NextEra Energy Stock Dividend has always been attractive and impressive for the shareholders. The stock market plunged in June this year, and NextEra Energy Stock did not stop paying its shareholders dividends.

In this article, we will discuss the NextEra Energy Stock Dividend and the returns expected to receive by the end of 2025. So, read about this large-cap energy stock listed on the NYSE.

Read Also: Is BBY A Buy or Sell? Is Best Buy still the Best Buy For Investors?

Company Profile

America’s third largest electricity utility company was founded in 1984 with the largest generation capacity of 58 GW. Serving America and Canada, it is the largest corporation to hold market capitalization.

This energy giant is leading the American energy storage market with storage facilities in nearly 12 states. These facilities are underway to serve another 13 states in the United States. Its energy system relies on solar and wind power generation with a capacity of 24Gw from fossil fuels.

Based in Florida, it lights the houses of more than 5 million people and with many subsidiaries in other states. It has successfully achieved the status of the World's largest utility company in decarbonization by focusing on wind and solar energy solutions.

NextEra Energy Stock Price

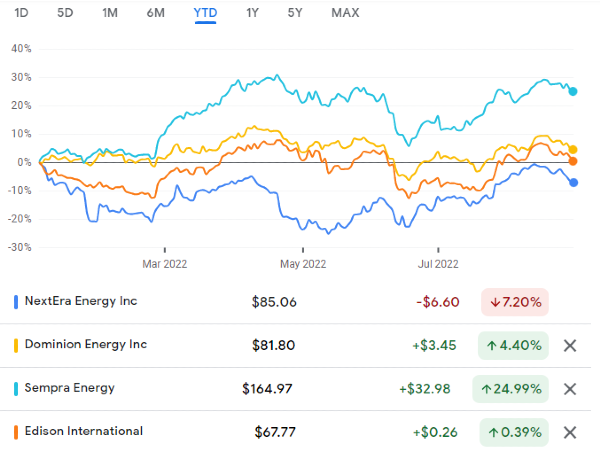

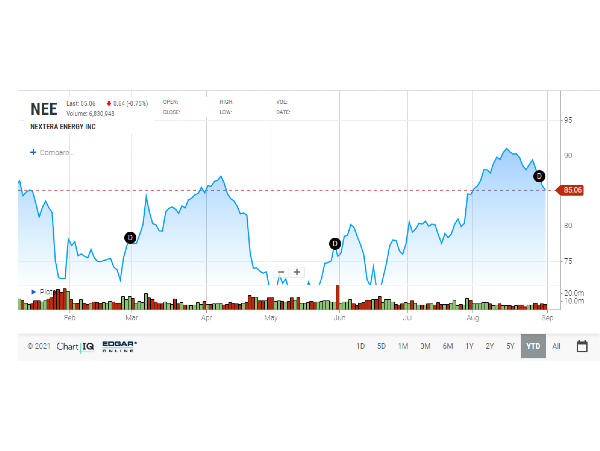

NextEra Energy's stock price is $85.06, and its price has fallen by 7.20% year to date. During the half year of 2022, the NEE price remained in a seesaw situation with many jumps and bumps. Except for the June low, it has gained momentum again and resumed its upward journey.

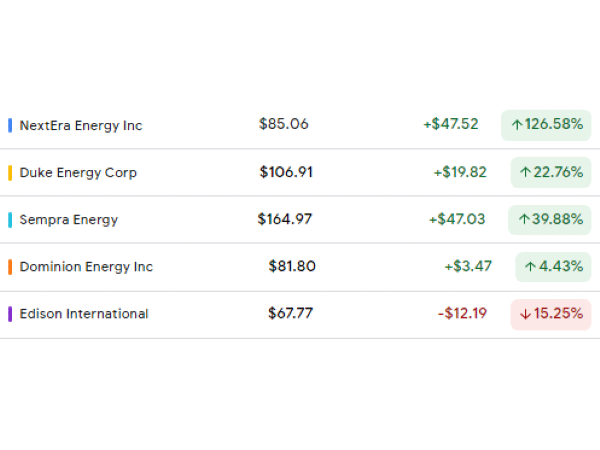

If we look back the last five years, we can notice that the price of NextEra Energy Stock has jumped by 126.58%, much higher than its peers in the utility industry.

However, NEE stock price has performed poorly this year as compared to its competitors, Sempra Energy Stock (SRE) and SRE Stock Forecast, Edison International Stock (EIX), NRG Energy Stock and Dominion Energy Stock (D).

