Berkshire Hathaway (BRK.B) has an equity investment portfolio worth nearly $300 billion as of the end of the 2022 third quarter.

Berkshire Hathaway’s portfolio is filled with quality stocks. You can follow Warren Buffett stocks to find picks for your portfolio. Buffett (and other institutional investors) must periodically show their holdings in a 13F Filing.

You can see all Warren Buffett stocks (along with relevant financial metrics like dividend yields and price-to-earnings ratios) by clicking on the link below:

Click here to instantly download your free spreadsheet of all Berkshire Hathaway / Warren Buffett stocks now, along with important investing metrics.

Note: 13F filing performance is different than fund performance. See how we calculate 13F filing performance here.

As of September 30th, 2022, Buffett’s Berkshire Hathaway owned nearly 6.0 million shares of Louisiana-Pacific (LPX) for a market value of about $297 million. Louisiana-Pacific represents about 0.1% of Berkshire Hathaway’s investment portfolio.

This article will analyze the forest products company in greater detail.

Business Overview

Louisiana-Pacific Corporation (LPX) is a leader in high-performance building solutions. The company manufactures engineered wood building products for builders, remodelers, and homeowners across the globe.

The company was founded in 1972 and operates 22 plants in the U.S., Canada, Chile, and Brazil. LPX trades with a market capitalization of $4.5 billion.

Source: Investor Presentation

On November 1st, 2022, Louisiana-Pacific reported third-quarter 2022 results. The company generated $852 million in net sales, which was a 16% year-over-year decrease. The siding solutions saw net sales rise 27% year-over-year to $393 million, while OSB net sales declined 35% to $388 million.

Adjusted diluted earnings per share were $1.72, a significant decrease from $3.52 per share in the third quarter of 2021.

Louisiana-Pacific repurchased 5.6 million shares in the third quarter for $325 million. On September 30th, 2022, the company had 71.7 million common shares outstanding.

We estimate that Louisiana-Pacific can generate $11.98 in earnings-per-share for the fiscal year 2022.

Growth Prospects

Growth has been lumpy in the past decade, with outsized earnings in 2021 more than three times that of 2020. In 2019, 2020, and 2021, LP generated adjusted earnings per share of $0.37, $4.31, and $13.97, respectively. The company’s stock price has reflected this massive jump in earnings, rising by 121% in the trailing three years.

Louisiana-Pacific’s Siding segment is experiencing strong growth and achieved record sales in the third quarter. Both volume and prices are rising impressively, at 9% and 16% in the most recent quarter, respectively.

The company is investing in the Siding segment by expanding facilities and improving capacity in the Houlton, Maine, and Washington facilities.

The addressable wood-like siding and trim market stand at about $10 billion, of which Louisiana-Pacific made up 12% in 2021. As a result, a significant market share remains that LP can pry from competitors or generate new business.

Additionally, the company has repurchased a significant number of shares in recent years as it executes its capital plan. Since 2019, LP has repurchased more than $2.7 billion of its own shares, which is remarkable considering the company only has a market capitalization of $4.5 billion. This will act as a tailwind to earnings on a per-share basis.

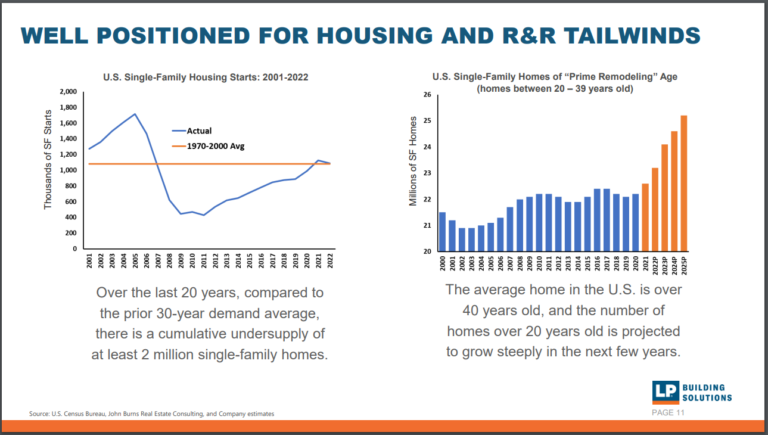

Source: Investor Presentation

A growth catalyst for the company would be the jump in the number of homes coming to their “Prime Remodeling” age, which is between 20 and 39 years old. Additionally, the demand for homes outstrips the supply, meaning many new homes that could use LP’s products must be built.

