The Significance of TSM: An In-Depth Analysis of Its Performance and Role in the Tech Industry

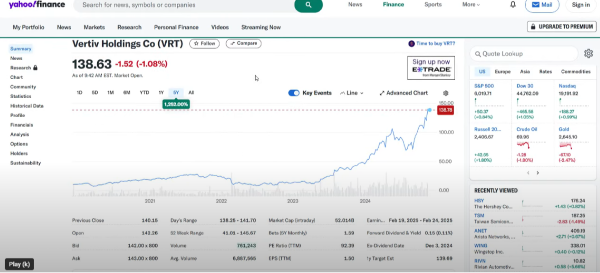

In recent years, TSM (Taiwan Semiconductor Manufacturing Company) has been a hot topic, and it's clear why. The company's stock has soared by an impressive 247% over the last five years, far outpacing the S&P 500's 90% increase during the same period. Even on a shorter scale, TSM's one-year performance has surged by 105%, highlighting its robust growth.

TSM's Outstanding Stock Performance

TSM's stock performance is truly remarkable. With a five-year increase of 247%, it has significantly outperformed the S&P 500, which only saw a 90% rise. Additionally, TSM's one-year performance stands at an impressive 105%, further solidifying its strong market presence.

TSM's Crucial Role in AI and Technology

However, the buzz around TSM isn't just about its stock performance. This company is a key player in the tech world. TSM provides the blueprints that Nvidia uses to manufacture their AI GPUs, which are essential for tech giants like Microsoft, Apple, Google, and Meta. Virtually all AI applications globally are powered through Nvidia and, by extension, TSM.

The Importance of TSM's Business Model

To understand whether TSM is a good investment, it's crucial to examine the company's business model and competitive advantages. TSM is often considered one of the most important companies globally due to its indispensable resources for major tech companies. Without TSM, companies couldn't produce advanced AI chips, GPUs, or even high-end iPhones. This is why TSM has such a significant moat in the industry.

The Competitive Landscape

While companies like Samsung and Intel are trying to compete with TSM, they face numerous challenges. Samsung's semiconductor business is not as profitable, and Intel lacks extensive experience in cutting-edge nanometer technology. TSM's expertise in chip fabrication, particularly in making smaller and more compact chips, sets it apart from the competition.

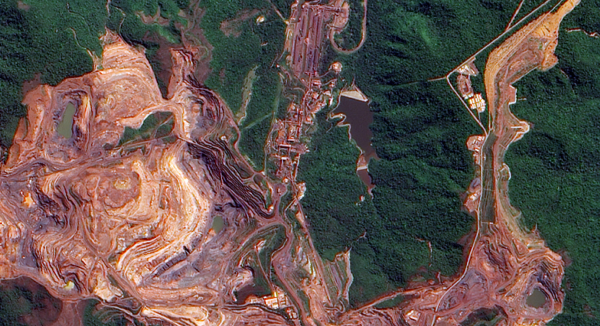

TSM's Complex and Costly Operations

TSM's operations are complex and costly. The machinery required is expensive, and it takes significant time and resources to train staff and establish new facilities. Despite these challenges, TSM continues to expand, with new facilities in Arizona and Japan, although most cutting-edge technology is developed in Taiwan.

TSM's Valuation and Growth Potential

PE ratios are crucial in evaluating TSM's value compared to the S&P 500. With a PE ratio of 32.85, TSM is slightly above the S&P 500's average, reflecting its significant growth and important moat. The company has been dramatically outpacing the S&P 500, making it an attractive investment for those looking at long-term growth.

Evaluating TSM: A Closer Look at PE Ratios, Earnings, and Revenue Growth

When analyzing a company's financial health, it’s essential to be cautious with Price-to-Earnings (PE) ratios. Sometimes, one-time expenses can distort PE ratios, making things look better or worse than they are. By comparing GAAP earnings to non-GAAP earnings, you can get a clearer picture. If these figures are similar, the PE ratio is likely accurate. However, a significant discrepancy between GAAP and non-GAAP earnings warrants a closer look to understand the reasons behind it.

PE Ratios and Earnings per Share

TSM doesn't have significant discrepancies between GAAP and non-GAAP earnings, indicating a reliable PE ratio. With consistent earnings per share, the company stands out in the semiconductor industry. TSM had exceptionally high margins in late 2021 and early 2022. Despite now recording record profits of $1.94 and an expected $2.20 for the last quarter, the performance isn't as high as it was during that period. Currently, TSM is generating $20.2 billion in revenue, with profits expected to reach $23.5 billion to $26.3 billion.

The Importance of Sustaining Margins

In earnings calls, investors are often eager to know if profit margins will increase. However, unless TSM can sustain high margins over an extended period, short-term gains aren't particularly significant. As a long-term investor, consistent profit margins are more important than temporary spikes. TSM excels in maintaining customer loyalty by not inflating prices for short-term gains.

