Sound investments

don't happen alone

Find your crew, build teams, compete in VS MODE, and identify investment trends in our evergrowing investment ecosystem. You aren't on an island anymore, and our community is here to help you make informed decisions in a complex world.

In December 2024, DeepSeek released its "R1" model which has been known for its enhanced capabilities in mathematics and coding. The model's performance is comparable to OpenAI's offerings but was developed using significantly fewer resources. DeepSeek claims that training the R1 model cost less than $6 million and required only about 2,000 specialized computer chips, specifically Nvidia's H800 series. In contrast, other leading AI companies often utilize supercomputers with over 16,000 chips for similar tasks.

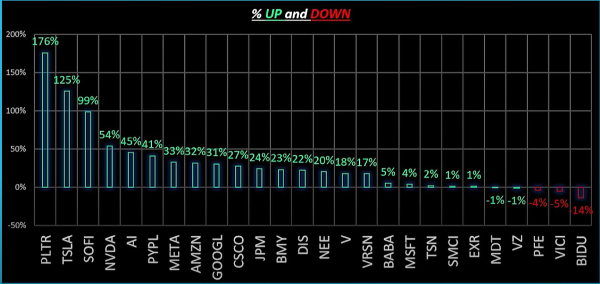

The release of the R1 model current has a significant impact on the tech industry. On January 27, 2025, major U.S. tech stocks, including Nvidia, Microsoft, and Tesla, experienced a combined loss of over $1 trillion in market value. Nvidia's stock alone plunged by up to 18%, marking the largest single-day loss for any public company. To put this in perspective, Nvidia almost lost $500 billion in market value. This market reaction underscores the disruptive potential of DeepSeek's advancements in the AI sector.

Not only that, DeepSeek's success has further highlighted the limitations of U.S. sanctions aimed at restricting China's access to advanced AI technologies. Despite these sanctions, DeepSeek has managed to develop competitive AI models at a fraction of the cost compared to its European and American competitors. Hence, creating discussions about the effectiveness of these export restrictions and the evolving dynamics of global AI competition.