Expertise provided by Darius Smith

Reviewed by Chaster Johnson

Introduction

Starting to invest can be a way to grow your wealth even though some think you need a lot of money to begin. But by using strategies and understanding the basics getting started with $500 can work out well. This piece looks into whether $ 500 is sufficient, for investing the ways to invest this sum, and the possible advantages of sticking to investments, in the long run.

Article Keywords

- Best way to invest $500

- Where to invest $500 right now

- If I invest $500 a month for 10 years

- If I invest $500 a month for 20 years

- Invest $500 a month for 20 years

Can I Start Investing with $500?

Sure thing! You're good to begin investing with $500. Nowadays there are plenty of investment opportunities, for people starting with an amount of money. The important factors to consider are your comfort level, with risk that you aim to achieve with your investments, and the suitable ways to grow your funds.

Understanding Risk Tolerance

Your willingness to accept fluctuations, in investment returns is known as your risk tolerance. Generally, greater potential returns are associated with increased risks. For individuals to invest, finding the balance, between risk tolerance and investment approach is essential to minimize stress and prevent possible financial setbacks.

Setting Investment Goals

Determining your investment objectives is another step. Are you aiming for profits sustained long-term growth or a steady stream of income? Your objectives will impact the investment options you choose.

Best Way to Invest $500

Equities Market

Investing $500 wisely can be done by exploring the stock market. With a history of returns spanning over a century, the U.S. Stock market is a choice, for beginners. Opting for stocks or exchange-traded funds (ETFs) allows investors to diversify across sectors and industries minimizing risks and maximizing profits.

Exchange-Traded Funds (ETFs)

Exchange-traded funds (ETFs) offer a starting point, for newcomers to investing. These funds provide diversification by mirroring indexes such, as the S&P 500. Opting for an ETF allows you to access a market sector without having to select stocks.

Individual Stocks

If you like getting involved choosing to invest in stocks can bring good returns. Yet it demands study and a deeper grasp of the market. New investors could think about beginning with established companies known for growth and dividends over time.

Cryptocurrency

Experienced investors may find cryptocurrency to be an option. Bitcoin and Ethereum, among other currencies, have demonstrated substantial growth in the last ten years. Nonetheless, they also carry increased volatility and risk. Conducting research and gaining an understanding of the market are crucial steps to take before delving into cryptocurrency investments.

Where to Invest $500 Right Now

To help you get started, we have compiled a continuously updated list of stocks to invest in right now. Our first list is the best stocks for beginners, and the second list includes the best value stocks.

Beginner Stocks

For newcomers, in the investment world, these stocks are a starting point. They come from established companies known for their performance. Opting for beginner stocks can lay the groundwork, for your investment portfolio.

Value Stocks

Stocks of value refer to shares of businesses that are perceived as being undervalued compared to their worth. These stocks have the potential, for growth when the market acknowledges and rectifies their status.

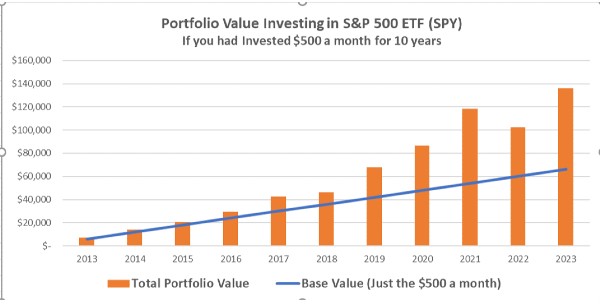

If I Invest $500 a Month for 10 Years

Regularly putting money into investments can result in wealth growth, in the run. Let us delve into the scenario of investing $500, per month for a decade.

Scenario: Investing in an S&P 500 ETF

If you began investing $500 each month in an S&P 500 ETF, in 2013 by the year 2023 your total investment would amount to $60,000. Based on the return rate of about 10% your investment would have expanded to roughly $75,996 after ten years resulting in a profit of 127%.

Graph showing the growth of $500 monthly investment in SPY ETF over 10 years.

This example demonstrates the power of compound interest and the benefits of regular, disciplined investing.

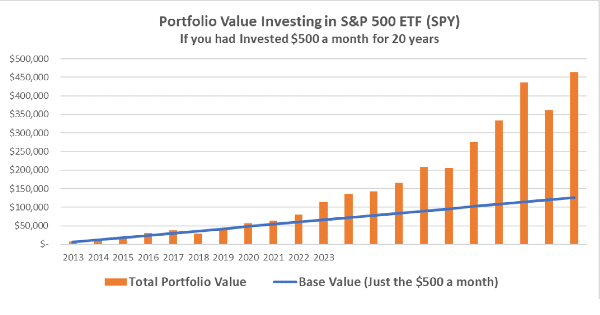

If I Invest $500 a Month for 20 Years

Let’s extend the investment horizon to 20 years to see the long-term potential.

