Why is Healthcare a Good Sector to Invest In?

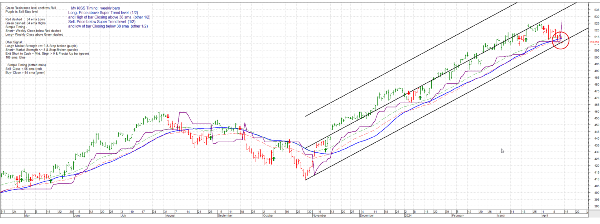

Healthcare is one of the largest market sectors in the world. In fact, U.S Bank has identified healthcare as the third largest sector in the S&P 500. After a challenging 2023, healthcare stocks began to perform better so far in 2024. To put it into perspective, in 2023, the S&P Health Care Index fell far behind the market, rising 2.06%. This is during a time when the 26.29% for the S&P 500. So far in 2024, the Health Care Index has gained 6.69%, about 1% below the S&P 500.

While these numbers are definitely improving, you may still be wondering where this ranks compared to other sectors? A study from InvestinGoal has identified the healthcare sector as the third best in terms of return. The average return was 13.4%, falling just behind the IT and consumer discretionary sectors. Some companies in the sector that have been experiencing some notable growth in recent years include Stryker, Pfizer, and Johnson & Johnson.

Advantages of Investing in Healthcare Stocks

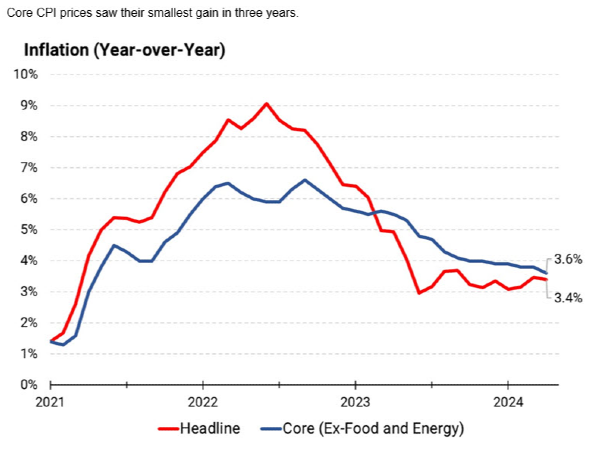

As mentioned previously, the healthcare sector is one of the highest performing in terms of return. Healthcare stocks tend to be resilient and resistant to recession and inflation. This, along with the high rate of return make healthcare stock an attractive option for investors.

Innovation lies at the heart of healthcare stocks and their performance. The rapid innovation within the sector can offer attractive growth opportunities. Companies that may not have been in the public eye can very quickly become a major player due to innovations in technology or treatment. For example, McKesson Corporation, a pharmaceutical company, has increased from revenues of $231 billion in 2020 to $309 billion now. This is largely due to being a key distributor of Covid-19 vaccines.

Risks of Investing in Healthcare Stocks

While resistance to negative market trends is an important component of why investors may choose healthcare stocks, there are many factors that can affect stock prices. Changes to regulation, care standards, and potential failure of products are all risks you have to consider when investing in a healthcare stock.

Currently there is also a potential less obvious risk when considering investing in healthcare stocks. In an election year, many investors have viewed healthcare stocks as especially risky. Potential legislative changes have a clear potential impact on the performance of healthcare stocks. But this is not quite so simple. In fact, there has not been a noticeable consistent return pattern during election years.

How Can I Find the Best Healthcare Stocks to Invest In?

When investing, it can be difficult to know where to gather information and which resources to trust. After all, it is your money on the line at the end of the day. So, how do you determine which stocks to invest in? One tool I like to use is the GuruFocus FCF intrinsic value tool. This gives a good idea if a stock is valued appropriately based on their free-cash-flow.

Other well-known outlets will regularly publish their lists of stocks in any given sector that they believe represent good potential investments in the future. This is something I always take with a grain of salt. I advise always to do your own research when considering a stock. Recognizing trends in the market, studying recent performance, and using tools to identify how appropriately the stock is valued.

Is the Healthcare Sector Underperforming?

In 2024, there was certainly a bit of a lull in the performance in healthcare stocks. This is likely due to a “Covid-19 hangover” as many companies saw decreased revenue after the pandemic. This followed incredible growth in the pharmaceutical and biotech sub-sectors from 2020-2022. The sale of Covid-19 vaccines alone topped $90 billion in 2022. This was approximately 20% of all “blockbuster” biotech drug sales that year. After that kind of explosive growth, we were due for the sector to normalize.

Now, after a challenging 2023, there is a light at the end of the tunnel. Some biotech companies are trading at or near the largest discounts ever seen. This all despite the third highest rate of return of any market segment identified by U.S. Bank. As a long-term investment, with increasing lifespans, the healthcare sector offers another interesting potential advantage. By the year 2050, one in six people are projected to be aged 65 or greater. The reason this is significant is that this age group tends to spend three times as much on medical services than their younger counterparts. This offers an interesting idea to think about as that age group continues to increase in size.

Is the Healthcare Sector a Good Long-Term Investment?

