Artificial intelligence (AI) has become one of the most trending topics and innovations in recent years. More specifically, generative AI models are created that have the ability to generate texts, images and even videos based on a given prompt. Furthermore, it continues to develop its natural language model thanks to the millions of parameter inputs it receives.

As a result, the tech industry is massively investing in AI technologies to stimulate innovation, economic growth and even societal change as AI can be implemented in any industry. Some popular examples of AI implementations in the world include optimizing crop yields in the agricultural sector, AI driven learning platforms, AI assistants for online shopping or customer feedback, AI’s capability of analyzing large datasets of unstructured data etc. Hence, artificial intelligence is set to redefine industries

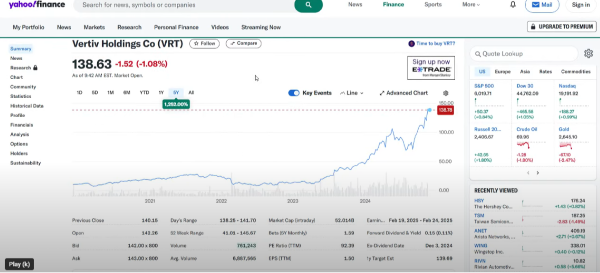

In 2024, the stock market has seen a massive wave of interest in AI-driven innovations with investors betting on the companies that are leveraging AI to drive growth and productivity. However, while many companies are investing in artificial intelligence, not all of them are incorporating and developing it efficiently. Ultimately, highlighting clear winners and losers in the stock market. In this article, we will take a closer look at the development, benefits, winners and losers as well as the risks and challenges of AI.

The development of artificial intelligence

Academic theories around artificial intelligence have been around since the start of 1950 and rapidly evolved in the following decades. The first major breakthrough in AI was the computer system Deep Blue made by IBM in 1996. A computer specialized in playing chess and which was able to analyze 200 million potential moves in less than a second. Making it impossible to win as a human against the computer. This was the first step in artificial intelligence as it showcased it could process information much faster than the human brain.

From 2000 and onwards, new AI technologies entered the market such as the Nasa Rovers that could walk independently on Mars without any assistance of humans. Next, IBM created another computer called Watson which was able to analyze and remember a large dataset consisting of encyclopedias as well as data found on the internet. The computer participated in Jeopardy, an American quiz show and won against the human champions. Finally, other large companies like Apple and Amazon jumped into the action by creating a virtual assistant called Siri and Alexa respectively. These systems were able to interpret a spoken question from the user and provide accurate responses.

Starting from 2020, generative AI entered the market where AI models were able to learn from billions of inputs and give a variety of outputs ranging from documents, text, images or videos all based on a given prompt. It further analyzes all the information found on the internet to provide a detailed and accurate response to the user. The most popular generative AI today is ChatGPT, created by OpenAI. ChatGPT can be used for a variety of tasks including but not limited to building resumes, doing research, coding, providing feedback and much more.

Hence, artificial intelligence will continue to develop in the future and is here to transform the world. While some jobs may be at risk, artificial intelligence will also create new job opportunities. That’s why it is crucial to learn how to work with these new technologies in order to stay up to date and improve your performance by utilizing and collaborating with AI.

The key benefits of artificial intelligence

Implementing artificial intelligence into businesses brings many benefits across various industries. Some examples of AI technologies include AI powered robots that perform surgery (healthcare), self-driving cars (transportation), weather forecasting (agriculture), fraud detection (finance) etc. The key benefits of artificial intelligence are as follows:

- Solve complex problems: AI can detect issues or correlations that are difficult to spot with the naked eye. Examples include processing large datasets in a fraction of a second, detecting suspicious transactions or even finding patterns in unstructured data.

- Enhanced decision making: AI can analyze financial statements or other datasets and give recommendations based on logic, meaning no emotions are involved which is a common mistake made by humans. Recommendations can range from creating forecasts, discovering trends or even detecting potential risks.

- Automation: AI reduces the need for repetitive human labor and prevents human errors. This will lead to increased productivity, reduced costs and improved efficiency. Hence, saving companies both time and resources.

