In November and December, the holiday shopping season starts which is a golden sales period for the retail industry. Thanksgiving, black Friday, cyber-weekend and Christmas all dramatically boost the total sales of large retailers because many consumers are buying presents for friends, family as well as personal gifts thanks to the many discounts offered online and in store deals. The behavioral science behind the shopping frenzy in this period is that consumers want to get the best value out of their purchases. Hence, companies attract customers by providing them with more and longer periods of special offers.

While the total value of US retail sales gradually increases year over year during the holiday shopping season, 2024 does bring both opportunities and challenges to the table when it comes to the total retail sales. In this article we will take a closer look at the economic conditions that shape consumer expenditures, the sales growth in E-commerce versus brick-and-mortar stores, key players to watch during shopping season and trending sales categories with respect to gifts.

Economic conditions that affect the shopping season

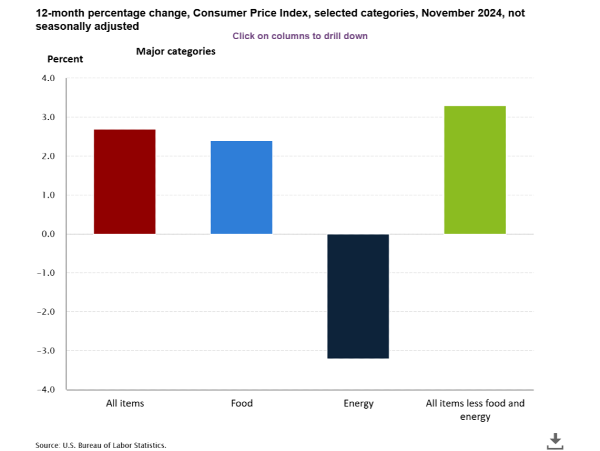

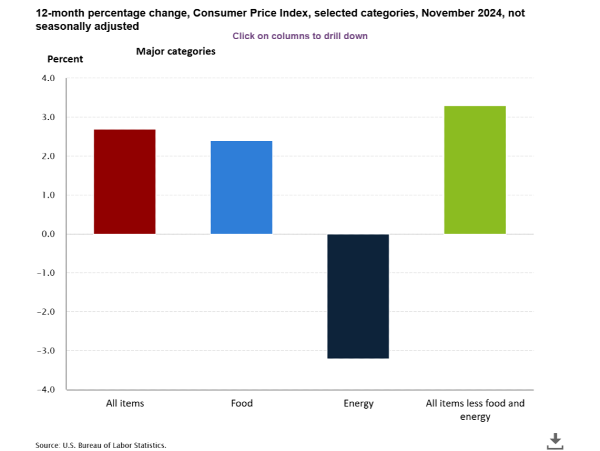

While inflation did decrease significantly from its 40 year high of 9.1% back in mid-2022, the current inflation rate is still above the Federal Reserves target rate of 2%. The Consumer Price Index (CPI) of November 2024 showed a 12-month inflation rate of 2.7% which is 0.3% higher than the previous month. Figure 1 shows where the increase in CPI is coming from. First, energy prices have decreased driven by lower energy commodity prices. Second, prices of food went up due to an increase in the prices of dining out as well as higher costs for meat and poultry. The price increase of other items is primarily driven by the increase in service prices (shelter, medical care, transportation).

As a result, holiday shoppers face tighter budgets, prioritizing essential expenditures like rent, groceries, and transportation costs over discretionary purchases. To counteract the increased prices and prevent customers from not spending money, many retailers like Walmart and Target offer extended discount periods during the holiday season. This strategy helps consumers to spread out their purchases, making it easier for them to manage their monthly expenses while at the same time buying all the gifts they want.

Figure 1: US Consumer Price Index (CPI) November 2024

**E-commerce versus brick and mortar stores **

Since the Covid-19 pandemic in 2020, online sales have surged due to many stores being closed enforced by the lockdown. While everything is back to normal now and all physical stores are open, E-commerce will continue to grow within the retail industry. Currently, the E-commerce market size is expected to grow with a CAGR of 10.35% until 2029.

Furthermore, over 60% of the consumers in the US prefer to buy their holidays gifts online since it often is easier, faster and you can avoid busy stores during the shopping highseason. Retailers act upon this shift in consumer behavior by providing customers with online personalized suggestions, longer period of discounts, same day delivery and so forth. Ultimately, improving the online shopping experience.

While E-commerce is on the rise, brick and mortar stores remain popular among consumers. 63% of consumers are planning to visit physical stores during the holiday season to purchase gifts. Some of the reasons include to avoid shopping delays, ensure that the product is not damaged, avoid shipping costs and rather see it as a true shopping experience when going to the physical store and get into the Christmas/holiday spirit.