The energy stock has a market capitalization of $167.21 billion with a P/E Ratio of 65.12. Its dividend yield has increased by 2% this quarter. Its Earnings per share have jumped from $0.40 in 2021 to $0.50 this year.

| NEE Stock Metrics |

Values |

| Market Cap |

$167.21 B |

| P/E Ratio |

65.12 |

| Dividend Yield |

2.00% |

| 52 Week Range |

$67.22 - $93.73 |

| Beta |

0.47 |

| EPS |

$0.50 |

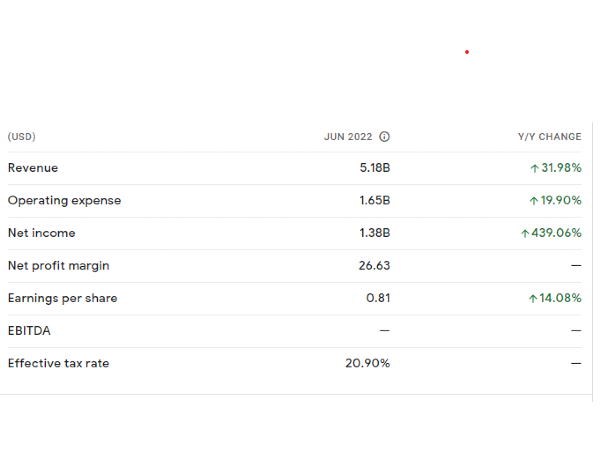

In the second quarter report that ended June 30, the company reported earnings of $5.18 billion, with an increase of 31.98% year over year. The increase in net income was a whopping 439.06%, reaching $1.38 billion.

The diluted EPS also jumped by 438.65% and reached 0.7. The net profit margin was impressive and grew as high as 26.63%.

Read Also: Visa (V) and Bank of America (BAC)

NextEra Energy stock Dividend

NextEra Energy stock dividend performed poorly during the half year 2022. However, the prospects for this stock's growth are higher due to the heavy investment of this energy giant into decarbonization. NextEra Energy stock revealed their mega plan for their commitment towards achieving sustainable energy solutions with their focus on Florida-based electric utility.

| Year |

Dividend Yield |

Year |

Dividend Yield |

| 2012 |

0.60 |

2018 |

1.11 |

| 2013 |

0.66 |

2019 |

1.25 |

| 2014 |

0.73 |

2020 |

1.40 |

| 2015 |

0.77 |

2021 |

1.54 |

| 2016 |

0.87 |

2022 |

1.66 |

| 2017 |

0.98 |

|

|

The table shows that the NEE stock dividend has grown over the last ten years and continues to increase this year as well. If NEE invests in renewable energy sources and succeeds in leading the market, the dividends are expected to grow by a percentage of 10% annually, as many analysts have predicted.

Read Also: Why is Apple Dividend So Low? and Amazon Stock Price Prediction.

NextEra Energy Stock Forecast

They committed to installing hundreds of million solar panels in Florida, adding a battery storage capacity of 50,000 Megawatt (MW). It will be more than 500 MW from today's battery storage capacity.

Moreover, it has shown its interest and commitment to switching to green hydrogen and renewable natural gas. It relies on natural gas to reduce carbon emissions and provide clean and green energy solutions.

In the long run, it will bring higher returns for the shareholders and reduced energy costs for their customers. So, it will be a win-win for the investors and customers if you use energy supplied by NextEra energy and have invested in this corporation.

Read Also: Will Meta Stock Go Up?

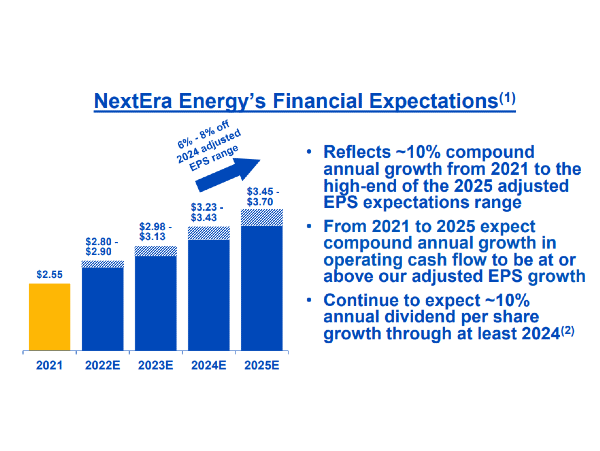

Moreover, the earnings-per-share are expected to grow by 10% by the end of 2025. The company's additional clean energy infrastructure investment will also grow to the estimated $85 - $95 billion by then.

The Real Zero strategy of NextEra Energy stock is attractive to many customers and investors. The EPS of this energy stock has accelerated by 8.4%, with a dividend growth of 9.8% annually.

