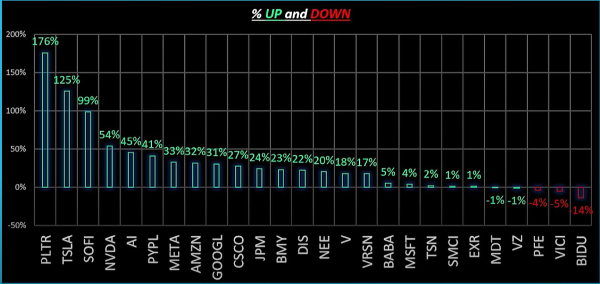

Wall Street analysts have predicted that the S&P 500 could end 2025 with a price range between 6,400 and 7,100, indicating a potential gain between 10-20%. However, with an underwhelming performance in 2024 and a challenging start to 2025, it's difficult to predict with certainty. In today's article, we focus on three high-growth stocks that we believe offer better opportunities than the S&P 500 this year. The first stock in the spotlight is Grab.

Grab: A Southeast Asian Technology Leader

Grab is a Southeast Asian technology company known for its diverse range of services, including ride-hailing, food delivery, digital payments, and financial services. Through their app, users can book rides, order food, pay bills, and access various on-demand services. Grab is widely used in countries like Singapore, Indonesia, Malaysia, Thailand, and the Philippines.

Company Performance and Ratings

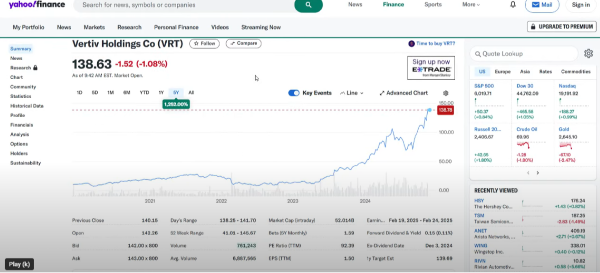

Grab holds a double strong buy rating from both Wall Street and Quant, and Seeking Alpha also gives it a buy rating. The stock is currently trading in the midpoint of its 52-week range and has a market capitalization of around $18 billion. Over the past year, Grab's stock has appreciated by about 35%. Their earnings projections for the next quarter indicate a 96% year-on-year growth in earnings per share.

Valuation and Grading

While Grab's forward P/E ratio is high at 94, this is expected to decrease significantly over time as the company continues to grow. Their valuation grades are as follows:

- Valuation: C+

- Growth: A+

- Profitability: A

Financial Metrics

Growth

- Revenue Growth: 22% (past 12 months) vs 4% sector average

- Forward-Looking Revenue Growth: 33% vs 5.2% sector average

- Free Cash Flow Growth: 571% vs 7% sector average

- Operating Cash Flow: 551% vs 6.84% sector average

Profitability

- Gross Margin: 42% vs 32% sector average

- Net Margin: -4% vs 6.5% sector average

- Free Cash Flow Margin: 43% vs 6.8% sector average

- Cash from Operations: $573 million vs $344 million sector average

Institutional Confidence

Institutions hold around 55% of Grab's shares. Over the last year, there were $540 million worth of sales, with institutions' buying activity double the amount of their sales.

Valuation Overview

Using a discounted cash flow (DCF) model, Grab's intrinsic value is estimated at around $6, indicating a potential upside of 38% over the next year, which is significantly higher than the 10-20% expected from the S&P 500. Here's the breakdown for different growth rates:

- Medium-rate (15% MOS): $5.56 buy target

- High-rate (20% MOS): $4.63 buy target

- Higher-rate (25% MOS): $2.78 buy target

Key Takeaways

- Strong Market Position: Grab is a leader in Southeast Asia's tech ecosystem, offering a wide range of services.

- Diversified Revenue Streams: Their diversified offerings reduce reliance on any single service, providing multiple revenue streams.

- Growing Market: Southeast Asia's increasing population and smartphone adoption present a large and expanding market for Grab.

- Growth Potential: Grab is still in its growth stages with opportunities to expand its user base, geographic reach, and service offerings.

Challenges

- Intense Competition: Competing with major companies like Uber and local services could impact market share.

- Regulatory Challenges: Operating in multiple countries with different regulations can lead to legal and operational hurdles.

- Profitability Concerns: While showing strong revenue growth, consistent profitability remains a challenge.

- Economic Downturns: Demand for services like ride-hailing and food delivery may decrease during challenging economic times.

Grab offers significant growth potential despite its challenges. The company's strength lies in its market position, diversified offerings, and positive financial metrics. With institutional confidence and an estimated upside, Grab is a high-growth stock worth considering.

https://youtu.be/b36ArzFEndk?si=eOO-5ubBYNreb8u_

Wall Street analysts have predicted that the S&P 500 could end 2025 with a price range between 6,400 and 7,100, indicating a potential gain between 10-20%. However, with an underwhelming performance in 2024 and a challenging start to 2025, it's difficult to predict with certainty. In today's article, we focus on three high-growth stocks that we believe offer better opportunities than the S&P 500 this year. The first stock in the spotlight is Grab.

Grab: A Southeast Asian Technology Leader

Grab is a Southeast Asian technology company known for its diverse range of services, including ride-hailing, food delivery, digital payments, and financial services. Through their app, users can book rides, order food, pay bills, and access various on-demand services. Grab is widely used in countries like Singapore, Indonesia, Malaysia, Thailand, and the Philippines.

Company Performance and Ratings

Grab holds a double strong buy rating from both Wall Street and Quant, and Seeking Alpha also gives it a buy rating. The stock is currently trading in the midpoint of its 52-week range and has a market capitalization of around $18 billion. Over the past year, Grab's stock has appreciated by about 35%. Their earnings projections for the next quarter indicate a 96% year-on-year growth in earnings per share.

Valuation and Grading

While Grab's forward P/E ratio is high at 94, this is expected to decrease significantly over time as the company continues to grow. Their valuation grades are as follows:

Financial Metrics

Growth

Profitability

Institutional Confidence

Institutions hold around 55% of Grab's shares. Over the last year, there were $540 million worth of sales, with institutions' buying activity double the amount of their sales.

Valuation Overview

Using a discounted cash flow (DCF) model, Grab's intrinsic value is estimated at around $6, indicating a potential upside of 38% over the next year, which is significantly higher than the 10-20% expected from the S&P 500. Here's the breakdown for different growth rates:

Key Takeaways

Challenges

Grab offers significant growth potential despite its challenges. The company's strength lies in its market position, diversified offerings, and positive financial metrics. With institutional confidence and an estimated upside, Grab is a high-growth stock worth considering.

https://youtu.be/b36ArzFEndk?si=eOO-5ubBYNreb8u_