- Personalization: AI can be implemented on many websites in order to enhance the customer experience by providing personalized recommendations and services. For example, chatbots that can be used to resolve customer issues more quickly. This can also reduce the need for human labor and reduce the costs of the company.

- Stimulate economic growth: rather than destroying existing jobs, AI creates new job opportunities in many industries. Furthermore, AI enhances labor productivity, product development and acts on changing consumer behavior by providing personalized campaigns. Hence, increasing GDP growth for countries.

**AI winners and losers in the stock market **

The stock market in 2024 experienced significant returns, especially the companies that are in the spotlight with respect to artificial intelligence. As AI adoption accelerated across industries, investors are looking into the firms that drive technological innovation and benefit from the increasing demand towards AI. However, while many companies benefited from the AI trend, others suffered in AI adoption. Let’s take a closer look at both the winners and losers of 2024.

Nvidia is the biggest winner in 2024 with a total return of 178% year-to-date (YTD). The main reason for this increase is the fact that Nvidia is currently dominating the GPU production market as the GPU’s are essential for training large language models (LLMs). By providing the highest quality of GPU’s and other microchips on the market, Nvidia’s revenue has skyrocketed and almost tripled compared to 2023.

Microsoft is another tech giant that returned just over 15% YTD. While this is much lower compared to Nvidia, Microsoft remains a market leader when it comes to artificial intelligence. They continue to invest in generative AI and are currently partnering with OpenAI, who are the creators of ChatGPT. Analysts are expecting that Microsoft’s Azure cloud platform and AI driven tools like Copilot will continue to grow in 2025

Tesla is also expanding its reach into AI and currently has a year-to-date performance of 73%. While Tesla primarily manufactures EV’s, it can also be seen as a tech company thanks to leveraging vast amounts of data to fuel their innovation. All the Tesla’s on the road act as a data collection network, gathering crucial information. While driving, the cars collect road data, driving behavior, self-driving data, energy & performance data as well as environmental data. As a result, Tesla will continue to improve their cars with respect to autonomous driving, energy efficiency and user experience.

Losers struggling in the AI era

Unfortunately, not everyone can be a winner and some companies are losing their market share to competitors due to a lack of AI adoption into their business model.

Intel is one of the clear losers in 2024 with a total year-to-date performance of -60%. Intel has lost market share to Nvidia and AMD due to its focus on CPU’s rather than GPU’s, which are essential for fast computing power and AI implementation. Furthermore, Intel is suffering from increasing financial pressure as 2024 quarterly earnings indicated that Intel is struggling to generate revenue growth and is even facing a negative profit margin.

Another loser in the market is Snapchat with a year-to-date performance of -34%. The social media platform struggled to capitalize on AI trends compared to its rival Meta, which did an incredible job in implementing AI for personalized content recommendations and advertisements. Factors that caused the price of Snapchat to decrease are a decreasing average revenue per user, lower EBITDA margins and its inability to generate profits.

Risk and challenges of AI

Artificial intelligence is here to change the world and will become increasingly important in the future as it can be implemented in every industry. The main benefits consist of improved efficiency, lower costs, automation, personalized advertising and more. However, new technologies also bring risks and challenges.

The rapid rise in AI stock prices has led to increased fears of overvaluation or even a potential bubble. Many companies are trading at higher valuations as investors are expecting exponential growth in the future. The real question is whether AI will effectively increase the production and efficiency of companies or if it is rather a hype that will die out for companies. But what can history tell us? The dotcom bubble was a speculative surge in the late 1990s driven by investor enthusiasm for internet companies, many of which had little revenue or proven business models. In 2000, the bubble popped, and many tech stocks collapsed. Hence, exposing the risks of hype driven investments.

Another challenge of the rapid adoption of artificial intelligence is regulatory scrutiny as well as ethical dilemmas. Data privacy and algorithmic biases must be taken into consideration as we want to ensure that AI is using the data appropriately without harming any parties. Videos such as deepfakes are becoming more realistic and difficult to differentiate from reality. As a result, many people can fall trap to fake advertisements or even fake websites. Hence, harming the normal consumers in the process.

