Expertise Provided by Mark Robertson

Global economic growth and stability depend crucially on the industrial sector. It affects production, employment, and innovation. Investors, policymakers, and business leaders need to understand what shapes the industrials sector. It's important that they comprehend these factors. In this article, we will look at industrial market trends and the manufacturing market outlook. We will also explore industrial manufacturing trends. We will also explore broader trends that influence the industrials sector.

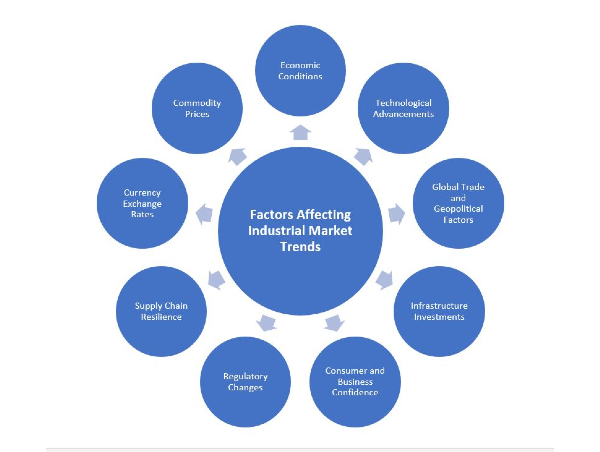

Factors Affecting Industrial Market Trends

The performance and dynamics of the industrials sector are determined by many factors collectively. Understanding what affects the industrials sector is critical. This is important to investors, policymakers, and business leaders. Below are some of the key factors that affect the industry or affect it significantly.

1. Economic Conditions:

The industrials sector is like a big team in the world of businesses. It is also influenced by how countries get along and trade with each other. The team's performance is affected by trade policies, tariffs, and global stability. Just like how the team's game can change based on the rules and how well everyone gets along. The industrial sector's success is influenced by these international factors.

2. Technological Advancements:

Changes in the industry have happened because of new technologies. These include automation and artificial intelligence. People call this Industry 4.0. Companies can benefit from these changes. They can use these technologies to make things work better, faster, and be more competitive. So, if businesses start using these new technologies, it can help them do their work more and be more successful.

3. Global Trade and Geopolitical Factors:

Geopolitics and international business relations are those factors which influence the industrial sector. The performance of this industry is affected by trade policies, tariffs as well as the stability of global politics.

4. Infrastructure Investments:

Another thing that really matters for how well the industrial sector does is how much the government spends on big projects. This includes building roads, energy systems, and other important things. When the government puts more money into these projects, it creates a higher need for construction work, machines, and other things. Industries make or do these things. When the government invests more in building and improving these essential things, it helps industries. It creates more demand for their products and services.

5. Consumer and Business Confidence:

Consumer confidence and business confidence level also affects the industrial activities. A high level of confidence boosts investment and spending. This, in turn, favors industrials.

6. Regulatory Changes:

This can greatly affect costs due to changes in regulations. For example, environmental standards, safety issues, or trade policies may all play a part for industrial operations.

7. Currency Exchange Rates:

Foreign exchange rates are very unstable. Various industrial merchandise can be affected competitiveness on a global scale due to fluctuating currency exchange rates. Exchange rate movements affect export/import dynamics for industrial goods.

8. Supply Chain Resilience:

Resilience and efficiency of supply chains are key factors for the industrials sector. Disruptions may occur due to natural disasters, pandemics, or geopolitical events. They can have major impacts on production and distribution.

9. Commodity Prices:

Industrial companies rely on the cost of raw materials and energy. It's a fundamental factor for them. Changes in commodity prices could affect profit margins and operational costs.

Manufacturing Market Outlook for 2024

In the industrial world, the manufacturing industry is like its ground floor. Its performance in 2024 will depend on a few things. Firstly, it will depend on how well the entire world is doing economically speaking. Secondly, this sector has also been influenced by new technological developments as well as improved ones. Lastly, there’s also an aspect of how different nations work together here too.