Given the lumpiness in the company’s historical earnings, we estimate a 4.0% decline in earnings per share from now into 2027 due to the high comparison base formed this year.

Competitive Advantages & Recession Performance

Louisiana-Pacific operates in a heavily competitive environment. The company’s product innovation could be considered a competitive advantage over peers.

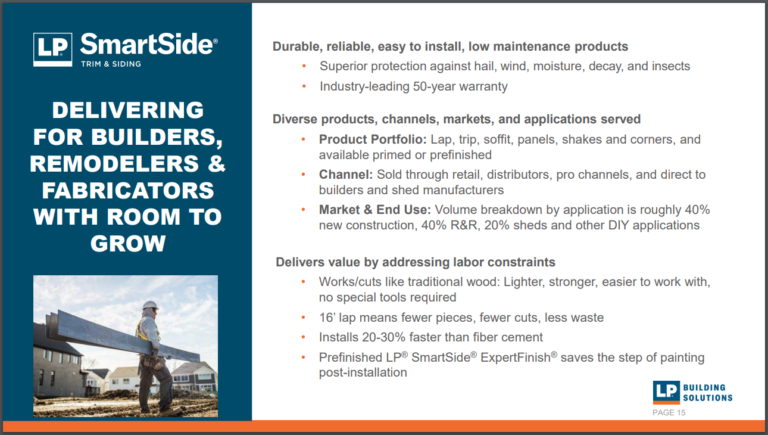

Source: Investor Presentation

The company’s results are tightly linked to the housing and remodeling market. As a result, the company’s business is likely to slow in the face of a recession or rising interest rates.

In the Great Financial Crisis, LP performed very poorly. The company posted losses throughout that period and in 2009, completely cut the dividend. This dividend was not reinstated until 2018, but it has grown yearly since then.

However, in the recent recession, which resulted from the pandemic, the company managed to grow its sales and earnings thanks to solid housing, construction, and remodeling growth.

Louisiana-Pacific has raised its dividend for four consecutive years so far. And the current dividend is well-covered by earnings. Based on expected fiscal 2022 earnings, LPX has a payout ratio of just 7%. We expect the company will be able to grow its dividend, albeit at a reasonable pace, so that the dividend remains sustainable, unlike during the great recession.

Valuation & Expected Returns

Shares of Louisiana-Pacific Corporation have traded for an average price-to-earnings multiple of 17.8 over the last five years. Shares are now trading far below this average, which indicates that shares could be highly undervalued at the current 5.4 times earnings.

Our fair value estimate for Louisiana-Pacific stock is 10.0 times earnings. If this proves correct, the stock will benefit from a 13.3% annualized return gain through 2027.

Shares of Louisiana-Pacific currently yield 1.4%, which is in line with its average yield of 1.5%. On a dividend yield basis, Louisiana-Pacific shares seem to be trading at about fair value.

Putting it all together, the combination of valuation changes, EPS growth, and dividends produces total expected returns of 9.7% per year over the next five years. This makes Louisiana-Pacific Corporation a hold.

Final Thoughts

Louisiana-Pacific Corporation is a leader in high-performance building solutions. The company manufactures a vital component for new and old buildings.

The stock has risen by 121% in the last three years, and 2021 earnings appear to mark a cyclical top for a company that has posted volatile results over the last decade.

Image by Paul Brennan from Pixabay

Berkshire Hathaway (BRK.B) has an equity investment portfolio worth nearly $300 billion as of the end of the 2022 third quarter.

Berkshire Hathaway’s portfolio is filled with quality stocks. You can follow Warren Buffett stocks to find picks for your portfolio. Buffett (and other institutional investors) must periodically show their holdings in a 13F Filing.

You can see all Warren Buffett stocks (along with relevant financial metrics like dividend yields and price-to-earnings ratios) by clicking on the link below:

Note: 13F filing performance is different than fund performance. See how we calculate 13F filing performance here.

As of September 30th, 2022, Buffett’s Berkshire Hathaway owned nearly 6.0 million shares of Louisiana-Pacific (LPX) for a market value of about $297 million. Louisiana-Pacific represents about 0.1% of Berkshire Hathaway’s investment portfolio.

This article will analyze the forest products company in greater detail.

Business Overview

Louisiana-Pacific Corporation (LPX) is a leader in high-performance building solutions. The company manufactures engineered wood building products for builders, remodelers, and homeowners across the globe.