Revenue Growth Over the Years

Revenue growth is a key indicator of a company's health. Visualizing TSM's revenue annually makes it clear. Despite a slight downturn, the company experienced substantial growth from 2021 to 2023 and is projected to continue this trajectory into 2024. The semiconductor industry is typically cyclical, with companies like STM and Micron experiencing downturns. However, TSM has bucked this trend due to the high demand for high-end GPU computing from companies like Nvidia, Apple, Meta, Google, and Microsoft.

Long-Term Investment Perspective

For long-term investors, understanding these cyclical trends can be advantageous. Buying at lows and holding through highs allows for potential gains. Consistent growth in revenue and profit over time is a positive sign, suggesting that TSM can outpace the S&P 500 in the long run.

Revenue Sources and Industry Impact

TSM's revenue primarily comes from high-performance computing (likely AI and top-end gaming), which accounts for a significant portion of its revenue. Smartphones contribute 34%, with other sectors like automotive, internet of things, and digital others also playing a role. The automotive sector, in particular, is expected to grow with advancements in self-driving vehicles.

Competitors and Market Position

While companies like Samsung and Intel are also in the semiconductor market, TSM has a competitive edge with cutting-edge technology (5 nanometer and 3 nanometer). Samsung's semiconductor business is not as profitable, and Intel lacks the advanced technology that TSM has mastered.

Evaluating Growth, Risks, and Future Prospects

Steady Growth and Fair Valuation

Expecting TSM to continue its growth trajectory, the current price point isn't excessively high. With a PE ratio of 34, the stock isn't cheap, but considering the rapid pace of the business, it's justified. In terms of share price performance, TSM is performing well, and there's little worry among investors. However, it isn't the perfect buying opportunity, as it's not undervalued. The S&P 500's PE ratio is around 30, while TSM's is 34, making it fairly valued but not a bargain.

Unique Risks and Advantages

Every company has its unique risks and advantages, and TSM is no exception. One significant risk is the geopolitical situation involving China and Taiwan. The possibility of an invasion of Taiwan has been a concern, though a full-scale military operation seems unlikely due to the complexity. However, any significant disruption could severely impact TSM, making it a critical factor for investors to consider.

Performance Compared to U.S. Companies

Historically, U.S. companies tend to outperform their foreign counterparts. However, TSM is an exception due to its significant technological advancements and strategic importance in the semiconductor industry. Despite being a foreign company, TSM's performance and potential make it a valuable investment.

Leadership and Long-Term Strategy

TSM's leadership is another key advantage. The company's long-term thinking, commitment to not exploiting customers for short-term gains, and strategic supply management contribute to its stability and growth. TSM's approach to maintaining good relationships with customers and competitors, such as AMD and Nvidia, is indicative of its forward-thinking strategy.

Projecting Future Performance

While predicting a stock's future price is challenging, TSM is expected to outperform the S&P 500 over the next five years. The continuous investment in AI and the demand for high-quality, high-tech chips position TSM at the forefront of the industry. Although a 500% increase in five years might be unrealistic, TSM's potential for consistent growth makes it a strong candidate for long-term investment.

https://youtu.be/ackCj05Qkcg?si=JHM7DLLFQLCZdhDa

The Significance of TSM: An In-Depth Analysis of Its Performance and Role in the Tech Industry

In recent years, TSM (Taiwan Semiconductor Manufacturing Company) has been a hot topic, and it's clear why. The company's stock has soared by an impressive 247% over the last five years, far outpacing the S&P 500's 90% increase during the same period. Even on a shorter scale, TSM's one-year performance has surged by 105%, highlighting its robust growth.

TSM's Outstanding Stock Performance

TSM's stock performance is truly remarkable. With a five-year increase of 247%, it has significantly outperformed the S&P 500, which only saw a 90% rise. Additionally, TSM's one-year performance stands at an impressive 105%, further solidifying its strong market presence.

TSM's Crucial Role in AI and Technology

However, the buzz around TSM isn't just about its stock performance. This company is a key player in the tech world. TSM provides the blueprints that Nvidia uses to manufacture their AI GPUs, which are essential for tech giants like Microsoft, Apple, Google, and Meta. Virtually all AI applications globally are powered through Nvidia and, by extension, TSM.

The Importance of TSM's Business Model

To understand whether TSM is a good investment, it's crucial to examine the company's business model and competitive advantages. TSM is often considered one of the most important companies globally due to its indispensable resources for major tech companies. Without TSM, companies couldn't produce advanced AI chips, GPUs, or even high-end iPhones. This is why TSM has such a significant moat in the industry.

The Competitive Landscape

While companies like Samsung and Intel are trying to compete with TSM, they face numerous challenges. Samsung's semiconductor business is not as profitable, and Intel lacks extensive experience in cutting-edge nanometer technology. TSM's expertise in chip fabrication, particularly in making smaller and more compact chips, sets it apart from the competition.

TSM's Complex and Costly Operations

TSM's operations are complex and costly. The machinery required is expensive, and it takes significant time and resources to train staff and establish new facilities. Despite these challenges, TSM continues to expand, with new facilities in Arizona and Japan, although most cutting-edge technology is developed in Taiwan.

