Sound investments

don't happen alone

Find your crew, build teams, compete in VS MODE, and identify investment trends in our evergrowing investment ecosystem. You aren't on an island anymore, and our community is here to help you make informed decisions in a complex world.

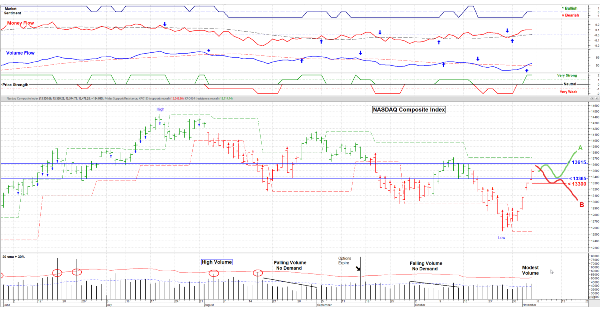

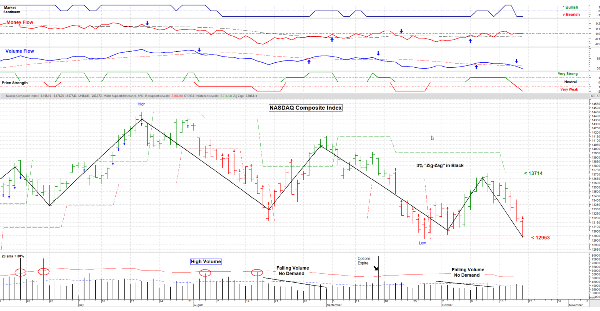

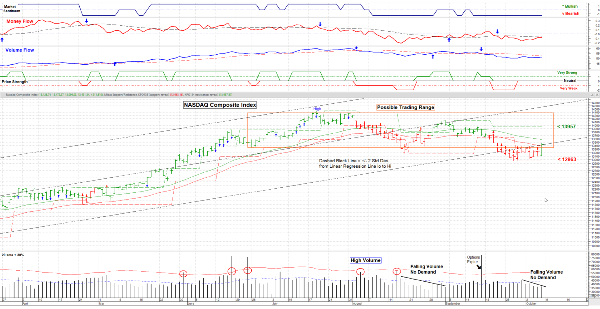

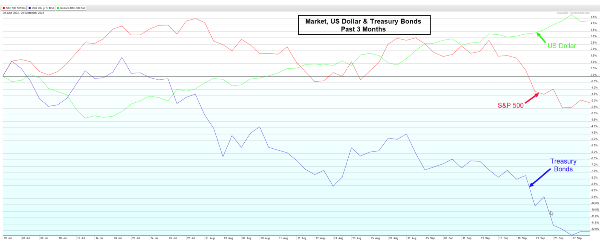

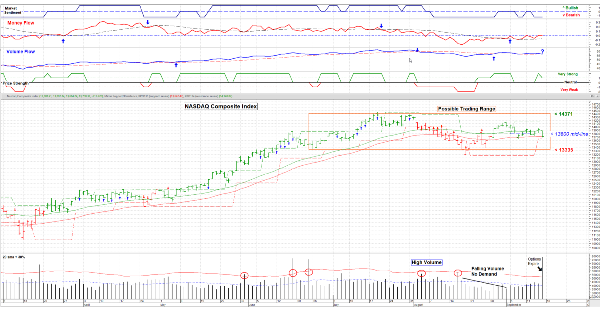

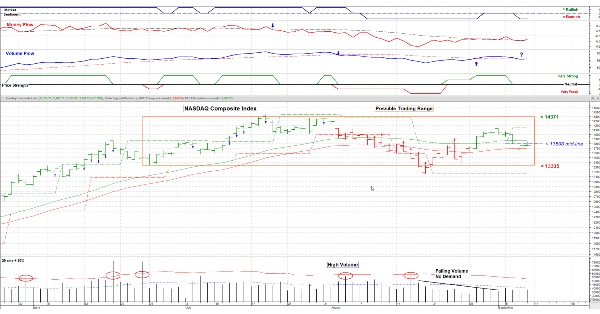

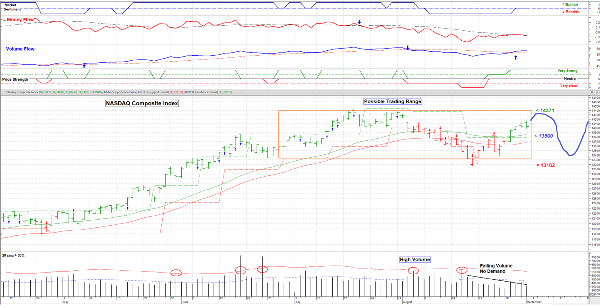

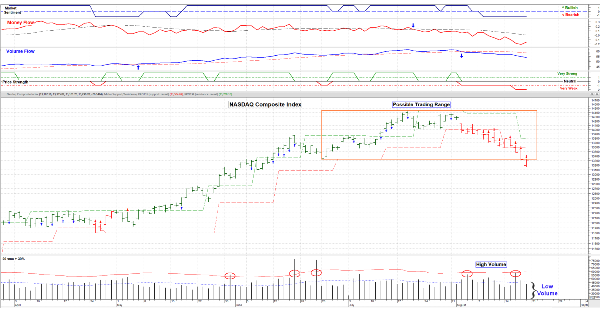

