Utilities are often a favorite of dividend growth investors as they can provide excellent returns and high-income levels.

Companies in this sector can do so because they often hold regulatory-based competitive advantages limiting competition. Utilities can typically apply and receive approval for rate base increases as they make upgrades and investments in their infrastructure. This can lead to dependable cash flows that then be distributed to shareholders in the form of dividends.

As such, many utility stocks typically have dividend yields that are several times that of the average stock in the S&P 500 Index.

Because of these favorable industry characteristics, we’ve compiled a list of utility stocks. The list is derived from the major utility sector exchange-traded funds JXI, VPU, and XLU.

You can download the list of all utility stocks (along with important financial ratios such as dividend yields and payout ratios) by clicking on the link below:

Click here to instantly download your free spreadsheet of all Utility Stocks now, along with important investing metrics.

Electric utilities are one of the most common types in the sector, as these companies provide energy to consumers that are needed daily.

Most electricity consumption in the U.S. is due to lighting, appliances, heating, ventilation, and air conditioning. But besides powering homes, businesses, and industrial facilities, electricity will be needed to meet the rising demand from the increased adoption of electric vehicles.

At the end of 2021, it was estimated that there were already 2.3 million electric cars on the road, representing about 1% of the total in the U.S. This leaves much room for growth. While the total number of electric vehicles is still low, the growth rates have been very high. Total global electric cars sold were up 107% in 2021 and followed a 98% increase in 2020. There is much demand for electric vehicles that is growing.

This article will examine 10 of our favorite electric utility names, ranked in order of potential returns over the next five years (total expected returns are based on closing stock prices for the November 25th, 2022, trading session).

Top Utility Stock #10: Sempra Energy (SRE)

- 5-year expected annual returns: 7.7%

Founded over two decades ago, Sempra Energy has blossomed into a nearly $51 billion market cap company. Sempra Energy operates in Southern California, giving the company one of the largest utility customer bases in the U.S. The company provides electricity and natural gas to more than 20 million customers.

Sempra Energy also has a majority stake in the Texas-based Oncor. This transmission and distribution business provides electricity to more than 10 million customers. In addition, Sempra Energy owns and operates other utilities and merchant renewable energy projects, liquefied natural gas facilities, and gas pipes and storage in the U.S. and Latin America.

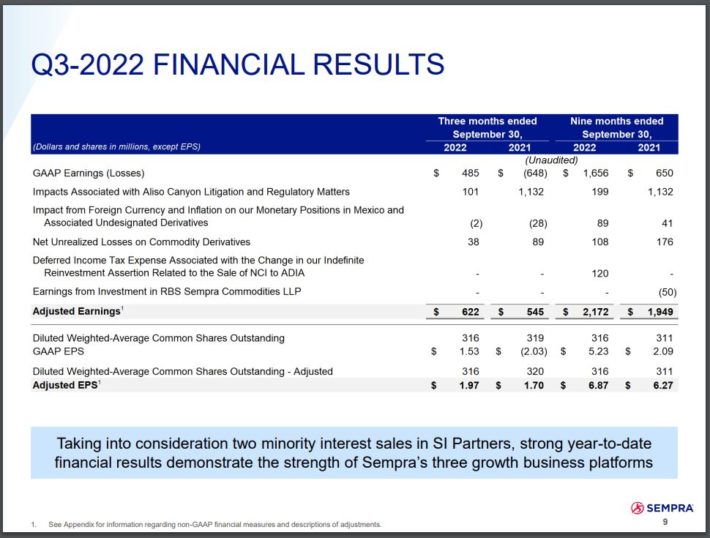

Sempra Energy reported third-quarter earnings results on November 3rd, 2022.

The company’s earnings-per-share grew 16% to $1.97 and came in $0.19 above analysts’ anticipated. As a result, management raised its annual earnings-per-share guidance to $8.70 to $9.00 compared to $8.10 to $8.70.

Long-term, Sempra Energy expects to grow its earnings-per-share by 6% to 8% due to an intensive capital investment plan and customer growth in its areas of operation. Erring on the side of caution, we project earnings-per-share growth of 5% over the next five years.

Sempra Energy has increased its dividend for the past 12 years and has a projected payout ratio of just 52% for 2022, a very low figure for a utility company. Shares yield 2.8%, which compares well to the 1.6% average yield for the S&P 500 Index.

Lastly, shares of the company are trading near our five-year target price-to-earnings (P/E) ratio of 18.8, implying a 0.2% tailwind from multiple expansions over the next five years.

Sempra Energy is projected to return 7.7% annually through 2027, resulting from 5% earnings growth, the 2.8% starting yield, and the valuation contribution. Shares earn a hold rating due to expected total returns.

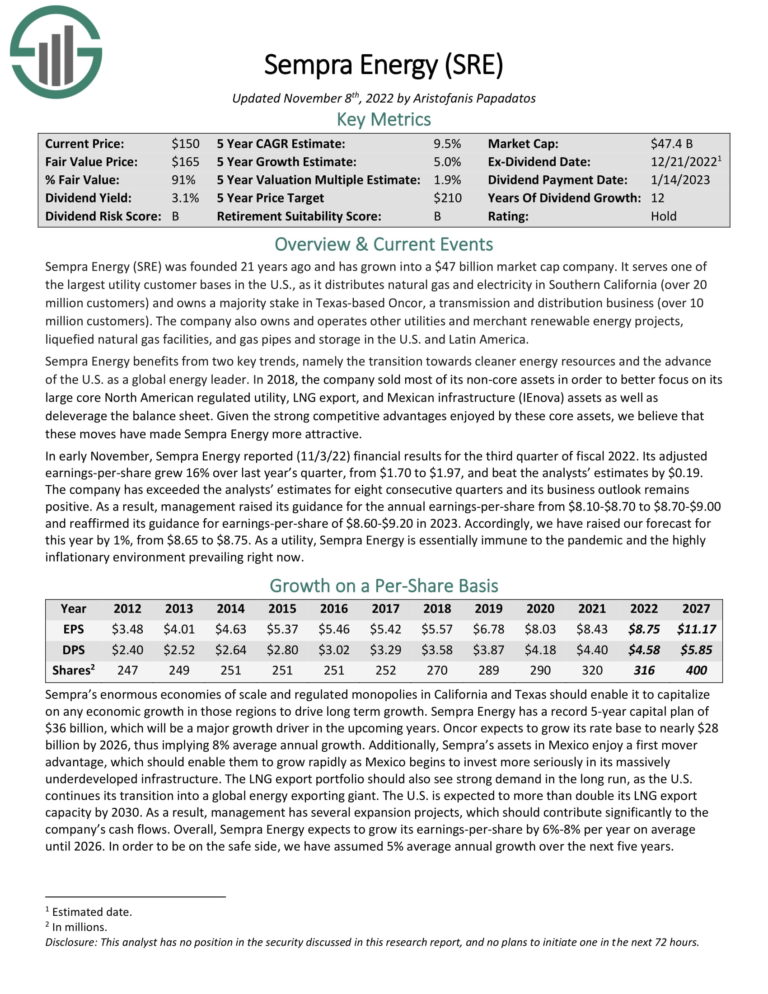

Click here to download our most recent Sure Analysis report on Sempra Energy (preview of page 1 of 3 shown below):

Top Utility Stock #9: FirstEnergy Corp. (FE)

- 5-year expected annual returns: 8.3%

Through its subsidiaries, FirstEnergy generates, transmits, and distributes electricity to customers in the U.S. The company comprises two segments, Regulated Distribution and Regulated Transmission. FirstEnergy owns and manages hydroelectric, coal-fired, nuclear, and natural gas facilities and its renewable power generating operations. The $23 billion company serves close to six million customers across Ohio, Pennsylvania, New Jersey, West Virginia, Maryland, and New York.

FirstEnergy reported third-quarter results on October 25th, 2022. Revenue improved 12% to $3.5 billion while adjusted earnings-per-share of $0.79 compared to $0.82 in the prior year. Higher planned expenses and share dilution were the primary reasons for the decline in earnings.

FirstEnergy has a more uneven profitability track record than most utility names, mainly because of bankruptcy in a former subsidiary and poor investments. That said, the company has taken steps to improve its business and balance sheet, including reducing its debt by 30% since the end of 2021.

To illustrate how far the company has come, management reaffirmed its previous forecast of 6% to 8% earnings growth over the medium term, which is well above the compound annual growth rate of 2.7% that FirstEnergy had during the previous decade. We forecast earnings growth of 6.5%.

In tandem with earnings, the dividend has also struggled to grow. In fact, the current annualized dividend of $1.56 is still well below the $2.20 shareholders received in 2012. Still, the dividend was raised in 2020 and has remained constant. We believe that the current dividend is well protected given the expected payout ratio of 65% for 2022, which would be the lowest figure in more than a decade. Shares yield 3.9%.

The stock is trading slightly above our target P/E of 15.5, which would mean that valuation could be a 1.5% headwind to annual returns over the next five years.

