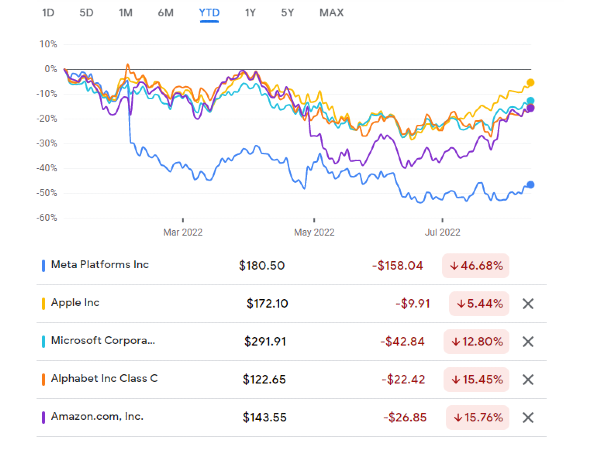

Many investors are worried about the continuous Meta stock price fall and they are concerned about "will meta stock go up?". The recent great plunge in the price of stock of nearly 50% has caused panic among the shareholders who are selling the Meta stock.

On the other hand, other investors have called this dip in price a short-term fall due to Meta's heavy investment in the future of Metaverse. Formerly konwn as Facebook, Metaverse has become a hot debate for the last three quarters due to the low quarterly earnings after having earned a revenue hike of more than $117 billion during 2021 due to the isolation and pandemic.

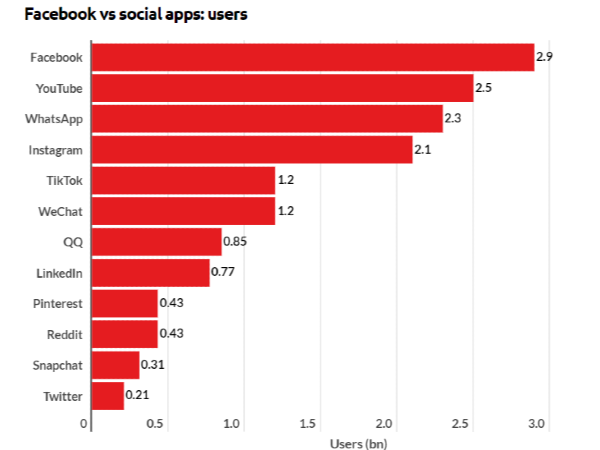

Is this social media giant doomed to fail after the end of covid-led revenues and the fierce competition from its competitors? Or, does it still dominate the market by owning the social media networks of Facebook, Instagram, and WhatsApp? Let’s dive deep!

Read other Stock analyses on Tesla (TSLA), Visa (V), Alphabet (GOOG), Apple (APPL) and Netflix (NFLX)

Meta–Social Metaverse Company

In 2004, Mark Zuckerberg developed a social media platform for connecting Harvard University Students. Nobody knew that It will be a game changer and it will connect people globally by revolutionizing the businesses. Facebook was listed on NASDAQ in 2012 and raised approximately $16 billion, a historic moment when Facebook became the third largest US IPO after VISA and General Motors.

Since its evolution and progress, this giant social media tech has acquired many Mergers & Acquisitions (M&As) to adapt to the latest trends in the world. Having acquired Instagram in 2012 and WhatsApp in 2014, it is now moving towards the world of virtual and augmented reality where people can connect virtually.

In 2021, Facebook was rebranded with the name of Metaverse to signify its commitment to the new augmented reality. However, the company witnessed a huge revenue fall after rebranding Facebook. The main source of revenue for Meta is advertising and it is equal to almost 97% of the total revenue. It earns only 2% of its revenue from its non-advertising sources.

Read analysis on dividend-paying stocks like Sempra Energy Stock (SRE), Edison International Stock (EIX), NRG Energy Stock and Dominion Energy Stock (D).

Fundamental Analysis

The company has witnessed a decline in revenues for the first time in its outstanding history so far. Besides, the main source of declining revenue is the decreased share of advertising due to the rising share of other competitors in the market. For example, Apple's privacy policy caused Metaverse to bear a cost of $10 billion last year.