Read also: Utility Stocks in a Recession- Are Utility Stocks a Good Buy Now?

The Bottom Line

NextEra Energy Stock is the best investment due to the high dividend payment and the high returns now and in the next three years. Suppose the utility company excels in providing renewable energy services by 2025. In that case, it can also provide the best returns for the upcoming ten years.

Read also about Tesla (TSLA) Alphabet (GOOG), and Netflix (NFLX) stocks

NextEra Energy Stock Dividend has always been attractive and impressive for the shareholders. The stock market plunged in June this year, and NextEra Energy Stock did not stop paying its shareholders dividends.

In this article, we will discuss the NextEra Energy Stock Dividend and the returns expected to receive by the end of 2025. So, read about this large-cap energy stock listed on the NYSE.

Read Also: Is BBY A Buy or Sell? Is Best Buy still the Best Buy For Investors?

Company Profile

America’s third largest electricity utility company was founded in 1984 with the largest generation capacity of 58 GW. Serving America and Canada, it is the largest corporation to hold market capitalization.

This energy giant is leading the American energy storage market with storage facilities in nearly 12 states. These facilities are underway to serve another 13 states in the United States. Its energy system relies on solar and wind power generation with a capacity of 24Gw from fossil fuels.

Based in Florida, it lights the houses of more than 5 million people and with many subsidiaries in other states. It has successfully achieved the status of the World's largest utility company in decarbonization by focusing on wind and solar energy solutions.

NextEra Energy Stock Price

NextEra Energy's stock price is $85.06, and its price has fallen by 7.20% year to date. During the half year of 2022, the NEE price remained in a seesaw situation with many jumps and bumps. Except for the June low, it has gained momentum again and resumed its upward journey.

If we look back the last five years, we can notice that the price of NextEra Energy Stock has jumped by 126.58%, much higher than its peers in the utility industry.

However, NEE stock price has performed poorly this year as compared to its competitors, Sempra Energy Stock (SRE) and SRE Stock Forecast, Edison International Stock (EIX), NRG Energy Stock and Dominion Energy Stock (D).

The energy stock has a market capitalization of $167.21 billion with a P/E Ratio of 65.12. Its dividend yield has increased by 2% this quarter. Its Earnings per share have jumped from $0.40 in 2021 to $0.50 this year.

In the second quarter report that ended June 30, the company reported earnings of $5.18 billion, with an increase of 31.98% year over year. The increase in net income was a whopping 439.06%, reaching $1.38 billion.

The diluted EPS also jumped by 438.65% and reached 0.7. The net profit margin was impressive and grew as high as 26.63%.

Read Also: Visa (V) and Bank of America (BAC)

NextEra Energy stock Dividend

NextEra Energy stock dividend performed poorly during the half year 2022. However, the prospects for this stock's growth are higher due to the heavy investment of this energy giant into decarbonization. NextEra Energy stock revealed their mega plan for their commitment towards achieving sustainable energy solutions with their focus on Florida-based electric utility.

The table shows that the NEE stock dividend has grown over the last ten years and continues to increase this year as well. If NEE invests in renewable energy sources and succeeds in leading the market, the dividends are expected to grow by a percentage of 10% annually, as many analysts have predicted.

Read Also: Why is Apple Dividend So Low? and Amazon Stock Price Prediction.

NextEra Energy Stock Forecast

They committed to installing hundreds of million solar panels in Florida, adding a battery storage capacity of 50,000 Megawatt (MW). It will be more than 500 MW from today's battery storage capacity.

Moreover, it has shown its interest and commitment to switching to green hydrogen and renewable natural gas. It relies on natural gas to reduce carbon emissions and provide clean and green energy solutions.

In the long run, it will bring higher returns for the shareholders and reduced energy costs for their customers. So, it will be a win-win for the investors and customers if you use energy supplied by NextEra energy and have invested in this corporation.

Read Also: Will Meta Stock Go Up?

Moreover, the earnings-per-share are expected to grow by 10% by the end of 2025. The company's additional clean energy infrastructure investment will also grow to the estimated $85 - $95 billion by then.

The Real Zero strategy of NextEra Energy stock is attractive to many customers and investors. The EPS of this energy stock has accelerated by 8.4%, with a dividend growth of 9.8% annually.

Read also: Utility Stocks in a Recession- Are Utility Stocks a Good Buy Now?

The Bottom Line

NextEra Energy Stock is the best investment due to the high dividend payment and the high returns now and in the next three years. Suppose the utility company excels in providing renewable energy services by 2025. In that case, it can also provide the best returns for the upcoming ten years.

Read also about Tesla (TSLA) Alphabet (GOOG), and Netflix (NFLX) stocks