Over the past 3 weeks, Ollie's Bargain Outlet (OLLI) has seen a 35% increase in their stock price. After reviewing a fews studies, OLLI's short interest is still high at around 12% but has has weakened over the past couple of weeks, potentially causing the price increase.

Shameless plug: These discussions happen daily on our forums at https://www.manifestinvesting.com

Subscribe to our YouTube channel: https://www.youtube.com/c/manifestinvest

ONTO THE ARTICLE!!!

I wanted to take the time to potentially explain what I believe may be going on. So let us expand on the Short Interest (SI) and the OLLI stock price. If you don’t know what a short is, simply put, it’s a bet on a stock that the price will decrease. This is how some investors and institutions make money in a down market. The VERY nature of shorting a stock has the same implications as if it was being sold. So when a stock starts to be heavily shorted, the stock price will tend to go down with it. To close the short out, it must be BOUGHT back and buying creates upward pressure on a stock’s price.

It isn’t always a 1-for-1 as natural price-seeking behavior still needs to occur. You can pay for daily SI reports if you’d like, I don’t use them enough. It’s simply a way for me to see if the price increase is natural or if SI is buying back shares to cover their shorts. Because buying pressure will increase the stock price.

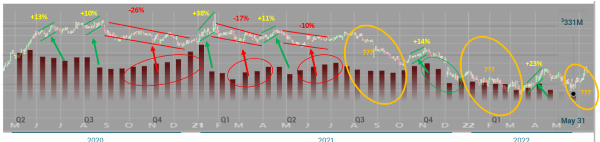

In the attached chart, I did my best to overlay two graphs from May 15th, 2020 through today. The SI bar graph stops May 30th, 2022 because that is all the data I can get. The bars represent the Short Interest and I lined it up with the OLLI’s stock price chart over the same period with June hanging over.

So, when looking at this chart, it is important to remember that the SI report is delayed between 15 to 30 days. So when you see a sudden drop in SI, this will tend to correlate with an increase in stock price 15 to 30 days prior (each bar is about 15 days). Now that the price is elevated, SI will begin to increase which decreases the price. Once SI believes the price is low enough, they’ll cover their shorts by purchasing the stock back at that lower price closing their shorts. This increases the price again and SI will increase again to continue the cycle.

Again, this isn’t a 1-for-1 deal, but it gives you an idea of the ebb and flow of how shorts operate.

In the orange circles, I am not 100% sure what occurred there, this could be natural price-seeking market behavior, but you can clearly see that Short Interest is waning as inflation increases. My assumption is since OLLI is a bargain store, SI believes more people will visit in search of cheaper products. So the Short Interest will get lower till they believe the stock price is high enough to be shorted again.

I/we have no positions in any asset mentioned, but may initiate a position over the next 7 days

Over the past 3 weeks, Ollie's Bargain Outlet (OLLI) has seen a 35% increase in their stock price. After reviewing a fews studies, OLLI's short interest is still high at around 12% but has has weakened over the past couple of weeks, potentially causing the price increase.

Shameless plug: These discussions happen daily on our forums at https://www.manifestinvesting.com Subscribe to our YouTube channel: https://www.youtube.com/c/manifestinvest

ONTO THE ARTICLE!!!

I wanted to take the time to potentially explain what I believe may be going on. So let us expand on the Short Interest (SI) and the OLLI stock price. If you don’t know what a short is, simply put, it’s a bet on a stock that the price will decrease. This is how some investors and institutions make money in a down market. The VERY nature of shorting a stock has the same implications as if it was being sold. So when a stock starts to be heavily shorted, the stock price will tend to go down with it. To close the short out, it must be BOUGHT back and buying creates upward pressure on a stock’s price. It isn’t always a 1-for-1 as natural price-seeking behavior still needs to occur. You can pay for daily SI reports if you’d like, I don’t use them enough. It’s simply a way for me to see if the price increase is natural or if SI is buying back shares to cover their shorts. Because buying pressure will increase the stock price. In the attached chart, I did my best to overlay two graphs from May 15th, 2020 through today. The SI bar graph stops May 30th, 2022 because that is all the data I can get. The bars represent the Short Interest and I lined it up with the OLLI’s stock price chart over the same period with June hanging over. So, when looking at this chart, it is important to remember that the SI report is delayed between 15 to 30 days. So when you see a sudden drop in SI, this will tend to correlate with an increase in stock price 15 to 30 days prior (each bar is about 15 days). Now that the price is elevated, SI will begin to increase which decreases the price. Once SI believes the price is low enough, they’ll cover their shorts by purchasing the stock back at that lower price closing their shorts. This increases the price again and SI will increase again to continue the cycle. Again, this isn’t a 1-for-1 deal, but it gives you an idea of the ebb and flow of how shorts operate. In the orange circles, I am not 100% sure what occurred there, this could be natural price-seeking market behavior, but you can clearly see that Short Interest is waning as inflation increases. My assumption is since OLLI is a bargain store, SI believes more people will visit in search of cheaper products. So the Short Interest will get lower till they believe the stock price is high enough to be shorted again.

I/we have no positions in any asset mentioned, but may initiate a position over the next 7 days