What will Microsoft stock be worth in 10 years? The solid fundamentals and rosy outlook for future performance have made this stock the favorite one of many investors right now. The revenues of this American corporation have been soaring due to the cloud-computing infrastructure and gaming ventures.

In this blog, we will discuss Microsoft's stock price in 10 years and how you can rise to the occasion to enjoy the future higher valuation of this tech stock by 2032. So, let's analyze!

Read Also: Sempra Energy Stock (SRE), Edison International Stock (EIX), Dominion Energy Stock (D) and NextEra Energy Stock (NEE)

Microsoft

Founded in 1975 by Bill Gates and Paul Allen, this technological American Corporation has ruled over the technology sector for over three decades by revolutionizing personal computers and Windows Operating Systems.

The whole business model of Microsoft surrounds the development of hardware and software, including the production of electronic gadgets. Its name is a combination of microcomputer software. In 1975, Bill Gates and Paul Allen formed Microsoft after the historic launch of MS-DOS and a successful contract with IBM.

However, the real breakthrough was the release of Windows in 1985 by Microsoft, and its initial Public Offer (IPO) took place the following year. Microsoft also moved its headquarters to Washington. The tech corporation did not stop there and introduced another innovative suite of applications, Microsoft Office Suit, in 1990.

| Stock Metrics |

Values |

| Market Cap |

$ 2.00 Trillion |

| 52-week Range |

$241.51 - $349.67 |

| P/E Ration |

27.79 |

| EPS |

9.64 |

| Beta |

0.93 |

| Dividend Yied |

0.93% |

After five years, Microsoft changed its business model slightly to meet the new market demand of internet hype. It introduced Windows 95 and Microsoft Network (MSN), the first web portal and internet service provider.

The launch of Microsoft Office 2007 and Windows Vista brought the highest revenues to Microsoft in 2007 and 2008. However, Apple and Android dethroned this software company in 2010, and it lost most of its market share ultimately.

After this, the company rebranded itself and introduced Windows 8,and Surface devices in 2012. They stepped into video gaming in 2013 and introduced the video game controller. During the same year, Microsoft suffered the highest plunge in its stock price since 2000 due to weak earnings and returns sufferred by the new technoogical innovations.

With a few mergers of Skype and LinkedIn, the company has been successfully fetching its market share due to the introduction of cloud computing into its business. Microsoft reached the highest market capitalization of $1 trillion after Apple and Amazon.

Microsoft has successfully reclaimed its market dominance in cloud computing and 'the Disney of Metaverse.' The company is leading the market in cloud computing services and is expected to achieve the acquisition of America's largest video game developers by 2023.

.

Microsoft (MSFT) Stock Price

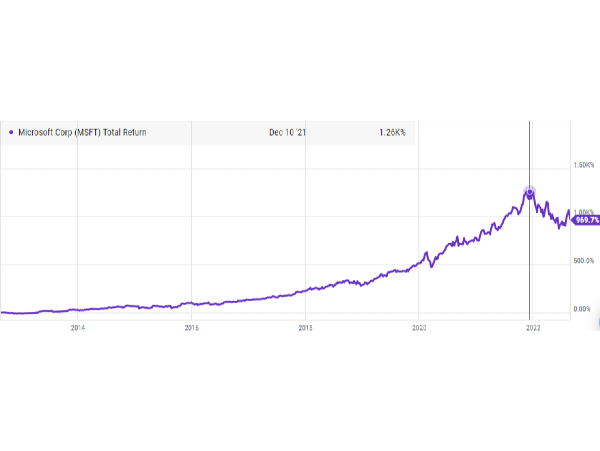

Maintaining a business moat, Microsoft's stock price and valuation have gained momentum in the last five years. The business model is solid, and earnings are resilient as the MSFT is recession-proof and is making a leap forward quickly. Termed as a safe haven by many stock analysts, MSFT is proliferating by dominating the technological market.

Although the market cap of Microsoft has decreased year-to-date in 2022, the overall business financial position has grown rock solid over the years. The corporation is a cash cow with robust earnings and valuation.

The cloud infrastructure of MSFT has provided this king-sized business with opportunities to thrive in the technological sector and the industry. It has been successful in dominating the market along with META and APPLE.