The first is that we will keep track of a few key things in 2024. First and foremost, how new and emerging markets are faring is worth noting. These are places where an increasing number of people are beginning to buy and sell more stuff. We will again consider whether our supply chains can withstand adversity. Essentially, we will check if they can deliver the required raw materials promptly. Finally, we eagerly anticipate using smart technologies. We want to manufacture better and faster.

Thus, speaking about the manufacturing outlook for 2024 means talking about how factories and industries are doing. It depends on how well the world is doing. What exciting new technologies are they using? How do they work with other countries? By doing so, we can understand what to expect from the world of manufacturing in the upcoming year.

Industrial Manufacturing Trends

Several different technological advancements and shifting priorities are currently shaping industrial manufacturing. So, these trends have caused a change in how products are made. They have also transformed industries generally. Here are some significant industrial manufacturing trends.

1. Smart Manufacturing and Industry 4.0:

Smart manufacturing integrates advanced technologies. It also uses data analytics and connectivity. It improves efficiency and productivity in the manufacturing sector. They call the fourth industrial revolution Industry 4.0. It emphasizes digital technology for a more understandable manufacturing setup.

Factories are becoming smarter. They are also interconnected with each other. This allows machines to collaborate with one another. They can examine real-time information. They can also make decisions without human involvement. This trend increases effectiveness. It cuts down downtime and enhances quality control.

2. Internet of Things (IoT):

IoT links physical devices and sensors to the internet. They collect data from their environment. They also exchange data with each other. In manufacturing, IoT creates an interconnected network of devices and systems. This offers insightful knowledge about the production process.

It helps monitor the performance of equipment. It predicts maintenance requirements. It also optimizes production flows. It encourages making decisions based on data. This improves results by increasing efficiency. It also reduces operational expenses.

3. Robotics and Automation:

Robotics and automation revolve around robots. They also involve automated systems. They do work that was done by humans. This includes assembly, welding, and material handling.

Automation improves the speed, precision, and safety of production. As a result, robots are increasingly being deployed in industrial processes. They perform repetitive tasks. This enables people to focus on more intricate and creative aspects of production.

4. Sustainability and Green Manufacturing:

Sustainable and eco-friendly production are the growing trends. It emphasizes green manufacturing to minimize waste. It also reduces energy use. It uses environmentally friendly materials.

Companies are embracing sustainable practices. They want to comply with environmental regulations. They also want to reduce their carbon footprint. They are also doing this to attract customers who care about the environment. By examining the range of raw material sourcing in the supply chain, we can observe trends in the industrials sector. We can also look at production inputs and disposal of products that have reached the end of their useful lives.

Industrials Sector Trends

There are various types of industries in industrial sector. For example, those dealing with airplanes, machines, and building stuff. If someone wants their money to grow, they should understand how this sector works. Problems between countries, trading rules, and changes in world money can all affect how well this sector does. So, when we talk about trends in the industrial sector, we're basically talking about big changes happening in these industries. People who spend money or make business decisions need to pay attention to these things to make smart choices. Stuff like how countries get along, rules about trading, and the world's money situation all have a big impact on how well the industrial sector does.

What Affects the Industrials Sector?

The segment of the economy called Industry is a key player in economic growth and development. It is influenced by different elements. The first factor that contributes to this situation is the general health of an economy. In a strong economy, a strong industrial sector will thrive. There are opportunities to buy more items and build roads and buildings. It will struggle when the economy is weak. Second, industrial technology changes. Government regulations also come into play. Some industries may adopt new policies. These policies support environmentally friendly practices.

For example. This is in response to changing conservation rules. Additionally, the level of global goods demand affects the industry’s activities. As a result, people want to buy more products. They also want to invest in construction projects, such as highways and buildings. Then, the economy becomes more active.

