Steel Industry Overview

The steel industry is a significant contributor to the global economy with its extensive applications in construction, transportation, and consumer goods. Steel stocks represent an attractive investment opportunity for those aiming to diversify their portfolios and capitalize on the sector's growth.

Major players like ArcelorMittal, Nippon Steel, and POSCO dominate this highly competitive industry. The American steel industry, in particular, boasts a storied history, rising to prominence after the Civil War and facing a decline in the 20th century. Today, it is rejuvenated with roughly 100 supply and production facilities, employing nearly 400,000 workers, and supporting millions of Americans.

Today, the U.S. steel industry demonstrates its resilience and significance. Comprising numerous production and supply facilities, it not only sustains the economy but also provides livelihoods for a vast workforce. The industry's rich past and contemporary relevance make it a focal point of study for economists and investors alike.

Why are Steel Stocks Falling?

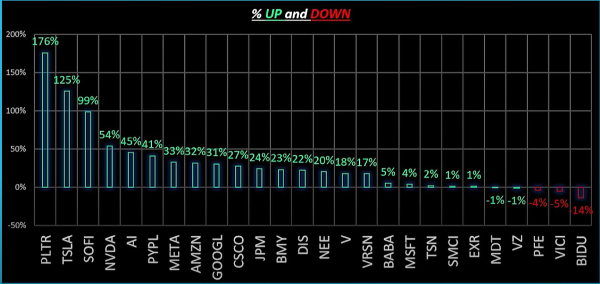

Steel stocks in the U.S. have been falling due to a combination of factors. One major reason is the decline in steel prices, which have dropped significantly since the start of the year. This price drop is largely due to slowing demand in key industries like construction and manufacturing. Additionally, high interest rates have made it more expensive for industries that rely on steel to borrow money, further reducing demand.

Another factor is increased competition, both domestically and internationally. New steel mills coming online in the U.S. have added to the supply, while countries like China, despite their own economic challenges, continue to export steel, putting downward pressure on prices. Moreover, uncertainty surrounding trade policies and potential mergers, such as the blocked acquisition of U.S. Steel by Nippon Steel, have also contributed to the decline in stock prices Shares Are Falling.

Market Outlook of the Steel Industry

The market outlook for the steel industry presents a mixed picture. In the short term, global steel demand is expected to decline by 0.9% in 2024, primarily due to economic headwinds such as declining household purchasing power, tight monetary policies, and geopolitical tensions. However, a modest recovery is anticipated in 2025, with demand projected to increase by 1.2%.

In the United States, the steel market is expected to grow at a compound annual growth rate (CAGR) of 2.2% from 2024 to 2030. The construction and heavy industry segments are likely to drive this growth. Additionally, sustainability initiatives and technological advancements, such as automation and digitalization, are expected to play a significant role in shaping the industry's future.

Challenges Facing Steel Stocks

The steel industry is facing significant challenges, with a steeper-than-expected downward trend that has weakened the recovery forecasted for 2024 and 2025. This downturn is largely driven by poor demand conditions exacerbated by high energy prices, persistent inflation, economic uncertainty, and geopolitical tensions. As a result, apparent steel consumption is deteriorating further, with projections for 2024 and 2025 revised downward. These factors are creating a challenging environment for steel stocks, as investors remain wary of the sector's potential for growth amidst these headwinds.

Adding to these challenges, steel imports continue to show historically high shares, currently at 27%, contributing to an oversupply in the market. The European steel market is also experiencing similar difficulties, with a steeper-than-expected downward trend weakening recovery in the coming years. This global outlook highlights the critical obstacles steel producers and investors face, as they navigate a complex landscape marked by economic and geopolitical uncertainties. As the industry grapples with these issues, strategic planning and adaptive measures will be essential for sustaining operations and maintaining market positions.

Opportunities and Growth Prospects in the U.S. Steel Industry

Read More: The Top Steel Stocks on the NYSE

The U.S. steel industry is poised for growth, driven by increasing demand from key sectors like construction, automotive, and renewable energy. As infrastructure projects ramp up across the country, the need for high-quality steel products is expected to soar. This growth is further bolstered by government initiatives aimed at modernizing infrastructure, which includes bridges, highways, and public transportation systems. Additionally, the push for clean energy solutions is creating new opportunities, with steel playing a vital role in the production of wind turbines, solar panels, and electric vehicles.

