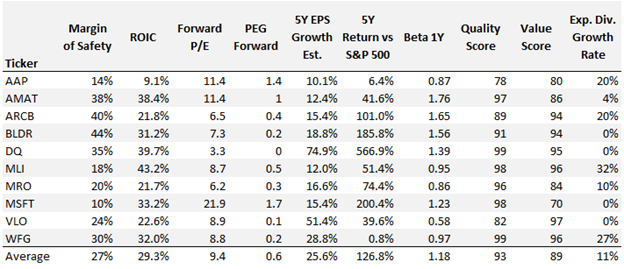

Using the screening tools available in StockRover, I searched for companies that are inexpensive relative to their fair value (margin of safety) and have above-average price and earnings growth prospects.

Starting with a universe of 2,500 US listed names, I kept raising the bar until I whittled the list down to just ten finalists. All 10 have outperformed the S&P 500 over the past 5 years and they all have above-average ROIC compared to their industry peers.

The idea was to find high quality companies that can weather the market storm we are in today. If the market continues to decline from here, many of these stocks will also decline. But having a margin of safety and solid growth prospects should help these companies weather the storm better than most.

I begin with a brief description of each company, along with their StockRover profile. At the end of the article, I have a table that summarizes all of the metrics I used in the screening process for easy comparison.

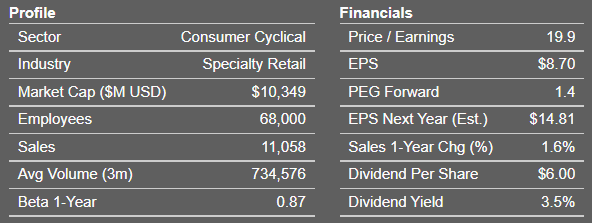

AAP - Advance Auto Parts

Advance Auto Parts is one of the largest retailers of aftermarket automotive parts, tools, and accessories in North America. At today’s price of $172.15, it has a 12% margin of safety based on consensus fair value of $192.46. The average 12 month price target for AAP is $217.67, giving it a 26.4% upside. It pays a 3.5% dividend.

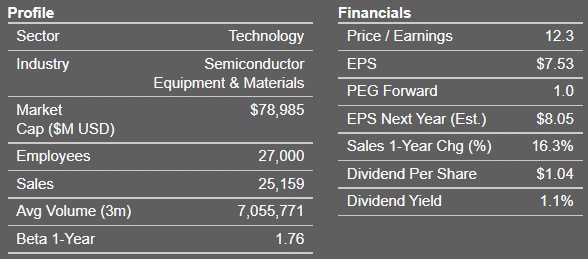

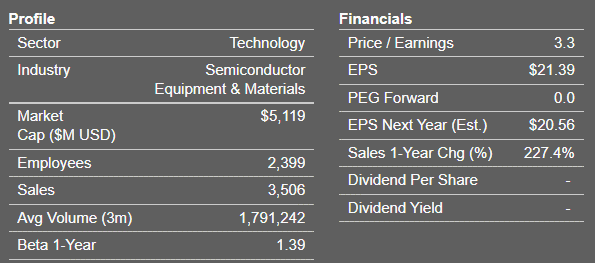

AMAT - Applied Materials

Applied Materials is the world's largest supplier of semiconductor manufacturing equipment. It has a 38% margin of safety and a 12 month upside target of 46.3%. It pays a 1.1% dividend.

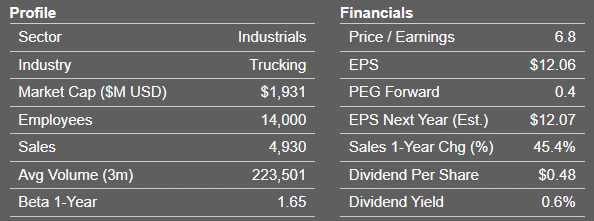

ARCB - ArcBest

ArcBest Corp is engaged in freight transportation and logistics operations. It has a margin of safety of 40% and a 12 month upside target of 56%. ARCB pays a 0.6% dividend.