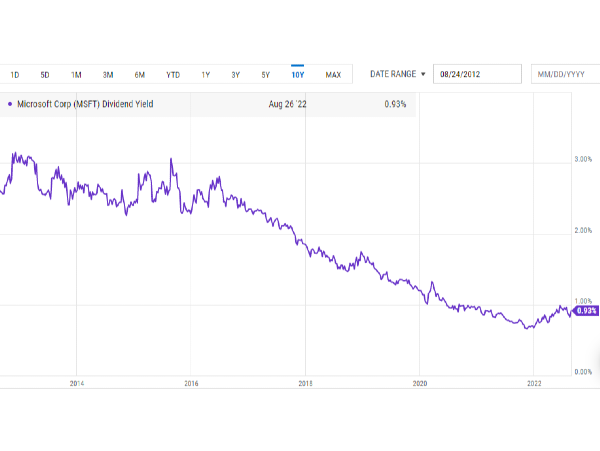

Its enterprise software and gaming ventures have strengthened its financials and are more attractive to many investors. Although the valuation has gone up of MSFT, the dividend has decreased over the last few years.

Microsoft stock is currently undervalued by 20%, and you can take advantage of this opportunity and buy this stock to earn higher revenues and enjoy a higher valuation in the future. Microsoft's Free Cash flow is currently at $65.15 billion.

How much will Microsoft stock be worth in 10 years?

MSFT is expected to grow over the next ten years based on the performance of the last five years and current solid fundamentals. The stock outlook is rosy, and investors can earn higher returns on their investments today.

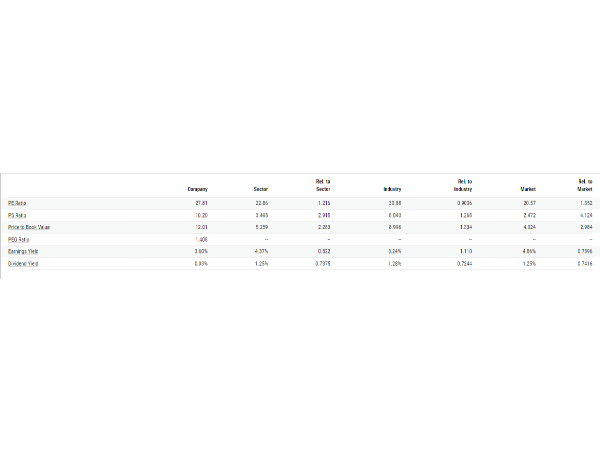

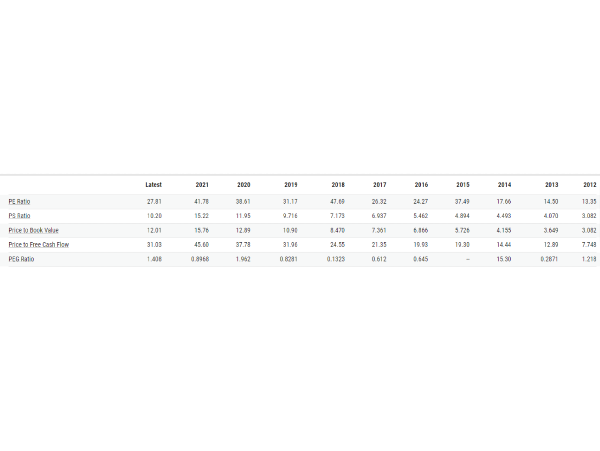

The P/E ratio has doubled over the last ten years. P/S ratio has tripled while the P/B value and Price to Free Cash Flow has quadrupled since 2012 until now.

Microsoft stock price is expected to rise by $845 by the end of 2032 and $932 by 2034. However, it all depends on the interest rate, market sentiments, and how this stock behaves in changing market dynamics.

The current outlook and the performance of the last five years lead us towards the safe prediction of a surge in the stock price in the upcoming ten years.

Read also about Tesla (TSLA) Alphabet (GOOG) and Netflix (NFLX) stocks

Conclusion

Given the high P/E ratio and the EPS of the MSFT, Microsoft's stock price in 10 years will increase, and the corporation will perform much better as its fundamentals support our outlook on the stock's future performance. So, how much will Microsoft be worth in 10 years is the right question to ask right now. One must invest in this safe haven, recession-proof MSFT stock as a long-term investor.

Read Also: Visa (V) and Bank of America (BAC)

What will Microsoft stock be worth in 10 years? The solid fundamentals and rosy outlook for future performance have made this stock the favorite one of many investors right now. The revenues of this American corporation have been soaring due to the cloud-computing infrastructure and gaming ventures.

