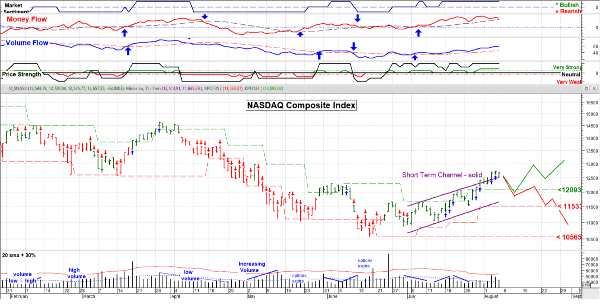

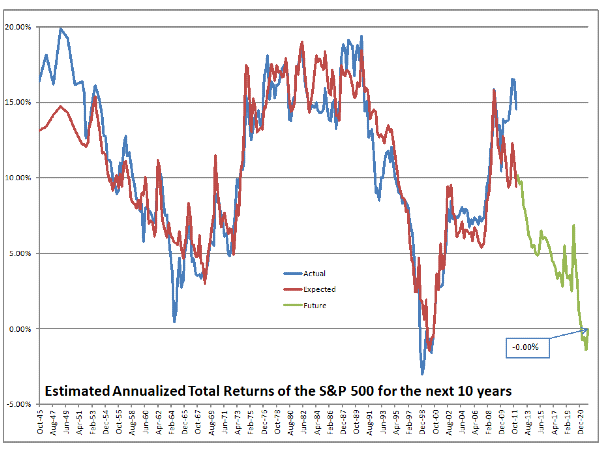

The markets have recovered a little over the past three weeks. But the market is still down for the year. Thus, the market has brought down many stocks with it. Over the past three weeks, the market has been up a little over 7.5% from this year’s lows. However, this start to the year is one of the worst in many years. However, a down market creates opportunities. When the market is down, I like to find support levels and create price alerts at those support levels for all the companies that I am interested in buying or currently own. For example, Comcast (CMCSA) is undervalued with an approximately 2.5% dividend yield.

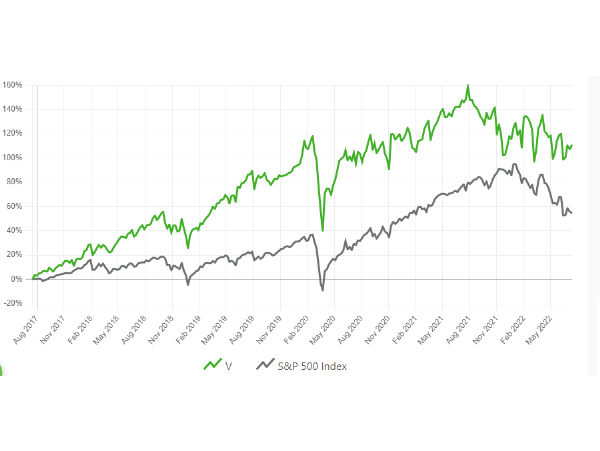

Hence, Comcast is one company that I have been buying as it hit a support level at $38. The chart below shows that the $38-$40 level was once a resistance level. Once resistance is broken, it then becomes support. That is why I bought more shares under $40. As of this writing, the stock is now at $42.72 per share. However, CMCSA is still undervalued at current levels, and the dividend yield is ~2.5%. Next, we will discuss more details about the company and the amount of undervaluation.

Source: TradingView

Comcast (CMCSA): Undervalued and 2.5% Yield

Overview of Comcast Corporation

Comcast Corporation is an US multinational telecommunications conglomerate headquartered in Philadelphia, Pennsylvania. The company was founded in1963. It is the second-biggest global broadcasting and cable TV business enterprise via revenue, the largest pay-TV corporation, the most significant cable television business enterprise, the largest home internet carrier provider in the US, and the country’s third largest domestic phone provider company. It services US residential and business customers in 40 states and the District of Columbia. Comcast is also a producer of feature movies for theatrical exhibitions and over-the-air and cable television programming through its NBC Universal division.