Technological advancements are another driving force behind the growth prospects of the U.S. steel industry. Innovations in manufacturing processes, such as automation and digitalization, are enhancing efficiency and reducing costs. Advanced high-strength steels (AHSS) are gaining traction in the automotive sector, providing manufacturers with materials that offer superior performance and weight reduction. Moreover, the adoption of sustainable practices and the development of eco-friendly steel products are positioning the U.S. steel industry as a leader in the global market, attracting environmentally conscious investors and consumers.

Read More: What are Advanced Material Companies

Investment in research and development is also opening up new avenues for the U.S. steel industry. Companies are exploring cutting-edge technologies like artificial intelligence and machine learning to optimize production and predict market trends. Collaborative efforts between industry players and academic institutions are fostering innovation and driving the development of new steel applications. With a focus on sustainability, efficiency, and technological advancement, the U.S. steel industry is well-positioned to capitalize on emerging opportunities and achieve long-term growth.

Conclusion and Next Steps

The future of steel stocks hinges on navigating both challenges and opportunities. The steel industry remains a cornerstone of the global economy, with extensive applications in various sectors. However, factors such as declining steel prices, high energy costs, and geopolitical uncertainties are exerting downward pressure on steel stocks. Despite these challenges, the market presents growth prospects driven by infrastructure projects, technological advancements, and sustainability initiatives. Investors should stay informed about industry trends and conduct thorough research to make well-informed decisions. Consulting with financial advisors can further help tailor investment strategies to individual circumstances, ensuring a balanced and diversified portfolio. By understanding the dynamics at play, investors can capitalize on the potential of steel stocks while mitigating risks associated with the industry's cyclical nature.

Material Stocks Quick Find List 🚀

Discover more about the material sector with our collection of in depth market exploration and and hot investment topics.

General 🌟

Construction Stocks 🏗️

Lumber Stocks 🌲

International Material Stocks 🌍

Metal Stocks ⚙️

Aluminum Stocks ✨

Steel Stocks 💪

Precious Metal Stocks 💎

Material Stocks with Dividends 🎯

Industrial Gas Stocks 🚀

Rare Earth Stocks 🌐

Advanced Materials 🔬

Steel Industry Overview

The steel industry is a significant contributor to the global economy with its extensive applications in construction, transportation, and consumer goods. Steel stocks represent an attractive investment opportunity for those aiming to diversify their portfolios and capitalize on the sector's growth. Major players like ArcelorMittal, Nippon Steel, and POSCO dominate this highly competitive industry. The American steel industry, in particular, boasts a storied history, rising to prominence after the Civil War and facing a decline in the 20th century. Today, it is rejuvenated with roughly 100 supply and production facilities, employing nearly 400,000 workers, and supporting millions of Americans. Today, the U.S. steel industry demonstrates its resilience and significance. Comprising numerous production and supply facilities, it not only sustains the economy but also provides livelihoods for a vast workforce. The industry's rich past and contemporary relevance make it a focal point of study for economists and investors alike.

Why are Steel Stocks Falling?

Steel stocks in the U.S. have been falling due to a combination of factors. One major reason is the decline in steel prices, which have dropped significantly since the start of the year. This price drop is largely due to slowing demand in key industries like construction and manufacturing. Additionally, high interest rates have made it more expensive for industries that rely on steel to borrow money, further reducing demand.

Another factor is increased competition, both domestically and internationally. New steel mills coming online in the U.S. have added to the supply, while countries like China, despite their own economic challenges, continue to export steel, putting downward pressure on prices. Moreover, uncertainty surrounding trade policies and potential mergers, such as the blocked acquisition of U.S. Steel by Nippon Steel, have also contributed to the decline in stock prices Shares Are Falling.