FirstEnergy is expected to provide a total annual return of 8.3% through 2027 due to earnings growth of 6.5% and the starting yield of 3.9%, offset slightly by multiple compression. The stock earns a hold recommendation.

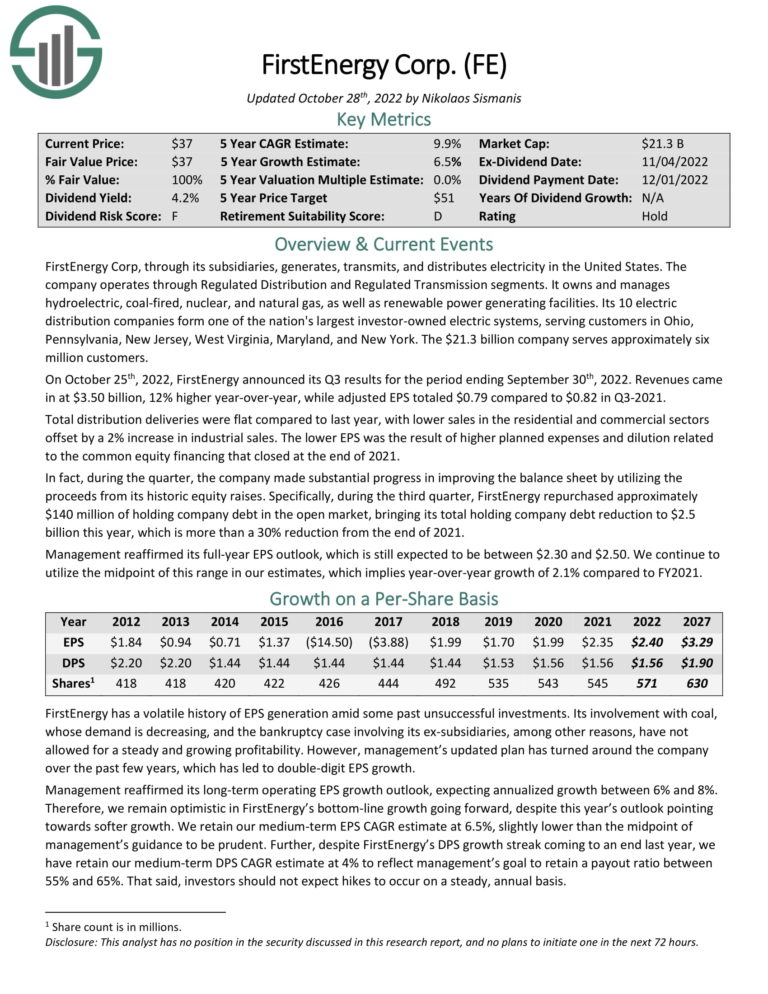

Click here to download our most recent Sure Analysis report on FirstEnergy Corp. (preview of page 1 of 3 shown below):

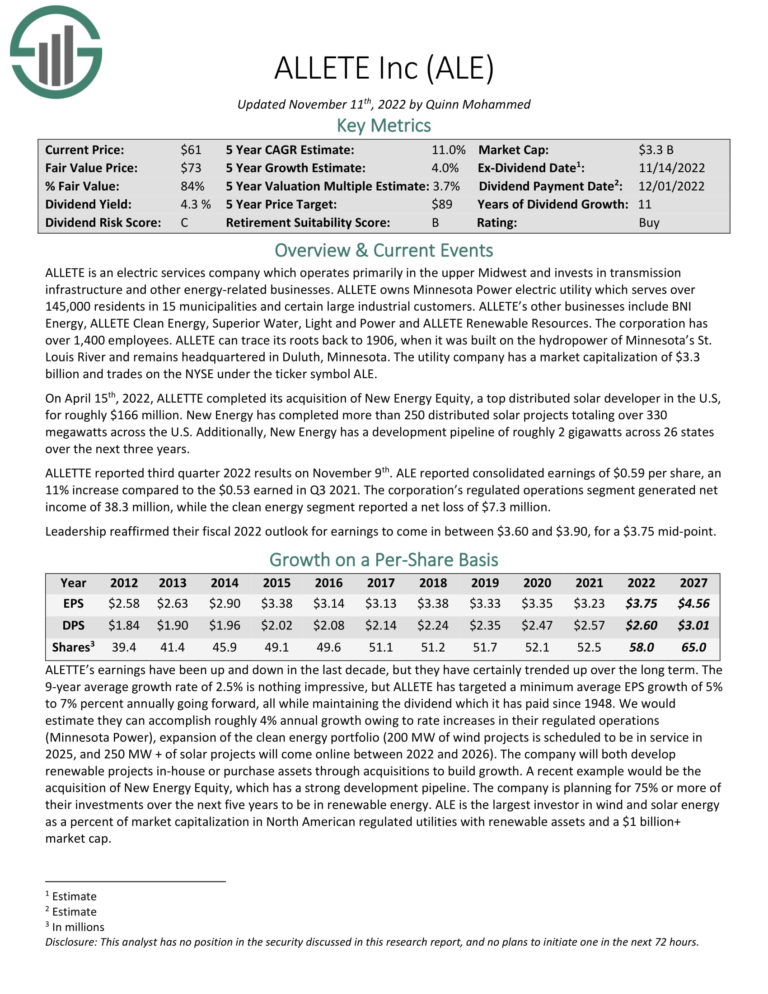

Top Utility Stock #8: ALLETE, Inc. (ALE)

- 5-year expected annual returns: 9.0%

Allete is an electric services company operating primarily in the upper Midwest that also invests in transmission infrastructure and other energy-related businesses. ALLETE owns Minnesota Power electric utility, which provides electricity to 145,000 residents in 15 municipalities in the region along with specific large industrial customers.

While the regulated business is important to ALLETE, the company is also making solid inroads into renewable energy. To further that end, the company acquired New Energy Equity, a top solar developer in the U.S., for $166 million on April 15th, 2022. Other businesses include BNI Energy, ALLETE Clean Energy, Superior Water, and Light and Power. Wind projects should have 200 MW in service by 2025, and solar is expected to have at least 250 MW by the end of 2026.

ALLETE reported quarterly results on November 9th, 2022.

Earnings-per-share equaled $0.59, which was an 11% improvement from the prior year’s figure of $0.53. Management forecasts that earnings-per-share will grow 16% in 2022.

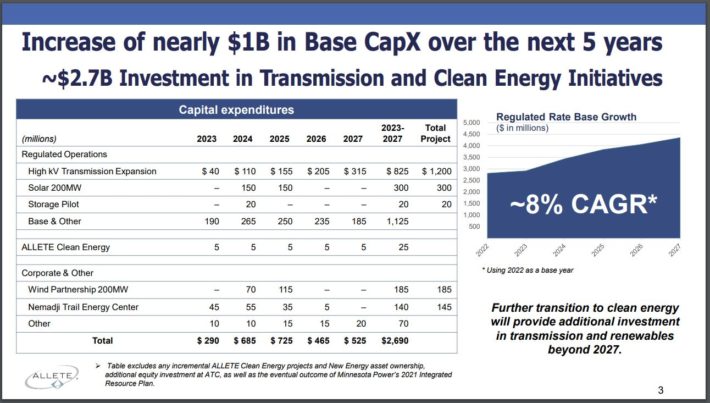

ALLETE expects its rate base growth will be ~8% annually over the next half-decade, which should lead to solid long-term growth. While we share in this enthusiasm, especially because of the renewable portfolio, we have earnings growth estimated at 4% per year.

Long-term, ALLETE’s dividend growth has been solid as the company has a dividend growth streak of 11 years and has maintained its payments to shareholders since 1948. The stock offers a yield of 3.9%.

Shares of ALLETE are trading below our target P/E/ of 19.5, with potential multiple expansion adding 1.8% to annual returns going forward.

Therefore, total returns come to 9%, stemming from 4% earnings growth, the 3.9% starting yield, and a low single-digit contribution from a valuation. On a pullback, we would view ALLETE as a buy.

Click here to download our most recent Sure Analysis report on ALLETE, Inc. (preview of page 1 of 3 shown below):

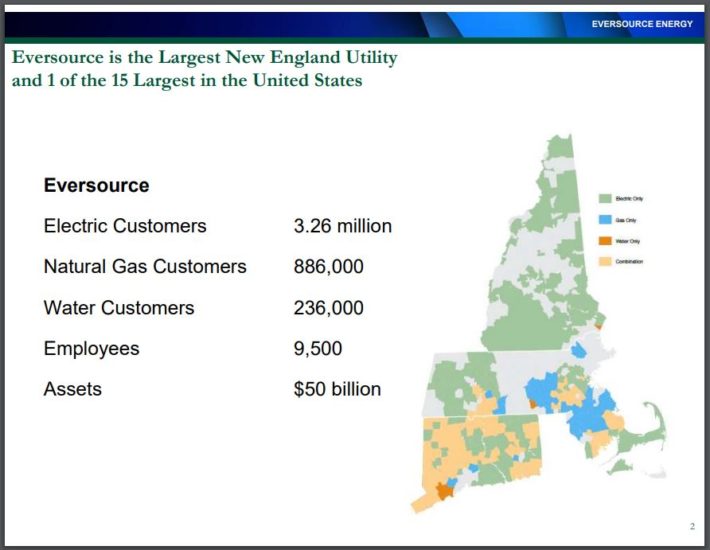

Top Utility Stock #7: Eversource Energy (ES)

- 5-year expected annual returns: 9.6%

Next up is Eversource, a diversified holding company whose subsidiaries provide regulated electric, gas, and water distribution service in the northeastern U.S. In fact, the company is the largest utility in New England.