TSM's Valuation and Growth Potential

PE ratios are crucial in evaluating TSM's value compared to the S&P 500. With a PE ratio of 32.85, TSM is slightly above the S&P 500's average, reflecting its significant growth and important moat. The company has been dramatically outpacing the S&P 500, making it an attractive investment for those looking at long-term growth.

Evaluating TSM: A Closer Look at PE Ratios, Earnings, and Revenue Growth

When analyzing a company's financial health, it’s essential to be cautious with Price-to-Earnings (PE) ratios. Sometimes, one-time expenses can distort PE ratios, making things look better or worse than they are. By comparing GAAP earnings to non-GAAP earnings, you can get a clearer picture. If these figures are similar, the PE ratio is likely accurate. However, a significant discrepancy between GAAP and non-GAAP earnings warrants a closer look to understand the reasons behind it.

PE Ratios and Earnings per Share

TSM doesn't have significant discrepancies between GAAP and non-GAAP earnings, indicating a reliable PE ratio. With consistent earnings per share, the company stands out in the semiconductor industry. TSM had exceptionally high margins in late 2021 and early 2022. Despite now recording record profits of $1.94 and an expected $2.20 for the last quarter, the performance isn't as high as it was during that period. Currently, TSM is generating $20.2 billion in revenue, with profits expected to reach $23.5 billion to $26.3 billion.

The Importance of Sustaining Margins

In earnings calls, investors are often eager to know if profit margins will increase. However, unless TSM can sustain high margins over an extended period, short-term gains aren't particularly significant. As a long-term investor, consistent profit margins are more important than temporary spikes. TSM excels in maintaining customer loyalty by not inflating prices for short-term gains.

Revenue Growth Over the Years

Revenue growth is a key indicator of a company's health. Visualizing TSM's revenue annually makes it clear. Despite a slight downturn, the company experienced substantial growth from 2021 to 2023 and is projected to continue this trajectory into 2024. The semiconductor industry is typically cyclical, with companies like STM and Micron experiencing downturns. However, TSM has bucked this trend due to the high demand for high-end GPU computing from companies like Nvidia, Apple, Meta, Google, and Microsoft.

Long-Term Investment Perspective

For long-term investors, understanding these cyclical trends can be advantageous. Buying at lows and holding through highs allows for potential gains. Consistent growth in revenue and profit over time is a positive sign, suggesting that TSM can outpace the S&P 500 in the long run.

Revenue Sources and Industry Impact

TSM's revenue primarily comes from high-performance computing (likely AI and top-end gaming), which accounts for a significant portion of its revenue. Smartphones contribute 34%, with other sectors like automotive, internet of things, and digital others also playing a role. The automotive sector, in particular, is expected to grow with advancements in self-driving vehicles.

Competitors and Market Position

While companies like Samsung and Intel are also in the semiconductor market, TSM has a competitive edge with cutting-edge technology (5 nanometer and 3 nanometer). Samsung's semiconductor business is not as profitable, and Intel lacks the advanced technology that TSM has mastered.

Evaluating Growth, Risks, and Future Prospects

Steady Growth and Fair Valuation

Expecting TSM to continue its growth trajectory, the current price point isn't excessively high. With a PE ratio of 34, the stock isn't cheap, but considering the rapid pace of the business, it's justified. In terms of share price performance, TSM is performing well, and there's little worry among investors. However, it isn't the perfect buying opportunity, as it's not undervalued. The S&P 500's PE ratio is around 30, while TSM's is 34, making it fairly valued but not a bargain.

Unique Risks and Advantages

Every company has its unique risks and advantages, and TSM is no exception. One significant risk is the geopolitical situation involving China and Taiwan. The possibility of an invasion of Taiwan has been a concern, though a full-scale military operation seems unlikely due to the complexity. However, any significant disruption could severely impact TSM, making it a critical factor for investors to consider.

Performance Compared to U.S. Companies

Historically, U.S. companies tend to outperform their foreign counterparts. However, TSM is an exception due to its significant technological advancements and strategic importance in the semiconductor industry. Despite being a foreign company, TSM's performance and potential make it a valuable investment.

Leadership and Long-Term Strategy

TSM's leadership is another key advantage. The company's long-term thinking, commitment to not exploiting customers for short-term gains, and strategic supply management contribute to its stability and growth. TSM's approach to maintaining good relationships with customers and competitors, such as AMD and Nvidia, is indicative of its forward-thinking strategy.

Projecting Future Performance

While predicting a stock's future price is challenging, TSM is expected to outperform the S&P 500 over the next five years. The continuous investment in AI and the demand for high-quality, high-tech chips position TSM at the forefront of the industry. Although a 500% increase in five years might be unrealistic, TSM's potential for consistent growth makes it a strong candidate for long-term investment.

https://youtu.be/ackCj05Qkcg?si=JHM7DLLFQLCZdhDa