Moreover, TikTok is attracting customers due to its short video-based content.

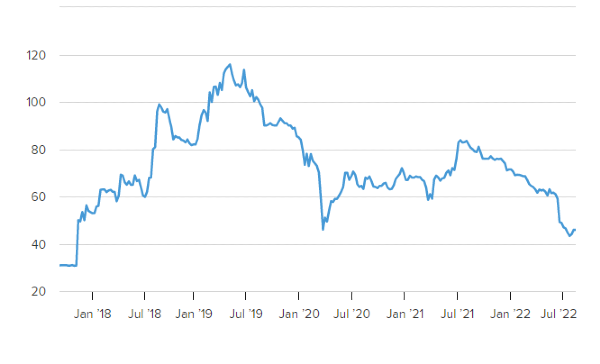

The Metaverse Platforms is currently valued at $485.12 billion with a P/E ratio of 14.96. The current share price of Meta is $180.50 after seeing the 52-week lowest of $154.25 and the 52-week highest price of $384.33.

| Meta Stock Metrics |

Values |

| Market Cap |

$485.10 Billion |

| P/E Ratio |

$14.95 |

| 52-week Range |

$154.25 - $383.33 |

| Shares Outstanding |

2.69 Billion |

| Beta |

1.33 |

| Earnings Yield |

6.93% |

| FCF Yield |

7.41% |

| BuyBack/Shareholder Yield |

5.70% |

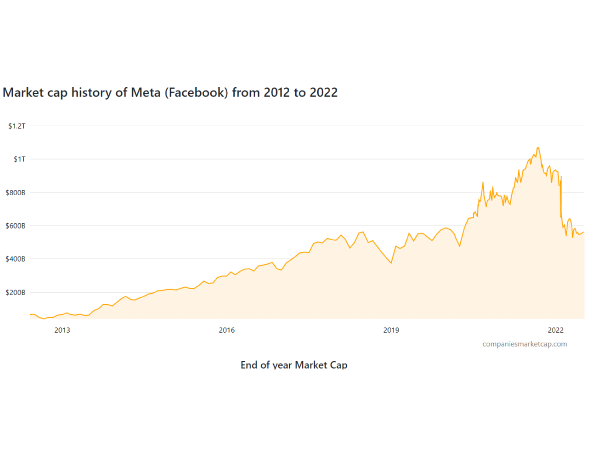

In June last year, Facebook's market capitalization hit the biggest market cap of $1 trillion for the first time. However, the market cap fell sharply after the rebranding of the company.

Since February, the market value of Meta stock dropped significantly after the company announced slow advertising growth and a lower number of Daily Active People (DAP). It lost approximately $232 billion in value after the announcement of a weaker financial report, naming as the biggest one-day stock drop in the history of the stock market.

The main contributors to the market cap plummeting were the changes in the privacy policy and the disruptions in the supply chains which brought the revenues down to 33.67 billion and $3.67 profit per share.

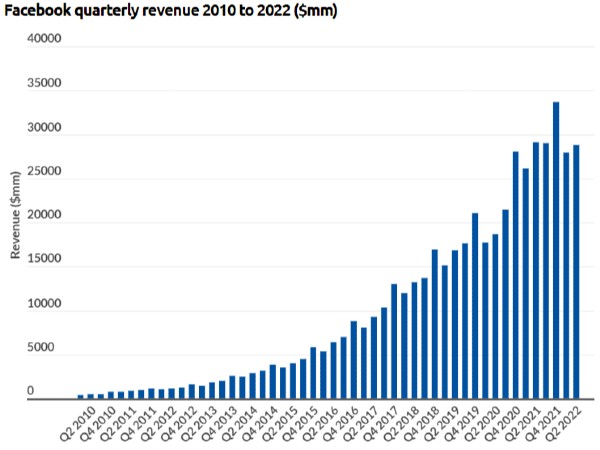

However, the company reported positive results with a stock surge of 18% and revenue growth of 7% in the first quarter of 2022. However, the stock was still down 40% from the start of the year due to the rising wave of inflation and tightening Fed policy.