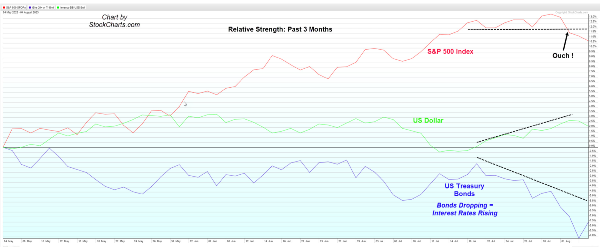

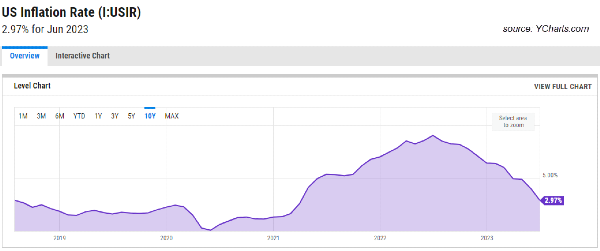

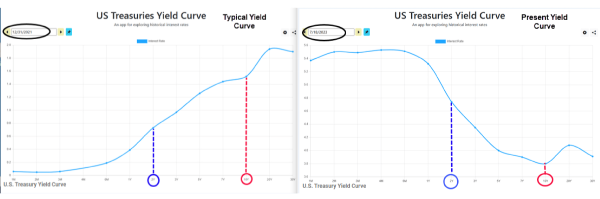

November 3, 2023 – OK, Wednesday it all started. No, not the FED as such (Powell holding interest rates steady was widely expected), it was Janel Yellen having an exceptionally successful T-Bond sale. It seemed that everyone is now expecting rates to hold steady, or nearly so, and early in 2024 rates will come down. Lower rates . . . equals higher bond prices, and they couldn’t wait to get ‘in’ on it. Add to the Bond prices going higher was a US Dollar going lower, making ‘things’ in the USA cheaper. Off the market went.