The industrials sector behaves somewhat like a roller coaster. This is despite all these factors. It goes up during good times but flip-flops during economic downturns. Therefore, we should pay close attention to the economy and what people want to buy and build. This way, we won't be caught off guard by business fluctuations.

Is the Industrials Sector a Defensive Sector?

The industrials sector is more defensive or cyclical. The decision depends on a few things. Traditionally, people thought of industrials as mere followers of economic cycles. This means when the economy is great and people are buying and building more, it’s good for industrials. However, when the economy is bad such that people do not spend as much in big projects, this can be bad for industrial sector.

So simply put, they could be either defensive or cyclical depending on how they act during different times in an economy. If their prices rise and fall with those of whole economy, then they are said to be more cyclical. Also, if they don’t go down even then there’s recession; so maybe we can say that sometimes insurers are defensive.

Now imagine that the industrials sectors were a team playing a match. When they play well under tough circumstances in the game, we may call them defensive players. If their performance depends on what happens during games, consider these players as cyclic players. Understanding this will help us think about industrial sectors. It will help us understand their place in the overall economy.

Are Industrials Cyclical or Defensive?

When playing a big economic game, industries could be defensive and cyclical. Think of the game as being played by different teams with respective styles. Cyclical industries tend to thrive when the economy is doing well. They are similar to players who excel while winning. These industries thrive during economic booms. People buy and build more things. However, they may face challenges. These are like a struggling team facing strong opponents. This happens when the game gets tough and the economy does badly. Defensive industries are like players who can maintain their position even during poor games.

On the other hand, they might have less effect from ups and downs. This is due to a resilient attitude towards hard situations. Thus, industries can appear as cyclical players, who go with the flow of the game. Or, they may be defensive ones who are on stand-by. This depends on their conduct at different points in time within an economy. It's similar to different teams using distinct styles throughout a match.