The founder’s son, Brian Roberts, is still the Chairman and CEO of Comcast. He owns less than 1% of the common stock, but all the Class B shares of the company give him 33% of the voting power.

Source: Comcast Investor Relations

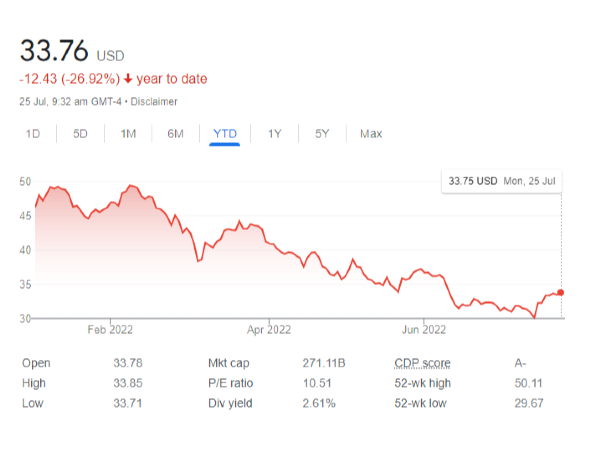

CMCSA was down 39% since its high in August 2021, 6 weeks ago. The main driver of the stock price decrease has nothing to do with the company itself. The price was run up fast in a short time. Also, the overall market has gone down as well, entering a bear market.

As of this writing, the current stock price is $42.72, the lower end of the 52-week range, between $37.56 and $61.80 per share. Thus, CMCSA looks like a stock that seems to be in the right place to buy up shares where both the 52-week range and support line meet.

CMCSA Dividend History, Growth, and Yield

We will now look at CMCSA’s dividend history, growth, and yield. We will then determine if it’s still a good buy at current prices.

CMCSA is considered a Dividend Contender, a company that has increased its dividend for more than ten years. In this case, CMCSA has increased its dividend for 14 consecutive years. CMCSA’s most recent dividend increase was 8% to $0.27 from $0.25 per share, announced in January 2022.

Dividend Yield

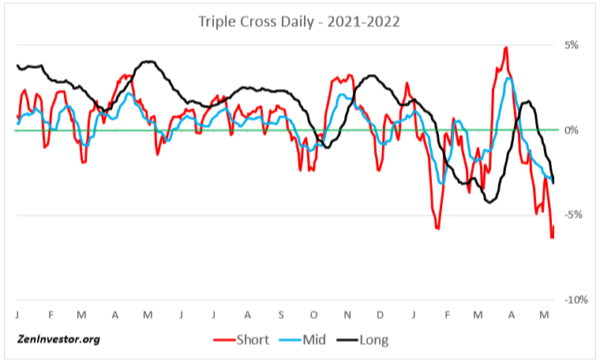

Next, according to Portfolio Insight* , CMCSA has a five-year dividend growth rate of roughly 7.74%, which is solid. However, the 10-year dividend growth rate is more significant at ~13.65%, exceeding the inflation rate.

Something critical to note is that CMCSA continued to pay its dividend during the last century’s most challenging period for businesses. Many businesses and industries cut or suspended their dividend payments during the COVID-19 pandemic. However, CMCSA continued to pay out its dividend and instead increased it. That is very remarkable. This fact alone leads me to believe in the strength of the company and the fact that management is committed to the dividend policy.

Dividend Yield

The company has an excellent dividend yield of approximately 2.5%, which is more than double the average dividend yield of the S&P 500 Index. This dividend yield is a respectable initial yield for investors following a dividend growth strategy.

This dividend yield is also suitable for investors leaving the bond market looking for higher yields. Although, it may not be an excellent stock for income-driven investors who may want a 4.5% yield or more. However, with the company’s increasing dividend rate, I can see over 5% yield on cost (YOC) in the next 5 to 7 years.