In this blog, we will discuss Microsoft's stock price in 10 years and how you can rise to the occasion to enjoy the future higher valuation of this tech stock by 2032. So, let's analyze!

Read Also: Sempra Energy Stock (SRE), Edison International Stock (EIX), Dominion Energy Stock (D) and NextEra Energy Stock (NEE)

Microsoft

Founded in 1975 by Bill Gates and Paul Allen, this technological American Corporation has ruled over the technology sector for over three decades by revolutionizing personal computers and Windows Operating Systems.

The whole business model of Microsoft surrounds the development of hardware and software, including the production of electronic gadgets. Its name is a combination of microcomputer software. In 1975, Bill Gates and Paul Allen formed Microsoft after the historic launch of MS-DOS and a successful contract with IBM.

However, the real breakthrough was the release of Windows in 1985 by Microsoft, and its initial Public Offer (IPO) took place the following year. Microsoft also moved its headquarters to Washington. The tech corporation did not stop there and introduced another innovative suite of applications, Microsoft Office Suit, in 1990.

After five years, Microsoft changed its business model slightly to meet the new market demand of internet hype. It introduced Windows 95 and Microsoft Network (MSN), the first web portal and internet service provider.

The launch of Microsoft Office 2007 and Windows Vista brought the highest revenues to Microsoft in 2007 and 2008. However, Apple and Android dethroned this software company in 2010, and it lost most of its market share ultimately.

After this, the company rebranded itself and introduced Windows 8,and Surface devices in 2012. They stepped into video gaming in 2013 and introduced the video game controller. During the same year, Microsoft suffered the highest plunge in its stock price since 2000 due to weak earnings and returns sufferred by the new technoogical innovations.

With a few mergers of Skype and LinkedIn, the company has been successfully fetching its market share due to the introduction of cloud computing into its business. Microsoft reached the highest market capitalization of $1 trillion after Apple and Amazon.

Microsoft has successfully reclaimed its market dominance in cloud computing and 'the Disney of Metaverse.' The company is leading the market in cloud computing services and is expected to achieve the acquisition of America's largest video game developers by 2023. .

Microsoft (MSFT) Stock Price

Maintaining a business moat, Microsoft's stock price and valuation have gained momentum in the last five years. The business model is solid, and earnings are resilient as the MSFT is recession-proof and is making a leap forward quickly. Termed as a safe haven by many stock analysts, MSFT is proliferating by dominating the technological market.

Although the market cap of Microsoft has decreased year-to-date in 2022, the overall business financial position has grown rock solid over the years. The corporation is a cash cow with robust earnings and valuation.

The cloud infrastructure of MSFT has provided this king-sized business with opportunities to thrive in the technological sector and the industry. It has been successful in dominating the market along with META and APPLE.

Its enterprise software and gaming ventures have strengthened its financials and are more attractive to many investors. Although the valuation has gone up of MSFT, the dividend has decreased over the last few years.

Microsoft stock is currently undervalued by 20%, and you can take advantage of this opportunity and buy this stock to earn higher revenues and enjoy a higher valuation in the future. Microsoft's Free Cash flow is currently at $65.15 billion.

How much will Microsoft stock be worth in 10 years?

MSFT is expected to grow over the next ten years based on the performance of the last five years and current solid fundamentals. The stock outlook is rosy, and investors can earn higher returns on their investments today.

The P/E ratio has doubled over the last ten years. P/S ratio has tripled while the P/B value and Price to Free Cash Flow has quadrupled since 2012 until now.

Microsoft stock price is expected to rise by $845 by the end of 2032 and $932 by 2034. However, it all depends on the interest rate, market sentiments, and how this stock behaves in changing market dynamics.

The current outlook and the performance of the last five years lead us towards the safe prediction of a surge in the stock price in the upcoming ten years.

Read also about Tesla (TSLA) Alphabet (GOOG) and Netflix (NFLX) stocks

Conclusion

Given the high P/E ratio and the EPS of the MSFT, Microsoft's stock price in 10 years will increase, and the corporation will perform much better as its fundamentals support our outlook on the stock's future performance. So, how much will Microsoft be worth in 10 years is the right question to ask right now. One must invest in this safe haven, recession-proof MSFT stock as a long-term investor.

Read Also: Visa (V) and Bank of America (BAC)