income.

During these strong periods, companies in this sector often report better sales and bigger profits. Investors also become more willing to take risks, which helps push stock prices higher. Sub-industries that usually do well include e-commerce, travel and leisure, automotive, luxury goods, and home improvement. A good example is the long bull market after 2009, when many consumer discretionary stocks grew steadily for years.

Sub‑industries that tend to perform well include:

- E‑commerce

- Travel and leisure

- Automotive

- Luxury goods

- Home improvement

Market Peaks: Slowing Growth and Rising Caution

A market peak happens when growth slows. Inflation may rise, and interest rates often increase. Consumers start to feel pressure. They may still spend, but not as freely.

Investors also become cautious. They may shift money into safer sectors. High‑valuation discretionary stocks can fall first because they depend on strong growth.

Industries most at risk at peaks include luxury goods and high‑growth retail brands. These companies often trade at high prices, so even small changes in demand can hurt their stock value.

Even at market peaks—when growth slows and investors grow cautious—some consumer discretionary sub‑industries can still hold up better than others. These areas tend to benefit from steady demand, strong brand loyalty, or pricing power that helps them weather late‑cycle pressure.

Sub‑industries that may still perform well at market peaks

1. Luxury Goods

High‑income consumers are less sensitive to economic slowdowns. Premium brands often maintain strong sales even when the broader market cools.

2. Home Improvement Retail

Homeowners continue spending on repairs and upgrades, especially when housing prices remain high. This supports companies in home improvement and home décor.

3. Select E‑Commerce Segments

Online retailers with strong logistics, loyal customers, or essential‑leaning product mixes can stay resilient as consumers shift toward convenience.

4. Affordable Entertainment

Streaming services, gaming, and low‑cost entertainment options may hold up because people trade down from expensive activities.

5. Discount and Off‑Price Retail

As consumers become more price‑conscious, off‑price retailers can see increased traffic even before a downturn fully hits.

Signs of a Market Peak

| Signal |

What It Means |

| Slowing retail sales |

Consumers are pulling back |

| Rising interest rates |

Borrowing becomes harder |

| High inflation |

Costs rise for companies |

| Flat or falling confidence |

People worry about the future |

Contraction: When Discretionary Stocks Struggle

A contraction or recession brings falling demand. People lose jobs or fear losing them. They cut back on travel, dining out, and big purchases. This hurts companies in the discretionary sector.

Industries hit the hardest include:

- Travel and leisure

- Automotive

- Apparel

- Luxury goods

Some areas show resilience. Discount retailers and value‑focused e‑commerce platforms may hold steady. People still shop, but they look for deals.

Examples of major downturns include the 2008 financial crisis and the early 2020 pandemic shock. Both caused sharp drops in discretionary spending.

Even during a market contraction, a few types of consumer discretionary stocks can hold up better than the rest. These companies benefit from value‑seeking behavior, strong brand loyalty, or business models that stay relevant even when people cut back on spending. Here are the areas that tend to show relative strength when the economy slows.

1. Discount and Off‑Price Retailers

These stores often see more traffic during downturns because shoppers look for deals. Companies with strong supply chains and steady inventory flow can outperform as consumers trade down from premium brands.

2. Affordable E‑Commerce Platforms

Online retailers that focus on low‑cost essentials, fast delivery, or budget‑friendly goods may stay resilient. Convenience remains important even when spending drops.

4. Auto Parts and Repair Chains

During recessions, people delay buying new cars and instead repair the ones they have. This shift supports companies in the auto‑parts and service space.

5. Value‑Oriented Entertainment

Low‑cost entertainment options—such as gaming, streaming, or budget‑friendly hobbies—can hold up as people stay home more.

6. Strong Global Luxury Brands

Some luxury brands with wealthy customer bases remain stable because high‑income consumers are less affected by recessions. This is not universal, but the strongest brands often show surprising resilience.

Market Bottoms: The Start of a Rebound

A market bottom is the lowest point in the cycle. It often comes with fear and uncertainty. But it also creates opportunity. Many discretionary stocks become oversold.

Investors who expect a recovery start buying again. These stocks often lead the rebound because they are tied to future spending. When confidence returns, demand rises quickly.

Industries that rebound fast include:

| Industry |

Why It Rebounds Fast |

| Travel |

Pent‑up demand |

| E‑commerce |

Convenience and habit |

| Home Improvement |

Renewed consumer confidence |

| Automotive |

Better credit conditions |

Recovery Leaders After Market Bottoms

The recovery after 2020 showed how fast discretionary stocks can bounce back once conditions improve.