The company was founded in 1972 and operates 22 plants in the U.S., Canada, Chile, and Brazil. LPX trades with a market capitalization of $4.5 billion.

Source: Investor Presentation

On November 1st, 2022, Louisiana-Pacific reported third-quarter 2022 results. The company generated $852 million in net sales, which was a 16% year-over-year decrease. The siding solutions saw net sales rise 27% year-over-year to $393 million, while OSB net sales declined 35% to $388 million.

Adjusted diluted earnings per share were $1.72, a significant decrease from $3.52 per share in the third quarter of 2021.

Louisiana-Pacific repurchased 5.6 million shares in the third quarter for $325 million. On September 30th, 2022, the company had 71.7 million common shares outstanding.

We estimate that Louisiana-Pacific can generate $11.98 in earnings-per-share for the fiscal year 2022.

Growth Prospects

Growth has been lumpy in the past decade, with outsized earnings in 2021 more than three times that of 2020. In 2019, 2020, and 2021, LP generated adjusted earnings per share of $0.37, $4.31, and $13.97, respectively. The company’s stock price has reflected this massive jump in earnings, rising by 121% in the trailing three years.

Louisiana-Pacific’s Siding segment is experiencing strong growth and achieved record sales in the third quarter. Both volume and prices are rising impressively, at 9% and 16% in the most recent quarter, respectively.

The company is investing in the Siding segment by expanding facilities and improving capacity in the Houlton, Maine, and Washington facilities.

The addressable wood-like siding and trim market stand at about $10 billion, of which Louisiana-Pacific made up 12% in 2021. As a result, a significant market share remains that LP can pry from competitors or generate new business.

Additionally, the company has repurchased a significant number of shares in recent years as it executes its capital plan. Since 2019, LP has repurchased more than $2.7 billion of its own shares, which is remarkable considering the company only has a market capitalization of $4.5 billion. This will act as a tailwind to earnings on a per-share basis.

Source: Investor Presentation

A growth catalyst for the company would be the jump in the number of homes coming to their “Prime Remodeling” age, which is between 20 and 39 years old. Additionally, the demand for homes outstrips the supply, meaning many new homes that could use LP’s products must be built.

Given the lumpiness in the company’s historical earnings, we estimate a 4.0% decline in earnings per share from now into 2027 due to the high comparison base formed this year.

Competitive Advantages & Recession Performance

Louisiana-Pacific operates in a heavily competitive environment. The company’s product innovation could be considered a competitive advantage over peers.

Source: Investor Presentation

The company’s results are tightly linked to the housing and remodeling market. As a result, the company’s business is likely to slow in the face of a recession or rising interest rates.

In the Great Financial Crisis, LP performed very poorly. The company posted losses throughout that period and in 2009, completely cut the dividend. This dividend was not reinstated until 2018, but it has grown yearly since then.

However, in the recent recession, which resulted from the pandemic, the company managed to grow its sales and earnings thanks to solid housing, construction, and remodeling growth.

Louisiana-Pacific has raised its dividend for four consecutive years so far. And the current dividend is well-covered by earnings. Based on expected fiscal 2022 earnings, LPX has a payout ratio of just 7%. We expect the company will be able to grow its dividend, albeit at a reasonable pace, so that the dividend remains sustainable, unlike during the great recession.

Valuation & Expected Returns

Shares of Louisiana-Pacific Corporation have traded for an average price-to-earnings multiple of 17.8 over the last five years. Shares are now trading far below this average, which indicates that shares could be highly undervalued at the current 5.4 times earnings.

Our fair value estimate for Louisiana-Pacific stock is 10.0 times earnings. If this proves correct, the stock will benefit from a 13.3% annualized return gain through 2027.

Shares of Louisiana-Pacific currently yield 1.4%, which is in line with its average yield of 1.5%. On a dividend yield basis, Louisiana-Pacific shares seem to be trading at about fair value.

Putting it all together, the combination of valuation changes, EPS growth, and dividends produces total expected returns of 9.7% per year over the next five years. This makes Louisiana-Pacific Corporation a hold.

Final Thoughts

Louisiana-Pacific Corporation is a leader in high-performance building solutions. The company manufactures a vital component for new and old buildings.

The stock has risen by 121% in the last three years, and 2021 earnings appear to mark a cyclical top for a company that has posted volatile results over the last decade.

Originally Posted on suredividend.com