Sound investments

don't happen alone

Find your crew, build teams, compete in VS MODE, and identify investment trends in our evergrowing investment ecosystem. You aren't on an island anymore, and our community is here to help you make informed decisions in a complex world.

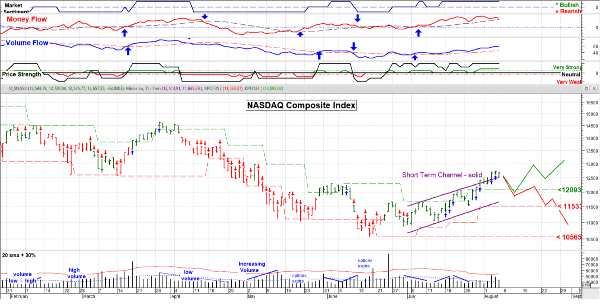

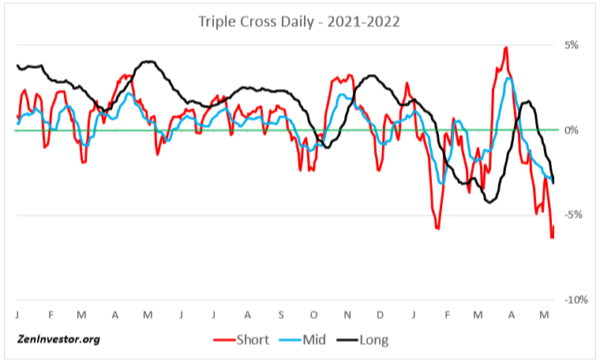

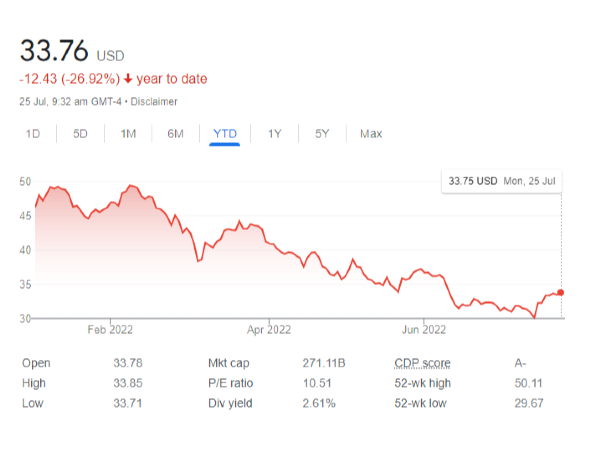

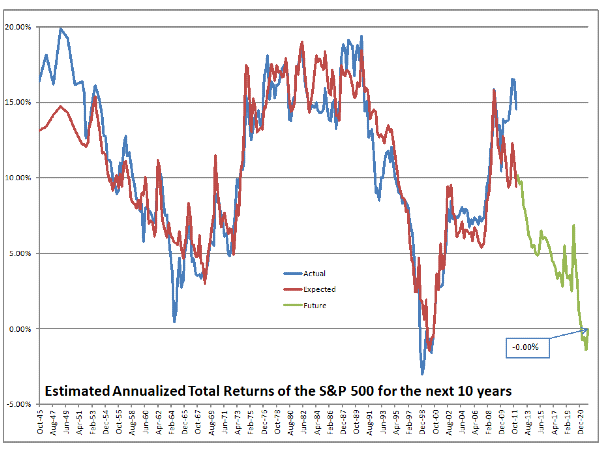

August 12, 2022 – This was a good week for the stock market . . . a steady march higher. My momentum / statistical indicators show that it is likely to pull back shortly. I feel that it will either be a short pull back then resumption higher (in green) or a pull back and the start of a consolidation pattern (in orange). In either case it sure is looking like the bottom is in, well, at least for now (the next couple of months). chart available at www.special-risk.net

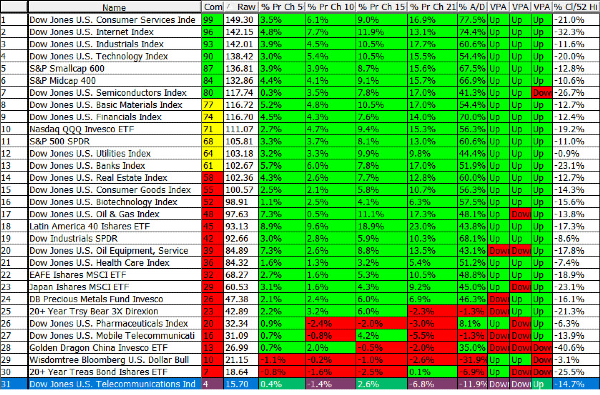

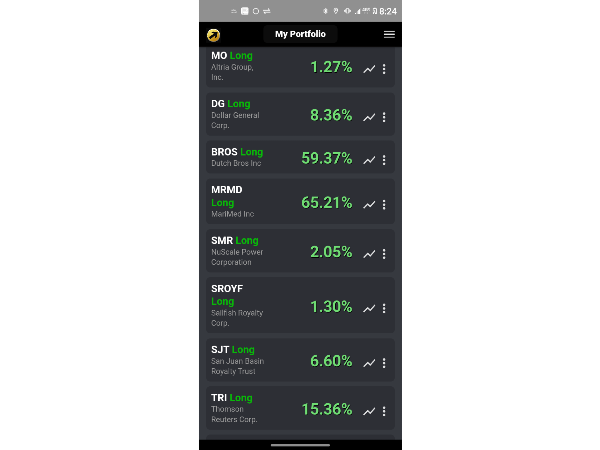

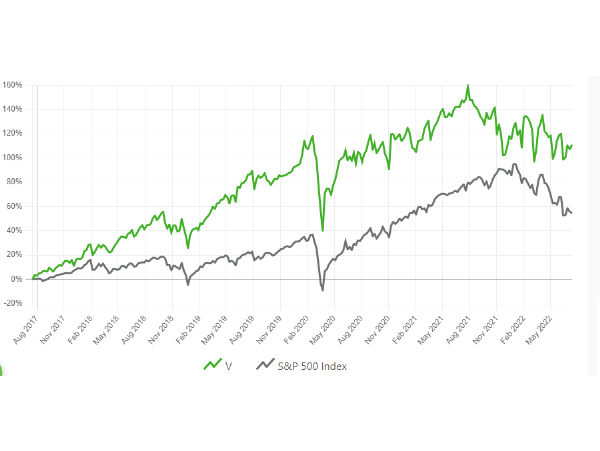

Our task now is to identify where to put investable funds, especially if that pull back happens soon. That’s where “Top Down Analysis” comes in. First determine the overall market Trend, then identify what Sectors are leading that Trend. Next what stocks in those sectors are the strongest. Scaling into positions is recommended; no need to jump into the deep end all at once. The Short Term Sector Strength table below gives us the information for the second step.

Overall we’re seeing some insider buying of their shares, the % of stocks above their 50 moving average is Bullish and Small Cap stocks are strong. With Technology strong and Financials gaining that appears to be “Risk On” mode. It’s been a busy week for me and I’ve still got a lot to do, so this will be a short posting, but the three steps that I outlined are important and deserve some careful thought by investors.

Have a good week. ………. Tom ……….. Comments are always welcome. Price chart by MetaStock; table by www.HighGrowthStock.com. Used with permission.

I/we have a position in an asset mentioned