Strategies for Investing Across Market Cycles

Investors can use different strategies to handle changing market cycles. Some people prefer a long‑term buy‑and‑hold approach, focusing on strong brands that can grow over time. Others use sector rotation, shifting their money into industries that fit the current stage of the market. Many investors also use dollar‑cost averaging to reduce timing risk, or choose ETFs to get broad exposure without picking individual stocks.

No matter the strategy, risk management plays a major role. Spreading investments across different industries helps protect a portfolio when the market slows down. This kind of diversification can reduce losses and make it easier to stay invested through ups and downs.

Case Studies: How Major Companies Behave in Cycles

Amazon often performs well in expansions due to strong online demand. It also holds up better than many retailers during downturns.

Tesla is sensitive to interest rates because cars are big purchases. High borrowing costs can slow sales.

Nike benefits from global brand strength. It tends to recover quickly after downturns.

Home Depot rises when the housing market is strong. It also benefits when people invest in home projects during recoveries.

Conclusion

Consumer discretionary stocks rise and fall with the economy. They perform best during expansions and recoveries. They struggle during peaks and contractions. By watching key indicators and understanding market cycles, investors can position themselves for better results.

A cycle‑aware strategy helps reduce risk and improve long‑term returns.

Recommended Reading on Consumer Discretionary Investing

Continue building your expertise with these related analyses and sector guides. Each resource expands on key themes discussed in this article and supports a deeper understanding of consumer discretionary dynamics.

Consumer discretionary stocks rise and fall with the economy. These companies sell goods and services that people buy when they feel confident. Examples include clothing, travel, cars, and entertainment. When times are good, people spend more. When times are tough, they cut back.

Understanding how these stocks behave in each market cycle helps investors make better choices. It also helps you avoid buying at the wrong time or selling too early.

Market cycles move through four main phases: expansion, peak, contraction, and recovery. Each phase affects consumer spending in different ways. This article explains how these stocks react and what investors should watch.

What Are Market Cycles?

A market cycle is the rise and fall of economic activity over time. These cycles repeat, but the length and speed can change. They are shaped by interest rates, inflation, jobs, and consumer confidence.

During an expansion, the economy grows. At a peak, growth slows. In a contraction, spending drops. At the bottom, conditions stabilize and prepare for recovery.

Consumer discretionary stocks are sensitive because they depend on extra income. When people feel secure, they spend more on non‑essential items. When they worry, they save instead.

Key Economic Indicators

Several indicators help investors track where the economy is heading:

Expansion: When Consumer Discretionary Stocks Shine

When the economy is growing, people feel more confident about their money. Jobs are easier to find, wages go up, and families have more to spend. This leads to higher demand for things like travel, clothes, electronics, and entertainment. These are all part of the consumer discretionary sector—products people buy when they have extra income.

During these strong periods, companies in this sector often report better sales and bigger profits. Investors also become more willing to take risks, which helps push stock prices higher. Sub-industries that usually do well include e-commerce, travel and leisure, automotive, luxury goods, and home improvement. A good example is the long bull market after 2009, when many consumer discretionary stocks grew steadily for years.

Sub‑industries that tend to perform well include:

Market Peaks: Slowing Growth and Rising Caution

A market peak happens when growth slows. Inflation may rise, and interest rates often increase. Consumers start to feel pressure. They may still spend, but not as freely.

Investors also become cautious. They may shift money into safer sectors. High‑valuation discretionary stocks can fall first because they depend on strong growth.

Industries most at risk at peaks include luxury goods and high‑growth retail brands. These companies often trade at high prices, so even small changes in demand can hurt their stock value.

Even at market peaks—when growth slows and investors grow cautious—some consumer discretionary sub‑industries can still hold up better than others. These areas tend to benefit from steady demand, strong brand loyalty, or pricing power that helps them weather late‑cycle pressure.

Sub‑industries that may still perform well at market peaks

1. Luxury Goods

High‑income consumers are less sensitive to economic slowdowns. Premium brands often maintain strong sales even when the broader market cools.

2. Home Improvement Retail

Homeowners continue spending on repairs and upgrades, especially when housing prices remain high. This supports companies in home improvement and home décor.

3. Select E‑Commerce Segments

Online retailers with strong logistics, loyal customers, or essential‑leaning product mixes can stay resilient as consumers shift toward convenience.

4. Affordable Entertainment

Streaming services, gaming, and low‑cost entertainment options may hold up because people trade down from expensive activities.

5. Discount and Off‑Price Retail

As consumers become more price‑conscious, off‑price retailers can see increased traffic even before a downturn fully hits.

Signs of a Market Peak

Contraction: When Discretionary Stocks Struggle

A contraction or recession brings falling demand. People lose jobs or fear losing them. They cut back on travel, dining out, and big purchases. This hurts companies in the discretionary sector.

