Sound investments

don't happen alone

Find your crew, build teams, compete in VS MODE, and identify investment trends in our evergrowing investment ecosystem. You aren't on an island anymore, and our community is here to help you make informed decisions in a complex world.

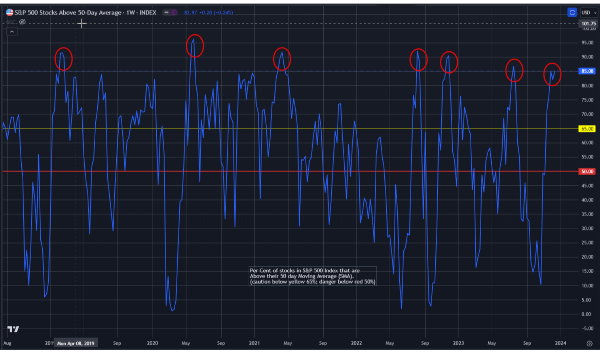

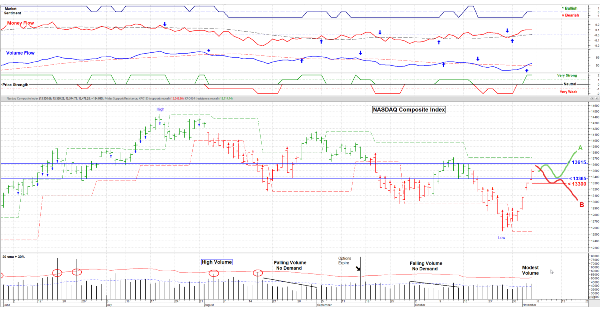

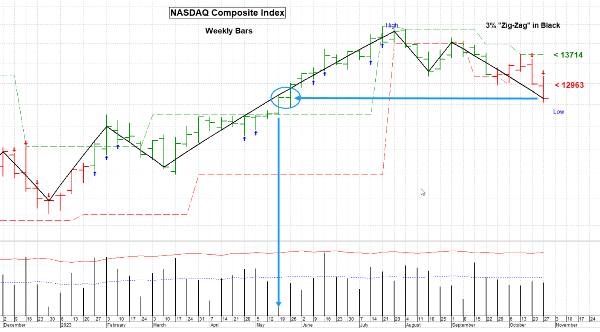

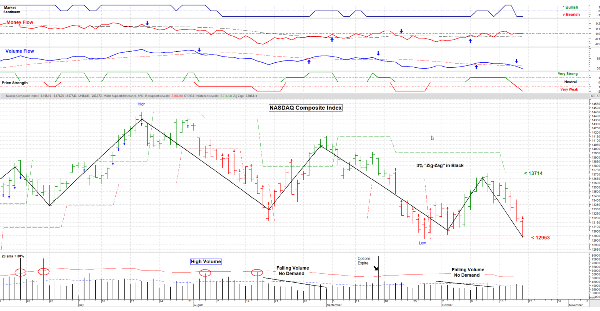

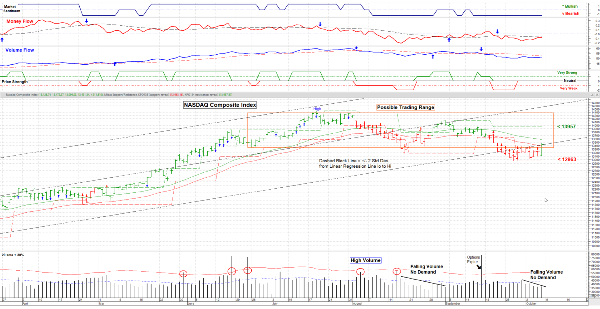

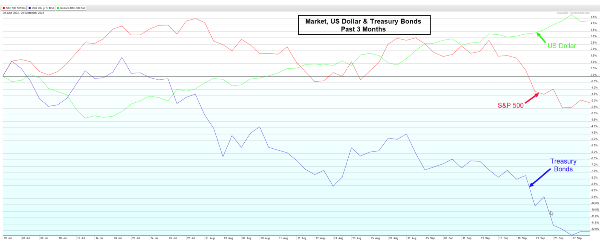

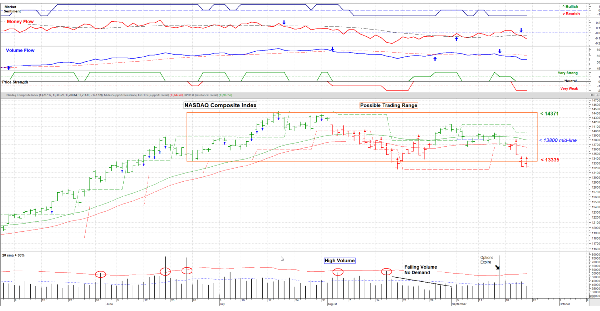

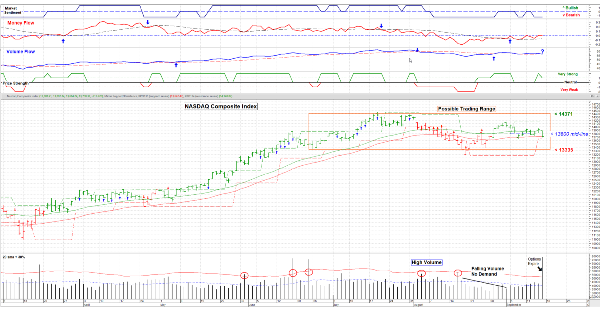

December 22, 2023 - If there is ANY doubt about how infatuated this market is with interest rates, well the action over the past 2 weeks will put that to rest. J. Powell has hinted of lower rates in 2024 and markets always anticipate the future; so off we go. Not even some tempering words about forward earnings from the likes of Apple, Nike or FedEx could put a damper on this "feel'in good" move. Geopolitical or domestic issues? Nah, the market will worry about that "tomorrow".