Source: Portfolio Insight*

CMCSA’s current dividend yield is higher than its own 5-year average dividend yield of 1.9%. I like to look at this metric because it gives me a good idea if a company I am researching is undervalued or overvalued based on the current and 5-year average yield. Stock price and dividend yield are inversely related. If the stock price increases, the dividend yield decreases, and vice versa.

Dividend Safety

Let’s determine if the current dividend is safe. This metric is essential to look at as an income investor. Unfortunately, undervalued dividend stocks sometimes present a “value trap,” and the stock price can continue to decline.

We must look at two critical metrics to determine if the dividend payments are safe yearly. The first one is earning per share (EPS), and then we must look into Free Cash Flow (FCF) per share or Operating Cash Flow (OCF).

Analysts predict that CMCSA will earn an EPS of about $3.59 per share for the fiscal year (FY) 2022. Analysts are 54% accurate when predicting CMCSA’s future EPS, and the company beats these estimates 38% of the time. In addition, the company is expected to pay out $1.08 per share in dividends for the entire year. These numbers give a payout ratio of approximately 30% based on EPS, a conservative value, leaving the company with much room to continue to grow its dividend.

I am excited by having a 50% or lower dividend coverage with a dividend yield of 2.5% for future growth. This point will allow the company to continue to grow its dividend at a mid-single-digit rate, a high single-digit rate, or even higher, as it has been doing for the past ten years, without sacrificing dividend safety. In addition, CMCSA has a dividend payout ratio of 32% on an FCF basis. Thus, the dividend is well covered in both EPS and FCF.

CMCSA Revenue and Earnings Growth / Balance Sheet Strength

We will now look at how well CMCSA performed and grew its EPS and revenue throughout the years. When valuing a company, these two metrics are at the top of my list to study. Without revenue growth, a company can’t have sustainable EPS growth and continue paying a growing dividend.

CMCSA revenues have been growing modestly at a compound annual growth rate (CAGR) of about 7.1% for the past ten years. Net income, however, did much better with a CAGR of ~9.6% over the same ten-year period.

However, according to Portfolio Insight* , EPS has grown 7.3% annually for the past ten years and at a CAGR of 13.2% over the past five years. Furthermore, EPS has significantly increased from FY2020 to FY2021, increasing nearly 24% year over year because of the low EPS that the company made during the COVID-19 year of 2020.

Since revenue, net income, and EPS did have good growth over the years, this stock is attractive based on its valuation and dividend yield. We will talk about the company’s valuation later in this article. In the meantime, analysts predict that the company will grow EPS at an11% rate over the next five years.

Last year’s EPS increased from $2.61 per share in FY2020 to $3.23 per share for FY2021, a significant increase of 24% considering the challenging two years because of the COVID-19 pandemic. This performance was an excellent growth year over year. Additionally, analysts expect CMCSA to make an EPS of $3.59 per share for the fiscal year 2022, which would be a ~11% increase compared to FY2021. I like to see that future earnings continue to grow.

The company has a solid balance sheet. CMCSA has an S&P Global credit rating of A-, an upper medium investment grade rating. Also, the company has a debt-to-equity ratio of 0.9, which is a good ratio. Thus, the company has a stable balance sheet to overcome significant economic downturns like the COVID-19 pandemic last two years, adding to the dividend safety.

CMCSA Risks

However, there are still risks with an investment in CMCSA. For example, if there is a recession, this can continue to bring the stock price lower as it did in the Great Recession and during the COVID-19 pandemic, which saw prices decrease 37.2% and 86.9%, respectively. Also, weakness in consumer spending because of higher inflation will hurt CMCSA’s top line.

On another note, the company acquired Sky, a European entertainment company with operations across Europe. Comcast bought Sky in 2018 for ~$39 billion-plus debt, and the acquisition has yet to add value for Comcast shareholders. However, Comcast has benefitted from this acquisition by using Sky technology to help build Peacock. Thus, I think this purchase will become profitable in a year or two.

