Eli Lilly and Company's Stock: A Promising Upside for 2025

The next stock that Wall Street analysts believe has significant upside potential is Eli Lilly and Company (LLY). Despite a mixed performance in recent months, long-term growth trends suggest a robust future for this pharmaceutical giant.

Recent Performance

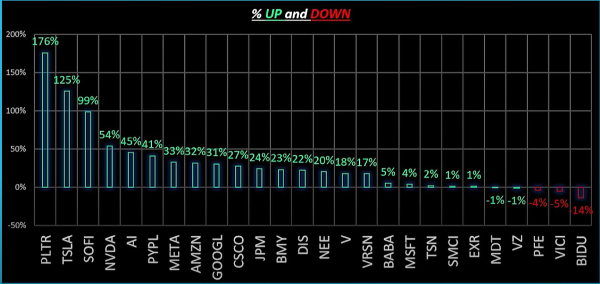

Eli Lilly's stock has seen a 15% increase over the last year. However, it has experienced some volatility, with a decline over the last month and a 20% drop over the past six months. Despite these short-term fluctuations, Eli Lilly has outperformed the S&P 500, with a 96% increase over the longer term. Currently trading towards the lower end of its 52-week range, the stock has been rated a double buy by both Seeking Alpha and Wall Street analysts, despite its relatively low dividend yield of 0.83%.

Earnings and Growth Expectations

Looking ahead, Eli Lilly's earnings projections indicate significant growth. The company anticipates triple-digit growth in the next quarter and in Q3 of 2025. Although they missed their most recent earnings by 29 cents, they have a 75% track record of hitting earnings targets. If they achieve their 2025 earnings per share (EPS) targets, the forward P/E ratio would be around 32, compared to their five-year average of 36.6, suggesting potential undervaluation.

Growth and Profitability

Eli Lilly's growth grade is very promising, with an A+ rating and a year-on-year growth rate of approximately 28%. Forward-looking growth is around 27%, significantly better than the sector's mid to high single-digit figures. The earnings per share are expected to grow by about 40% annually over the next decade, compared to the sector's 10.6%.

Profitability metrics are also attractive, with an A+ rating. The company's gross margin stands at 81%, compared to the sector's 58%, and the bottom line is 20.5%, with the sector median at -4%. Cash from operations is just over $6 billion, well above the sector median of -$5 million.

Institutional Activity and Valuation

Institutional investors hold 83% of Eli Lilly's stock. While they sold around $31 billion worth of shares over the last year, they also bought 50% more. However, recent quarters have seen increased selling activity, a trend observed across many stocks in Q4.

Intrinsic Value Assessment

Our intrinsic value assessment for Eli Lilly places the stock at $630, suggesting the current price of $725 is a premium. For those interested in a margin of safety (MOS), we estimate the stock value at $567 for a 10% MOS, $536 for a 15% MOS, and $505 for a 20% MOS. Wall Street, however, disagrees significantly, predicting a year-end price target of just over $1,000, indicating a 43% upside.

Conclusion

Is Eli Lilly a stock worth its current premium? Or do you see its value adjusting over time? Share your thoughts with us.

https://youtu.be/DCe75TA2CZE?si=i7gz6hGwphRFGfLA

Eli Lilly and Company's Stock: A Promising Upside for 2025

The next stock that Wall Street analysts believe has significant upside potential is Eli Lilly and Company (LLY). Despite a mixed performance in recent months, long-term growth trends suggest a robust future for this pharmaceutical giant.

Recent Performance

Eli Lilly's stock has seen a 15% increase over the last year. However, it has experienced some volatility, with a decline over the last month and a 20% drop over the past six months. Despite these short-term fluctuations, Eli Lilly has outperformed the S&P 500, with a 96% increase over the longer term. Currently trading towards the lower end of its 52-week range, the stock has been rated a double buy by both Seeking Alpha and Wall Street analysts, despite its relatively low dividend yield of 0.83%.

Earnings and Growth Expectations

Looking ahead, Eli Lilly's earnings projections indicate significant growth. The company anticipates triple-digit growth in the next quarter and in Q3 of 2025. Although they missed their most recent earnings by 29 cents, they have a 75% track record of hitting earnings targets. If they achieve their 2025 earnings per share (EPS) targets, the forward P/E ratio would be around 32, compared to their five-year average of 36.6, suggesting potential undervaluation.

Growth and Profitability

Eli Lilly's growth grade is very promising, with an A+ rating and a year-on-year growth rate of approximately 28%. Forward-looking growth is around 27%, significantly better than the sector's mid to high single-digit figures. The earnings per share are expected to grow by about 40% annually over the next decade, compared to the sector's 10.6%.

Profitability metrics are also attractive, with an A+ rating. The company's gross margin stands at 81%, compared to the sector's 58%, and the bottom line is 20.5%, with the sector median at -4%. Cash from operations is just over $6 billion, well above the sector median of -$5 million.

Institutional Activity and Valuation

Institutional investors hold 83% of Eli Lilly's stock. While they sold around $31 billion worth of shares over the last year, they also bought 50% more. However, recent quarters have seen increased selling activity, a trend observed across many stocks in Q4.

Intrinsic Value Assessment

Our intrinsic value assessment for Eli Lilly places the stock at $630, suggesting the current price of $725 is a premium. For those interested in a margin of safety (MOS), we estimate the stock value at $567 for a 10% MOS, $536 for a 15% MOS, and $505 for a 20% MOS. Wall Street, however, disagrees significantly, predicting a year-end price target of just over $1,000, indicating a 43% upside.

Conclusion

Is Eli Lilly a stock worth its current premium? Or do you see its value adjusting over time? Share your thoughts with us.

https://youtu.be/DCe75TA2CZE?si=i7gz6hGwphRFGfLA