Tuesday 9:45am - DNOWS Meetup

What Trades do you have?

How is your education going?

Market/Industry/Bitcoin Technicals

Stock, ETF, Crypto Alpha Boost Case Studies

Seabrook Discussion 7pm Wednesday

New Age Traders Noon Thursday

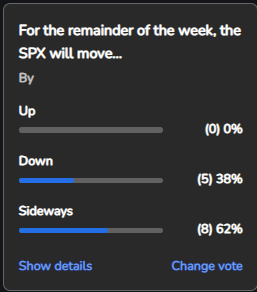

1. High Volatility: VIX > 25. The CPI Data confirms inflations persistence. The Market reacted badly and wiped the last 4 days of gains, driven by ECB QE and Rate Hike for European banks. Going forward, Bad Economic news is just bad news for the markets. Could we see a retest of the June lows before the midterm elections? Please keep your hedges on through the Midterm elections. The rise of both the US Dollar and Interest rates are hurting US Markets, Consumers and Businesses. The new expected SPX range for this week: 4018 top and 3830 bottom.

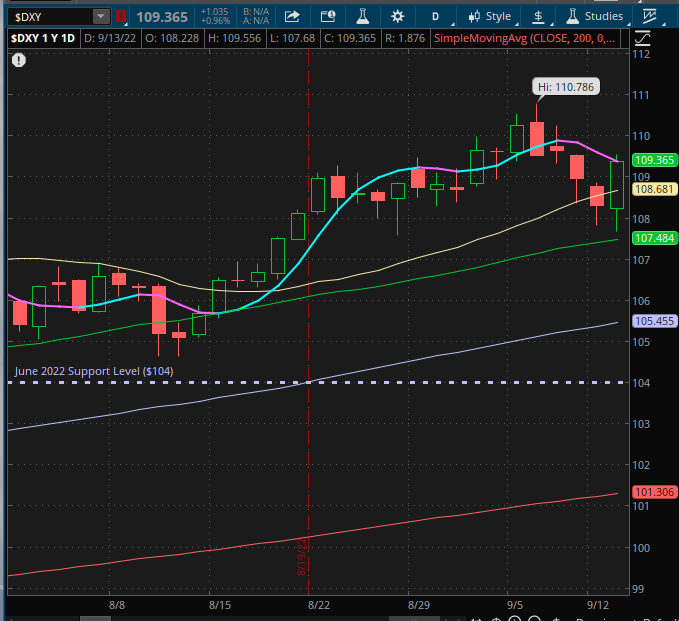

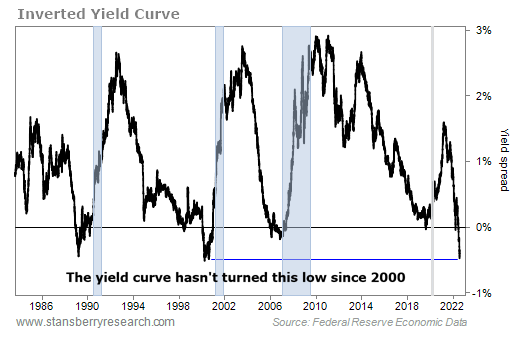

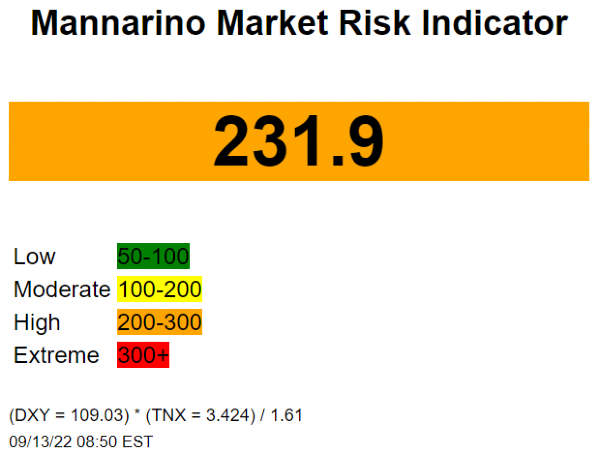

2. US Dollar and 10 Year Interest Rate:

The US Dollar rose today after a 4 day drop. Today’s CPI Data confirms persistence of inflation in spite of drop in oil prices. 10Y Note Interest is above 3.4% and 30 year fixed rate mortgages are around 6-6.5%. The Yield curve for the 2 year vs 10 year near 2000 levels. In the past, 2 negative GDP Quarters signaled a recession, but apparently this time is different?!?!? Long Term the US Dollar decline is still intact with Fiscal and Monetary stimulus flooding the world with US Dollars.