Hence, E-commerce is gaining more and more traction with platforms like Amazon leading the competition. However, traditional stores like Walmart are bridging the gap between digital and physical retail through innovation and the implementation of same day delivery options as well as curbside pickup strategies. Offering customers the best of both world.

Key Players to Watch

The holiday shopping season contributes to a large percentage of the total revenue for large retailers. Meaning, there are also high expectations among investors regarding the quarterly earnings of retail industry stocks after the holiday season is over. E-commerce businesses and major physical retail stores are the companies that benefit the most during the shopping season. In the following part, some popular companies among investors are mentioned that could profit significantly during this time of the year.

Amazon

The E-commerce giant we all know and love will continue to dominate the holiday shopping season thanks to its efficient online shopping & delivery services for online retailing and third party sellers. Other operations include Amazon Prime, AWS Cloud Services, Amazon Fresh and more. Furthermore, Amazon will continue to adapt to new market trends such as generative AI and delivery drones to enhance the customer’s experience.

Figure 2 shows that Amazon is up almost 53% year to date, outperforming the S&P500. The growth in share price was driven by stronger earnings, better profit margins as well as better earnings per share. In previous years, Amazon was the go-to online retailer for the holiday shopping season as is expected to be the most popular one in 2024 again.

Target And Walmart

Two of the biggest retailers in the United States that are competing against each other by offering competitive discounts as well as offering a variety of goods ranging from foods, clothing, electronics etc. Hence, attracting a broad audience from all income classes. While both Target and Walmart rely on their physical stores, they are making continuing improvements towards the e-commerce transition. New strategies like click and collect, pick-up locations and same day deliveries are simplifying the shopping experience of customers and in return, this has a positive effect on the sales.

However, Q3 earnings were very different for both companies. Both Target’s revenue growth and earnings per share were below expectations. One reason for missing their earnings was due to the lack of sales in discretionary products like clothing and home goods. The future outlook also had to be readjusted to lower expectations.

As a result, Target performed poorly with a year-to-date return of -5.46% as shown in figure 2. The major decline of the share price occurred after the Q3 earnings where the stock price dropped almost 20%. While Target’s share did recuperate some of its losses, it is being outperformed significantly by Walmart.

In contrast, Walmart crushed their Q3 earnings again and continues its momentum in the stock market. Revenue grew by 5.5% as well as their gross margin from 24,0% to 24,20%. Walmart further showed an increase in sales within the general merchandise department for the 2nd quarter in a row after declining for 11 quarters. Finally, Walmart experienced more growth in their E-commerce branch thanks to express deliveries, curbside pickups and third-party marketplace businesses.

Following from figure 2, we see that Walmart share price returned 77.21% year to date. One of the best performers of the retail industry and even outperforming the S&P500 which has a YTD return of 27.60%. One reason for the strong outperformance is thanks to its strong earnings, growth is various branches (E-commerce, apparel, electronics) and better margins this year as well as a positive outlook for 2025.

