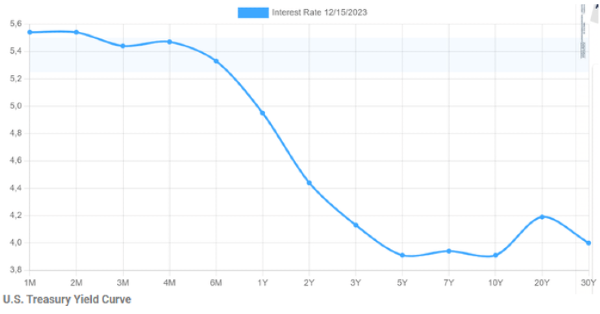

February 2, 2024 - It’s obvious and well known that the market (especially in the US) is obsessed with interest rates. If one watches the market intraday on say a 5 minute “bar chart” near the 2pm FED meeting announcement day, you’ll see wild moves up and down. The first 10 minutes appear to be driven by computer programs picking out key words from the press release and acting on them. Followed usually by moves from humans that actually take some time to figure out what the FED chairman actually means by his “word smithing”. Folks . . . it’s dramatic, and many traders either “fade the initial move” or just stay away entirely waiting for the dust to clear.

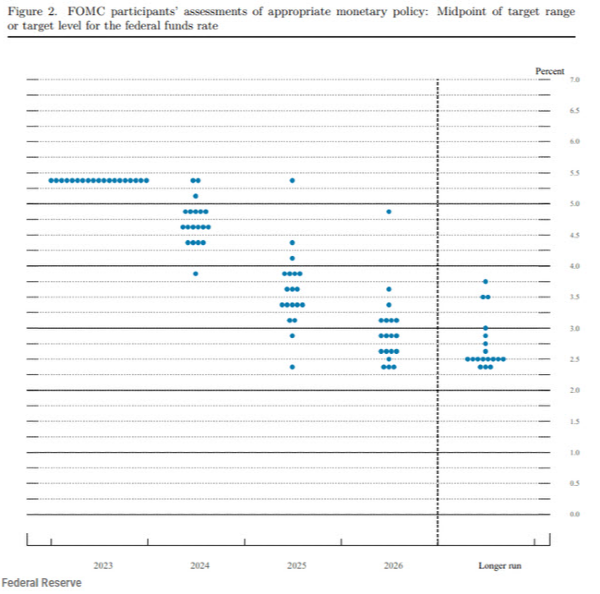

There has been a lot of talk about the “Fed Dot Plot” so I thought I’d cover that briefly. You’ll note in the graph below a series of vertical dots. Each dot is supposed to be either a statement or an interpolation of what each FED governor predicts for interest rates in the future. Note that most folks in the FED don’t predict, so take these predictions with a grain of salt . . . . perhaps the entire salt shaker!

Thus the market is always trying to front run and get well ahead of any significant news that would affect the economy or the market itself. And believe me when I say that “Cheap money” fuels the markets. They want interest rates to drop soooo bad they can taste it. Two rate drops, no (just may) 3 drops in 2024. Wonderful, the guessing continues. But until inflation & the economy cool down, I think that interest rates will stay put. (My own feeling, for what it’s worth, is maybe one late in the second quarter, but more likely early in the third.)

