Is Eli Lilly and Company a Buy?

About Eli Lilly (LLY)

Eli Lilly and Company are an American pharmaceutical company founded in 1876, and headquartered in Indianapolis, Indiana. Their focus has been on the development and research of medications and therapies to treat depression, such as Prozac and Cymbalta, as well as their drugs for diabetes, Humalog and Trulicity. These combine to bring in the majority of Eli Lilly’s revenues, which in 2023 was over $34 billion.

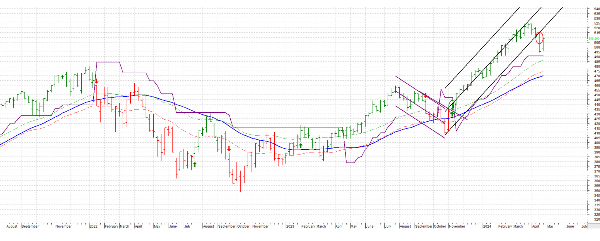

The increase in their revenues has been consistent, and is one of the reasons that Eli Lilly is one of the largest healthcare companies in the world, ranking 127th in the Fortune 500. This is a large factor in the increase in stock price, which at the time of this writing is $893.98. This is one of the higher stock prices in the sector, and does potentially raise red flags for investors.

The formula to determine intrinsic value by GuruFocus, which I have written about in previous articles, is not kind to Eli Lilly. Their formula places an intrinsic value of $57.07, far lower than the current price. This is worse than 96% of other companies in the drug manufacturing sector. While this is certainly not good, there are other factors in play when determining the value of Eli Lilly’s stock.

The dividend for Eli Lilly has been a mixed bag. Over the past 20 years, they have never decreased their dividend, but also have not increased every year. Notably, from 2009-2014, they did not increase their quarterly dividend of $0.49. Currently, Eli Lilly pays annual dividends of 0.59% which is certainly not as strong as I would hope. The quarterly dividend of $1.30 comes after two years of the largest dividend increases in the company’s history, so there is potential in the future for this to become a strength.

What I Thought of Eli Lilly’s Q1 Earnings Report

Eli Lilly’s Q1 earnings for 2024 were certainly optimistic, as they improved over last year’s Q1 revenue by 26%. This is tremendous growth, and in addition to higher revenue, they also returned greater earnings per share versus last year, coming in 66% greater than last year.

These are strong signs, and have contributed to YTD increases in their stock price of nearly 50%. It has been an incredible year for investors in LLY, but is the time to buy already behind us?

Based on the projections for their revenue for the remainder of the year, there is still significant potential for greater increases to their stock price. Much of this success can be attributed to the increase in sales for Mounjaro. Mounjaro is a diabetes medication, similar to Ozempic, that has also shown signs of assisting in weight loss. It is important to note that Eli Lilly has NOT encouraged use of Mounjaro for cosmetic weight loss, though there is reason to believe that weight loss has been a factor for some using the medication.

Risk and Uncertainty?

One potential cause for concern for those considering investing in Eli Lilly is the number of shares being bought versus those being sold. According to Stockinvest.us, over 100 transactions, 6.36 thousand shares were bought, but in the same time 1.13 million were sold. Others, however, are saying they can see the stock price reaching $1,000 per share as Eli Lilly seeks to become the first healthcare company with a market cap over $1 trillion.

A large amount of uncertainty, but also optimism, is on the horizon. The development of a new Alzheimer’s treatment drug offers tremendous potential, as advisors to the FDA have endorsed the new medication. This new medication, Donanemab, is intended to slow the progression of Alzheimers in patients, but has already once been denied FDA approval while they ran more trials to determine its safety and viability.

If Donanemab is granted FDA approval this year, it could provide tremendous additional revenue to Eli Lilly, as competing medications can cost up to $26,000 annually. This does hinge on eventual FDA approval, which is not a guarantee, and anything less could negatively impact the stock price. We have seen in other companies that drugs that do not gain FDA approval can have adverse impacts to stock price.

Is Eli Lilly a Buy or Sell Opportunity?

There is some uncertainty in the prospects of investing in Eli Lilly, but while there is some risk, many are still saying Eli Lilly is a buy opportunity. Investors.com says the optimism for Donanemab is leading to the stock trading at all-time highs, and is even still a strong opportunity for investors. This seems to be the consensus among many investors, as all signs appear to point towards continued increases to the stock price, as well as increasing revenues in the next few years.

Eli Lilly appears on track to become the first healthcare stock to reach a market cap of $1 trillion, while also having the potential to reach $1,000 per share. Some analysts have set their price targets as high as $1,000 due to the success of their diabetes and weight-loss medications, as well as the potential benefits of Donanemab as soon as the end of this year.