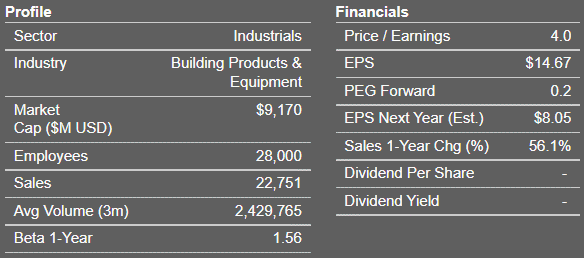

BLDR - Builders FirstSource

Builders FirstSource Inc. is a manufacturer and supplier of building materials. It has a 44% margin of safety and a 56% upside target. This company does not pay a dividend.

DQ - Daqo New Energy

Daqo New Energy Corp is a polysilicon manufacturer based in China. At today’s price of $68.28, it has a 35% margin of safety based on consensus fair value of $92.29. The average 12 month price target for DQ is $76.98, giving it a 12.7% upside. The company does not pay a dividend.

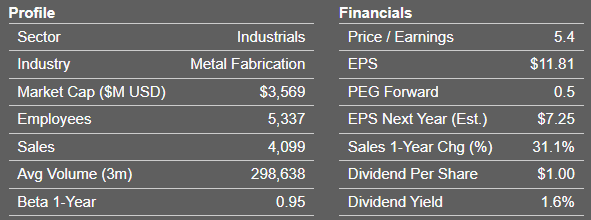

MLI - Mueller Industries

Mueller Industries makes copper, brass, aluminum, and plastic products. It has a margin of safety of 18% and a 12 month upside target of 98%. It pays a 1.6% dividend.

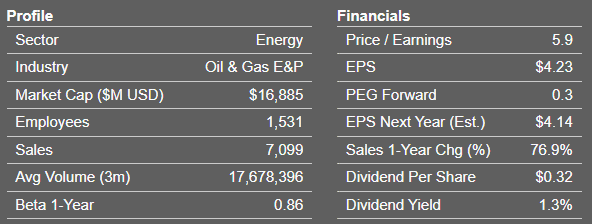

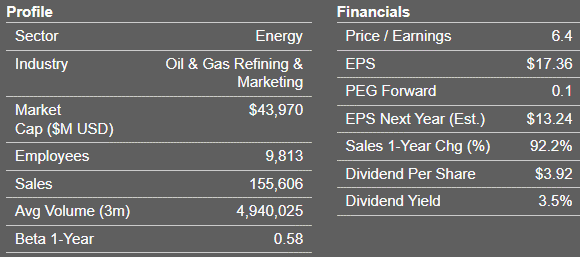

MRO - Marathon Oil

Marathon Oil is an independent exploration and production company primarily focusing on unconventional resources in the United States. It has a 23% margin of safety and a 12 month upside target of 18%. It pays a 1.3% dividend.

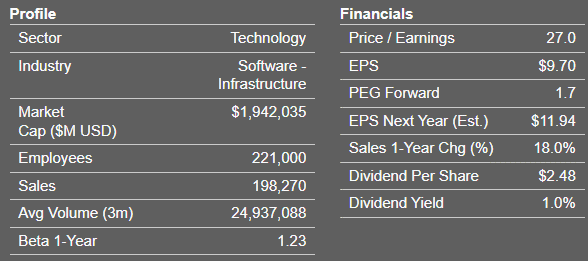

MSFT - Microsoft

Microsoft develops and licenses consumer and enterprise software. It is known for its Windows operating systems and Office productivity suite. It is the second largest company in the US, after Apple, Inc. It has a 11% margin of safety and a 27% 12 month upside target. It pays a 1% dividend.

VLO - Valero Energy

Valero Energy is one of the largest independent refiners in the United States. It has a 31% margin of safety, and a 30% upside price target. It pays a 3.5% dividend.

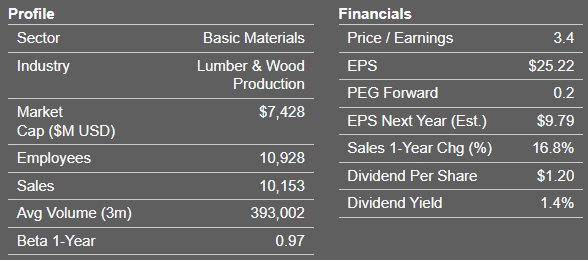

WFG - West Fraser Timber

West Fraser Timber produces lumber, engineered wood products (plywood, and particleboard), pulp, newsprint, wood chips, and renewable energy. It has a 30% margin of safety and a 55% upside target. It pays a 1.4% dividend.