Future outlook

Artificial intelligence is transforming industries and driving innovation, offering opportunities for both businesses and investors. AI can be used to solve complex problems, automate processes and give personalized recommendations. Hence, AI has become a cornerstone of growth across sectors. However, the rapid rise in share prices for companies that mention AI raises concerns of overvaluation and the risks of hype driven investments. Ultimately, showing similar characteristics as the dot-com bubble.

Looking ahead, AI is set to play an even greater role in shaping the global economy. Success will depend on balancing innovation with strong business models, ethical considerations and regulatory compliance. Companies that effectively integrate AI and address key challenges such as data privacy will likely emerge as leaders. As artificial intelligence continues to evolve, staying informed and leveraging its potential responsibly will be crucial for sustainable growth and long-term success.

I/we have a position in an asset mentioned

Artificial intelligence (AI) has become one of the most trending topics and innovations in recent years. More specifically, generative AI models are created that have the ability to generate texts, images and even videos based on a given prompt. Furthermore, it continues to develop its natural language model thanks to the millions of parameter inputs it receives.

As a result, the tech industry is massively investing in AI technologies to stimulate innovation, economic growth and even societal change as AI can be implemented in any industry. Some popular examples of AI implementations in the world include optimizing crop yields in the agricultural sector, AI driven learning platforms, AI assistants for online shopping or customer feedback, AI’s capability of analyzing large datasets of unstructured data etc. Hence, artificial intelligence is set to redefine industries

In 2024, the stock market has seen a massive wave of interest in AI-driven innovations with investors betting on the companies that are leveraging AI to drive growth and productivity. However, while many companies are investing in artificial intelligence, not all of them are incorporating and developing it efficiently. Ultimately, highlighting clear winners and losers in the stock market. In this article, we will take a closer look at the development, benefits, winners and losers as well as the risks and challenges of AI.

The development of artificial intelligence

Academic theories around artificial intelligence have been around since the start of 1950 and rapidly evolved in the following decades. The first major breakthrough in AI was the computer system Deep Blue made by IBM in 1996. A computer specialized in playing chess and which was able to analyze 200 million potential moves in less than a second. Making it impossible to win as a human against the computer. This was the first step in artificial intelligence as it showcased it could process information much faster than the human brain.

From 2000 and onwards, new AI technologies entered the market such as the Nasa Rovers that could walk independently on Mars without any assistance of humans. Next, IBM created another computer called Watson which was able to analyze and remember a large dataset consisting of encyclopedias as well as data found on the internet. The computer participated in Jeopardy, an American quiz show and won against the human champions. Finally, other large companies like Apple and Amazon jumped into the action by creating a virtual assistant called Siri and Alexa respectively. These systems were able to interpret a spoken question from the user and provide accurate responses.

Starting from 2020, generative AI entered the market where AI models were able to learn from billions of inputs and give a variety of outputs ranging from documents, text, images or videos all based on a given prompt. It further analyzes all the information found on the internet to provide a detailed and accurate response to the user. The most popular generative AI today is ChatGPT, created by OpenAI. ChatGPT can be used for a variety of tasks including but not limited to building resumes, doing research, coding, providing feedback and much more.

Hence, artificial intelligence will continue to develop in the future and is here to transform the world. While some jobs may be at risk, artificial intelligence will also create new job opportunities. That’s why it is crucial to learn how to work with these new technologies in order to stay up to date and improve your performance by utilizing and collaborating with AI.

The key benefits of artificial intelligence

Implementing artificial intelligence into businesses brings many benefits across various industries. Some examples of AI technologies include AI powered robots that perform surgery (healthcare), self-driving cars (transportation), weather forecasting (agriculture), fraud detection (finance) etc. The key benefits of artificial intelligence are as follows:

**AI winners and losers in the stock market **

The stock market in 2024 experienced significant returns, especially the companies that are in the spotlight with respect to artificial intelligence. As AI adoption accelerated across industries, investors are looking into the firms that drive technological innovation and benefit from the increasing demand towards AI. However, while many companies benefited from the AI trend, others suffered in AI adoption. Let’s take a closer look at both the winners and losers of 2024.