In the second quarter report in July, Meta reported revenue of 28.82 billion and a net income of 669 billion. The EPS was missed by 3.56%, sending a selling signal to the investors.

| Meta Stock Metrics |

Q2 2021 |

Q3 2021 |

Q4 2021 |

Q1 2022 |

Q2 2022 |

| Revenue |

29.08 Billion |

29.0 Billion |

33.7 Billion |

27.9 Billion |

28.82 Billion |

| Net Income |

10.39 Billion |

9.2 Billion |

10.3 Billion |

7.47 Billion |

6.69 Billion |

| Diluted EPS |

3.61 |

3.22 |

3.67 |

2.72 |

2.46 |

| Net Profit Margin |

35.75% |

31.69% |

30.55% |

26.75% |

23.2% |

| DAP |

1.91 Billion |

4.54 Billion |

2.93 Billion |

2.87 Billion |

2.88 Billion |

| Ad Impressions |

N/A |

13% Up |

15% Up |

15% Up |

|

| Capital Expenditures |

4.74 Bilion |

4.54 Bilion |

5.54 Bilion |

5.55 Billion |

7.75 Billion |

| Cash, Cash Equivalents, Marketable Securities |

64.08 Bilion |

58.08 Bilion |

48 Bilion |

43.89 Billion |

40.49 Billion |

| Headcount |

63 404 |

68 177 |

71 970 |

77 805 |

83 553 |

The company attributed the fall in earnings to the failure of accessing more users due to the iOS privacy policy and the prevailing uncertainty in the market.

Read Also: Amazon Stock Price Prediction and What will Microsodt Stock be in 10 Years?

Will Meta Stock Go Up?

Meta Platforms have seen a sharp increase in expenses as well due to the heavy investment into the Metaverse. The company is investing in the future while sacrificing the current growth and revenues.

Moreover, the company announced the issuance of bonds of $10 billion. Although the purpose is not clear behind the first-ever bond selling. Most analysts predict it is for the sake of buying back the company's shares.

On the Free Cash Flow side, the company is still a cash cow and it has liquid assets of $40 billion with a free cash flow of 40 billion generated every year. So, buying back shares might have been pursued to increase the market value of the shares.

Meta stock is likely to go up only if Facebook succeeds in their achieving what they are struggling for being the first in providing the Metaverse experience to their users.

The Bottom Line

If you look at the short-term performance of a company, you might get panic due to the fall in Daily Active Users and the fall in revenues. However, long-term investors should look at the fundamentals of the corporation that gives direction on what the company would be in the future, and should invest in this low-valued stock.

So, it is a great opportunity to invest in this tech giant company that is still dominating social media. So meta stock is likely to go up if it succeeds in achieving its dream of delivering a virtual reality.

You don’t need to panic about the current stock price plunge and the loss of daily active users if you are going to achieve greater in the end. The business model is still solid and is likely to remian in the market for a long time.

Read Also: NextEra Energy Stock (NEE)

Many investors are worried about the continuous Meta stock price fall and they are concerned about "will meta stock go up?". The recent great plunge in the price of stock of nearly 50% has caused panic among the shareholders who are selling the Meta stock.

On the other hand, other investors have called this dip in price a short-term fall due to Meta's heavy investment in the future of Metaverse. Formerly konwn as Facebook, Metaverse has become a hot debate for the last three quarters due to the low quarterly earnings after having earned a revenue hike of more than $117 billion during 2021 due to the isolation and pandemic.

Is this social media giant doomed to fail after the end of covid-led revenues and the fierce competition from its competitors? Or, does it still dominate the market by owning the social media networks of Facebook, Instagram, and WhatsApp? Let’s dive deep!