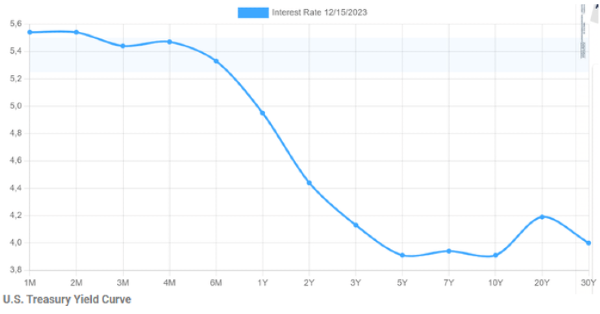

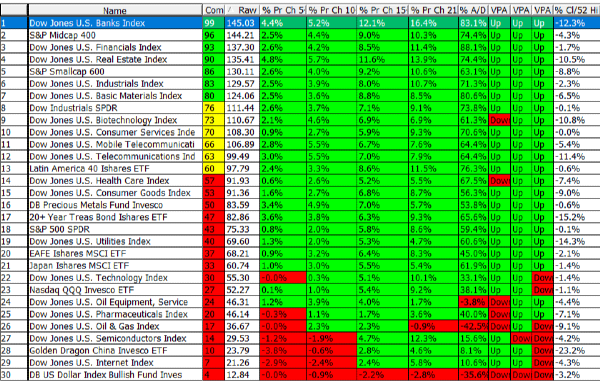

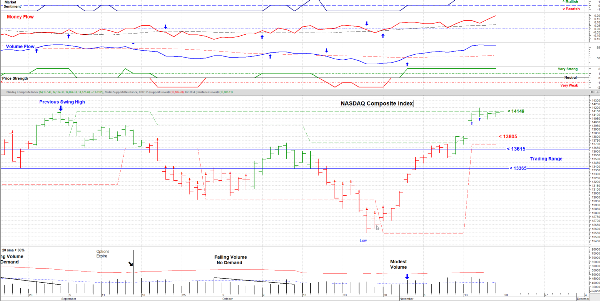

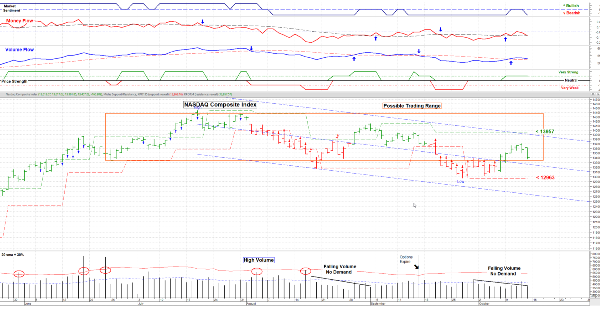

Here's the trend bounded by a +/- 2 standard deviation channel. Likely a slight dip lower before a resumption of the climb. The big thing to watch for is whether there will be tax selling of any magnitude after the first of the year that shows sector rotation (& a tax delay of a year). We'll just have to wait and see. Interest rates remain inverted, but not many care. (short term rates above long term = an inversion) I'm about 70% invested looking for opportunity in a set back. Until then wishing all a . . .

Very Happy & Healthy New Year. ............ Tom ............

(more charts at: www.Special-Risk.net; chart courtesy of MetaStock; used with permission)