Following several acquisitions during the last decade, the company’s utilities now provide services to more than four million customers. The $29 billion company changed its name to Eversource from Northeast utilities in 2015.

Eversource reported third-quarter results on November 2nd, 2022. Revenue surged more than 32% to $3.22 billion while reported earnings of $349.4 million, or $1.00 per share, compared to earnings of $283.2 million, or $0.82 per share.

Electric Transmission earnings were up almost 12% to $155.8 million, thanks mainly to higher levels of investment in Eversource’s electric transmission system. Electric Distribution earnings grew 5.4% to $225.1 million due to higher revenues and lower pensions-related costs.

Eversource has a highly ambitious plan to invest $18.1 billion in its transmission and distribution projects through 2026 to be carbon neutral by 2030. The company aims to add as much as 1,800 MW of offshore wind to its portfolio by 2025 through a joint venture.

We project earnings growth of 5% annually through 2027, which is close to the company’s forecast of 5% to 7% growth and the long-term average growth rate of 6%.

Eversource has increased its dividend for 24 years, placing the company on the cusp of attaining Dividend Champion status. With a reasonable payout ratio of 62%, it is likely that the current yield of 3.1% is safe.

Shares are trading at a discount to our five-year target P/E of 22, which could lead to a valuation tailwind of 1.8% annually.

In total, we find that the return potential for Eversource is 9.6% annually through 2027 due to earnings growth of 5%, the starting yield of 3.1%, and a small contribution from an expanding multiple. On a pullback, the stock would be an attractive investment option.

Click here to download our most recent Sure Analysis report on Eversource Energy (preview of page 1 of 3 shown below):

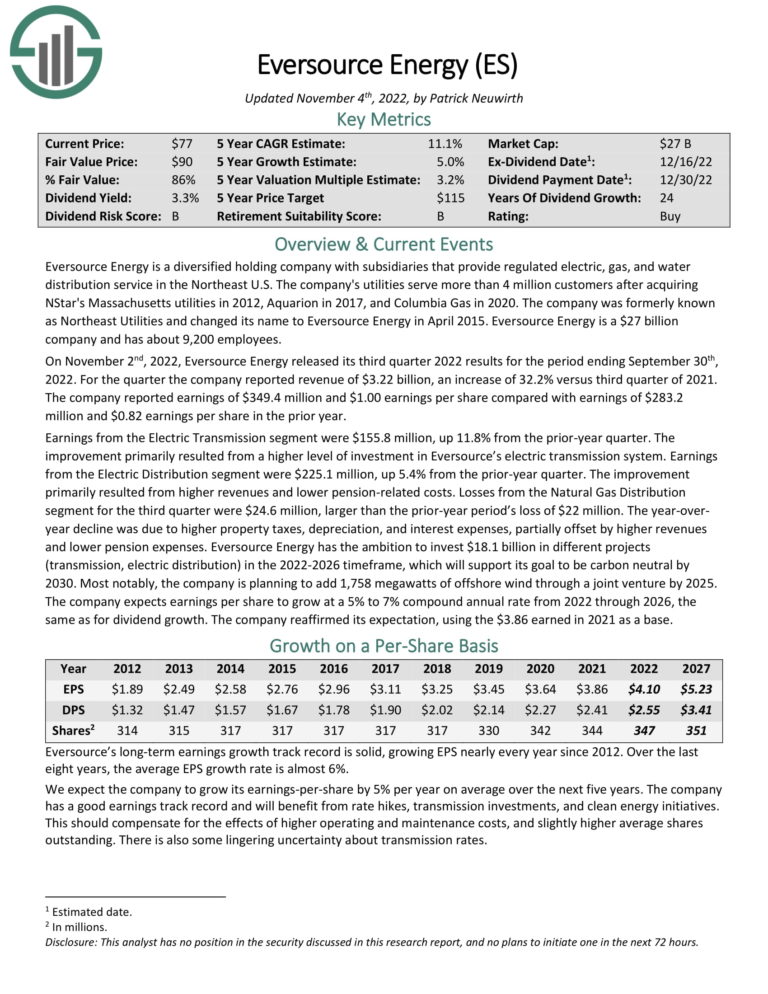

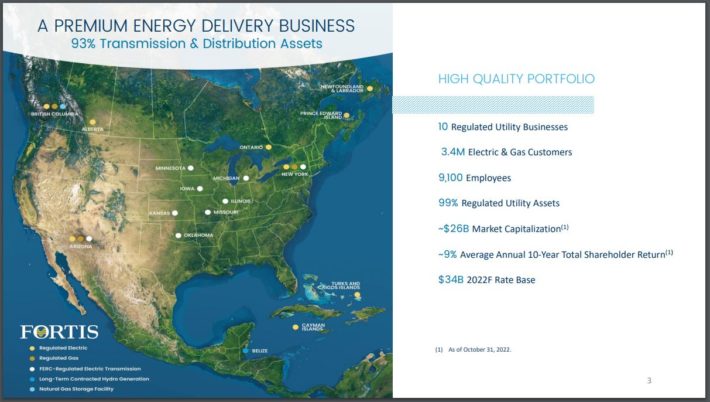

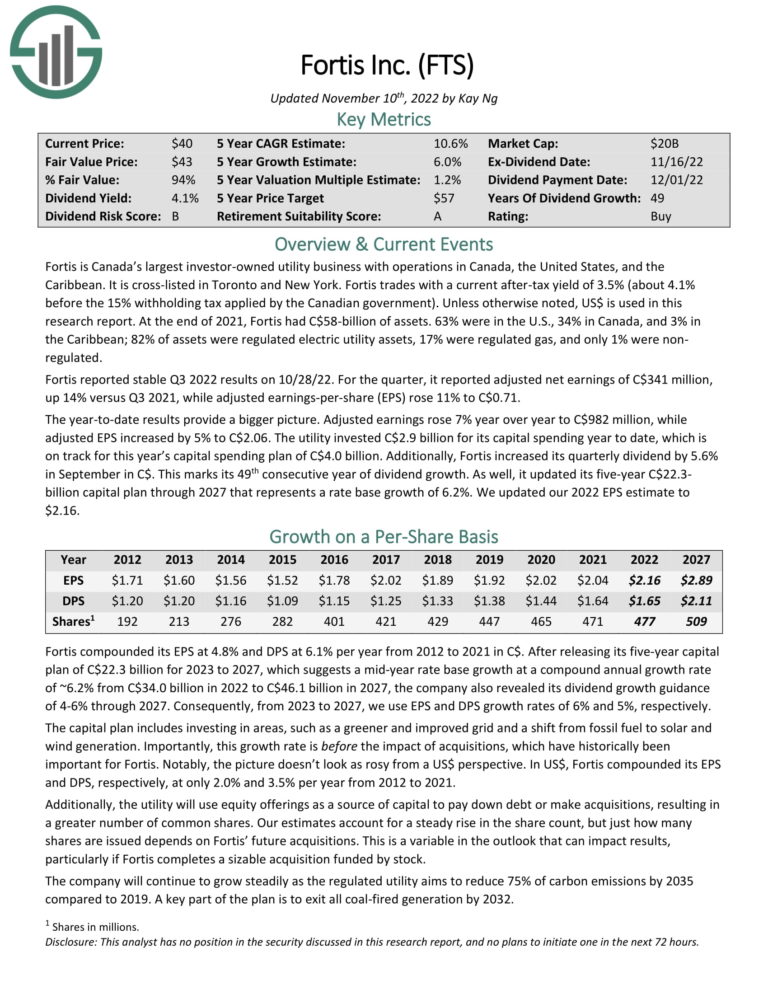

Top Utility Stock #6: Fortis Inc. (FTS)

- 5-year expected annual returns: 10.7%

The following utility name is Fortis, Canada’s largest publicly traded utility company. The company has a sizeable footprint throughout North America.

While Fortis is based in Canada, almost two-thirds of the company’s C$58 billion assets are located in the U.S. A third of assets are in Canada, with the remaining located in the Caribbean. Of these, 82% of all assets are regulated electric utilities, 17% are regulated gas, and 1% are nonregulated.

The company released quarterly results on October 28th, 2022. Net earnings of C$341 million were a 14% increase year-over-year, while adjusted earnings-per-share increased 11%. The company invested about C$3 billion, with a stated target of C$4 billion for the year. We believe that Fortis is capable of 6% earnings growth annually over the next five years.