All this combines to indicate that the market may be right, and that Eli Lilly should be considered a buy, as there is too much positive momentum and uninterrupted stock growth to be ignored. Eli Lilly appears poised to continue surpassing its competitors, and will likely become the first healthcare company with a $1 trillion market cap.

Is Eli Lilly and Company a Buy?

About Eli Lilly (LLY)

Eli Lilly and Company are an American pharmaceutical company founded in 1876, and headquartered in Indianapolis, Indiana. Their focus has been on the development and research of medications and therapies to treat depression, such as Prozac and Cymbalta, as well as their drugs for diabetes, Humalog and Trulicity. These combine to bring in the majority of Eli Lilly’s revenues, which in 2023 was over $34 billion.

The increase in their revenues has been consistent, and is one of the reasons that Eli Lilly is one of the largest healthcare companies in the world, ranking 127th in the Fortune 500. This is a large factor in the increase in stock price, which at the time of this writing is $893.98. This is one of the higher stock prices in the sector, and does potentially raise red flags for investors.

The formula to determine intrinsic value by GuruFocus, which I have written about in previous articles, is not kind to Eli Lilly. Their formula places an intrinsic value of $57.07, far lower than the current price. This is worse than 96% of other companies in the drug manufacturing sector. While this is certainly not good, there are other factors in play when determining the value of Eli Lilly’s stock.

The dividend for Eli Lilly has been a mixed bag. Over the past 20 years, they have never decreased their dividend, but also have not increased every year. Notably, from 2009-2014, they did not increase their quarterly dividend of $0.49. Currently, Eli Lilly pays annual dividends of 0.59% which is certainly not as strong as I would hope. The quarterly dividend of $1.30 comes after two years of the largest dividend increases in the company’s history, so there is potential in the future for this to become a strength.

What I Thought of Eli Lilly’s Q1 Earnings Report

Eli Lilly’s Q1 earnings for 2024 were certainly optimistic, as they improved over last year’s Q1 revenue by 26%. This is tremendous growth, and in addition to higher revenue, they also returned greater earnings per share versus last year, coming in 66% greater than last year. These are strong signs, and have contributed to YTD increases in their stock price of nearly 50%. It has been an incredible year for investors in LLY, but is the time to buy already behind us?

Based on the projections for their revenue for the remainder of the year, there is still significant potential for greater increases to their stock price. Much of this success can be attributed to the increase in sales for Mounjaro. Mounjaro is a diabetes medication, similar to Ozempic, that has also shown signs of assisting in weight loss. It is important to note that Eli Lilly has NOT encouraged use of Mounjaro for cosmetic weight loss, though there is reason to believe that weight loss has been a factor for some using the medication.

Risk and Uncertainty?

One potential cause for concern for those considering investing in Eli Lilly is the number of shares being bought versus those being sold. According to Stockinvest.us, over 100 transactions, 6.36 thousand shares were bought, but in the same time 1.13 million were sold. Others, however, are saying they can see the stock price reaching $1,000 per share as Eli Lilly seeks to become the first healthcare company with a market cap over $1 trillion.

A large amount of uncertainty, but also optimism, is on the horizon. The development of a new Alzheimer’s treatment drug offers tremendous potential, as advisors to the FDA have endorsed the new medication. This new medication, Donanemab, is intended to slow the progression of Alzheimers in patients, but has already once been denied FDA approval while they ran more trials to determine its safety and viability.

If Donanemab is granted FDA approval this year, it could provide tremendous additional revenue to Eli Lilly, as competing medications can cost up to $26,000 annually. This does hinge on eventual FDA approval, which is not a guarantee, and anything less could negatively impact the stock price. We have seen in other companies that drugs that do not gain FDA approval can have adverse impacts to stock price.

Is Eli Lilly a Buy or Sell Opportunity?

There is some uncertainty in the prospects of investing in Eli Lilly, but while there is some risk, many are still saying Eli Lilly is a buy opportunity. Investors.com says the optimism for Donanemab is leading to the stock trading at all-time highs, and is even still a strong opportunity for investors. This seems to be the consensus among many investors, as all signs appear to point towards continued increases to the stock price, as well as increasing revenues in the next few years.

Eli Lilly appears on track to become the first healthcare stock to reach a market cap of $1 trillion, while also having the potential to reach $1,000 per share. Some analysts have set their price targets as high as $1,000 due to the success of their diabetes and weight-loss medications, as well as the potential benefits of Donanemab as soon as the end of this year.

All this combines to indicate that the market may be right, and that Eli Lilly should be considered a buy, as there is too much positive momentum and uninterrupted stock growth to be ignored. Eli Lilly appears poised to continue surpassing its competitors, and will likely become the first healthcare company with a $1 trillion market cap.