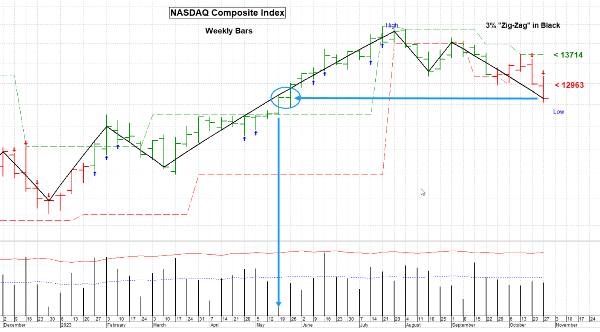

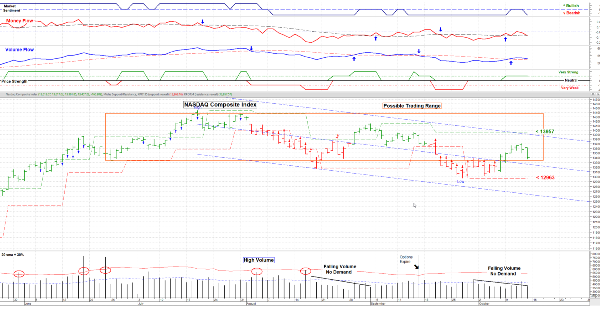

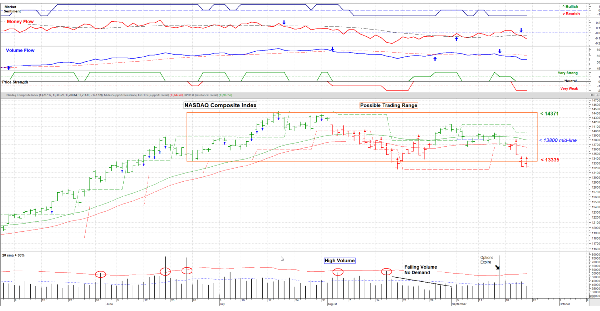

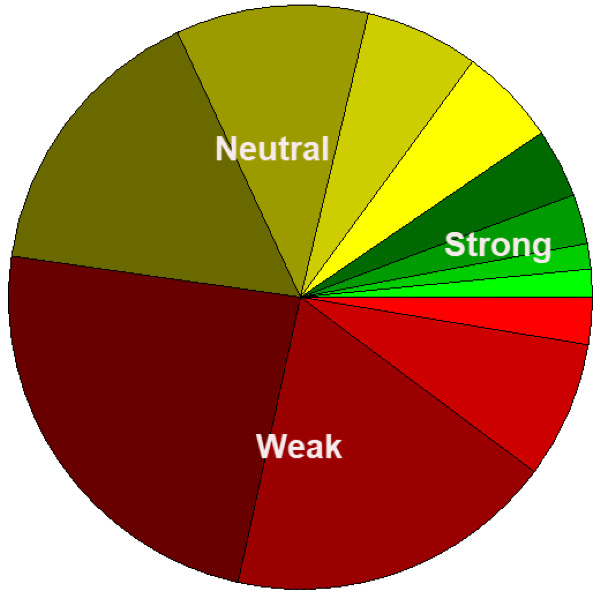

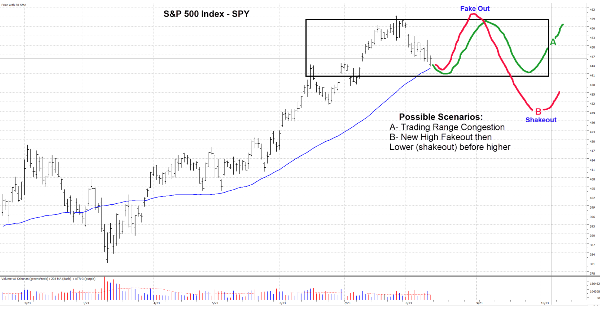

But we’re at or near an important level where in the past, things happened (blue lines). We’re either going to Scenario ‘A’ (green) and consolidate in November before finishing the year back higher. Or . . . Scenario ‘B’ (red) where we bounce just a little before heading back lower. The key level to watch is a close below 13300 on the NASDAQ Composite (roughly 431 on the SPY).

In either case, we should have to wait very long to see which way it goes.

Have a good week. …… Tom …..