Should you Buy Tesla Stock?

Tesla Business Strengths

Tesla is one of the largest electric vehicle manufacturers in the world, and are the most globally recognizable brands. Tesla is a trailblazer in the EV industry, offering affordable all-electric vehicles ahead of many previously more recognizable manufacturers. Since their introduction to the market in 2008 with the first Roadster, Tesla has become synonymous with the electric vehicle industry. Globally, Tesla delivered 1.8 million in 2023, their most successful year to date. This equals approximately 20% of the global EV market, with several Chinese-made competitors making up much of the top performing companies in the sector. I do not think this increased competition should dissuade investors, as Tesla is still the most globally recognizable and popular brand of EVs.

Other key factors in Tesla’s success is their continued vision for a sustainable future, as well their innovation and disruption of the industry. Tesla was one of the first commercially successful EV manufacturers, and they continued to innovate even after introducing their first sedans and sports cars. In 2017, Tesla unveiled the Tesla Semi, which is hoping to enter volume production in 2025. The new Tesla Roadster has a supposed 0-60 time of under one second (though this should be taken with a grain of salt) after previously showing a still impressive time of 1.9 seconds. These innovations in the electric vehicle space are part of why so many people pay attention to the company.

Not to be ignored is their vision for sustainability. Tesla and EVs in general can reach CO2 parity after just 6 months of operation if only using renewables. This means that after these 6 months, despite initial greater carbon needs to produce, the Tesla has a smaller carbon footprint than traditional internal combustion vehicles. They estimate 3 years if using more traditional means of charging, but they do try to make it easier by charging with renewable energy. Offering solar panels as well as charging banks helps owners use renewable energy to power their car, helping further their mission for sustainability.

Stock Performance and Outlook

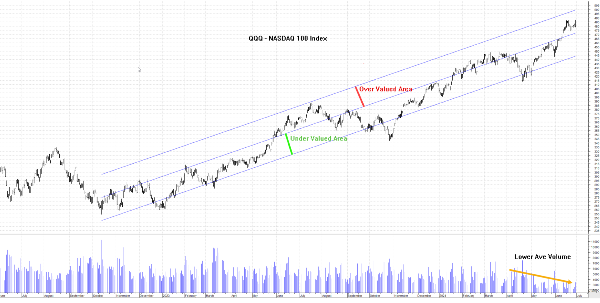

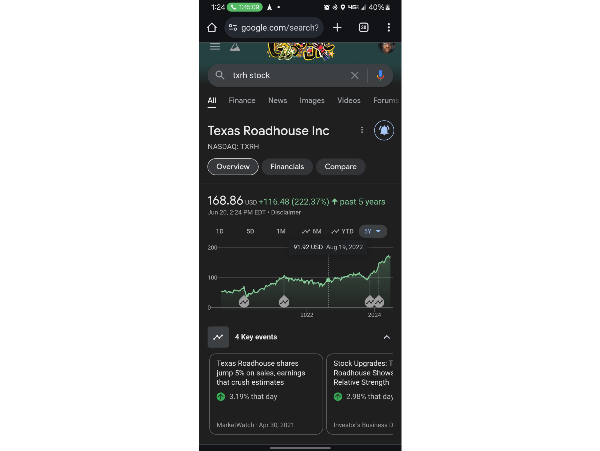

Tesla stock currently trades at $249.23. This falls below the 52-week high of $278.97, and actually falls below the $281 it was trading at one year ago. This stagnation in stock price is a unique position for Tesla, as they had experienced incredible growth over previous years. Despite increased deliveries and more vehicles entering the market, Tesla stock has struggled over much of the past year. This in addition to Tesla never having offered a dividend is a potential cause for concern from investors.

Tesla price targets vary, but many are placing the price target for Tesla at $225. This actually trails the current trading price for Tesla, and is a possible cause for concern for investors, despite Tesla increasing their market cap by over $300 billion since April of this year alone! Despite this, Tesla stock has struggled for much of the past year, and many are saying Tesla is either a sell or a hold rather than a buy.

Supporting Data and Statistics

GuruFocus, a website I have used to show the intrinsic value of companies based on their free-cash-flow places the intrinsic value of Tesla stock at $28.10. This is far below the current trading price of $249.23, indicating that Tesla stock is potentially overvalued.

Tesla’s revenue continued to grow, however in 2023 it was at a far slower rate than in previous years. 2021 and 2022 showed revenue increases of 70.67% and 51.35% respectively. 2023 increased revenue 18.8% versus 2022.

It is not all doom and gloom, however. As previously mentioned, after Tesla stock reached a 52-week low in April, both the stock and market cap have recovered very strongly. The stock price fell as low as $138 per share, and the market cap fell to $462 billion. Now valued around $791 billion, Tesla has begun to rebound after a dismal start to the year. This leads me to believe there may be brighter times ahead for Tesla, despite the challenges they have faced over the past year.