Scenario: Investing in an S&P 500 ETF

If you started putting $500 into the SPY ETF every month in 2003 by 2023 your initial investment of $120,000 would have ballooned to, around $463,000. That's a 286% increase, in your money.

Graph showing the growth of $500 monthly investment in SPY ETF over 20 years

Graph showing the growth of $500 monthly investment in SPY ETF over 20 years

This long-term approach highlights the significant benefits of starting early and staying committed to a regular investment plan.

What is a Good Amount to Invest for Beginners?

For beginners, starting with any amount you can afford is beneficial. While $500 is a great starting point, the critical factor is consistency. Regular contributions, no matter how small, can accumulate into substantial wealth over time.

Building a Habit

Establishing a routine of investing holds more significance, than the initial sum. Even modest monthly investments have the potential to expand substantially as a result of compound interest. The crucial factor is initiating early and maintaining regularity.

Utilizing Investment Platforms

Numerous investment platforms are designed for newcomers with no investment demands. Services such, as Robinhood, Acorns, and Betterment feature use interfaces and educational materials to assist novice investors in getting underway.

Is It Worth to Buy Less Than One Share

Investing in less than one share of a stock can be an interesting concept, especially with the rise of fractional shares. This option allows investors to buy a portion of a share, even if they can't afford a whole one. It's like owning a slice of a pie instead of the whole thing.

Here's why it can be worth considering:

Accessibility: Fractional shares make it possible for small investors to buy into expensive stocks like Amazon or Tesla without needing thousands of dollars.

Diversification: You can spread your investment across different stocks more easily. For example, with $100, you could buy fractions of shares in multiple companies rather than just one.

Learning and Engagement: It encourages learning about investing without risking a lot of money upfront. It's a hands-on way to understand how the stock market works.

Long-Term Growth Potential: Over time, even small investments can grow with the company's stock price. This can be particularly beneficial for companies that consistently perform well.

However, there are some things to keep in mind:

Fees: Some platforms charge fees for fractional trades, so be aware of these costs.

Fractional Limits: Not all stocks may be available for fractional trading, so you might not have access to every company.

Market Volatility: The stock market can be unpredictable, and investments can go up or down in value.

Conclusion

In summary, starting with $500 is sufficient to begin investing. By understanding your comfort level with risk setting investment objectives and selecting the investment options you can kickstart your financial journey. Whether you choose to enter the stock market or delve into cryptocurrencies the important thing is to start investing consistently and stay informed. Regular investing in increments has the potential to lead to substantial wealth accumulation over time.

Investing represents a voyage. Initiating it with $500 can pave the way, for prosperity. Therefore, take that step today. Witness your investments flourish.

For more information watch this video:

https://youtu.be/TMYN985e12o

Expertise provided by Darius Smith

Reviewed by Chaster Johnson

Introduction

Starting to invest can be a way to grow your wealth even though some think you need a lot of money to begin. But by using strategies and understanding the basics getting started with $500 can work out well. This piece looks into whether $ 500 is sufficient, for investing the ways to invest this sum, and the possible advantages of sticking to investments, in the long run.

Article Keywords

Can I Start Investing with $500?

Sure thing! You're good to begin investing with $500. Nowadays there are plenty of investment opportunities, for people starting with an amount of money. The important factors to consider are your comfort level, with risk that you aim to achieve with your investments, and the suitable ways to grow your funds.

Understanding Risk Tolerance

Your willingness to accept fluctuations, in investment returns is known as your risk tolerance. Generally, greater potential returns are associated with increased risks. For individuals to invest, finding the balance, between risk tolerance and investment approach is essential to minimize stress and prevent possible financial setbacks.

Setting Investment Goals

Determining your investment objectives is another step. Are you aiming for profits sustained long-term growth or a steady stream of income? Your objectives will impact the investment options you choose.

Best Way to Invest $500

Equities Market

Investing $500 wisely can be done by exploring the stock market. With a history of returns spanning over a century, the U.S. Stock market is a choice, for beginners. Opting for stocks or exchange-traded funds (ETFs) allows investors to diversify across sectors and industries minimizing risks and maximizing profits.