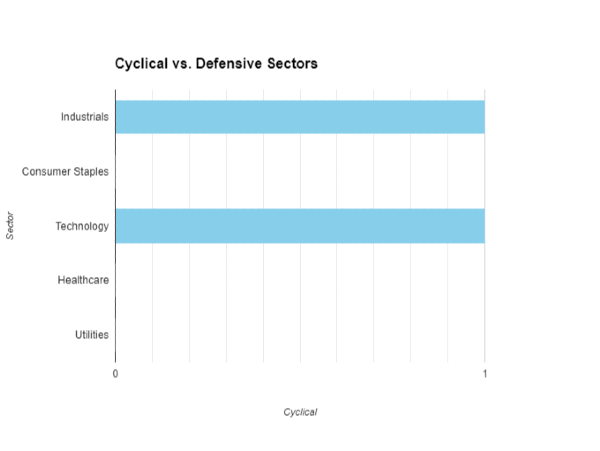

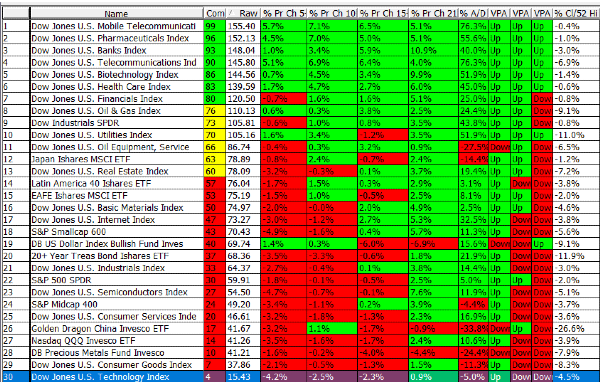

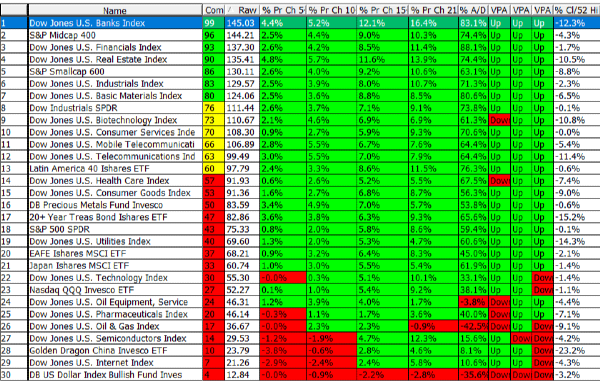

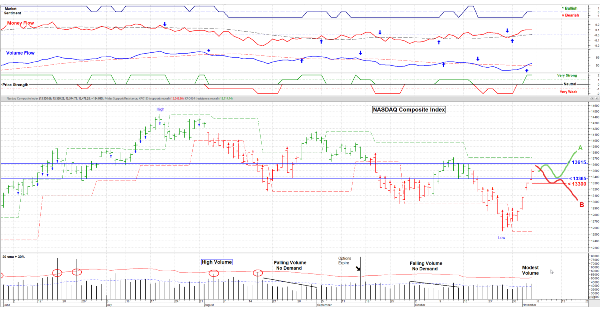

The above image show that which industrial sector is cyclical and which defensive.

The above image show that which industrial sector is cyclical and which defensive.

Why Are Industrials Cyclical?

Cyclical industries are named so because they play like a game. Their performance varies with the economy. Industries usually do well when the economy is doing well. This is because more people buy houses, cars, and other things. It’s like their winning season. During sluggish economies, people spend less. Industries suffer, much like in a tough competition.

Therefore, they are cyclical. Players move through different seasons within a game. Industries enjoy good times and face the hard times of economic games.

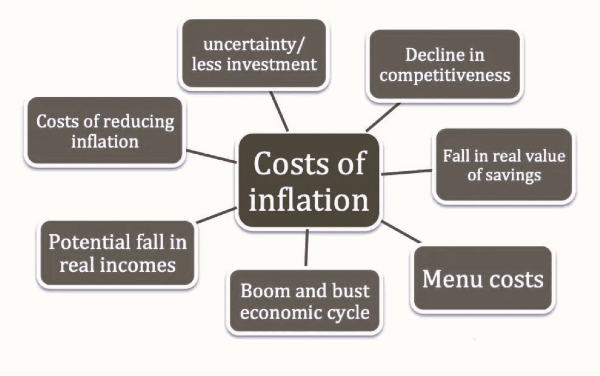

Do Industrials Do Bad During Inflation?

Inflation can be quite dicey for industrialists since it involves rising prices. Imagine having a lemonade stand. Suddenly, lemons and sugar become expensive. This is what happens to industries when prices of materials, such as metals and energy, go up. For instance, if a company makes smartphones and material costs increase. Then, the cost of producing each phone also goes up. This challenge results from increased costs. They can reduce margins for businesses in these sectors.

This is the interesting thing – often it means a good economy if prices are going up. So, there are more people who have jobs and they buy more things. As a result, industries get an opportunity. Suddenly, their products become in demand. To deal with inflation, they might slightly increase prices of their products for consumers. It helps offset additional expenses. It helps them test if they can manage this.

When the economy is performing well, it changes a burden into an opportunity to prosper. It represents industries struggling with increased sales. They are grappling with inflated costs. It happens when the economy is doing well during times of inflation.

Source: Economicshelp

Source: Economicshelp

Conclusion

In conclusion, the industrial sector is very crucial to the global economy. It determines how things are made, sold, and constructed. We can analyze developments like computerization. We can also analyze eco-friendliness and global trade. This can help us understand what has led to the current state of affairs in this sector.

The fate of manufacturing come 2024 will depend on the world’s economic performance at that time. It will also depend on its acceptance of new technologies. It will depend on linkages across nations. Industrial trends show that industries are getting smarter and going green. They are also changing their way of producing goods. The industry is cyclical as a whole.