By most metrics, the healthcare sector is a good investment. After an impressive stretch from 2020-2022, the revenues and growth of many companies slowed in 2023, but have settled again in 2024. In fact, as previously mentioned, healthcare stocks are trading at a greater discount than the greater market. This represents an interesting opportunity for investors.

Despite the struggles of the sector in recent years, the average return of 13.4% was higher than most sectors. Only the consumer discretionary and IT sector offered greater returns. Thanks to innovation and the protection from recession, healthcare stocks offer a safer option. The healthcare sector has been and looks to remain a good opportunity for investors both in the short and long-term.

With the increases to population and longer lifespans, the spending from customers on healthcare also appears poised to continue growing. More people are able to contribute to the industry, and for longer amounts of time. This is due in part to more people having access to healthcare. representing potential for even more growth across the sector.

Why is Healthcare a Good Sector to Invest In?

Healthcare is one of the largest market sectors in the world. In fact, U.S Bank has identified healthcare as the third largest sector in the S&P 500. After a challenging 2023, healthcare stocks began to perform better so far in 2024. To put it into perspective, in 2023, the S&P Health Care Index fell far behind the market, rising 2.06%. This is during a time when the 26.29% for the S&P 500. So far in 2024, the Health Care Index has gained 6.69%, about 1% below the S&P 500.

While these numbers are definitely improving, you may still be wondering where this ranks compared to other sectors? A study from InvestinGoal has identified the healthcare sector as the third best in terms of return. The average return was 13.4%, falling just behind the IT and consumer discretionary sectors. Some companies in the sector that have been experiencing some notable growth in recent years include Stryker, Pfizer, and Johnson & Johnson.

Advantages of Investing in Healthcare Stocks

As mentioned previously, the healthcare sector is one of the highest performing in terms of return. Healthcare stocks tend to be resilient and resistant to recession and inflation. This, along with the high rate of return make healthcare stock an attractive option for investors.

Innovation lies at the heart of healthcare stocks and their performance. The rapid innovation within the sector can offer attractive growth opportunities. Companies that may not have been in the public eye can very quickly become a major player due to innovations in technology or treatment. For example, McKesson Corporation, a pharmaceutical company, has increased from revenues of $231 billion in 2020 to $309 billion now. This is largely due to being a key distributor of Covid-19 vaccines.

Risks of Investing in Healthcare Stocks

While resistance to negative market trends is an important component of why investors may choose healthcare stocks, there are many factors that can affect stock prices. Changes to regulation, care standards, and potential failure of products are all risks you have to consider when investing in a healthcare stock.

Currently there is also a potential less obvious risk when considering investing in healthcare stocks. In an election year, many investors have viewed healthcare stocks as especially risky. Potential legislative changes have a clear potential impact on the performance of healthcare stocks. But this is not quite so simple. In fact, there has not been a noticeable consistent return pattern during election years.

How Can I Find the Best Healthcare Stocks to Invest In?

When investing, it can be difficult to know where to gather information and which resources to trust. After all, it is your money on the line at the end of the day. So, how do you determine which stocks to invest in? One tool I like to use is the GuruFocus FCF intrinsic value tool. This gives a good idea if a stock is valued appropriately based on their free-cash-flow.

Other well-known outlets will regularly publish their lists of stocks in any given sector that they believe represent good potential investments in the future. This is something I always take with a grain of salt. I advise always to do your own research when considering a stock. Recognizing trends in the market, studying recent performance, and using tools to identify how appropriately the stock is valued.

Is the Healthcare Sector Underperforming?

In 2024, there was certainly a bit of a lull in the performance in healthcare stocks. This is likely due to a “Covid-19 hangover” as many companies saw decreased revenue after the pandemic. This followed incredible growth in the pharmaceutical and biotech sub-sectors from 2020-2022. The sale of Covid-19 vaccines alone topped $90 billion in 2022. This was approximately 20% of all “blockbuster” biotech drug sales that year. After that kind of explosive growth, we were due for the sector to normalize.

Now, after a challenging 2023, there is a light at the end of the tunnel. Some biotech companies are trading at or near the largest discounts ever seen. This all despite the third highest rate of return of any market segment identified by U.S. Bank. As a long-term investment, with increasing lifespans, the healthcare sector offers another interesting potential advantage. By the year 2050, one in six people are projected to be aged 65 or greater. The reason this is significant is that this age group tends to spend three times as much on medical services than their younger counterparts. This offers an interesting idea to think about as that age group continues to increase in size.

Is the Healthcare Sector a Good Long-Term Investment?

By most metrics, the healthcare sector is a good investment. After an impressive stretch from 2020-2022, the revenues and growth of many companies slowed in 2023, but have settled again in 2024. In fact, as previously mentioned, healthcare stocks are trading at a greater discount than the greater market. This represents an interesting opportunity for investors.

Despite the struggles of the sector in recent years, the average return of 13.4% was higher than most sectors. Only the consumer discretionary and IT sector offered greater returns. Thanks to innovation and the protection from recession, healthcare stocks offer a safer option. The healthcare sector has been and looks to remain a good opportunity for investors both in the short and long-term.

With the increases to population and longer lifespans, the spending from customers on healthcare also appears poised to continue growing. More people are able to contribute to the industry, and for longer amounts of time. This is due in part to more people having access to healthcare. representing potential for even more growth across the sector.