Sound investments

don't happen alone

Find your crew, build teams, compete in VS MODE, and identify investment trends in our evergrowing investment ecosystem. You aren't on an island anymore, and our community is here to help you make informed decisions in a complex world.

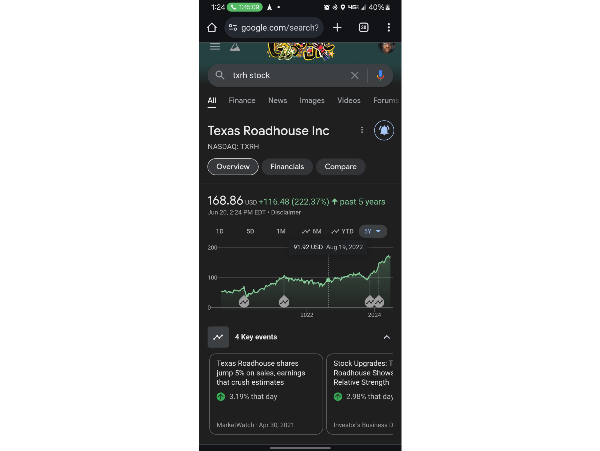

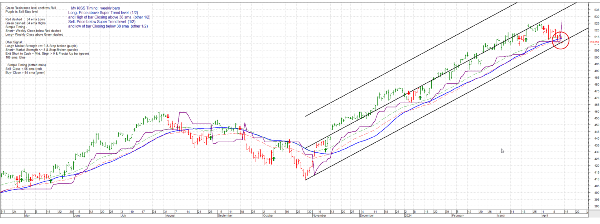

Price pushing $170 a share

I/we have no positions in any asset mentioned, and no plans to initiate any positions for the next 7 days