CMCSA Competitive Advantage

CMCSA’s competitive advantage comes from its size and history of doing business. As a result, the company can optimize and scale much faster than most competitors. In addition, new organizations trying to enter would need to spend many billions of dollars to establish themselves as a key cable participants or entertainment networks. So, competitive pressures are not very excessive. The nationwide cord-cutting trend impacts the cable industry, though, as some clients are ditching conventional pay television entirely. Comcast has to this point, has been capable of withstanding this trend thru growth from its other businesses.

CMCSA is Undervalued

One of the valuation metrics that I like to look for is the dividend yield compared to the past few years histories. I also want to look for a lower price-to-earnings ratio based on the past 5-year or 10-year average. Lastly, I like to use the Dividend Discount Model (DDM). I use a DDM analysis because a business ultimately equals the sum of the future cash flow that that business can provide.

Let’s first look at the P/E ratio. CMCSA has a P/E ratio of ~12.4X based on FY 2022 EPS of $3.59 per share. The P/E multiple is excellent compared to the past 5-year PE average of 17.3X. If CMCSA were to revert back to a P/E of 17.3X, we would obtain a price of $62.11 per share.

Now let’s look at the dividend yield. As I mentioned, the dividend yield currently is 2.5%. There is good upside potential as CMCSA’s own 5-year dividend yield average is ~1.9%. For example, if CMCSA were to return to its dividend yield 5-year average, the price target would be $56.84.

The last item I like to look at to determine a fair price is the DDM analysis. I factored in an 11% discount rate and a long-term dividend growth rate of 9%. I use an 11% discount rate because of the higher-than-normal current dividend yield. In addition, the projected dividend growth rate is conservative and lower than its past 5-year average. These assumptions give a fair price target of approximately $58.86 per share.

If we average the three fair price targets of $62.11, $56.84, and $58.86, we obtain a reasonable, fair price of $59.27 per share, demonstrating is CMCSA is undervalued and gives a possible upside of 38.7% from the current $42.72 share price.

A look at the stock price and valuation metrics show that CMCSA is undervalued, according to Stock Rover*.

Conclusion on Comcast (CMCSA): Undervalued and 2.5% Yield

CMCSA is a high-quality, undervalued company that should meet most investors’ requirements. The company has a market-beating 2.5% yield and a long-term dividend growth history. Past earnings growth has been excellent. However, past performance does not mean it will be the same in the future. However, I am beating that CMCSA will do well. That is why I own shares and have been buying at this level.

*Disclosure: Long CMCSA

Thanks for reading Comcast (CMCSA): Undervalued and 2.5% Yield.

You can also read Medical Trust Properties (MPW): Undervalued and 7%+ Yield by the same author.

Author Bio: My name is Felix Martinez, and I am a Dividend Growth Investor who has invested in dividend growth stocks for the past seven years. I also run a YouTube channel called FiscalVoyage. I have written for SeekingAlpha.com as well as SureDividend.com. I focus on undervalued dividend growth stocks with capital return and dividend income potential. Make sure to follow me on my YouTube Channel. See you there.

Related Articles on Dividend Power

Here are my recommendations:

Look at my Review of the Simply Investing Report if you are unsure how to invest in dividend stocks or are just getting started with dividend investing. I provide a review of the Simply Investing Course and am an affiliate of Simply Investing.

If you are interested in an excellent resource for DIY dividend growth investors, I suggest reading my Review of The Sure Dividend Newsletter and I am an affiliate of Sure Dividend.

Read my Review of Stock Rover if you want leading investment research and a portfolio management platform with all the fundamental metrics, screens, and analysis tools you need. I am an affiliate of Stock Rover.

Please sign up for my free weekly e-mail if you would like notifications of when my new articles are published. You will receive a free Dividend Kings spreadsheet and will join thousands of other readers each month!