Summary table showing the key metrics for each of these ten stocks.

As always, do your own research before making any trading decisions. Treat this as a watchlist rather than a blanket endorsement.

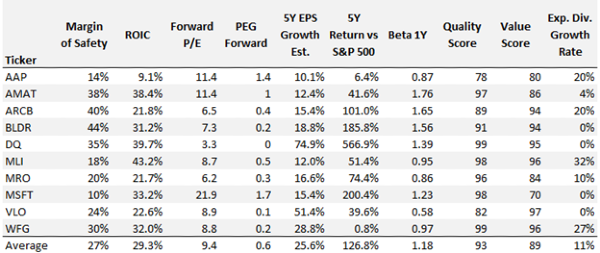

Using the screening tools available in StockRover, I searched for companies that are inexpensive relative to their fair value (margin of safety) and have above-average price and earnings growth prospects.

Starting with a universe of 2,500 US listed names, I kept raising the bar until I whittled the list down to just ten finalists. All 10 have outperformed the S&P 500 over the past 5 years and they all have above-average ROIC compared to their industry peers.

The idea was to find high quality companies that can weather the market storm we are in today. If the market continues to decline from here, many of these stocks will also decline. But having a margin of safety and solid growth prospects should help these companies weather the storm better than most.

I begin with a brief description of each company, along with their StockRover profile. At the end of the article, I have a table that summarizes all of the metrics I used in the screening process for easy comparison.

AAP - Advance Auto Parts

Advance Auto Parts is one of the largest retailers of aftermarket automotive parts, tools, and accessories in North America. At today’s price of $172.15, it has a 12% margin of safety based on consensus fair value of $192.46. The average 12 month price target for AAP is $217.67, giving it a 26.4% upside. It pays a 3.5% dividend.

AMAT - Applied Materials

Applied Materials is the world's largest supplier of semiconductor manufacturing equipment. It has a 38% margin of safety and a 12 month upside target of 46.3%. It pays a 1.1% dividend.

ARCB - ArcBest

ArcBest Corp is engaged in freight transportation and logistics operations. It has a margin of safety of 40% and a 12 month upside target of 56%. ARCB pays a 0.6% dividend.

BLDR - Builders FirstSource

Builders FirstSource Inc. is a manufacturer and supplier of building materials. It has a 44% margin of safety and a 56% upside target. This company does not pay a dividend.

DQ - Daqo New Energy

Daqo New Energy Corp is a polysilicon manufacturer based in China. At today’s price of $68.28, it has a 35% margin of safety based on consensus fair value of $92.29. The average 12 month price target for DQ is $76.98, giving it a 12.7% upside. The company does not pay a dividend.

MLI - Mueller Industries

Mueller Industries makes copper, brass, aluminum, and plastic products. It has a margin of safety of 18% and a 12 month upside target of 98%. It pays a 1.6% dividend.

MRO - Marathon Oil

Marathon Oil is an independent exploration and production company primarily focusing on unconventional resources in the United States. It has a 23% margin of safety and a 12 month upside target of 18%. It pays a 1.3% dividend.

MSFT - Microsoft

Microsoft develops and licenses consumer and enterprise software. It is known for its Windows operating systems and Office productivity suite. It is the second largest company in the US, after Apple, Inc. It has a 11% margin of safety and a 27% 12 month upside target. It pays a 1% dividend.

VLO - Valero Energy

Valero Energy is one of the largest independent refiners in the United States. It has a 31% margin of safety, and a 30% upside price target. It pays a 3.5% dividend.

WFG - West Fraser Timber

West Fraser Timber produces lumber, engineered wood products (plywood, and particleboard), pulp, newsprint, wood chips, and renewable energy. It has a 30% margin of safety and a 55% upside target. It pays a 1.4% dividend.

Summary table showing the key metrics for each of these ten stocks.

As always, do your own research before making any trading decisions. Treat this as a watchlist rather than a blanket endorsement.

Originally Posted on zeninvestor.org