Industries hit the hardest include:

Some areas show resilience. Discount retailers and value‑focused e‑commerce platforms may hold steady. People still shop, but they look for deals.

Examples of major downturns include the 2008 financial crisis and the early 2020 pandemic shock. Both caused sharp drops in discretionary spending.

Even during a market contraction, a few types of consumer discretionary stocks can hold up better than the rest. These companies benefit from value‑seeking behavior, strong brand loyalty, or business models that stay relevant even when people cut back on spending. Here are the areas that tend to show relative strength when the economy slows.

1. Discount and Off‑Price Retailers

These stores often see more traffic during downturns because shoppers look for deals. Companies with strong supply chains and steady inventory flow can outperform as consumers trade down from premium brands.

2. Affordable E‑Commerce Platforms

Online retailers that focus on low‑cost essentials, fast delivery, or budget‑friendly goods may stay resilient. Convenience remains important even when spending drops.

4. Auto Parts and Repair Chains

During recessions, people delay buying new cars and instead repair the ones they have. This shift supports companies in the auto‑parts and service space.

5. Value‑Oriented Entertainment

Low‑cost entertainment options—such as gaming, streaming, or budget‑friendly hobbies—can hold up as people stay home more.

6. Strong Global Luxury Brands

Some luxury brands with wealthy customer bases remain stable because high‑income consumers are less affected by recessions. This is not universal, but the strongest brands often show surprising resilience.

Market Bottoms: The Start of a Rebound

A market bottom is the lowest point in the cycle. It often comes with fear and uncertainty. But it also creates opportunity. Many discretionary stocks become oversold.

Investors who expect a recovery start buying again. These stocks often lead the rebound because they are tied to future spending. When confidence returns, demand rises quickly.

Industries that rebound fast include:

Recovery Leaders After Market Bottoms

The recovery after 2020 showed how fast discretionary stocks can bounce back once conditions improve.

Strategies for Investing Across Market Cycles

Investors can use different strategies to handle changing market cycles. Some people prefer a long‑term buy‑and‑hold approach, focusing on strong brands that can grow over time. Others use sector rotation, shifting their money into industries that fit the current stage of the market. Many investors also use dollar‑cost averaging to reduce timing risk, or choose ETFs to get broad exposure without picking individual stocks.

No matter the strategy, risk management plays a major role. Spreading investments across different industries helps protect a portfolio when the market slows down. This kind of diversification can reduce losses and make it easier to stay invested through ups and downs.

Case Studies: How Major Companies Behave in Cycles

Amazon often performs well in expansions due to strong online demand. It also holds up better than many retailers during downturns.

Tesla is sensitive to interest rates because cars are big purchases. High borrowing costs can slow sales.

Nike benefits from global brand strength. It tends to recover quickly after downturns.

Home Depot rises when the housing market is strong. It also benefits when people invest in home projects during recoveries.

Conclusion

Consumer discretionary stocks rise and fall with the economy. They perform best during expansions and recoveries. They struggle during peaks and contractions. By watching key indicators and understanding market cycles, investors can position themselves for better results.

A cycle‑aware strategy helps reduce risk and improve long‑term returns.

Recommended Reading on Consumer Discretionary Investing

Continue building your expertise with these related analyses and sector guides. Each resource expands on key themes discussed in this article and supports a deeper understanding of consumer discretionary dynamics.

The Top Consumer Discretionary Stocks

A dynamic list of leading companies within the sector, highlighting notable performers and long‑term growth drivers. A majority of top investors on StockBossUp rated each company on this list a buy.

What Are Consumer Discretionary Stocks?

An introduction to the sector’s core characteristics and market role.

How Consumer Discretionary Stocks Perform in Different Market Cycles

A review of how economic conditions influence sector performance.

Consumer Discretionary vs Consumer Staples: Key Differences

A comparison of spending patterns, risk profiles, and investment considerations.

How to Analyze Consumer Discretionary Companies

A structured approach to evaluating business models and financial strength.

The Role of Consumer Sentiment in Discretionary Stock Performance

Insight into how consumer confidence and behavioral trends shape demand.

How Interest Rates Impact Consumer Discretionary Stocks

An examination of rate sensitivity and macroeconomic pressures.

Are Consumer Discretionary Stocks Good for Long Term Investors?

A long term perspective on growth potential and sector volatility.

How to Build a Portfolio of Consumer Discretionary Stocks

Practical guidance for constructing and managing sector exposure.

Best ETFs for Consumer Discretionary Exposure

A review of leading ETFs offering diversified access to the sector.

How to Classify a Stock as Consumer Discretionary

A clear explanation of classification standards and sector placement.