What are Consumer Discretionary Stocks?

Understanding Consumer Discretionary Stocks

According to Nasdaq, consumer discretionary stocks are companies that create goods or offer services that consumers WANT, but do not necessarily NEED. The consumer discretionary sector is one of the largest and most popular choices for investors seeking larger returns at a faster rate. Consumer discretionary offers some of the largest returns of any sector, but this does come with potentially higher risk. Due to the non-essential nature of the goods and services offered in the consumer discretionary sector, they are often some of the first to suffer during economic downturn or financial hardships. However, due to the diverse nature of the sector, there are pockets of stocks at value prices, even during market downturns.

Definition and Overview

The consumer discretionary sector is made up of the multitude of companies offering non-essential goods and services. This ranges from hotels, to entertainment, to clothes, cars, and fast food. Though they are non-essential, many companies in the consumer discretionary sector are among the most recognizable global brands. Amazon, McDonalds, Tesla, and Disney are all massive and globally recognizable companies, and are all examples of the success companies in the sector can achieve.

Types of Consumer Discretionary Stocks

There are many different types of companies that combine to make up the consumer discretionary sector. As it is made of companies that sell goods and services that are wanted but not needed, there are many companies we see in our day-to-day life that make up the sector as a whole. Examples of some of the sub-sectors are vehicles, clothing, and fast food companies.

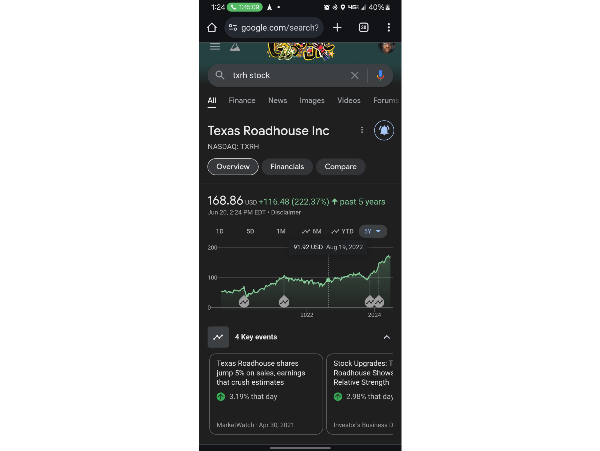

The vehicle sub-sector is fairly self-explanatory. They are the companies that manufacture vehicles, vehicle accessories, and vehicle service plans. These would be companies like Ford or O’Reilly Automotive. Clothing, or apparel, are the companies that make new clothing, such as Nike. The fast-food sub-sector is also very straightforward. Companies that operate fast-food chains such as McDonalds and Starbucks are some of the largest companies in the world, and are also some of the most commonly traded stocks.

Investing in Consumer Discretionary Stocks

Advantages and Risks

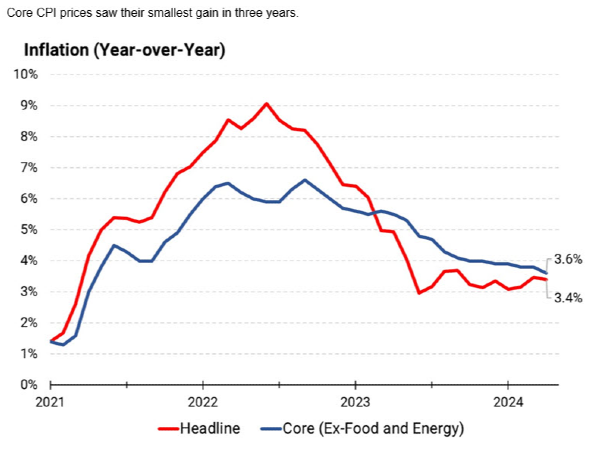

Consumer discretionary stocks are impacted by a variety of outside factors. Retail sales, unemployment, and home sales are just some of the factors that influence consumer discretionary stocks. This is the largest drawback; the impact of outside factors on stock prices. In my articles about the healthcare sector, I wrote about how the healthcare sector is fairly resistant to outside influence. This is due to the necessity of healthcare, people will always spend money on healthcare regardless of economic performance. People always need medical care.