Market Outlook of the Steel Industry

The market outlook for the steel industry presents a mixed picture. In the short term, global steel demand is expected to decline by 0.9% in 2024, primarily due to economic headwinds such as declining household purchasing power, tight monetary policies, and geopolitical tensions. However, a modest recovery is anticipated in 2025, with demand projected to increase by 1.2%.

In the United States, the steel market is expected to grow at a compound annual growth rate (CAGR) of 2.2% from 2024 to 2030. The construction and heavy industry segments are likely to drive this growth. Additionally, sustainability initiatives and technological advancements, such as automation and digitalization, are expected to play a significant role in shaping the industry's future.

Challenges Facing Steel Stocks

The steel industry is facing significant challenges, with a steeper-than-expected downward trend that has weakened the recovery forecasted for 2024 and 2025. This downturn is largely driven by poor demand conditions exacerbated by high energy prices, persistent inflation, economic uncertainty, and geopolitical tensions. As a result, apparent steel consumption is deteriorating further, with projections for 2024 and 2025 revised downward. These factors are creating a challenging environment for steel stocks, as investors remain wary of the sector's potential for growth amidst these headwinds.

Adding to these challenges, steel imports continue to show historically high shares, currently at 27%, contributing to an oversupply in the market. The European steel market is also experiencing similar difficulties, with a steeper-than-expected downward trend weakening recovery in the coming years. This global outlook highlights the critical obstacles steel producers and investors face, as they navigate a complex landscape marked by economic and geopolitical uncertainties. As the industry grapples with these issues, strategic planning and adaptive measures will be essential for sustaining operations and maintaining market positions.

Opportunities and Growth Prospects in the U.S. Steel Industry

The U.S. steel industry is poised for growth, driven by increasing demand from key sectors like construction, automotive, and renewable energy. As infrastructure projects ramp up across the country, the need for high-quality steel products is expected to soar. This growth is further bolstered by government initiatives aimed at modernizing infrastructure, which includes bridges, highways, and public transportation systems. Additionally, the push for clean energy solutions is creating new opportunities, with steel playing a vital role in the production of wind turbines, solar panels, and electric vehicles.

Technological advancements are another driving force behind the growth prospects of the U.S. steel industry. Innovations in manufacturing processes, such as automation and digitalization, are enhancing efficiency and reducing costs. Advanced high-strength steels (AHSS) are gaining traction in the automotive sector, providing manufacturers with materials that offer superior performance and weight reduction. Moreover, the adoption of sustainable practices and the development of eco-friendly steel products are positioning the U.S. steel industry as a leader in the global market, attracting environmentally conscious investors and consumers.

Investment in research and development is also opening up new avenues for the U.S. steel industry. Companies are exploring cutting-edge technologies like artificial intelligence and machine learning to optimize production and predict market trends. Collaborative efforts between industry players and academic institutions are fostering innovation and driving the development of new steel applications. With a focus on sustainability, efficiency, and technological advancement, the U.S. steel industry is well-positioned to capitalize on emerging opportunities and achieve long-term growth.

Conclusion and Next Steps

The future of steel stocks hinges on navigating both challenges and opportunities. The steel industry remains a cornerstone of the global economy, with extensive applications in various sectors. However, factors such as declining steel prices, high energy costs, and geopolitical uncertainties are exerting downward pressure on steel stocks. Despite these challenges, the market presents growth prospects driven by infrastructure projects, technological advancements, and sustainability initiatives. Investors should stay informed about industry trends and conduct thorough research to make well-informed decisions. Consulting with financial advisors can further help tailor investment strategies to individual circumstances, ensuring a balanced and diversified portfolio. By understanding the dynamics at play, investors can capitalize on the potential of steel stocks while mitigating risks associated with the industry's cyclical nature.

Material Stocks Quick Find List 🚀

Discover more about the material sector with our collection of in depth market exploration and and hot investment topics.

General 🌟

Construction Stocks 🏗️

Lumber Stocks 🌲

International Material Stocks 🌍

Metal Stocks ⚙️

Aluminum Stocks ✨

Steel Stocks 💪

Precious Metal Stocks 💎

Material Stocks with Dividends 🎯

Industrial Gas Stocks 🚀

Rare Earth Stocks 🌐

Advanced Materials 🔬