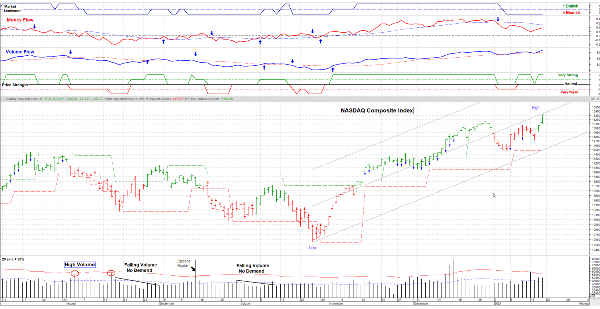

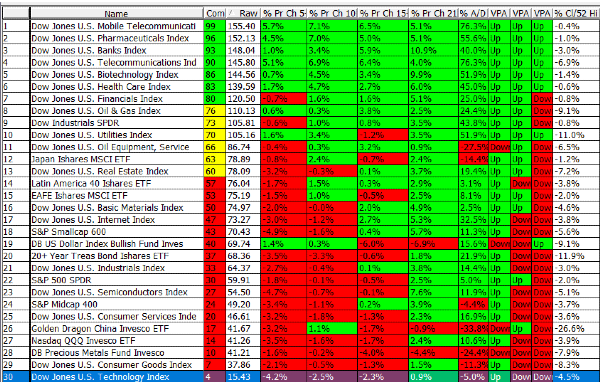

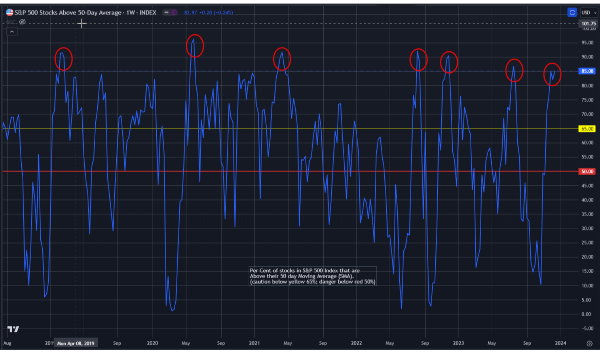

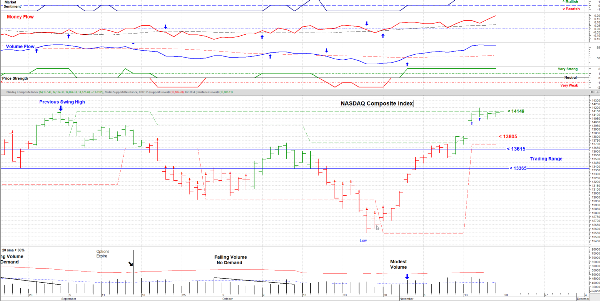

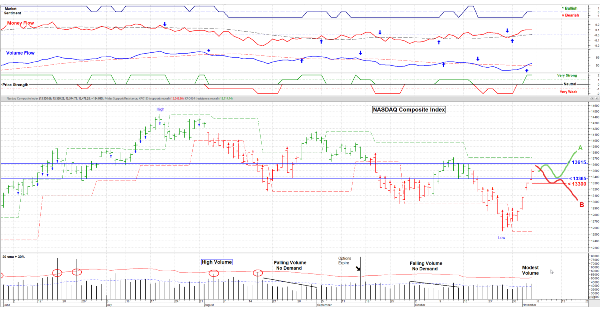

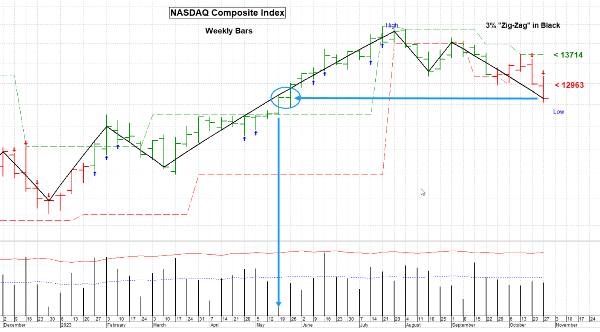

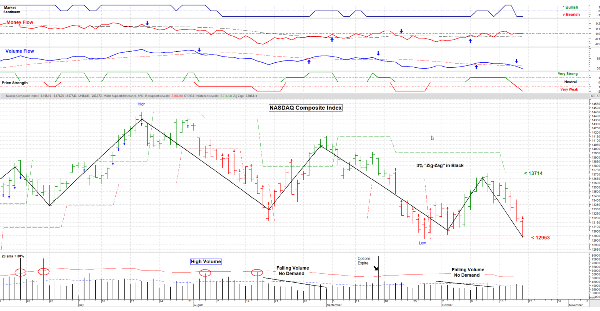

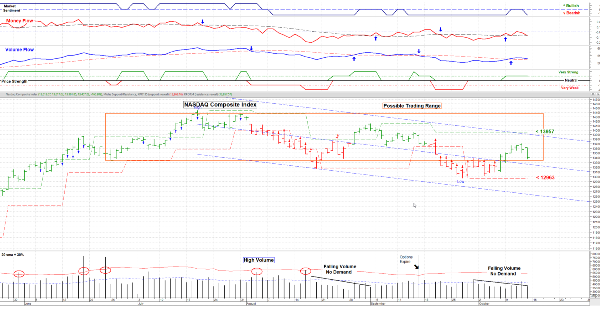

I’m thinking that we’re likely headed for a market slow spot late in February / early March before it picks up steam this Summer. I’m staying invested but still have some Cash on the side lines to put to work. Tech is expensive, let’s keep our eyes open for solid opportunities in other sectors too.

Have a good week(s) and Take Care. ……………. Tom ……………

February 2, 2024 - It’s obvious and well known that the market (especially in the US) is obsessed with interest rates. If one watches the market intraday on say a 5 minute “bar chart” near the 2pm FED meeting announcement day, you’ll see wild moves up and down. The first 10 minutes appear to be driven by computer programs picking out key words from the press release and acting on them. Followed usually by moves from humans that actually take some time to figure out what the FED chairman actually means by his “word smithing”. Folks . . . it’s dramatic, and many traders either “fade the initial move” or just stay away entirely waiting for the dust to clear.

There has been a lot of talk about the “Fed Dot Plot” so I thought I’d cover that briefly. You’ll note in the graph below a series of vertical dots. Each dot is supposed to be either a statement or an interpolation of what each FED governor predicts for interest rates in the future. Note that most folks in the FED don’t predict, so take these predictions with a grain of salt . . . . perhaps the entire salt shaker!

Thus the market is always trying to front run and get well ahead of any significant news that would affect the economy or the market itself. And believe me when I say that “Cheap money” fuels the markets. They want interest rates to drop soooo bad they can taste it. Two rate drops, no (just may) 3 drops in 2024. Wonderful, the guessing continues. But until inflation & the economy cool down, I think that interest rates will stay put. (My own feeling, for what it’s worth, is maybe one late in the second quarter, but more likely early in the third.)

I’m thinking that we’re likely headed for a market slow spot late in February / early March before it picks up steam this Summer. I’m staying invested but still have some Cash on the side lines to put to work. Tech is expensive, let’s keep our eyes open for solid opportunities in other sectors too.

Have a good week(s) and Take Care. ……………. Tom ……………