*This post contains affiliate links meaning I earn a commission for any purchases you make at the Affiliates website through these links. This will not incur additional costs for you. Please read my disclosure for more information.

The markets have recovered a little over the past three weeks. But the market is still down for the year. Thus, the market has brought down many stocks with it. Over the past three weeks, the market has been up a little over 7.5% from this year’s lows. However, this start to the year is one of the worst in many years. However, a down market creates opportunities. When the market is down, I like to find support levels and create price alerts at those support levels for all the companies that I am interested in buying or currently own. For example, Comcast (CMCSA) is undervalued with an approximately 2.5% dividend yield.

Hence, Comcast is one company that I have been buying as it hit a support level at $38. The chart below shows that the $38-$40 level was once a resistance level. Once resistance is broken, it then becomes support. That is why I bought more shares under $40. As of this writing, the stock is now at $42.72 per share. However, CMCSA is still undervalued at current levels, and the dividend yield is ~2.5%. Next, we will discuss more details about the company and the amount of undervaluation.

Source: TradingView

Comcast (CMCSA): Undervalued and 2.5% Yield

Overview of Comcast Corporation

Comcast Corporation is an US multinational telecommunications conglomerate headquartered in Philadelphia, Pennsylvania. The company was founded in1963. It is the second-biggest global broadcasting and cable TV business enterprise via revenue, the largest pay-TV corporation, the most significant cable television business enterprise, the largest home internet carrier provider in the US, and the country’s third largest domestic phone provider company. It services US residential and business customers in 40 states and the District of Columbia. Comcast is also a producer of feature movies for theatrical exhibitions and over-the-air and cable television programming through its NBC Universal division.

The founder’s son, Brian Roberts, is still the Chairman and CEO of Comcast. He owns less than 1% of the common stock, but all the Class B shares of the company give him 33% of the voting power.

Source: Comcast Investor Relations

CMCSA was down 39% since its high in August 2021, 6 weeks ago. The main driver of the stock price decrease has nothing to do with the company itself. The price was run up fast in a short time. Also, the overall market has gone down as well, entering a bear market.

As of this writing, the current stock price is $42.72, the lower end of the 52-week range, between $37.56 and $61.80 per share. Thus, CMCSA looks like a stock that seems to be in the right place to buy up shares where both the 52-week range and support line meet.

CMCSA Dividend History, Growth, and Yield

We will now look at CMCSA’s dividend history, growth, and yield. We will then determine if it’s still a good buy at current prices.

CMCSA is considered a Dividend Contender, a company that has increased its dividend for more than ten years. In this case, CMCSA has increased its dividend for 14 consecutive years. CMCSA’s most recent dividend increase was 8% to $0.27 from $0.25 per share, announced in January 2022.

Dividend Yield

Next, according to Portfolio Insight* , CMCSA has a five-year dividend growth rate of roughly 7.74%, which is solid. However, the 10-year dividend growth rate is more significant at ~13.65%, exceeding the inflation rate.

Source: Portfolio Insight

Something critical to note is that CMCSA continued to pay its dividend during the last century’s most challenging period for businesses. Many businesses and industries cut or suspended their dividend payments during the COVID-19 pandemic. However, CMCSA continued to pay out its dividend and instead increased it. That is very remarkable. This fact alone leads me to believe in the strength of the company and the fact that management is committed to the dividend policy.

Dividend Yield

The company has an excellent dividend yield of approximately 2.5%, which is more than double the average dividend yield of the S&P 500 Index. This dividend yield is a respectable initial yield for investors following a dividend growth strategy.

This dividend yield is also suitable for investors leaving the bond market looking for higher yields. Although, it may not be an excellent stock for income-driven investors who may want a 4.5% yield or more. However, with the company’s increasing dividend rate, I can see over 5% yield on cost (YOC) in the next 5 to 7 years.