Figure 2: YTD performance

What’s selling in 2024

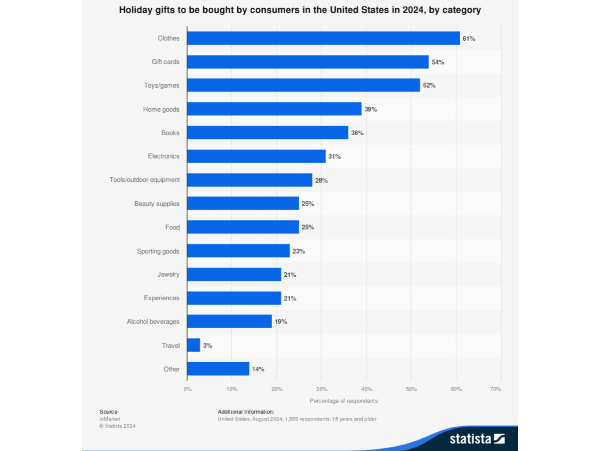

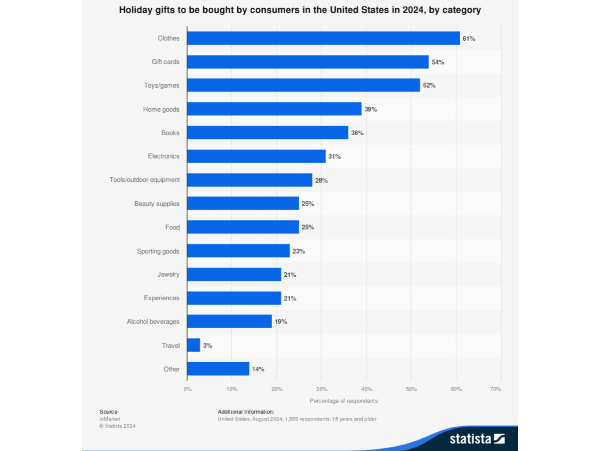

In order for retailers to benefit the most during the holiday shopping season, they want to have a clear understanding of what products are going to be the most popular so they can strategically offer unique deals to their customers. Figure 3 shows that the top selling categories of this holiday season will be clothes, gift cards as well as toys & games. Clothes and gift cards are always a safe bet since everyone needs clothes, gift cards give the person the freedom to buy what he or she wants most. The holiday season is also the time of the year when a lot of companies release their new games and toys to stimulate demand towards their products.

Figure 3: Holidays gift bought by consumers

Conclusion

The 2024 holiday shopping season reflects the adaptability of the retail sector with respect to shifting consumer behavior and economic pressures. While inflation is significantly lower than its 2022 peak, it continues to influence the purchasing power of customers. Causing consumers to prioritize value and essential expenditures over non-essential goods. As a result, retailers have responded by extending their discount periods, enhancing e-commerce capabilities as well as offering hybrid shopping options (curbside pickups, express deliveries, etc.) that satisfy the changing wants and needs of customers.

Key players such as Amazon, Walmart, and Target are showcasing their strong fundamentals and operational capabilities to meet consumer needs, with Walmart emerging as the top performer thanks to its strong earnings and robust e-commerce strategy. Meanwhile, traditional categories like apparel, toys, and gift cards remain top sellers during the holiday season.

The outlook, companies that will invest in both digital as well as physical shopping experiences, while also meeting evolving consumer preferences are well positioned to succeed this holiday season as well as in the future.

I/we have no positions in any asset mentioned, but may initiate a position over the next 7 days

In November and December, the holiday shopping season starts which is a golden sales period for the retail industry. Thanksgiving, black Friday, cyber-weekend and Christmas all dramatically boost the total sales of large retailers because many consumers are buying presents for friends, family as well as personal gifts thanks to the many discounts offered online and in store deals. The behavioral science behind the shopping frenzy in this period is that consumers want to get the best value out of their purchases. Hence, companies attract customers by providing them with more and longer periods of special offers.

While the total value of US retail sales gradually increases year over year during the holiday shopping season, 2024 does bring both opportunities and challenges to the table when it comes to the total retail sales. In this article we will take a closer look at the economic conditions that shape consumer expenditures, the sales growth in E-commerce versus brick-and-mortar stores, key players to watch during shopping season and trending sales categories with respect to gifts.

Economic conditions that affect the shopping season

While inflation did decrease significantly from its 40 year high of 9.1% back in mid-2022, the current inflation rate is still above the Federal Reserves target rate of 2%. The Consumer Price Index (CPI) of November 2024 showed a 12-month inflation rate of 2.7% which is 0.3% higher than the previous month. Figure 1 shows where the increase in CPI is coming from. First, energy prices have decreased driven by lower energy commodity prices. Second, prices of food went up due to an increase in the prices of dining out as well as higher costs for meat and poultry. The price increase of other items is primarily driven by the increase in service prices (shelter, medical care, transportation).

As a result, holiday shoppers face tighter budgets, prioritizing essential expenditures like rent, groceries, and transportation costs over discretionary purchases. To counteract the increased prices and prevent customers from not spending money, many retailers like Walmart and Target offer extended discount periods during the holiday season. This strategy helps consumers to spread out their purchases, making it easier for them to manage their monthly expenses while at the same time buying all the gifts they want.

Figure 1: US Consumer Price Index (CPI) November 2024

**E-commerce versus brick and mortar stores **

Since the Covid-19 pandemic in 2020, online sales have surged due to many stores being closed enforced by the lockdown. While everything is back to normal now and all physical stores are open, E-commerce will continue to grow within the retail industry. Currently, the E-commerce market size is expected to grow with a CAGR of 10.35% until 2029.

Furthermore, over 60% of the consumers in the US prefer to buy their holidays gifts online since it often is easier, faster and you can avoid busy stores during the shopping highseason. Retailers act upon this shift in consumer behavior by providing customers with online personalized suggestions, longer period of discounts, same day delivery and so forth. Ultimately, improving the online shopping experience.

While E-commerce is on the rise, brick and mortar stores remain popular among consumers. 63% of consumers are planning to visit physical stores during the holiday season to purchase gifts. Some of the reasons include to avoid shopping delays, ensure that the product is not damaged, avoid shipping costs and rather see it as a true shopping experience when going to the physical store and get into the Christmas/holiday spirit.