Fortis’ dividend is subject to currency fluctuations between the U.S. and Canadian dollar, but the company has a very long dividend growth streak of 49 consecutive years. The stock offers a generous yield of 4.2%. Fortis has a projected payout ratio of 76% for this year.

Shares of the company are trading just below our target of 19.8 times earnings estimates, which could add 1.2% to annual returns.

Therefore, Fortis is projected to offer total annual returns of 10.7% through 2027 due to a combination of 6% earnings growth, a starting yield of 4.1%, and a small tailwind from multiple expansions. Shares earn a buy rating due to projected returns.

Click here to download our most recent Sure Analysis report on Fortis Inc. (preview of page 1 of 3 shown below):

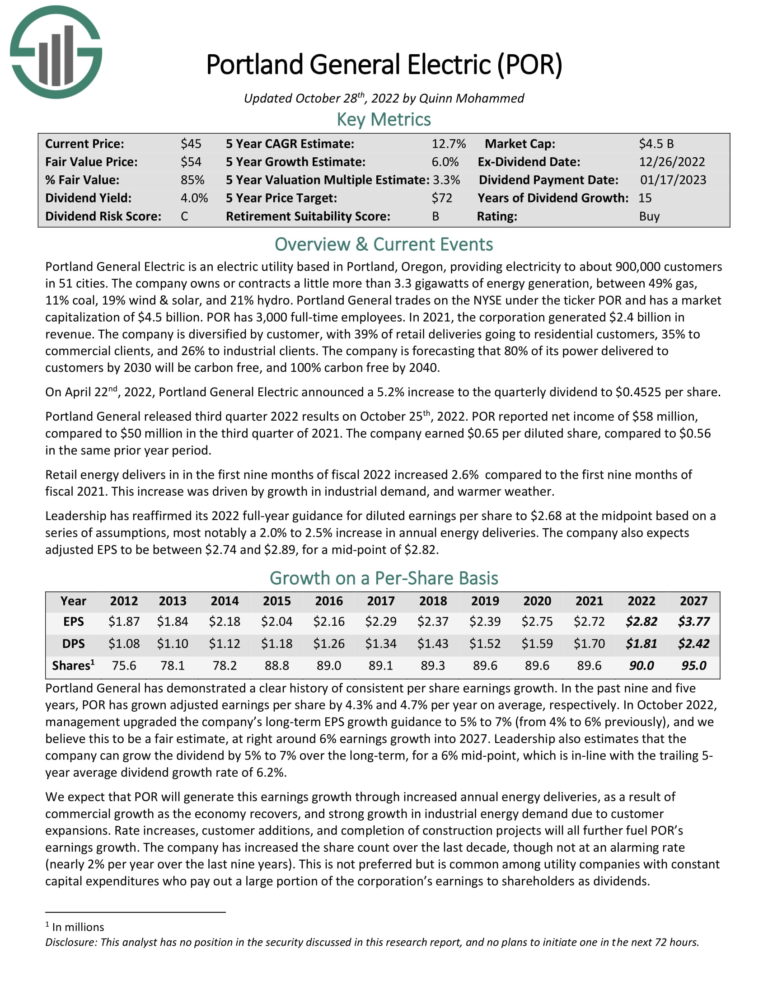

Top Utility Stock #5: Portland General Electric Company (POR)

- 5-year expected annual returns: 11.2%

Portland General Electric is an electric utility based in Portland, Oregon. The company is on the smaller side, providing electricity to nearly 900,000 customers and two million residents in 51 cities.

The customer base is very diversified, with 30% of retail deliveries going to residential customers, 35% to commercial clients, and 26% to industrial clients.

Portland General Electric owns or contracts 3.3 gigawatts of energy generation through gas (49% of total), hydro (21%), wind and solar (19%), and coal (11%). From this breakdown, it is clear that the company is investing heavily in renewable energy sources. To that end, Portland General Electric expects to be carbon-free by 2040.

Portland General Electric announced third-quarter results on October 25th, 2022. Net income and earnings-per-share improved by 16% for the period due to higher energy deliveries due to warmer weather and increased industrial demand.

We project that Portland General Electric will grow earnings-per-share by 6%, which matches the long-term trend.

Portland General Electric has raised its dividend for 15 consecutive years. And with an expected payout ratio of 64% this year, the stock’s yield of 3.7% looks safe.

Valuation could contribute to total returns, and shares are trading below our target P/E of 19. If the stock reached this level by 2027, the valuation would add 2% to annual returns.

Annual returns are expected to be 11.2% through 2027, driven by a 6% earnings growth rate, a 3.7% dividend yield, and a slight tailwind from multiple expansions. We rate shares as a buy.

Click here to download our most recent Sure Analysis report on Portland General Electric Company (preview of page 1 of 3 shown below):

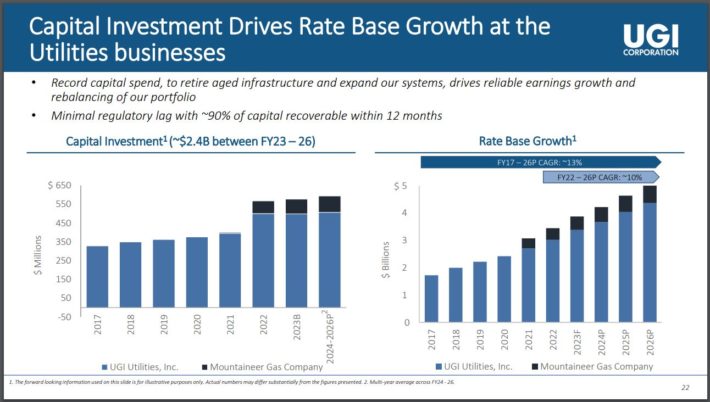

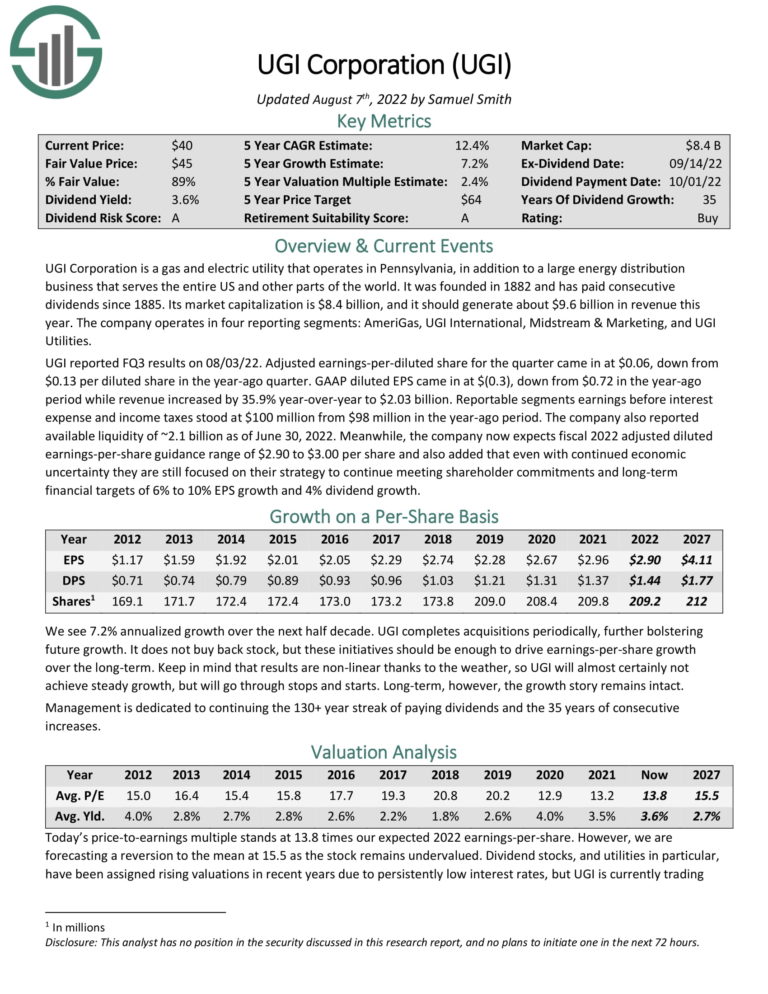

Top Utility Stock #4: UGI Corporation (UGI)

- 5-year expected annual returns: 12.6%

UGI is an electric and gas utility company that operates in Pennsylvania, in addition to a large energy distribution business that serves the entire U.S. and other parts of the world. The company has four segments: AmeriGas, UGI International, Midstream & Marketing, and UGI Utilities.

UGI reported fourth-quarter results for the fiscal year 2022 on November 17th, 2022. Adjusted net income of $1.467 billion compared favorably to $629 million in the prior year. Adjusted earnings-per-share fell slightly to $2.90 from $2.96.