Nvidia is the biggest winner in 2024 with a total return of 178% year-to-date (YTD). The main reason for this increase is the fact that Nvidia is currently dominating the GPU production market as the GPU’s are essential for training large language models (LLMs). By providing the highest quality of GPU’s and other microchips on the market, Nvidia’s revenue has skyrocketed and almost tripled compared to 2023.

Microsoft is another tech giant that returned just over 15% YTD. While this is much lower compared to Nvidia, Microsoft remains a market leader when it comes to artificial intelligence. They continue to invest in generative AI and are currently partnering with OpenAI, who are the creators of ChatGPT. Analysts are expecting that Microsoft’s Azure cloud platform and AI driven tools like Copilot will continue to grow in 2025

Tesla is also expanding its reach into AI and currently has a year-to-date performance of 73%. While Tesla primarily manufactures EV’s, it can also be seen as a tech company thanks to leveraging vast amounts of data to fuel their innovation. All the Tesla’s on the road act as a data collection network, gathering crucial information. While driving, the cars collect road data, driving behavior, self-driving data, energy & performance data as well as environmental data. As a result, Tesla will continue to improve their cars with respect to autonomous driving, energy efficiency and user experience.

Losers struggling in the AI era

Unfortunately, not everyone can be a winner and some companies are losing their market share to competitors due to a lack of AI adoption into their business model.

Intel is one of the clear losers in 2024 with a total year-to-date performance of -60%. Intel has lost market share to Nvidia and AMD due to its focus on CPU’s rather than GPU’s, which are essential for fast computing power and AI implementation. Furthermore, Intel is suffering from increasing financial pressure as 2024 quarterly earnings indicated that Intel is struggling to generate revenue growth and is even facing a negative profit margin.

Another loser in the market is Snapchat with a year-to-date performance of -34%. The social media platform struggled to capitalize on AI trends compared to its rival Meta, which did an incredible job in implementing AI for personalized content recommendations and advertisements. Factors that caused the price of Snapchat to decrease are a decreasing average revenue per user, lower EBITDA margins and its inability to generate profits.

Risk and challenges of AI

Artificial intelligence is here to change the world and will become increasingly important in the future as it can be implemented in every industry. The main benefits consist of improved efficiency, lower costs, automation, personalized advertising and more. However, new technologies also bring risks and challenges.

The rapid rise in AI stock prices has led to increased fears of overvaluation or even a potential bubble. Many companies are trading at higher valuations as investors are expecting exponential growth in the future. The real question is whether AI will effectively increase the production and efficiency of companies or if it is rather a hype that will die out for companies. But what can history tell us? The dotcom bubble was a speculative surge in the late 1990s driven by investor enthusiasm for internet companies, many of which had little revenue or proven business models. In 2000, the bubble popped, and many tech stocks collapsed. Hence, exposing the risks of hype driven investments.

Another challenge of the rapid adoption of artificial intelligence is regulatory scrutiny as well as ethical dilemmas. Data privacy and algorithmic biases must be taken into consideration as we want to ensure that AI is using the data appropriately without harming any parties. Videos such as deepfakes are becoming more realistic and difficult to differentiate from reality. As a result, many people can fall trap to fake advertisements or even fake websites. Hence, harming the normal consumers in the process.

Future outlook

Artificial intelligence is transforming industries and driving innovation, offering opportunities for both businesses and investors. AI can be used to solve complex problems, automate processes and give personalized recommendations. Hence, AI has become a cornerstone of growth across sectors. However, the rapid rise in share prices for companies that mention AI raises concerns of overvaluation and the risks of hype driven investments. Ultimately, showing similar characteristics as the dot-com bubble.

Looking ahead, AI is set to play an even greater role in shaping the global economy. Success will depend on balancing innovation with strong business models, ethical considerations and regulatory compliance. Companies that effectively integrate AI and address key challenges such as data privacy will likely emerge as leaders. As artificial intelligence continues to evolve, staying informed and leveraging its potential responsibly will be crucial for sustainable growth and long-term success.

I/we have a position in an asset mentioned