However, parts offering essential services may be more stable. Inflation is among these challenges, but they can be seen as opportunities. Adjusting prices with respect for the overall economy. Understanding these dynamics helps investors, policymakers, and business leaders make informed decisions. This is crucial in the ever-changing industrial landscape.

Read more about Industrial Stocks in our ongoing sector series:

The Top Industrial Stocks

Are Industrials a Good Investment?

The Best Industrial ETFs

How do you Evaluate Industrial Stocks?

What is the Manufacturing Sector

Industrial Stocks with Dividends

Why Invest in Manufacturing Stocks

Important Manufacturing Sector Ratios

Why are Industrial Stocks Doing Well

What Affects the Industrial Industry?

Expertise Provided by Mark Robertson

Global economic growth and stability depend crucially on the industrial sector. It affects production, employment, and innovation. Investors, policymakers, and business leaders need to understand what shapes the industrials sector. It's important that they comprehend these factors. In this article, we will look at industrial market trends and the manufacturing market outlook. We will also explore industrial manufacturing trends. We will also explore broader trends that influence the industrials sector.

Factors Affecting Industrial Market Trends

The performance and dynamics of the industrials sector are determined by many factors collectively. Understanding what affects the industrials sector is critical. This is important to investors, policymakers, and business leaders. Below are some of the key factors that affect the industry or affect it significantly.

1. Economic Conditions:

The industrials sector is like a big team in the world of businesses. It is also influenced by how countries get along and trade with each other. The team's performance is affected by trade policies, tariffs, and global stability. Just like how the team's game can change based on the rules and how well everyone gets along. The industrial sector's success is influenced by these international factors.

2. Technological Advancements:

Changes in the industry have happened because of new technologies. These include automation and artificial intelligence. People call this Industry 4.0. Companies can benefit from these changes. They can use these technologies to make things work better, faster, and be more competitive. So, if businesses start using these new technologies, it can help them do their work more and be more successful.

3. Global Trade and Geopolitical Factors:

Geopolitics and international business relations are those factors which influence the industrial sector. The performance of this industry is affected by trade policies, tariffs as well as the stability of global politics.

4. Infrastructure Investments:

Another thing that really matters for how well the industrial sector does is how much the government spends on big projects. This includes building roads, energy systems, and other important things. When the government puts more money into these projects, it creates a higher need for construction work, machines, and other things. Industries make or do these things. When the government invests more in building and improving these essential things, it helps industries. It creates more demand for their products and services.

5. Consumer and Business Confidence:

Consumer confidence and business confidence level also affects the industrial activities. A high level of confidence boosts investment and spending. This, in turn, favors industrials.

6. Regulatory Changes:

This can greatly affect costs due to changes in regulations. For example, environmental standards, safety issues, or trade policies may all play a part for industrial operations.

7. Currency Exchange Rates:

Foreign exchange rates are very unstable. Various industrial merchandise can be affected competitiveness on a global scale due to fluctuating currency exchange rates. Exchange rate movements affect export/import dynamics for industrial goods.

8. Supply Chain Resilience:

Resilience and efficiency of supply chains are key factors for the industrials sector. Disruptions may occur due to natural disasters, pandemics, or geopolitical events. They can have major impacts on production and distribution.

9. Commodity Prices:

Industrial companies rely on the cost of raw materials and energy. It's a fundamental factor for them. Changes in commodity prices could affect profit margins and operational costs.

Manufacturing Market Outlook for 2024

In the industrial world, the manufacturing industry is like its ground floor. Its performance in 2024 will depend on a few things. Firstly, it will depend on how well the entire world is doing economically speaking. Secondly, this sector has also been influenced by new technological developments as well as improved ones. Lastly, there’s also an aspect of how different nations work together here too.

The first is that we will keep track of a few key things in 2024. First and foremost, how new and emerging markets are faring is worth noting. These are places where an increasing number of people are beginning to buy and sell more stuff. We will again consider whether our supply chains can withstand adversity. Essentially, we will check if they can deliver the required raw materials promptly. Finally, we eagerly anticipate using smart technologies. We want to manufacture better and faster.