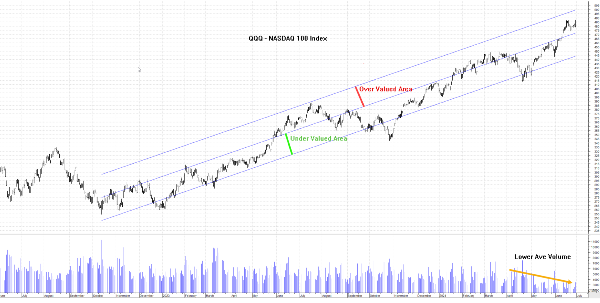

The consumer discretionary sector, meanwhile, offers potential for higher returns than many sectors when interest rates are low and consumer spending is up. This is what entices investors. In the article on the healthcare sector, I wrote about the only sectors that outperformed healthcare were IT and consumer discretionary. These returns draw attention, and always make the consumer discretionary sector one to keep an eye on.

Consumer Discretionary vs Consumer Staples

When investing in consumer discretionary stocks, it is also important to note the difference between them and consumer staples. While consumer discretionary stocks are companies that offer goods and services that are wanted but not necessary to customers, consumer staples are companies that offer necessary goods or services. This would include companies that sell food, beverages, household and personal products.

Two of the largest consumer staple companies are Walmart and Costco, companies that sell other necessary products such as food, beverages, and personal care items. Even in times of economic downturn, customers will always need food, beverages, and items to take care of themselves. This is the benefit to consumer staples, there is consistent performance even during recessionary times, and they offer consistent, if slow, growth.

What are Consumer Discretionary Stocks?

Understanding Consumer Discretionary Stocks

According to Nasdaq, consumer discretionary stocks are companies that create goods or offer services that consumers WANT, but do not necessarily NEED. The consumer discretionary sector is one of the largest and most popular choices for investors seeking larger returns at a faster rate. Consumer discretionary offers some of the largest returns of any sector, but this does come with potentially higher risk. Due to the non-essential nature of the goods and services offered in the consumer discretionary sector, they are often some of the first to suffer during economic downturn or financial hardships. However, due to the diverse nature of the sector, there are pockets of stocks at value prices, even during market downturns.

Definition and Overview

The consumer discretionary sector is made up of the multitude of companies offering non-essential goods and services. This ranges from hotels, to entertainment, to clothes, cars, and fast food. Though they are non-essential, many companies in the consumer discretionary sector are among the most recognizable global brands. Amazon, McDonalds, Tesla, and Disney are all massive and globally recognizable companies, and are all examples of the success companies in the sector can achieve.

Types of Consumer Discretionary Stocks

There are many different types of companies that combine to make up the consumer discretionary sector. As it is made of companies that sell goods and services that are wanted but not needed, there are many companies we see in our day-to-day life that make up the sector as a whole. Examples of some of the sub-sectors are vehicles, clothing, and fast food companies.

The vehicle sub-sector is fairly self-explanatory. They are the companies that manufacture vehicles, vehicle accessories, and vehicle service plans. These would be companies like Ford or O’Reilly Automotive. Clothing, or apparel, are the companies that make new clothing, such as Nike. The fast-food sub-sector is also very straightforward. Companies that operate fast-food chains such as McDonalds and Starbucks are some of the largest companies in the world, and are also some of the most commonly traded stocks.

Investing in Consumer Discretionary Stocks

Advantages and Risks

Consumer discretionary stocks are impacted by a variety of outside factors. Retail sales, unemployment, and home sales are just some of the factors that influence consumer discretionary stocks. This is the largest drawback; the impact of outside factors on stock prices. In my articles about the healthcare sector, I wrote about how the healthcare sector is fairly resistant to outside influence. This is due to the necessity of healthcare, people will always spend money on healthcare regardless of economic performance. People always need medical care.

The consumer discretionary sector, meanwhile, offers potential for higher returns than many sectors when interest rates are low and consumer spending is up. This is what entices investors. In the article on the healthcare sector, I wrote about the only sectors that outperformed healthcare were IT and consumer discretionary. These returns draw attention, and always make the consumer discretionary sector one to keep an eye on.

Consumer Discretionary vs Consumer Staples

When investing in consumer discretionary stocks, it is also important to note the difference between them and consumer staples. While consumer discretionary stocks are companies that offer goods and services that are wanted but not necessary to customers, consumer staples are companies that offer necessary goods or services. This would include companies that sell food, beverages, household and personal products.

Two of the largest consumer staple companies are Walmart and Costco, companies that sell other necessary products such as food, beverages, and personal care items. Even in times of economic downturn, customers will always need food, beverages, and items to take care of themselves. This is the benefit to consumer staples, there is consistent performance even during recessionary times, and they offer consistent, if slow, growth.