We find that UGI can grow earnings-per-share by 7.2% per year over the medium term, driven by investment in its business that could lead to a 10% rate base growth from 2022 through 2026.

UGI has paid a dividend every year since 1885 and has raised its dividend for 35 consecutive years. The payout ratio was 50% for the fiscal year 2022. The stock is paying a 3.6% dividend yield at the moment.

Shares of the company are trading at a discount to our target multiple of 15.5, which could add 2.5% to annual returns over the next five years.

The combination of 7.2% earnings growth, the starting yield of 3.6%, and a low single-digit tailwind from multiple expansions could lead to 12.6% annual returns for the stock. Shares of UGI receive a buy rating.

Click here to download our most recent Sure Analysis report on UGI Corporation (preview of page 1 of 3 shown below):

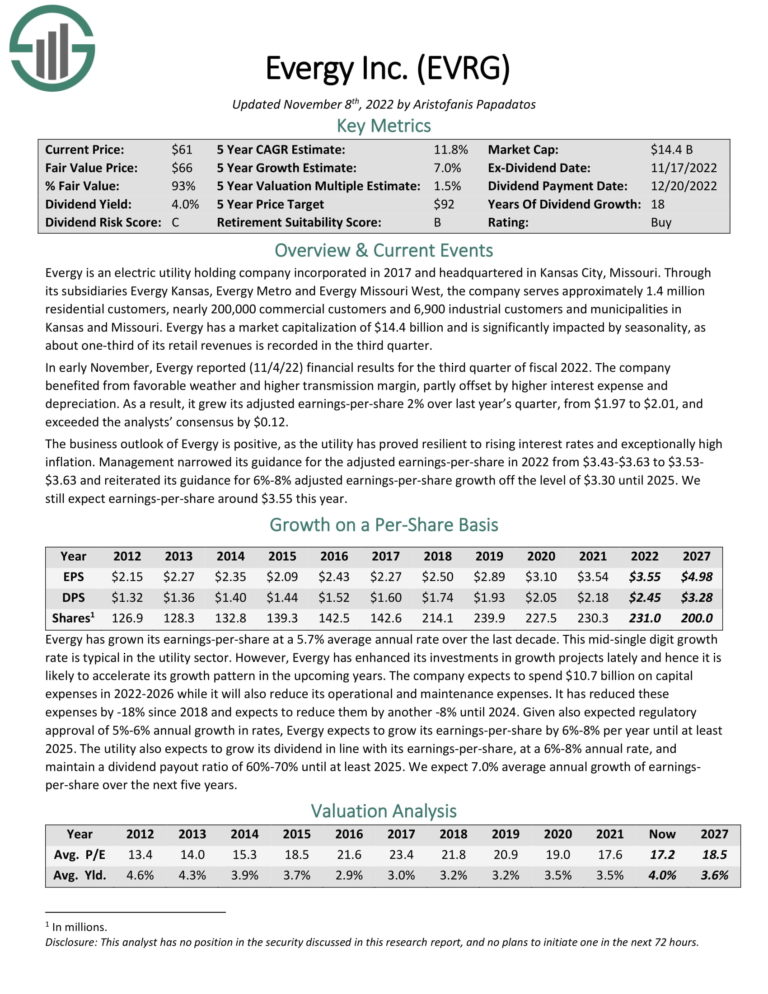

Top Utility Stock #3: Evergy Inc. (EVRG)

- 5-year expected annual returns: 12.7%

Incorporated in 2017, Evergy is an electric utility holding company that serves 1.4 million residential customers, 200,000 commercial customers, and 6,900 industrial customers and municipalities in Kansas and Missouri. The weather tremendously impacts this $13 billion company as approximately one-third of annual revenues are recorded in the third quarter.

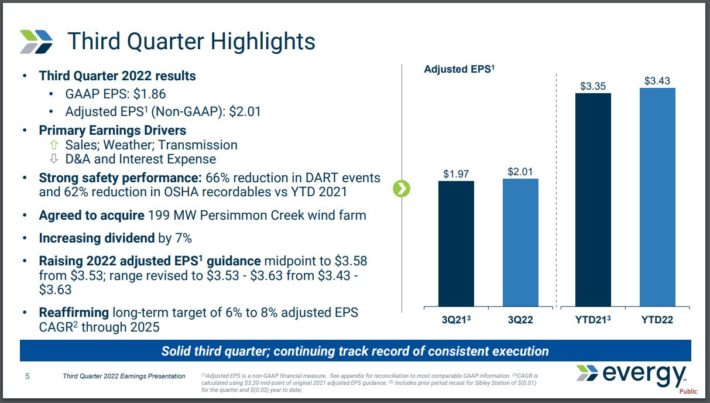

Evergy reported third-quarter results on November 4th, 2022.

Favorable weather and higher transmission margin were only partially offset by higher interest expense and depreciation and helped drive a 2% increase in earnings-per-share to $2.01. Management narrowed its prior guidance for adjusted earnings-per-share to $3.53 to $3.63 from $3.43 to $3.63.

The company also reiterated its guidance for 6% to 8% earnings-per-share growth from $3.30 until 2025. We believe that the midpoint of this range is possible as Evergy has a capital allocation clan of almost $11 billion for the 2022 to 2026 period. The company should also benefit from a reduction in expenses. For example, the company has already reduced expenses by 18% since 2018 and expects another 8% reduction by the end of 2024.

Evergy has increased its dividend for 18 consecutive years and has a projected payout ratio of 69% for 2022. Shares yield 4.2%.

The stock is trading below our fair value estimate of 18.5. Multiple expansions could add as much as 2.3% to annual returns over the next five years.

Therefore, we peg annual returns at 12.7%, stemming from a 7% earnings growth rate, a 4.2% starting yield, and a small contribution from an expanding multiple.

Click here to download our most recent Sure Analysis report on Evergy Inc. (preview of page 1 of 3 shown below):

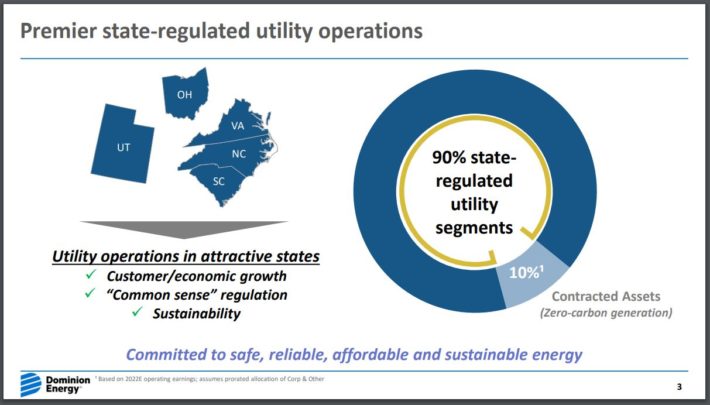

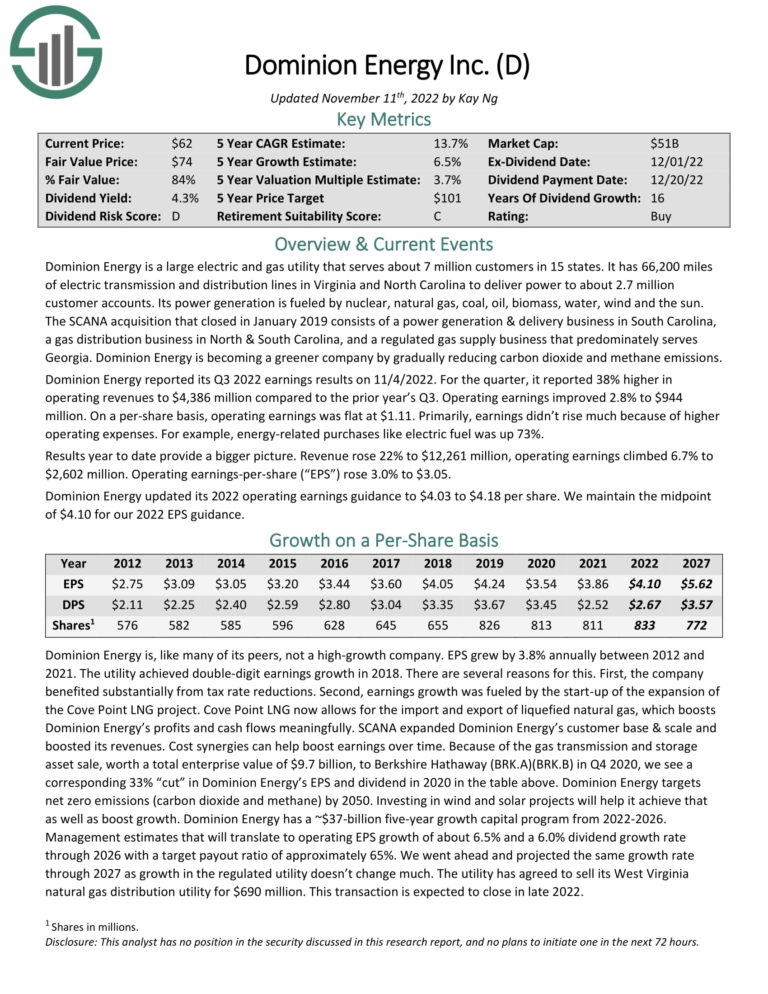

Top Utility Stock #2: Dominion Energy (D)

- 5-year expected annual returns: 13.8%

Dominion Energy is one of the largest electric utility companies in the U.S.