Thus, speaking about the manufacturing outlook for 2024 means talking about how factories and industries are doing. It depends on how well the world is doing. What exciting new technologies are they using? How do they work with other countries? By doing so, we can understand what to expect from the world of manufacturing in the upcoming year.

Industrial Manufacturing Trends

Several different technological advancements and shifting priorities are currently shaping industrial manufacturing. So, these trends have caused a change in how products are made. They have also transformed industries generally. Here are some significant industrial manufacturing trends.

1. Smart Manufacturing and Industry 4.0:

Smart manufacturing integrates advanced technologies. It also uses data analytics and connectivity. It improves efficiency and productivity in the manufacturing sector. They call the fourth industrial revolution Industry 4.0. It emphasizes digital technology for a more understandable manufacturing setup.

Factories are becoming smarter. They are also interconnected with each other. This allows machines to collaborate with one another. They can examine real-time information. They can also make decisions without human involvement. This trend increases effectiveness. It cuts down downtime and enhances quality control.

2. Internet of Things (IoT):

IoT links physical devices and sensors to the internet. They collect data from their environment. They also exchange data with each other. In manufacturing, IoT creates an interconnected network of devices and systems. This offers insightful knowledge about the production process.

It helps monitor the performance of equipment. It predicts maintenance requirements. It also optimizes production flows. It encourages making decisions based on data. This improves results by increasing efficiency. It also reduces operational expenses.

3. Robotics and Automation:

Robotics and automation revolve around robots. They also involve automated systems. They do work that was done by humans. This includes assembly, welding, and material handling.

Automation improves the speed, precision, and safety of production. As a result, robots are increasingly being deployed in industrial processes. They perform repetitive tasks. This enables people to focus on more intricate and creative aspects of production.

4. Sustainability and Green Manufacturing:

Sustainable and eco-friendly production are the growing trends. It emphasizes green manufacturing to minimize waste. It also reduces energy use. It uses environmentally friendly materials.

Companies are embracing sustainable practices. They want to comply with environmental regulations. They also want to reduce their carbon footprint. They are also doing this to attract customers who care about the environment. By examining the range of raw material sourcing in the supply chain, we can observe trends in the industrials sector. We can also look at production inputs and disposal of products that have reached the end of their useful lives.

Industrials Sector Trends

There are various types of industries in industrial sector. For example, those dealing with airplanes, machines, and building stuff. If someone wants their money to grow, they should understand how this sector works. Problems between countries, trading rules, and changes in world money can all affect how well this sector does. So, when we talk about trends in the industrial sector, we're basically talking about big changes happening in these industries. People who spend money or make business decisions need to pay attention to these things to make smart choices. Stuff like how countries get along, rules about trading, and the world's money situation all have a big impact on how well the industrial sector does.

What Affects the Industrials Sector?

The segment of the economy called Industry is a key player in economic growth and development. It is influenced by different elements. The first factor that contributes to this situation is the general health of an economy. In a strong economy, a strong industrial sector will thrive. There are opportunities to buy more items and build roads and buildings. It will struggle when the economy is weak. Second, industrial technology changes. Government regulations also come into play. Some industries may adopt new policies. These policies support environmentally friendly practices.

For example. This is in response to changing conservation rules. Additionally, the level of global goods demand affects the industry’s activities. As a result, people want to buy more products. They also want to invest in construction projects, such as highways and buildings. Then, the economy becomes more active.

The industrials sector behaves somewhat like a roller coaster. This is despite all these factors. It goes up during good times but flip-flops during economic downturns. Therefore, we should pay close attention to the economy and what people want to buy and build. This way, we won't be caught off guard by business fluctuations.

Is the Industrials Sector a Defensive Sector?