Hence, E-commerce is gaining more and more traction with platforms like Amazon leading the competition. However, traditional stores like Walmart are bridging the gap between digital and physical retail through innovation and the implementation of same day delivery options as well as curbside pickup strategies. Offering customers the best of both world.

Key Players to Watch

The holiday shopping season contributes to a large percentage of the total revenue for large retailers. Meaning, there are also high expectations among investors regarding the quarterly earnings of retail industry stocks after the holiday season is over. E-commerce businesses and major physical retail stores are the companies that benefit the most during the shopping season. In the following part, some popular companies among investors are mentioned that could profit significantly during this time of the year.

Amazon

The E-commerce giant we all know and love will continue to dominate the holiday shopping season thanks to its efficient online shopping & delivery services for online retailing and third party sellers. Other operations include Amazon Prime, AWS Cloud Services, Amazon Fresh and more. Furthermore, Amazon will continue to adapt to new market trends such as generative AI and delivery drones to enhance the customer’s experience.

Figure 2 shows that Amazon is up almost 53% year to date, outperforming the S&P500. The growth in share price was driven by stronger earnings, better profit margins as well as better earnings per share. In previous years, Amazon was the go-to online retailer for the holiday shopping season as is expected to be the most popular one in 2024 again.

Target And Walmart

Two of the biggest retailers in the United States that are competing against each other by offering competitive discounts as well as offering a variety of goods ranging from foods, clothing, electronics etc. Hence, attracting a broad audience from all income classes. While both Target and Walmart rely on their physical stores, they are making continuing improvements towards the e-commerce transition. New strategies like click and collect, pick-up locations and same day deliveries are simplifying the shopping experience of customers and in return, this has a positive effect on the sales.

However, Q3 earnings were very different for both companies. Both Target’s revenue growth and earnings per share were below expectations. One reason for missing their earnings was due to the lack of sales in discretionary products like clothing and home goods. The future outlook also had to be readjusted to lower expectations.

As a result, Target performed poorly with a year-to-date return of -5.46% as shown in figure 2. The major decline of the share price occurred after the Q3 earnings where the stock price dropped almost 20%. While Target’s share did recuperate some of its losses, it is being outperformed significantly by Walmart.

In contrast, Walmart crushed their Q3 earnings again and continues its momentum in the stock market. Revenue grew by 5.5% as well as their gross margin from 24,0% to 24,20%. Walmart further showed an increase in sales within the general merchandise department for the 2nd quarter in a row after declining for 11 quarters. Finally, Walmart experienced more growth in their E-commerce branch thanks to express deliveries, curbside pickups and third-party marketplace businesses.

Following from figure 2, we see that Walmart share price returned 77.21% year to date. One of the best performers of the retail industry and even outperforming the S&P500 which has a YTD return of 27.60%. One reason for the strong outperformance is thanks to its strong earnings, growth is various branches (E-commerce, apparel, electronics) and better margins this year as well as a positive outlook for 2025.

Figure 2: YTD performance

What’s selling in 2024

In order for retailers to benefit the most during the holiday shopping season, they want to have a clear understanding of what products are going to be the most popular so they can strategically offer unique deals to their customers. Figure 3 shows that the top selling categories of this holiday season will be clothes, gift cards as well as toys & games. Clothes and gift cards are always a safe bet since everyone needs clothes, gift cards give the person the freedom to buy what he or she wants most. The holiday season is also the time of the year when a lot of companies release their new games and toys to stimulate demand towards their products.

Figure 3: Holidays gift bought by consumers

Conclusion

The 2024 holiday shopping season reflects the adaptability of the retail sector with respect to shifting consumer behavior and economic pressures. While inflation is significantly lower than its 2022 peak, it continues to influence the purchasing power of customers. Causing consumers to prioritize value and essential expenditures over non-essential goods. As a result, retailers have responded by extending their discount periods, enhancing e-commerce capabilities as well as offering hybrid shopping options (curbside pickups, express deliveries, etc.) that satisfy the changing wants and needs of customers.

Key players such as Amazon, Walmart, and Target are showcasing their strong fundamentals and operational capabilities to meet consumer needs, with Walmart emerging as the top performer thanks to its strong earnings and robust e-commerce strategy. Meanwhile, traditional categories like apparel, toys, and gift cards remain top sellers during the holiday season.

The outlook, companies that will invest in both digital as well as physical shopping experiences, while also meeting evolving consumer preferences are well positioned to succeed this holiday season as well as in the future.

I/we have no positions in any asset mentioned, but may initiate a position over the next 7 days