The company provides services to seven million customers in 15 U.S. states, including Virginia, Ohio, and North and South Carolina. Power generation is fueled by various sources, including nuclear, natural gas, coal, oil, water, wind, and sun.

Dominion Energy reported third-quarter results on November 4th, 2022. Operating revenue grew 38% to $4.4 billion. Operating earnings increased 2.8% to $944 million, while earnings-per-share of $1.11 was flat from the prior year. Increases in expenses, such as the cost of electric fuel going up 73%, kept a lid on earnings growth.

The company is forecasted to grow earnings-per-share by 6.5% per year over the medium term, nearly twice the long-term growth rate. We bilevel this is possible due to an aggressive capital investment of $37 billion over the next four years that should help grow rate bases. Renewable energy, such as wind and solar projects, should also aid results.

After selling its gas transmission and storage business to Berkshire Hathaway (BRK.A)(BRK.B) for $9.7 billion, including the assumption of debt, in 2020, Dominion Energy slashed its dividend by 33%. That said, it appears that the dividend has now been rightsized as we forecast that the company will have a payout ratio of 65% in 2022, which would match the previous year for the lowest payout ratio in more than a decade. Shares of Dominion Energy yield a generous 4.3% even after the dividend cut.

Dominion Energy is trading below our five-year target P/E ratio of 18, which could mean an annual contribution to total returns of 3.8%.

Therefore, Dominion Energy is projected to return 13.8% per year for the next half-decade, driven by a 6.5% earnings growth rate, the 4.3% starting yield, and a tailwind from multiple expansions.

Click here to download our most recent Sure Analysis report on Dominion Energy (preview of page 1 of 3 shown below):

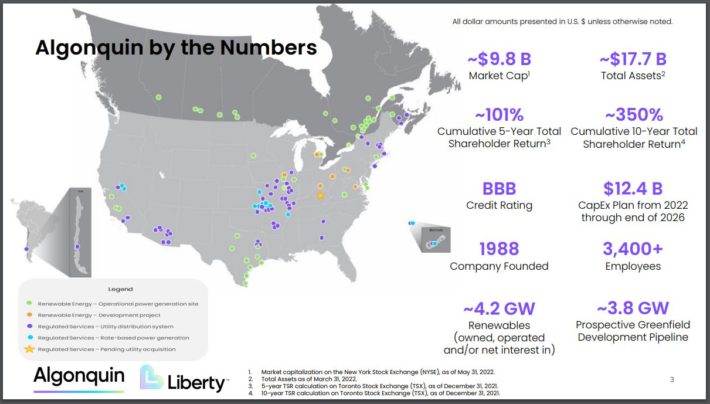

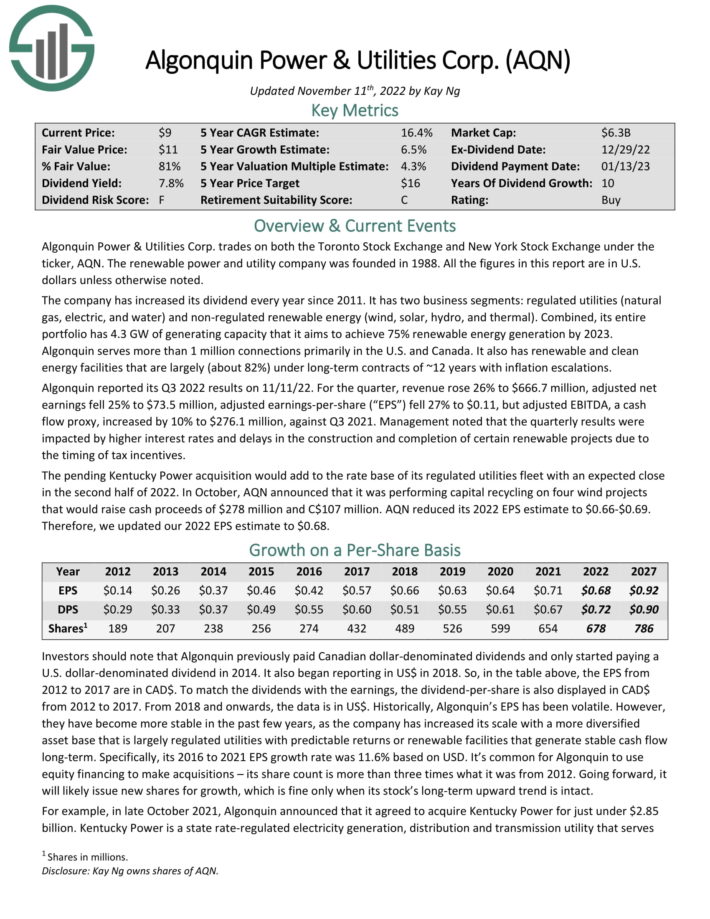

Top Utility Stock #1: Algonquin Power & Utilities Corporation (AQN)

- 5-year expected annual returns: 20.1%

Our top pick among electric utilities is Algonquin, which trades on both the Toronto Stock Exchange and New York Stock Exchange. The company provides services to more than one million connections, most of which are located in the U.S. and Canada.

The company comprises two business segments, regulated utilities, which include electric, gas, and water, and non-regulated renewable energy, which includes wind, solar, hydro, and thermal. Algonquin has 4.3 GW of generating capacity, 75% of which it aims to achieve through renewable energy generation by 2023. More than 80% of the company’s renewable and clean energy facilities are under long-term contracts of nearly 12 years with inflation escalators.

Algonquin reported its third-quarter results on November 11th, 2022. Revenue grew 26% to $666.7 million. Higher interest rates and delays in construction and completion of certain renewable projects due to the timing of tax incentives caused adjusted earnings-per-share to decline 27% to $0.11. However, adjusted EBITDA, a cash flow proxy, improved by 10% to $276.1 million.

As the company has used and will likely use in the future share issuance to grow its business, we believe that earnings growth of 6.5% can be achieved. This compares to the 11.6% annual growth the company saw for the last five years.

The company’s dividend does have some fluidity due to currency exchange, but Algonquin’s dividend growth streak does stand at a decade. Shares are yielding a very high 9.7%. We believe the payout ratio will be 107% for 2022. Usually, a high yield and an elevated payout ratio would cause concern, but the latter has been above 100% for most of the last decade and is mainly due to currency.

Algonquin is trading at a significant discount to our fair value multiple of 17 times earnings. Investors could see an annual contribution of 7.4% through 2027 if the multiple approach this target.

In total, we forecast that Algonquin will provide annual returns of 20.1% due to a combination of 6.5% earnings growth, the 9.7% dividend yield, and a high single-digit contribution from multiple expansions.

Click here to download our most recent Sure Analysis report on AQN (preview of page 1 of 3 shown below):

Final Thoughts

The need for electricity isn’t going away significantly as the popularity and growth of electric vehicles accelerate. Combining this need with the typical uses of electricity and those utility companies focused on this area of power generation should have further growth ahead due to rising demand.

Utility stocks can make significant income-generating positions because of their generally stable business models that allow for generous dividend yields.

While not all stocks listed in this article have a buy rating, they all have at least a high single-digit total return potential and very safe dividend yields. Investors looking for exposure to the utility sector and reliable income could do well adding these names to their portfolios.

Image by Peter Dargatz from Pixabay

Utilities are often a favorite of dividend growth investors as they can provide excellent returns and high-income levels.

Companies in this sector can do so because they often hold regulatory-based competitive advantages limiting competition. Utilities can typically apply and receive approval for rate base increases as they make upgrades and investments in their infrastructure. This can lead to dependable cash flows that then be distributed to shareholders in the form of dividends.

As such, many utility stocks typically have dividend yields that are several times that of the average stock in the S&P 500 Index.

Because of these favorable industry characteristics, we’ve compiled a list of utility stocks. The list is derived from the major utility sector exchange-traded funds JXI, VPU, and XLU.

You can download the list of all utility stocks (along with important financial ratios such as dividend yields and payout ratios) by clicking on the link below:

Click here to instantly download your free spreadsheet of all Utility Stocks now, along with important investing metrics.

Electric utilities are one of the most common types in the sector, as these companies provide energy to consumers that are needed daily.

Most electricity consumption in the U.S. is due to lighting, appliances, heating, ventilation, and air conditioning. But besides powering homes, businesses, and industrial facilities, electricity will be needed to meet the rising demand from the increased adoption of electric vehicles.