Source: Portfolio Insight*

CMCSA’s current dividend yield is higher than its own 5-year average dividend yield of 1.9%. I like to look at this metric because it gives me a good idea if a company I am researching is undervalued or overvalued based on the current and 5-year average yield. Stock price and dividend yield are inversely related. If the stock price increases, the dividend yield decreases, and vice versa.

Dividend Safety

Let’s determine if the current dividend is safe. This metric is essential to look at as an income investor. Unfortunately, undervalued dividend stocks sometimes present a “value trap,” and the stock price can continue to decline.

We must look at two critical metrics to determine if the dividend payments are safe yearly. The first one is earning per share (EPS), and then we must look into Free Cash Flow (FCF) per share or Operating Cash Flow (OCF).

Analysts predict that CMCSA will earn an EPS of about $3.59 per share for the fiscal year (FY) 2022. Analysts are 54% accurate when predicting CMCSA’s future EPS, and the company beats these estimates 38% of the time. In addition, the company is expected to pay out $1.08 per share in dividends for the entire year. These numbers give a payout ratio of approximately 30% based on EPS, a conservative value, leaving the company with much room to continue to grow its dividend.

I am excited by having a 50% or lower dividend coverage with a dividend yield of 2.5% for future growth. This point will allow the company to continue to grow its dividend at a mid-single-digit rate, a high single-digit rate, or even higher, as it has been doing for the past ten years, without sacrificing dividend safety. In addition, CMCSA has a dividend payout ratio of 32% on an FCF basis. Thus, the dividend is well covered in both EPS and FCF.

CMCSA Revenue and Earnings Growth / Balance Sheet Strength

We will now look at how well CMCSA performed and grew its EPS and revenue throughout the years. When valuing a company, these two metrics are at the top of my list to study. Without revenue growth, a company can’t have sustainable EPS growth and continue paying a growing dividend.

CMCSA revenues have been growing modestly at a compound annual growth rate (CAGR) of about 7.1% for the past ten years. Net income, however, did much better with a CAGR of ~9.6% over the same ten-year period.

However, according to Portfolio Insight* , EPS has grown 7.3% annually for the past ten years and at a CAGR of 13.2% over the past five years. Furthermore, EPS has significantly increased from FY2020 to FY2021, increasing nearly 24% year over year because of the low EPS that the company made during the COVID-19 year of 2020.

Source: Portfolio Insight*

Since revenue, net income, and EPS did have good growth over the years, this stock is attractive based on its valuation and dividend yield. We will talk about the company’s valuation later in this article. In the meantime, analysts predict that the company will grow EPS at an11% rate over the next five years.

Last year’s EPS increased from $2.61 per share in FY2020 to $3.23 per share for FY2021, a significant increase of 24% considering the challenging two years because of the COVID-19 pandemic. This performance was an excellent growth year over year. Additionally, analysts expect CMCSA to make an EPS of $3.59 per share for the fiscal year 2022, which would be a ~11% increase compared to FY2021. I like to see that future earnings continue to grow.

The company has a solid balance sheet. CMCSA has an S&P Global credit rating of A-, an upper medium investment grade rating. Also, the company has a debt-to-equity ratio of 0.9, which is a good ratio. Thus, the company has a stable balance sheet to overcome significant economic downturns like the COVID-19 pandemic last two years, adding to the dividend safety.

CMCSA Risks

However, there are still risks with an investment in CMCSA. For example, if there is a recession, this can continue to bring the stock price lower as it did in the Great Recession and during the COVID-19 pandemic, which saw prices decrease 37.2% and 86.9%, respectively. Also, weakness in consumer spending because of higher inflation will hurt CMCSA’s top line.

On another note, the company acquired Sky, a European entertainment company with operations across Europe. Comcast bought Sky in 2018 for ~$39 billion-plus debt, and the acquisition has yet to add value for Comcast shareholders. However, Comcast has benefitted from this acquisition by using Sky technology to help build Peacock. Thus, I think this purchase will become profitable in a year or two.