The industrials sector is more defensive or cyclical. The decision depends on a few things. Traditionally, people thought of industrials as mere followers of economic cycles. This means when the economy is great and people are buying and building more, it’s good for industrials. However, when the economy is bad such that people do not spend as much in big projects, this can be bad for industrial sector.

So simply put, they could be either defensive or cyclical depending on how they act during different times in an economy. If their prices rise and fall with those of whole economy, then they are said to be more cyclical. Also, if they don’t go down even then there’s recession; so maybe we can say that sometimes insurers are defensive.

Now imagine that the industrials sectors were a team playing a match. When they play well under tough circumstances in the game, we may call them defensive players. If their performance depends on what happens during games, consider these players as cyclic players. Understanding this will help us think about industrial sectors. It will help us understand their place in the overall economy.

Are Industrials Cyclical or Defensive?

When playing a big economic game, industries could be defensive and cyclical. Think of the game as being played by different teams with respective styles. Cyclical industries tend to thrive when the economy is doing well. They are similar to players who excel while winning. These industries thrive during economic booms. People buy and build more things. However, they may face challenges. These are like a struggling team facing strong opponents. This happens when the game gets tough and the economy does badly. Defensive industries are like players who can maintain their position even during poor games.

On the other hand, they might have less effect from ups and downs. This is due to a resilient attitude towards hard situations. Thus, industries can appear as cyclical players, who go with the flow of the game. Or, they may be defensive ones who are on stand-by. This depends on their conduct at different points in time within an economy. It's similar to different teams using distinct styles throughout a match.

Why Are Industrials Cyclical?

Cyclical industries are named so because they play like a game. Their performance varies with the economy. Industries usually do well when the economy is doing well. This is because more people buy houses, cars, and other things. It’s like their winning season. During sluggish economies, people spend less. Industries suffer, much like in a tough competition.

Therefore, they are cyclical. Players move through different seasons within a game. Industries enjoy good times and face the hard times of economic games.

Do Industrials Do Bad During Inflation?

Inflation can be quite dicey for industrialists since it involves rising prices. Imagine having a lemonade stand. Suddenly, lemons and sugar become expensive. This is what happens to industries when prices of materials, such as metals and energy, go up. For instance, if a company makes smartphones and material costs increase. Then, the cost of producing each phone also goes up. This challenge results from increased costs. They can reduce margins for businesses in these sectors.

This is the interesting thing – often it means a good economy if prices are going up. So, there are more people who have jobs and they buy more things. As a result, industries get an opportunity. Suddenly, their products become in demand. To deal with inflation, they might slightly increase prices of their products for consumers. It helps offset additional expenses. It helps them test if they can manage this.

When the economy is performing well, it changes a burden into an opportunity to prosper. It represents industries struggling with increased sales. They are grappling with inflated costs. It happens when the economy is doing well during times of inflation.

Conclusion

In conclusion, the industrial sector is very crucial to the global economy. It determines how things are made, sold, and constructed. We can analyze developments like computerization. We can also analyze eco-friendliness and global trade. This can help us understand what has led to the current state of affairs in this sector.

The fate of manufacturing come 2024 will depend on the world’s economic performance at that time. It will also depend on its acceptance of new technologies. It will depend on linkages across nations. Industrial trends show that industries are getting smarter and going green. They are also changing their way of producing goods. The industry is cyclical as a whole.

However, parts offering essential services may be more stable. Inflation is among these challenges, but they can be seen as opportunities. Adjusting prices with respect for the overall economy. Understanding these dynamics helps investors, policymakers, and business leaders make informed decisions. This is crucial in the ever-changing industrial landscape.

Read more about Industrial Stocks in our ongoing sector series:

The Top Industrial Stocks

Are Industrials a Good Investment?

The Best Industrial ETFs

How do you Evaluate Industrial Stocks?

What is the Manufacturing Sector

Industrial Stocks with Dividends

Why Invest in Manufacturing Stocks

Important Manufacturing Sector Ratios

Why are Industrial Stocks Doing Well

What Affects the Industrial Industry?