Conclusions

Tesla is facing uncertainty unlike they have at nearly any time over the past 5 years. Since exploding onto the scene and seeing some of the most impressive stock growth in the automobile industry, they have stagnated and seen their market cap fall from previously surpassing the $1 trillion mark just a few short years ago. Tesla is volatile, but has been a large part of public discourse for years now, and their continued innovation continues to attract the attention of investors, despite less than impressive performance over the past year or so.

Tesla appears overvalued based on both industry price targets and the intrinsic value based on free-cash-flow. For this reason, I do not think it is the time to buy Tesla stock, and rather think it is something to wait and see. There is always potential for growth, especially with the upcoming Robotaxi reveal, but at present, I just feel there is not enough to gain with the current price of Tesla.

Should you Buy Tesla Stock?

Tesla Business Strengths

Tesla is one of the largest electric vehicle manufacturers in the world, and are the most globally recognizable brands. Tesla is a trailblazer in the EV industry, offering affordable all-electric vehicles ahead of many previously more recognizable manufacturers. Since their introduction to the market in 2008 with the first Roadster, Tesla has become synonymous with the electric vehicle industry. Globally, Tesla delivered 1.8 million in 2023, their most successful year to date. This equals approximately 20% of the global EV market, with several Chinese-made competitors making up much of the top performing companies in the sector. I do not think this increased competition should dissuade investors, as Tesla is still the most globally recognizable and popular brand of EVs.

Other key factors in Tesla’s success is their continued vision for a sustainable future, as well their innovation and disruption of the industry. Tesla was one of the first commercially successful EV manufacturers, and they continued to innovate even after introducing their first sedans and sports cars. In 2017, Tesla unveiled the Tesla Semi, which is hoping to enter volume production in 2025. The new Tesla Roadster has a supposed 0-60 time of under one second (though this should be taken with a grain of salt) after previously showing a still impressive time of 1.9 seconds. These innovations in the electric vehicle space are part of why so many people pay attention to the company.

Not to be ignored is their vision for sustainability. Tesla and EVs in general can reach CO2 parity after just 6 months of operation if only using renewables. This means that after these 6 months, despite initial greater carbon needs to produce, the Tesla has a smaller carbon footprint than traditional internal combustion vehicles. They estimate 3 years if using more traditional means of charging, but they do try to make it easier by charging with renewable energy. Offering solar panels as well as charging banks helps owners use renewable energy to power their car, helping further their mission for sustainability.

Stock Performance and Outlook

Tesla stock currently trades at $249.23. This falls below the 52-week high of $278.97, and actually falls below the $281 it was trading at one year ago. This stagnation in stock price is a unique position for Tesla, as they had experienced incredible growth over previous years. Despite increased deliveries and more vehicles entering the market, Tesla stock has struggled over much of the past year. This in addition to Tesla never having offered a dividend is a potential cause for concern from investors.

Tesla price targets vary, but many are placing the price target for Tesla at $225. This actually trails the current trading price for Tesla, and is a possible cause for concern for investors, despite Tesla increasing their market cap by over $300 billion since April of this year alone! Despite this, Tesla stock has struggled for much of the past year, and many are saying Tesla is either a sell or a hold rather than a buy.

Supporting Data and Statistics

GuruFocus, a website I have used to show the intrinsic value of companies based on their free-cash-flow places the intrinsic value of Tesla stock at $28.10. This is far below the current trading price of $249.23, indicating that Tesla stock is potentially overvalued.

Tesla’s revenue continued to grow, however in 2023 it was at a far slower rate than in previous years. 2021 and 2022 showed revenue increases of 70.67% and 51.35% respectively. 2023 increased revenue 18.8% versus 2022.

It is not all doom and gloom, however. As previously mentioned, after Tesla stock reached a 52-week low in April, both the stock and market cap have recovered very strongly. The stock price fell as low as $138 per share, and the market cap fell to $462 billion. Now valued around $791 billion, Tesla has begun to rebound after a dismal start to the year. This leads me to believe there may be brighter times ahead for Tesla, despite the challenges they have faced over the past year.

Conclusions

Tesla is facing uncertainty unlike they have at nearly any time over the past 5 years. Since exploding onto the scene and seeing some of the most impressive stock growth in the automobile industry, they have stagnated and seen their market cap fall from previously surpassing the $1 trillion mark just a few short years ago. Tesla is volatile, but has been a large part of public discourse for years now, and their continued innovation continues to attract the attention of investors, despite less than impressive performance over the past year or so.

Tesla appears overvalued based on both industry price targets and the intrinsic value based on free-cash-flow. For this reason, I do not think it is the time to buy Tesla stock, and rather think it is something to wait and see. There is always potential for growth, especially with the upcoming Robotaxi reveal, but at present, I just feel there is not enough to gain with the current price of Tesla.