At the end of 2021, it was estimated that there were already 2.3 million electric cars on the road, representing about 1% of the total in the U.S. This leaves much room for growth. While the total number of electric vehicles is still low, the growth rates have been very high. Total global electric cars sold were up 107% in 2021 and followed a 98% increase in 2020. There is much demand for electric vehicles that is growing.

This article will examine 10 of our favorite electric utility names, ranked in order of potential returns over the next five years (total expected returns are based on closing stock prices for the November 25th, 2022, trading session).

Top Utility Stock #10: Sempra Energy (SRE)

Founded over two decades ago, Sempra Energy has blossomed into a nearly $51 billion market cap company. Sempra Energy operates in Southern California, giving the company one of the largest utility customer bases in the U.S. The company provides electricity and natural gas to more than 20 million customers.

Sempra Energy also has a majority stake in the Texas-based Oncor. This transmission and distribution business provides electricity to more than 10 million customers. In addition, Sempra Energy owns and operates other utilities and merchant renewable energy projects, liquefied natural gas facilities, and gas pipes and storage in the U.S. and Latin America.

Sempra Energy reported third-quarter earnings results on November 3rd, 2022.

Source: Investor Presentation

The company’s earnings-per-share grew 16% to $1.97 and came in $0.19 above analysts’ anticipated. As a result, management raised its annual earnings-per-share guidance to $8.70 to $9.00 compared to $8.10 to $8.70.

Long-term, Sempra Energy expects to grow its earnings-per-share by 6% to 8% due to an intensive capital investment plan and customer growth in its areas of operation. Erring on the side of caution, we project earnings-per-share growth of 5% over the next five years.

Sempra Energy has increased its dividend for the past 12 years and has a projected payout ratio of just 52% for 2022, a very low figure for a utility company. Shares yield 2.8%, which compares well to the 1.6% average yield for the S&P 500 Index.

Lastly, shares of the company are trading near our five-year target price-to-earnings (P/E) ratio of 18.8, implying a 0.2% tailwind from multiple expansions over the next five years.

Sempra Energy is projected to return 7.7% annually through 2027, resulting from 5% earnings growth, the 2.8% starting yield, and the valuation contribution. Shares earn a hold rating due to expected total returns.

Click here to download our most recent Sure Analysis report on Sempra Energy (preview of page 1 of 3 shown below):

Top Utility Stock #9: FirstEnergy Corp. (FE)

Through its subsidiaries, FirstEnergy generates, transmits, and distributes electricity to customers in the U.S. The company comprises two segments, Regulated Distribution and Regulated Transmission. FirstEnergy owns and manages hydroelectric, coal-fired, nuclear, and natural gas facilities and its renewable power generating operations. The $23 billion company serves close to six million customers across Ohio, Pennsylvania, New Jersey, West Virginia, Maryland, and New York.

FirstEnergy reported third-quarter results on October 25th, 2022. Revenue improved 12% to $3.5 billion while adjusted earnings-per-share of $0.79 compared to $0.82 in the prior year. Higher planned expenses and share dilution were the primary reasons for the decline in earnings.

FirstEnergy has a more uneven profitability track record than most utility names, mainly because of bankruptcy in a former subsidiary and poor investments. That said, the company has taken steps to improve its business and balance sheet, including reducing its debt by 30% since the end of 2021.

To illustrate how far the company has come, management reaffirmed its previous forecast of 6% to 8% earnings growth over the medium term, which is well above the compound annual growth rate of 2.7% that FirstEnergy had during the previous decade. We forecast earnings growth of 6.5%.

In tandem with earnings, the dividend has also struggled to grow. In fact, the current annualized dividend of $1.56 is still well below the $2.20 shareholders received in 2012. Still, the dividend was raised in 2020 and has remained constant. We believe that the current dividend is well protected given the expected payout ratio of 65% for 2022, which would be the lowest figure in more than a decade. Shares yield 3.9%.

The stock is trading slightly above our target P/E of 15.5, which would mean that valuation could be a 1.5% headwind to annual returns over the next five years.

FirstEnergy is expected to provide a total annual return of 8.3% through 2027 due to earnings growth of 6.5% and the starting yield of 3.9%, offset slightly by multiple compression. The stock earns a hold recommendation.

Click here to download our most recent Sure Analysis report on FirstEnergy Corp. (preview of page 1 of 3 shown below):

Top Utility Stock #8: ALLETE, Inc. (ALE)

Allete is an electric services company operating primarily in the upper Midwest that also invests in transmission infrastructure and other energy-related businesses. ALLETE owns Minnesota Power electric utility, which provides electricity to 145,000 residents in 15 municipalities in the region along with specific large industrial customers.

While the regulated business is important to ALLETE, the company is also making solid inroads into renewable energy. To further that end, the company acquired New Energy Equity, a top solar developer in the U.S., for $166 million on April 15th, 2022. Other businesses include BNI Energy, ALLETE Clean Energy, Superior Water, and Light and Power. Wind projects should have 200 MW in service by 2025, and solar is expected to have at least 250 MW by the end of 2026.

ALLETE reported quarterly results on November 9th, 2022.

Source: Investor Presentation

Earnings-per-share equaled $0.59, which was an 11% improvement from the prior year’s figure of $0.53. Management forecasts that earnings-per-share will grow 16% in 2022.

ALLETE expects its rate base growth will be ~8% annually over the next half-decade, which should lead to solid long-term growth. While we share in this enthusiasm, especially because of the renewable portfolio, we have earnings growth estimated at 4% per year.

Long-term, ALLETE’s dividend growth has been solid as the company has a dividend growth streak of 11 years and has maintained its payments to shareholders since 1948. The stock offers a yield of 3.9%.

Shares of ALLETE are trading below our target P/E/ of 19.5, with potential multiple expansion adding 1.8% to annual returns going forward.

Therefore, total returns come to 9%, stemming from 4% earnings growth, the 3.9% starting yield, and a low single-digit contribution from a valuation. On a pullback, we would view ALLETE as a buy.

Click here to download our most recent Sure Analysis report on ALLETE, Inc. (preview of page 1 of 3 shown below):

Top Utility Stock #7: Eversource Energy (ES)

Next up is Eversource, a diversified holding company whose subsidiaries provide regulated electric, gas, and water distribution service in the northeastern U.S. In fact, the company is the largest utility in New England.

Source: Investor Presentation

Following several acquisitions during the last decade, the company’s utilities now provide services to more than four million customers. The $29 billion company changed its name to Eversource from Northeast utilities in 2015.

Eversource reported third-quarter results on November 2nd, 2022. Revenue surged more than 32% to $3.22 billion while reported earnings of $349.4 million, or $1.00 per share, compared to earnings of $283.2 million, or $0.82 per share.

Electric Transmission earnings were up almost 12% to $155.8 million, thanks mainly to higher levels of investment in Eversource’s electric transmission system. Electric Distribution earnings grew 5.4% to $225.1 million due to higher revenues and lower pensions-related costs.

Eversource has a highly ambitious plan to invest $18.1 billion in its transmission and distribution projects through 2026 to be carbon neutral by 2030. The company aims to add as much as 1,800 MW of offshore wind to its portfolio by 2025 through a joint venture.

We project earnings growth of 5% annually through 2027, which is close to the company’s forecast of 5% to 7% growth and the long-term average growth rate of 6%.

Eversource has increased its dividend for 24 years, placing the company on the cusp of attaining Dividend Champion status. With a reasonable payout ratio of 62%, it is likely that the current yield of 3.1% is safe.

Shares are trading at a discount to our five-year target P/E of 22, which could lead to a valuation tailwind of 1.8% annually.

In total, we find that the return potential for Eversource is 9.6% annually through 2027 due to earnings growth of 5%, the starting yield of 3.1%, and a small contribution from an expanding multiple. On a pullback, the stock would be an attractive investment option.

Click here to download our most recent Sure Analysis report on Eversource Energy (preview of page 1 of 3 shown below):

Top Utility Stock #6: Fortis Inc. (FTS)

The following utility name is Fortis, Canada’s largest publicly traded utility company. The company has a sizeable footprint throughout North America.

Source: Investor Presentation

While Fortis is based in Canada, almost two-thirds of the company’s C$58 billion assets are located in the U.S. A third of assets are in Canada, with the remaining located in the Caribbean. Of these, 82% of all assets are regulated electric utilities, 17% are regulated gas, and 1% are nonregulated.

The company released quarterly results on October 28th, 2022. Net earnings of C$341 million were a 14% increase year-over-year, while adjusted earnings-per-share increased 11%. The company invested about C$3 billion, with a stated target of C$4 billion for the year. We believe that Fortis is capable of 6% earnings growth annually over the next five years.

Fortis’ dividend is subject to currency fluctuations between the U.S. and Canadian dollar, but the company has a very long dividend growth streak of 49 consecutive years. The stock offers a generous yield of 4.2%. Fortis has a projected payout ratio of 76% for this year.

Shares of the company are trading just below our target of 19.8 times earnings estimates, which could add 1.2% to annual returns.