3. Crypto Currency: Bitcoin at $21,470 is still range bound. 14 week range. The $24,000 to $18,525 range has lasted 14 weeks. Corporations, Countries, and Institutional investors are accumulating large Bitcoin positions. Please continue to Dollar Cost Average into Bitcoin and Ethereum. Crypto winter will last for another 10 months, as we wait for the next Bitcoin Halvening in 22 months.

https://support.tastyworks.com/support/solutions/articles/43000612831-available-cryptocurrencies

4. Tasty Works Algo Trading System: James at Quiet Foundation

Alpha Boost ideas, sign up https://info.quietfoundation.com/alphaboost

https://issuu.com/luckbox/docs/2111-luckbox-site/56 Alph Boost Article

If you are new to options or this blog sounds like gibberish, please tryout Tasty Trade’s New 2020 Education. Includes 40 Videos, Testing and you get a certificate of completion at the end of the course.

https://tastytrade.thinkific.com/courses/beginner-options-course

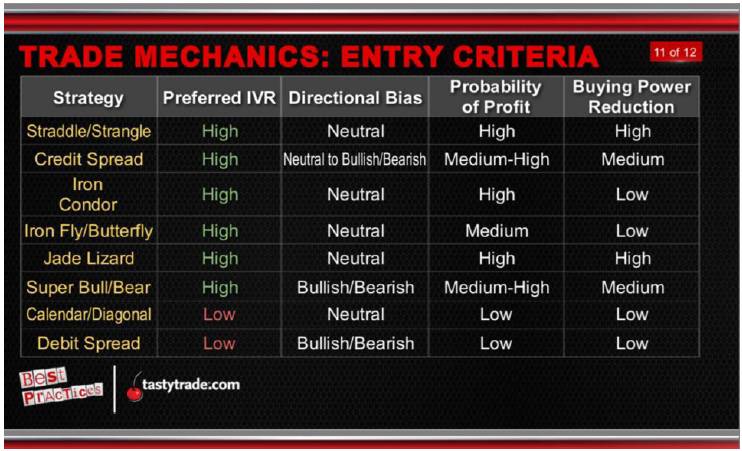

5. TRADE Log: VIX > 25

1.) Jade Lizards -

2.) Put Broken Wing Butterflies - TSLA, GOOGL

3.) Put and Call Credit Spreads - IWM, AMZN

4.) Put Calendars - BITO, F, XHB, AMD, PLTR

6.) Upside Ghetto Spreads - TSLA, SAVA, TBT

7.) Downside Ghetto Spreads - SPY

8.) Collars - F, PLTR

9.) Weekly Butterflies - SPX

10.) Covered Calls - PDBC

6. Video and Articles

https://theotrade.com/heres-why-you-cannot-trust-this-market-rally/

https://traderschoice.net/about-traders-choice/

https://www.tastytrade.com/shows/options-trading-concepts-live/episodes/broken-wing-butterfly-everything-you-need-to-know-09-12-2022

Tuesday 9:45am - DNOWS Meetup

What Trades do you have?

How is your education going?

Market/Industry/Bitcoin Technicals

Stock, ETF, Crypto Alpha Boost Case Studies

Seabrook Discussion 7pm Wednesday

New Age Traders Noon Thursday

1. High Volatility: VIX > 25. The CPI Data confirms inflations persistence. The Market reacted badly and wiped the last 4 days of gains, driven by ECB QE and Rate Hike for European banks. Going forward, Bad Economic news is just bad news for the markets. Could we see a retest of the June lows before the midterm elections? Please keep your hedges on through the Midterm elections. The rise of both the US Dollar and Interest rates are hurting US Markets, Consumers and Businesses. The new expected SPX range for this week: 4018 top and 3830 bottom.

https://traderschoice.net/about-traders-choice/

2. US Dollar and 10 Year Interest Rate:

The US Dollar rose today after a 4 day drop. Today’s CPI Data confirms persistence of inflation in spite of drop in oil prices. 10Y Note Interest is above 3.4% and 30 year fixed rate mortgages are around 6-6.5%. The Yield curve for the 2 year vs 10 year near 2000 levels. In the past, 2 negative GDP Quarters signaled a recession, but apparently this time is different?!?!? Long Term the US Dollar decline is still intact with Fiscal and Monetary stimulus flooding the world with US Dollars.

3. Crypto Currency: Bitcoin at $21,470 is still range bound. 14 week range. The $24,000 to $18,525 range has lasted 14 weeks. Corporations, Countries, and Institutional investors are accumulating large Bitcoin positions. Please continue to Dollar Cost Average into Bitcoin and Ethereum. Crypto winter will last for another 10 months, as we wait for the next Bitcoin Halvening in 22 months.

https://support.tastyworks.com/support/solutions/articles/43000612831-available-cryptocurrencies

4. Tasty Works Algo Trading System: James at Quiet Foundation

Alpha Boost ideas, sign up https://info.quietfoundation.com/alphaboost

https://issuu.com/luckbox/docs/2111-luckbox-site/56 Alph Boost Article

If you are new to options or this blog sounds like gibberish, please tryout Tasty Trade’s New 2020 Education. Includes 40 Videos, Testing and you get a certificate of completion at the end of the course.

https://tastytrade.thinkific.com/courses/beginner-options-course

5. TRADE Log: VIX > 25

1.) Jade Lizards -

2.) Put Broken Wing Butterflies - TSLA, GOOGL

3.) Put and Call Credit Spreads - IWM, AMZN

4.) Put Calendars - BITO, F, XHB, AMD, PLTR

6.) Upside Ghetto Spreads - TSLA, SAVA, TBT

7.) Downside Ghetto Spreads - SPY

8.) Collars - F, PLTR

9.) Weekly Butterflies - SPX

10.) Covered Calls - PDBC

6. Video and Articles

https://theotrade.com/heres-why-you-cannot-trust-this-market-rally/

https://traderschoice.net/about-traders-choice/

https://www.tastytrade.com/shows/options-trading-concepts-live/episodes/broken-wing-butterfly-everything-you-need-to-know-09-12-2022