Exchange-Traded Funds (ETFs)

Exchange-traded funds (ETFs) offer a starting point, for newcomers to investing. These funds provide diversification by mirroring indexes such, as the S&P 500. Opting for an ETF allows you to access a market sector without having to select stocks.

Individual Stocks

If you like getting involved choosing to invest in stocks can bring good returns. Yet it demands study and a deeper grasp of the market. New investors could think about beginning with established companies known for growth and dividends over time.

Cryptocurrency

Experienced investors may find cryptocurrency to be an option. Bitcoin and Ethereum, among other currencies, have demonstrated substantial growth in the last ten years. Nonetheless, they also carry increased volatility and risk. Conducting research and gaining an understanding of the market are crucial steps to take before delving into cryptocurrency investments.

Where to Invest $500 Right Now

To help you get started, we have compiled a continuously updated list of stocks to invest in right now. Our first list is the best stocks for beginners, and the second list includes the best value stocks.

Beginner Stocks

For newcomers, in the investment world, these stocks are a starting point. They come from established companies known for their performance. Opting for beginner stocks can lay the groundwork, for your investment portfolio.

Value Stocks

Stocks of value refer to shares of businesses that are perceived as being undervalued compared to their worth. These stocks have the potential, for growth when the market acknowledges and rectifies their status.

If I Invest $500 a Month for 10 Years

Regularly putting money into investments can result in wealth growth, in the run. Let us delve into the scenario of investing $500, per month for a decade.

Scenario: Investing in an S&P 500 ETF

If you began investing $500 each month in an S&P 500 ETF, in 2013 by the year 2023 your total investment would amount to $60,000. Based on the return rate of about 10% your investment would have expanded to roughly $75,996 after ten years resulting in a profit of 127%.

Graph showing the growth of $500 monthly investment in SPY ETF over 10 years.

This example demonstrates the power of compound interest and the benefits of regular, disciplined investing.

If I Invest $500 a Month for 20 Years

Let’s extend the investment horizon to 20 years to see the long-term potential.

Scenario: Investing in an S&P 500 ETF

If you started putting $500 into the SPY ETF every month in 2003 by 2023 your initial investment of $120,000 would have ballooned to, around $463,000. That's a 286% increase, in your money.

This long-term approach highlights the significant benefits of starting early and staying committed to a regular investment plan.

What is a Good Amount to Invest for Beginners?

For beginners, starting with any amount you can afford is beneficial. While $500 is a great starting point, the critical factor is consistency. Regular contributions, no matter how small, can accumulate into substantial wealth over time.

Building a Habit

Establishing a routine of investing holds more significance, than the initial sum. Even modest monthly investments have the potential to expand substantially as a result of compound interest. The crucial factor is initiating early and maintaining regularity.

Utilizing Investment Platforms

Numerous investment platforms are designed for newcomers with no investment demands. Services such, as Robinhood, Acorns, and Betterment feature use interfaces and educational materials to assist novice investors in getting underway.

Is It Worth to Buy Less Than One Share

Investing in less than one share of a stock can be an interesting concept, especially with the rise of fractional shares. This option allows investors to buy a portion of a share, even if they can't afford a whole one. It's like owning a slice of a pie instead of the whole thing.

Here's why it can be worth considering:

Accessibility: Fractional shares make it possible for small investors to buy into expensive stocks like Amazon or Tesla without needing thousands of dollars.

Diversification: You can spread your investment across different stocks more easily. For example, with $100, you could buy fractions of shares in multiple companies rather than just one.

Learning and Engagement: It encourages learning about investing without risking a lot of money upfront. It's a hands-on way to understand how the stock market works.

Long-Term Growth Potential: Over time, even small investments can grow with the company's stock price. This can be particularly beneficial for companies that consistently perform well.

However, there are some things to keep in mind:

Fees: Some platforms charge fees for fractional trades, so be aware of these costs.

Fractional Limits: Not all stocks may be available for fractional trading, so you might not have access to every company.

Market Volatility: The stock market can be unpredictable, and investments can go up or down in value.

Conclusion

In summary, starting with $500 is sufficient to begin investing. By understanding your comfort level with risk setting investment objectives and selecting the investment options you can kickstart your financial journey. Whether you choose to enter the stock market or delve into cryptocurrencies the important thing is to start investing consistently and stay informed. Regular investing in increments has the potential to lead to substantial wealth accumulation over time.

Investing represents a voyage. Initiating it with $500 can pave the way, for prosperity. Therefore, take that step today. Witness your investments flourish.

For more information watch this video:

https://youtu.be/TMYN985e12o