Therefore, Fortis is projected to offer total annual returns of 10.7% through 2027 due to a combination of 6% earnings growth, a starting yield of 4.1%, and a small tailwind from multiple expansions. Shares earn a buy rating due to projected returns.

Click here to download our most recent Sure Analysis report on Fortis Inc. (preview of page 1 of 3 shown below):

Top Utility Stock #5: Portland General Electric Company (POR)

Portland General Electric is an electric utility based in Portland, Oregon. The company is on the smaller side, providing electricity to nearly 900,000 customers and two million residents in 51 cities.

Source: Investor Presentation

The customer base is very diversified, with 30% of retail deliveries going to residential customers, 35% to commercial clients, and 26% to industrial clients.

Portland General Electric owns or contracts 3.3 gigawatts of energy generation through gas (49% of total), hydro (21%), wind and solar (19%), and coal (11%). From this breakdown, it is clear that the company is investing heavily in renewable energy sources. To that end, Portland General Electric expects to be carbon-free by 2040.

Portland General Electric announced third-quarter results on October 25th, 2022. Net income and earnings-per-share improved by 16% for the period due to higher energy deliveries due to warmer weather and increased industrial demand.

We project that Portland General Electric will grow earnings-per-share by 6%, which matches the long-term trend.

Portland General Electric has raised its dividend for 15 consecutive years. And with an expected payout ratio of 64% this year, the stock’s yield of 3.7% looks safe.

Valuation could contribute to total returns, and shares are trading below our target P/E of 19. If the stock reached this level by 2027, the valuation would add 2% to annual returns.

Annual returns are expected to be 11.2% through 2027, driven by a 6% earnings growth rate, a 3.7% dividend yield, and a slight tailwind from multiple expansions. We rate shares as a buy.

Click here to download our most recent Sure Analysis report on Portland General Electric Company (preview of page 1 of 3 shown below):

Top Utility Stock #4: UGI Corporation (UGI)

UGI is an electric and gas utility company that operates in Pennsylvania, in addition to a large energy distribution business that serves the entire U.S. and other parts of the world. The company has four segments: AmeriGas, UGI International, Midstream & Marketing, and UGI Utilities.

UGI reported fourth-quarter results for the fiscal year 2022 on November 17th, 2022. Adjusted net income of $1.467 billion compared favorably to $629 million in the prior year. Adjusted earnings-per-share fell slightly to $2.90 from $2.96.

We find that UGI can grow earnings-per-share by 7.2% per year over the medium term, driven by investment in its business that could lead to a 10% rate base growth from 2022 through 2026.

Source: Investor Presentation

UGI has paid a dividend every year since 1885 and has raised its dividend for 35 consecutive years. The payout ratio was 50% for the fiscal year 2022. The stock is paying a 3.6% dividend yield at the moment.

Shares of the company are trading at a discount to our target multiple of 15.5, which could add 2.5% to annual returns over the next five years.

The combination of 7.2% earnings growth, the starting yield of 3.6%, and a low single-digit tailwind from multiple expansions could lead to 12.6% annual returns for the stock. Shares of UGI receive a buy rating.

Click here to download our most recent Sure Analysis report on UGI Corporation (preview of page 1 of 3 shown below):

Top Utility Stock #3: Evergy Inc. (EVRG)

Incorporated in 2017, Evergy is an electric utility holding company that serves 1.4 million residential customers, 200,000 commercial customers, and 6,900 industrial customers and municipalities in Kansas and Missouri. The weather tremendously impacts this $13 billion company as approximately one-third of annual revenues are recorded in the third quarter.

Evergy reported third-quarter results on November 4th, 2022.

Source: Investor Presentation

Favorable weather and higher transmission margin were only partially offset by higher interest expense and depreciation and helped drive a 2% increase in earnings-per-share to $2.01. Management narrowed its prior guidance for adjusted earnings-per-share to $3.53 to $3.63 from $3.43 to $3.63.

The company also reiterated its guidance for 6% to 8% earnings-per-share growth from $3.30 until 2025. We believe that the midpoint of this range is possible as Evergy has a capital allocation clan of almost $11 billion for the 2022 to 2026 period. The company should also benefit from a reduction in expenses. For example, the company has already reduced expenses by 18% since 2018 and expects another 8% reduction by the end of 2024.

Evergy has increased its dividend for 18 consecutive years and has a projected payout ratio of 69% for 2022. Shares yield 4.2%.

The stock is trading below our fair value estimate of 18.5. Multiple expansions could add as much as 2.3% to annual returns over the next five years.

Therefore, we peg annual returns at 12.7%, stemming from a 7% earnings growth rate, a 4.2% starting yield, and a small contribution from an expanding multiple.

Click here to download our most recent Sure Analysis report on Evergy Inc. (preview of page 1 of 3 shown below):

Top Utility Stock #2: Dominion Energy (D)

Dominion Energy is one of the largest electric utility companies in the U.S.

Source: Investor Presentation

The company provides services to seven million customers in 15 U.S. states, including Virginia, Ohio, and North and South Carolina. Power generation is fueled by various sources, including nuclear, natural gas, coal, oil, water, wind, and sun.

Dominion Energy reported third-quarter results on November 4th, 2022. Operating revenue grew 38% to $4.4 billion. Operating earnings increased 2.8% to $944 million, while earnings-per-share of $1.11 was flat from the prior year. Increases in expenses, such as the cost of electric fuel going up 73%, kept a lid on earnings growth.

The company is forecasted to grow earnings-per-share by 6.5% per year over the medium term, nearly twice the long-term growth rate. We bilevel this is possible due to an aggressive capital investment of $37 billion over the next four years that should help grow rate bases. Renewable energy, such as wind and solar projects, should also aid results.

After selling its gas transmission and storage business to Berkshire Hathaway (BRK.A)(BRK.B) for $9.7 billion, including the assumption of debt, in 2020, Dominion Energy slashed its dividend by 33%. That said, it appears that the dividend has now been rightsized as we forecast that the company will have a payout ratio of 65% in 2022, which would match the previous year for the lowest payout ratio in more than a decade. Shares of Dominion Energy yield a generous 4.3% even after the dividend cut.

Dominion Energy is trading below our five-year target P/E ratio of 18, which could mean an annual contribution to total returns of 3.8%.

Therefore, Dominion Energy is projected to return 13.8% per year for the next half-decade, driven by a 6.5% earnings growth rate, the 4.3% starting yield, and a tailwind from multiple expansions.

Click here to download our most recent Sure Analysis report on Dominion Energy (preview of page 1 of 3 shown below):

Top Utility Stock #1: Algonquin Power & Utilities Corporation (AQN)

Our top pick among electric utilities is Algonquin, which trades on both the Toronto Stock Exchange and New York Stock Exchange. The company provides services to more than one million connections, most of which are located in the U.S. and Canada.

Source: Investor Presentation

The company comprises two business segments, regulated utilities, which include electric, gas, and water, and non-regulated renewable energy, which includes wind, solar, hydro, and thermal. Algonquin has 4.3 GW of generating capacity, 75% of which it aims to achieve through renewable energy generation by 2023. More than 80% of the company’s renewable and clean energy facilities are under long-term contracts of nearly 12 years with inflation escalators.

Algonquin reported its third-quarter results on November 11th, 2022. Revenue grew 26% to $666.7 million. Higher interest rates and delays in construction and completion of certain renewable projects due to the timing of tax incentives caused adjusted earnings-per-share to decline 27% to $0.11. However, adjusted EBITDA, a cash flow proxy, improved by 10% to $276.1 million.

As the company has used and will likely use in the future share issuance to grow its business, we believe that earnings growth of 6.5% can be achieved. This compares to the 11.6% annual growth the company saw for the last five years.

The company’s dividend does have some fluidity due to currency exchange, but Algonquin’s dividend growth streak does stand at a decade. Shares are yielding a very high 9.7%. We believe the payout ratio will be 107% for 2022. Usually, a high yield and an elevated payout ratio would cause concern, but the latter has been above 100% for most of the last decade and is mainly due to currency.

Algonquin is trading at a significant discount to our fair value multiple of 17 times earnings. Investors could see an annual contribution of 7.4% through 2027 if the multiple approach this target.

In total, we forecast that Algonquin will provide annual returns of 20.1% due to a combination of 6.5% earnings growth, the 9.7% dividend yield, and a high single-digit contribution from multiple expansions.

Click here to download our most recent Sure Analysis report on AQN (preview of page 1 of 3 shown below):

Final Thoughts

The need for electricity isn’t going away significantly as the popularity and growth of electric vehicles accelerate. Combining this need with the typical uses of electricity and those utility companies focused on this area of power generation should have further growth ahead due to rising demand.

Utility stocks can make significant income-generating positions because of their generally stable business models that allow for generous dividend yields.

While not all stocks listed in this article have a buy rating, they all have at least a high single-digit total return potential and very safe dividend yields. Investors looking for exposure to the utility sector and reliable income could do well adding these names to their portfolios.

Originally Posted on suredividend.com