Read other Stock analyses on Tesla (TSLA), Visa (V), Alphabet (GOOG), Apple (APPL) and Netflix (NFLX)

Meta–Social Metaverse Company

In 2004, Mark Zuckerberg developed a social media platform for connecting Harvard University Students. Nobody knew that It will be a game changer and it will connect people globally by revolutionizing the businesses. Facebook was listed on NASDAQ in 2012 and raised approximately $16 billion, a historic moment when Facebook became the third largest US IPO after VISA and General Motors.

Since its evolution and progress, this giant social media tech has acquired many Mergers & Acquisitions (M&As) to adapt to the latest trends in the world. Having acquired Instagram in 2012 and WhatsApp in 2014, it is now moving towards the world of virtual and augmented reality where people can connect virtually.

In 2021, Facebook was rebranded with the name of Metaverse to signify its commitment to the new augmented reality. However, the company witnessed a huge revenue fall after rebranding Facebook. The main source of revenue for Meta is advertising and it is equal to almost 97% of the total revenue. It earns only 2% of its revenue from its non-advertising sources.

Read analysis on dividend-paying stocks like Sempra Energy Stock (SRE), Edison International Stock (EIX), NRG Energy Stock and Dominion Energy Stock (D).

Fundamental Analysis

The company has witnessed a decline in revenues for the first time in its outstanding history so far. Besides, the main source of declining revenue is the decreased share of advertising due to the rising share of other competitors in the market. For example, Apple's privacy policy caused Metaverse to bear a cost of $10 billion last year.

Moreover, TikTok is attracting customers due to its short video-based content. The Metaverse Platforms is currently valued at $485.12 billion with a P/E ratio of 14.96. The current share price of Meta is $180.50 after seeing the 52-week lowest of $154.25 and the 52-week highest price of $384.33.

In June last year, Facebook's market capitalization hit the biggest market cap of $1 trillion for the first time. However, the market cap fell sharply after the rebranding of the company.

Since February, the market value of Meta stock dropped significantly after the company announced slow advertising growth and a lower number of Daily Active People (DAP). It lost approximately $232 billion in value after the announcement of a weaker financial report, naming as the biggest one-day stock drop in the history of the stock market.

The main contributors to the market cap plummeting were the changes in the privacy policy and the disruptions in the supply chains which brought the revenues down to 33.67 billion and $3.67 profit per share.

However, the company reported positive results with a stock surge of 18% and revenue growth of 7% in the first quarter of 2022. However, the stock was still down 40% from the start of the year due to the rising wave of inflation and tightening Fed policy.

In the second quarter report in July, Meta reported revenue of 28.82 billion and a net income of 669 billion. The EPS was missed by 3.56%, sending a selling signal to the investors.

The company attributed the fall in earnings to the failure of accessing more users due to the iOS privacy policy and the prevailing uncertainty in the market.

Read Also: Amazon Stock Price Prediction and What will Microsodt Stock be in 10 Years?

Will Meta Stock Go Up?

Meta Platforms have seen a sharp increase in expenses as well due to the heavy investment into the Metaverse. The company is investing in the future while sacrificing the current growth and revenues.

Moreover, the company announced the issuance of bonds of $10 billion. Although the purpose is not clear behind the first-ever bond selling. Most analysts predict it is for the sake of buying back the company's shares.

On the Free Cash Flow side, the company is still a cash cow and it has liquid assets of $40 billion with a free cash flow of 40 billion generated every year. So, buying back shares might have been pursued to increase the market value of the shares.

Meta stock is likely to go up only if Facebook succeeds in their achieving what they are struggling for being the first in providing the Metaverse experience to their users.

The Bottom Line

If you look at the short-term performance of a company, you might get panic due to the fall in Daily Active Users and the fall in revenues. However, long-term investors should look at the fundamentals of the corporation that gives direction on what the company would be in the future, and should invest in this low-valued stock.

So, it is a great opportunity to invest in this tech giant company that is still dominating social media. So meta stock is likely to go up if it succeeds in achieving its dream of delivering a virtual reality.

You don’t need to panic about the current stock price plunge and the loss of daily active users if you are going to achieve greater in the end. The business model is still solid and is likely to remian in the market for a long time.

Read Also: NextEra Energy Stock (NEE)