CMCSA Competitive Advantage

CMCSA’s competitive advantage comes from its size and history of doing business. As a result, the company can optimize and scale much faster than most competitors. In addition, new organizations trying to enter would need to spend many billions of dollars to establish themselves as a key cable participants or entertainment networks. So, competitive pressures are not very excessive. The nationwide cord-cutting trend impacts the cable industry, though, as some clients are ditching conventional pay television entirely. Comcast has to this point, has been capable of withstanding this trend thru growth from its other businesses.

CMCSA is Undervalued

One of the valuation metrics that I like to look for is the dividend yield compared to the past few years histories. I also want to look for a lower price-to-earnings ratio based on the past 5-year or 10-year average. Lastly, I like to use the Dividend Discount Model (DDM). I use a DDM analysis because a business ultimately equals the sum of the future cash flow that that business can provide.

Let’s first look at the P/E ratio. CMCSA has a P/E ratio of ~12.4X based on FY 2022 EPS of $3.59 per share. The P/E multiple is excellent compared to the past 5-year PE average of 17.3X. If CMCSA were to revert back to a P/E of 17.3X, we would obtain a price of $62.11 per share.

Now let’s look at the dividend yield. As I mentioned, the dividend yield currently is 2.5%. There is good upside potential as CMCSA’s own 5-year dividend yield average is ~1.9%. For example, if CMCSA were to return to its dividend yield 5-year average, the price target would be $56.84.

The last item I like to look at to determine a fair price is the DDM analysis. I factored in an 11% discount rate and a long-term dividend growth rate of 9%. I use an 11% discount rate because of the higher-than-normal current dividend yield. In addition, the projected dividend growth rate is conservative and lower than its past 5-year average. These assumptions give a fair price target of approximately $58.86 per share.

If we average the three fair price targets of $62.11, $56.84, and $58.86, we obtain a reasonable, fair price of $59.27 per share, demonstrating is CMCSA is undervalued and gives a possible upside of 38.7% from the current $42.72 share price.

A look at the stock price and valuation metrics show that CMCSA is undervalued, according to Stock Rover*.

Conclusion on Comcast (CMCSA): Undervalued and 2.5% Yield

CMCSA is a high-quality, undervalued company that should meet most investors’ requirements. The company has a market-beating 2.5% yield and a long-term dividend growth history. Past earnings growth has been excellent. However, past performance does not mean it will be the same in the future. However, I am beating that CMCSA will do well. That is why I own shares and have been buying at this level.

*Disclosure: Long CMCSA

Thanks for reading Comcast (CMCSA): Undervalued and 2.5% Yield.

You can also read Medical Trust Properties (MPW): Undervalued and 7%+ Yield by the same author.

Author Bio: My name is Felix Martinez, and I am a Dividend Growth Investor who has invested in dividend growth stocks for the past seven years. I also run a YouTube channel called FiscalVoyage. I have written for SeekingAlpha.com as well as SureDividend.com. I focus on undervalued dividend growth stocks with capital return and dividend income potential. Make sure to follow me on my YouTube Channel. See you there.

Related Articles on Dividend Power

Here are my recommendations:

Look at my Review of the Simply Investing Report if you are unsure how to invest in dividend stocks or are just getting started with dividend investing. I provide a review of the Simply Investing Course and am an affiliate of Simply Investing.

If you are interested in an excellent resource for DIY dividend growth investors, I suggest reading my Review of The Sure Dividend Newsletter and I am an affiliate of Sure Dividend.

Read my Review of Stock Rover if you want leading investment research and a portfolio management platform with all the fundamental metrics, screens, and analysis tools you need. I am an affiliate of Stock Rover.

Please sign up for my free weekly e-mail if you would like notifications of when my new articles are published. You will receive a free Dividend Kings spreadsheet and will join thousands of other readers each month!

*This post contains affiliate links meaning I earn a commission for any purchases you make at the Affiliates website through these links. This will not incur additional costs for you. Please read my disclosure for more information.

Originally Posted on dividendpower.org