Introduction

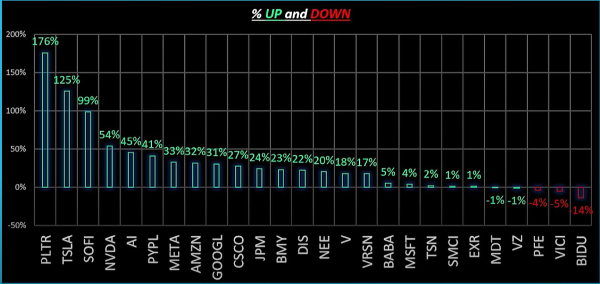

Good day, fellow investors! Verizon stock has been experiencing a downturn over the last five years. Simultaneously, the dividend has been on an upward trajectory. How can this be? This article explores the reasons behind this paradox and calculates Verizon's intrinsic value to help you determine if it fits your portfolio.

Verizon's Declining Stock and Rising Dividend

Verizon's stock has decreased by 36% over the past five years. While the decline has been somewhat cushioned by the dividend yield, five years of stagnant performance in a market that has doubled is far from ideal. With a market cap of $160 billion, we need to assess the risk and reward of investing in Verizon by calculating its intrinsic value compared to other stocks.

Key Summary: Dividend and Growth Analysis

Verizon boasts a 7% dividend yield and a 2.3% growth rate, resulting in an expected 9-10% return going forward. As a 5G leader alongside T-Mobile, Verizon's recent $20 billion Frontier acquisition aims to expand its fiber network. However, this adds to its already substantial debt pile of $200 billion accrued over the last decade.

Earnings and Revenue Analysis

Verizon's total revenue has remained flat, with wireless service revenue growing slowly. Cash flows from operations have decreased by $2.3 billion, while capital expenditures are down by $2 billion. This stability in free cash flow has allowed for modest dividend growth, though the increasing debt, now at $115 billion, remains a concern.

Interest Rates and Their Impact on Verizon

Verizon's performance is highly sensitive to interest rates. When rates rise, the dividend yield and debt costs increase, leading to a decline in stock value. Conversely, when rates fall, Verizon's profitability improves, and the stock price rises. Over the past 20 years, Verizon's dividend yield has increased from 4.29% to 7%, contributing to the stock's decline.

Intrinsic Value Calculation

To evaluate Verizon's intrinsic value, we consider a dividend of $2.6 per share and a growth rate based on historical performance. If the dividend continues to grow, Verizon is fairly priced for a 10% return. However, if interest rates decrease, the required dividend yield could drop to 5%, potentially increasing the stock value by 30-40%.

Risks and Rewards for Investors

The primary risk for Verizon is a potential dividend cut due to higher-than-expected debt costs or lower margins. If Verizon manages its debt and maintains its dividend, the stock could provide a stable return. However, a dividend cut would significantly impact the stock value.

Conclusion

Verizon's stock performance is closely tied to interest rates and debt management. While the high dividend yield is attractive, investors must consider the risks associated with Verizon's debt and the competitive telecommunications environment. In a diversified portfolio, Verizon could be a valuable addition for those seeking dividend income.

https://youtu.be/PhhMXcDSSyw?si=LssnxnlrowOa-T3M

Introduction

Good day, fellow investors! Verizon stock has been experiencing a downturn over the last five years. Simultaneously, the dividend has been on an upward trajectory. How can this be? This article explores the reasons behind this paradox and calculates Verizon's intrinsic value to help you determine if it fits your portfolio.

Verizon's Declining Stock and Rising Dividend

Verizon's stock has decreased by 36% over the past five years. While the decline has been somewhat cushioned by the dividend yield, five years of stagnant performance in a market that has doubled is far from ideal. With a market cap of $160 billion, we need to assess the risk and reward of investing in Verizon by calculating its intrinsic value compared to other stocks.

Key Summary: Dividend and Growth Analysis

Verizon boasts a 7% dividend yield and a 2.3% growth rate, resulting in an expected 9-10% return going forward. As a 5G leader alongside T-Mobile, Verizon's recent $20 billion Frontier acquisition aims to expand its fiber network. However, this adds to its already substantial debt pile of $200 billion accrued over the last decade.

Earnings and Revenue Analysis

Verizon's total revenue has remained flat, with wireless service revenue growing slowly. Cash flows from operations have decreased by $2.3 billion, while capital expenditures are down by $2 billion. This stability in free cash flow has allowed for modest dividend growth, though the increasing debt, now at $115 billion, remains a concern.

Interest Rates and Their Impact on Verizon

Verizon's performance is highly sensitive to interest rates. When rates rise, the dividend yield and debt costs increase, leading to a decline in stock value. Conversely, when rates fall, Verizon's profitability improves, and the stock price rises. Over the past 20 years, Verizon's dividend yield has increased from 4.29% to 7%, contributing to the stock's decline.

Intrinsic Value Calculation

To evaluate Verizon's intrinsic value, we consider a dividend of $2.6 per share and a growth rate based on historical performance. If the dividend continues to grow, Verizon is fairly priced for a 10% return. However, if interest rates decrease, the required dividend yield could drop to 5%, potentially increasing the stock value by 30-40%.

Risks and Rewards for Investors

The primary risk for Verizon is a potential dividend cut due to higher-than-expected debt costs or lower margins. If Verizon manages its debt and maintains its dividend, the stock could provide a stable return. However, a dividend cut would significantly impact the stock value.

Conclusion

Verizon's stock performance is closely tied to interest rates and debt management. While the high dividend yield is attractive, investors must consider the risks associated with Verizon's debt and the competitive telecommunications environment. In a diversified portfolio, Verizon could be a valuable addition for those seeking dividend income.

https://youtu.be/PhhMXcDSSyw?si=LssnxnlrowOa-T3M